Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000 ). Round your answers to the nearest 2 decimal points.

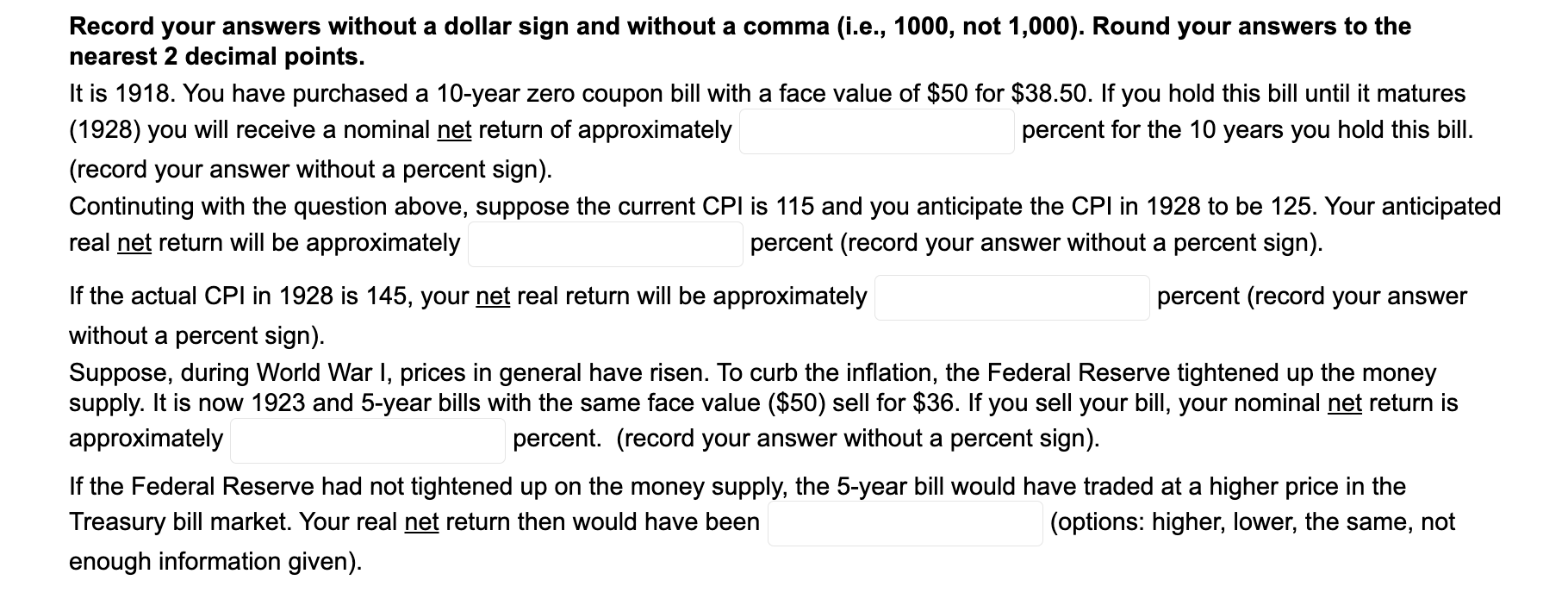

Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000 ). Round your answers to the nearest 2 decimal points. It is 1918 . You have purchased a 10 -year zero coupon bill with a face value of $50 for $38.50. If you hold this bill until it matures (1928) you will receive a nominal net return of approximately percent for the 10 years you hold this bill. (record your answer without a percent sign). Continuting with the question above, suppose the current CPI is 115 and you anticipate the CPI in 1928 to be 125. Your anticipated real net return will be approximately percent (record your answer without a percent sign). If the actual CPI in 1928 is 145 , your net real return will be approximately percent (record your answer without a percent sign). Suppose, during World War I, prices in general have risen. To curb the inflation, the Federal Reserve tightened up the money supply. It is now 1923 and 5-year bills with the same face value ($50) sell for $36. If you sell your bill, your nominal net return is approximately percent. (record your answer without a percent sign). If the Federal Reserve had not tightened up on the money supply, the 5-year bill would have traded at a higher price in the Treasury bill market. Your real net return then would have been (options: higher, lower, the same, not enough information given). Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000 ). Round your answers to the nearest 2 decimal points. It is 1918 . You have purchased a 10 -year zero coupon bill with a face value of $50 for $38.50. If you hold this bill until it matures (1928) you will receive a nominal net return of approximately percent for the 10 years you hold this bill. (record your answer without a percent sign). Continuting with the question above, suppose the current CPI is 115 and you anticipate the CPI in 1928 to be 125. Your anticipated real net return will be approximately percent (record your answer without a percent sign). If the actual CPI in 1928 is 145 , your net real return will be approximately percent (record your answer without a percent sign). Suppose, during World War I, prices in general have risen. To curb the inflation, the Federal Reserve tightened up the money supply. It is now 1923 and 5-year bills with the same face value ($50) sell for $36. If you sell your bill, your nominal net return is approximately percent. (record your answer without a percent sign). If the Federal Reserve had not tightened up on the money supply, the 5-year bill would have traded at a higher price in the Treasury bill market. Your real net return then would have been (options: higher, lower, the same, not enough information given)

Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000 ). Round your answers to the nearest 2 decimal points. It is 1918 . You have purchased a 10 -year zero coupon bill with a face value of $50 for $38.50. If you hold this bill until it matures (1928) you will receive a nominal net return of approximately percent for the 10 years you hold this bill. (record your answer without a percent sign). Continuting with the question above, suppose the current CPI is 115 and you anticipate the CPI in 1928 to be 125. Your anticipated real net return will be approximately percent (record your answer without a percent sign). If the actual CPI in 1928 is 145 , your net real return will be approximately percent (record your answer without a percent sign). Suppose, during World War I, prices in general have risen. To curb the inflation, the Federal Reserve tightened up the money supply. It is now 1923 and 5-year bills with the same face value ($50) sell for $36. If you sell your bill, your nominal net return is approximately percent. (record your answer without a percent sign). If the Federal Reserve had not tightened up on the money supply, the 5-year bill would have traded at a higher price in the Treasury bill market. Your real net return then would have been (options: higher, lower, the same, not enough information given). Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000 ). Round your answers to the nearest 2 decimal points. It is 1918 . You have purchased a 10 -year zero coupon bill with a face value of $50 for $38.50. If you hold this bill until it matures (1928) you will receive a nominal net return of approximately percent for the 10 years you hold this bill. (record your answer without a percent sign). Continuting with the question above, suppose the current CPI is 115 and you anticipate the CPI in 1928 to be 125. Your anticipated real net return will be approximately percent (record your answer without a percent sign). If the actual CPI in 1928 is 145 , your net real return will be approximately percent (record your answer without a percent sign). Suppose, during World War I, prices in general have risen. To curb the inflation, the Federal Reserve tightened up the money supply. It is now 1923 and 5-year bills with the same face value ($50) sell for $36. If you sell your bill, your nominal net return is approximately percent. (record your answer without a percent sign). If the Federal Reserve had not tightened up on the money supply, the 5-year bill would have traded at a higher price in the Treasury bill market. Your real net return then would have been (options: higher, lower, the same, not enough information given) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started