Record transactions on a balance sheet, income statement and Cash Flow

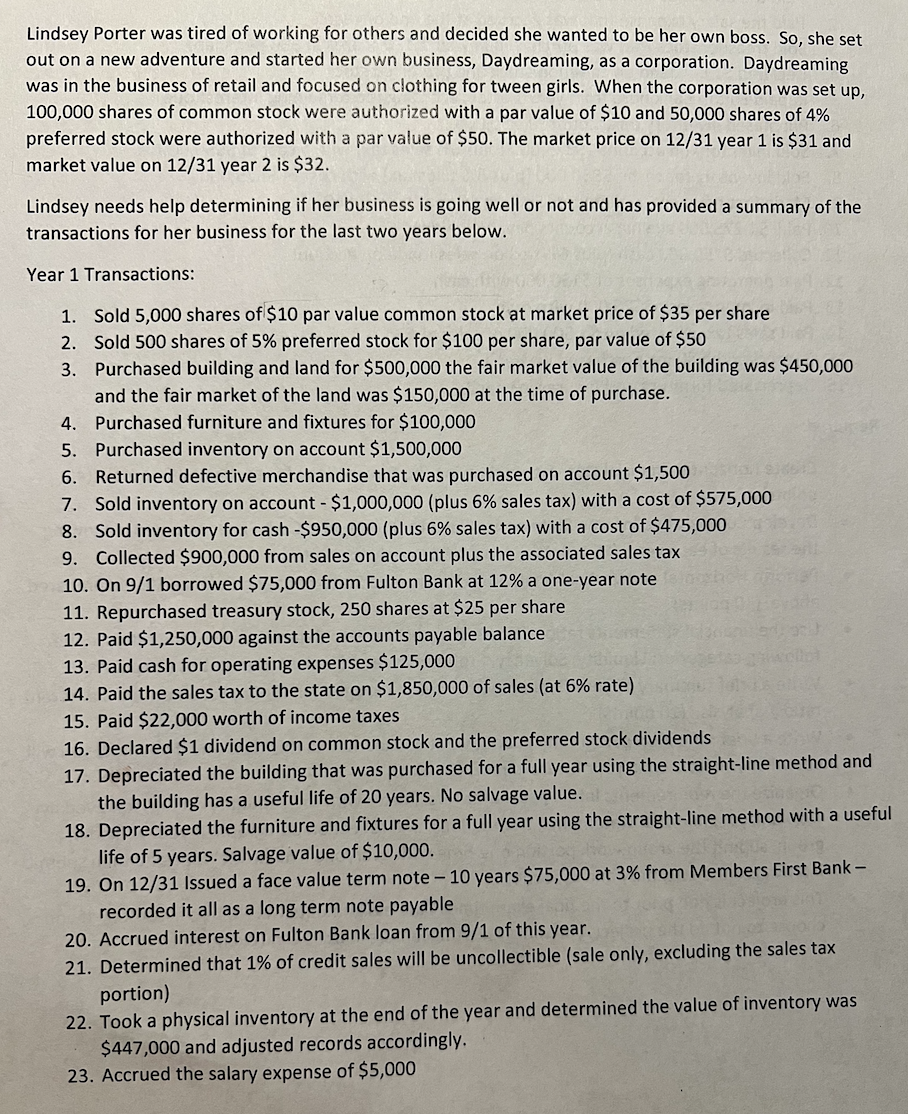

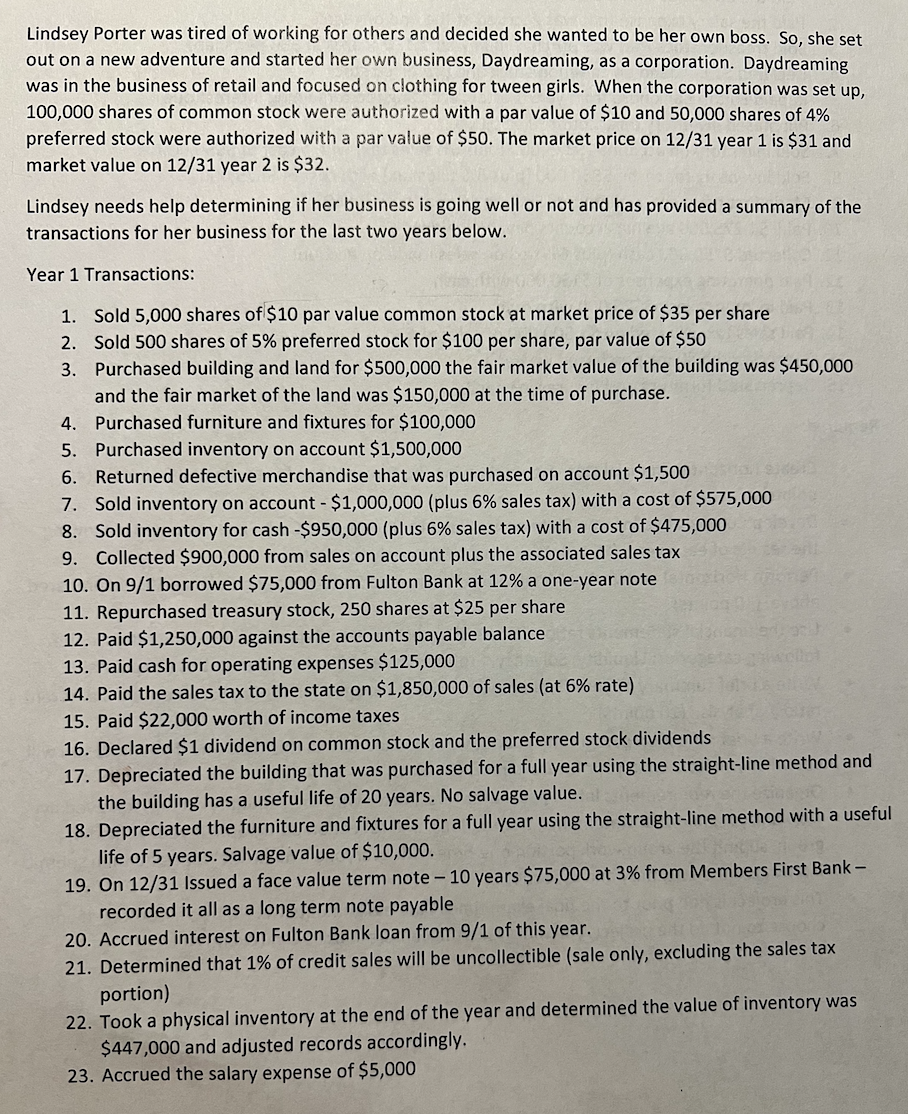

Lindsey Porter was tired of working for others and decided she wanted to be her own boss. So, she set out on a new adventure and started her own business, Daydreaming, as a corporation. Daydreaming was in the business of retail and focused on clothing for tween girls. When the corporation was set up, 100,000 shares of common stock were authorized with a par value of $10 and 50,000 shares of 4% preferred stock were authorized with a par value of $50. The market price on 12/31 year 1 is $31 and market value on 12/31 year 2 is $32. Lindsey needs help determining if her business is going well or not and has provided a summary of the transactions for her business for the last two years below. Year 1 Transactions: 1. Sold 5,000 shares of $10 par value common stock at market price of $35 per share 2. Sold 500 shares of 5% preferred stock for $100 per share, par value of $50 3. Purchased building and land for $500,000 the fair market value of the building was $450,000 and the fair market of the land was $150,000 at the time of purchase. 4. Purchased furniture and fixtures for $100,000 5. Purchased inventory on account $1,500,000 6. Returned defective merchandise that was purchased on account $1,500 7. Sold inventory on account - $1,000,000 (plus 6% sales tax) with a cost of $575,000 8. Sold inventory for cash $950,000 (plus 6% sales tax) with a cost of $475,000 9. Collected $900,000 from sales on account plus the associated sales tax 10. On 9/1 borrowed $75,000 from Fulton Bank at 12% a one-year note 11. Repurchased treasury stock, 250 shares at $25 per share 12. Paid $1,250,000 against the accounts payable balance 13. Paid cash for operating expenses $125,000 14. Paid the sales tax to the state on $1,850,000 of sales (at 6% rate) 15. Paid $22,000 worth of income taxes 16. Declared $1 dividend on common stock and the preferred stock dividends 17. Depreciated the building that was purchased for a full year using the straight-line method and the building has a useful life of 20 years. No salvage value. 18. Depreciated the furniture and fixtures for a full year using the straight-line method with a useful life of 5 years. Salvage value of $10,000. 19. On 12/31 Issued a face value term note 10 years $75,000 at 3% from Members First Bankrecorded it all as a long term note payable 20. Accrued interest on Fulton Bank loan from 9/1 of this year. 21. Determined that 1% of credit sales will be uncollectible (sale only, excluding the sales tax portion) 22. Took a physical inventory at the end of the year and determined the value of inventory was $447,000 and adjusted records accordingly. 