Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record the year end closing journal entries and the after-closing trial balance as at December 31, 2019. (26 marks) Lyons Limited provides IT consulting services.

Record the year end closing journal entries and the after-closing trial balance as at December 31, 2019. (26 marks)

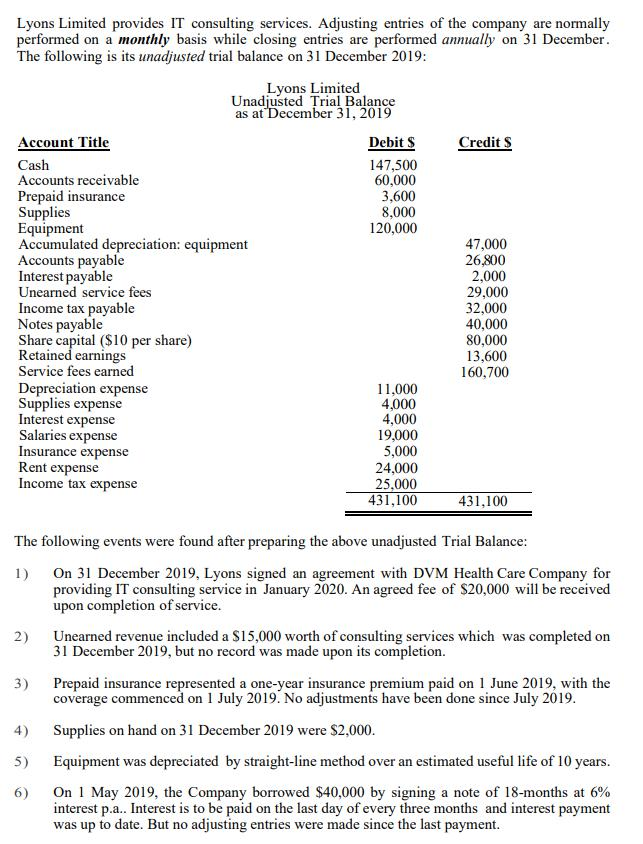

Lyons Limited provides IT consulting services. Adjusting entries of the company are normally performed on a monthly basis while closing entries are performed annually on 31 December. The following is its unadjusted trial balance on 31 December 2019: Lyons Limited Unadjusted Trial Balance as at December 31, 2019 Credits Debit S 147,500 60,000 3,600 8,000 120,000 Account Title Cash Accounts receivable Prepaid insurance Supplies Equipment Accumulated depreciation: equipment Accounts payable Interest payable Unearned service fees Income tax payable Notes payable Share capital ($10 per share) Retained earnings Service fees earned Depreciation expense Supplies expense Interest expense Salaries expense Insurance expense Rent expense Income tax expense 47,000 26,800 2,000 29,000 32,000 40,000 80,000 13,600 160,700 11.000 4,000 4,000 19,000 5,000 24,000 25.000 431,100 431,100 The following events were found after preparing the above unadjusted Trial Balance: 1) On 31 December 2019, Lyons signed an agreement with DVM Health Care Company for providing IT consulting service in January 2020. An agreed fee of $20,000 will be received upon completion of service. 2) Unearned revenue included a $15,000 worth of consulting services which was completed on 31 December 2019, but no record was made upon its completion. 3) Prepaid insurance represented a one-year insurance premium paid on 1 June 2019, with the coverage commenced on 1 July 2019. No adjustments have been done since July 2019. 5) Supplies on hand on 31 December 2019 were $2,000. Equipment was depreciated by straight-line method over an estimated useful life of 10 years. On 1 May 2019, the Company borrowed $40,000 by signing a note of 18-months at 6% interest p.a.. Interest is to be paid on the last day of every three months and interest payment was up to date. But no adjusting entries were made since the last payment. 6) 7) The accountant of Lynos found that income tax expense for the entire year should be $22,000. The amount will be due for payment in March 2020. 8) On 31 December 2019, the Company declared a cash dividend of $1 per share and 70% was paid on the same day. The remaining portion is to be paid on 1 March 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started