23. Accrued the salary expense of $5,000 Lindsey Porter was tired of working for others and decided she wanted to be her own boss. So, she set out on a new adventure and started her own business, Daydreaming, as a corporation. Daydreaming was in the business of retail and focused on clothing for tween girls. When the corporation was set up, 100,000 shares of common stock were authorized with a par value of $10 and 50,000 shares of 4% preferred stock were authorized with a par value of $50. The market price on 12/31 year 1 is $31 and market value on 12/31 year 2 is $32. Lindsey needs help determining if her business is going well or not and has provided a summary of the transactions for her business for the last two years below. Year 1 Transactions: 1. Sold 5,000 shares of $10 par value common stock at market price of $35 per share 2. Sold 500 shares of 5% preferred stock for $100 per share, par value of $50 3. Purchased building and land for $500,000 the fair market value of the building was $450,000 and the fair market of the land was $150,000 at the time of purchase. 4. Purchased furniture and fixtures for $100,000 5. Purchased inventory on account $1,500,000 6. Returned defective merchandise that was purchased on account $1,500 7. Sold inventory on account - $1,000,000 (plus 6% sales tax) with a cost of $575,000 8. Sold inventory for cash $950,000 (plus 6% sales tax) with a cost of $475,000 9. Collected $900,000 from sales on account plus the associated sales tax 10. On 9/1 borrowed $75,000 from Fulton Bank at 12% a one-year note 11. Repurchased treasury stock, 250 shares at $25 per share 12. Paid $1,250,000 against the accounts payable balance 13. Paid cash for operating expenses $125,000 14. Paid the sales tax to the state on $1,850,000 of sales (at 6% rate) 15. Paid $22,000 worth of income taxes 16. Declared $1 dividend on common stock and the preferred stock dividends 17. Depreciated the building that was purchased for a full year using the straight-line method and the building has a useful life of 20 years. No salvage value. 18. Depreciated the furniture and fixtures for a full year using the straight-line method with a useful life of 5 years. Salvage value of $10,000. 19. On 12/31 Issued a face value term note 10 years $75,000 at 3% from Members First Bankrecorded it all as a long term note payable 20. Accrued interest on Fulton Bank loan from 9/1 of this year. 21. Determined that 1% of credit sales will be uncollectible (sale only, excluding the sales tax portion) 22. Took a physical inventory at the end of the year and determined the value of inventory was $447,000 and adjusted records accordingly. 23. Accrued the salary expense of $5,000