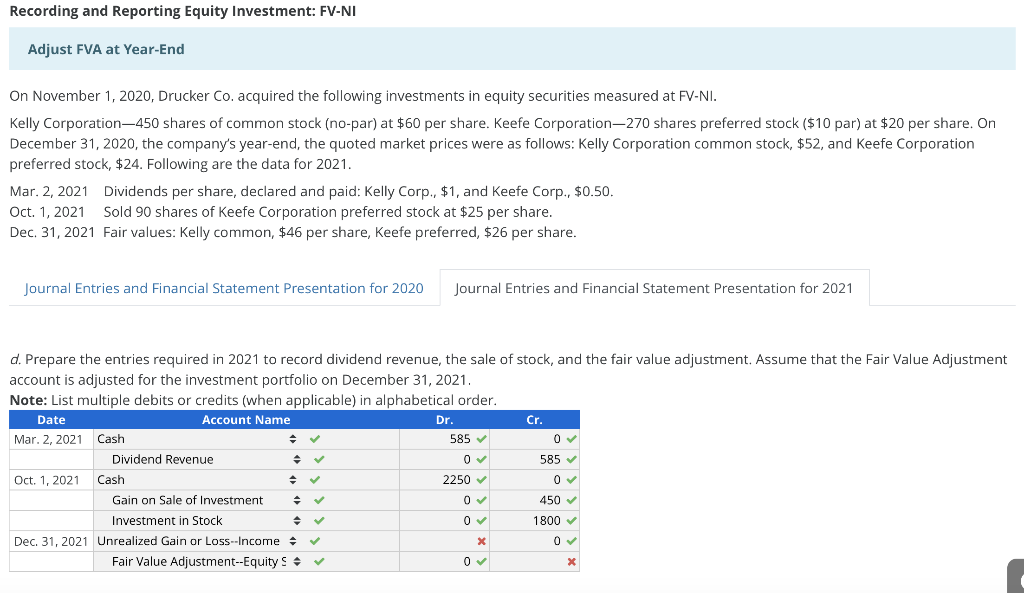

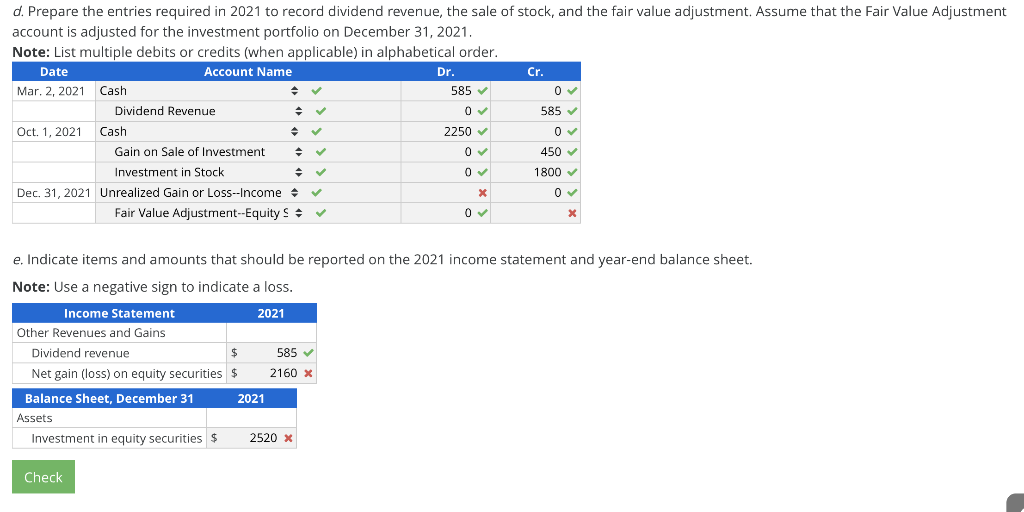

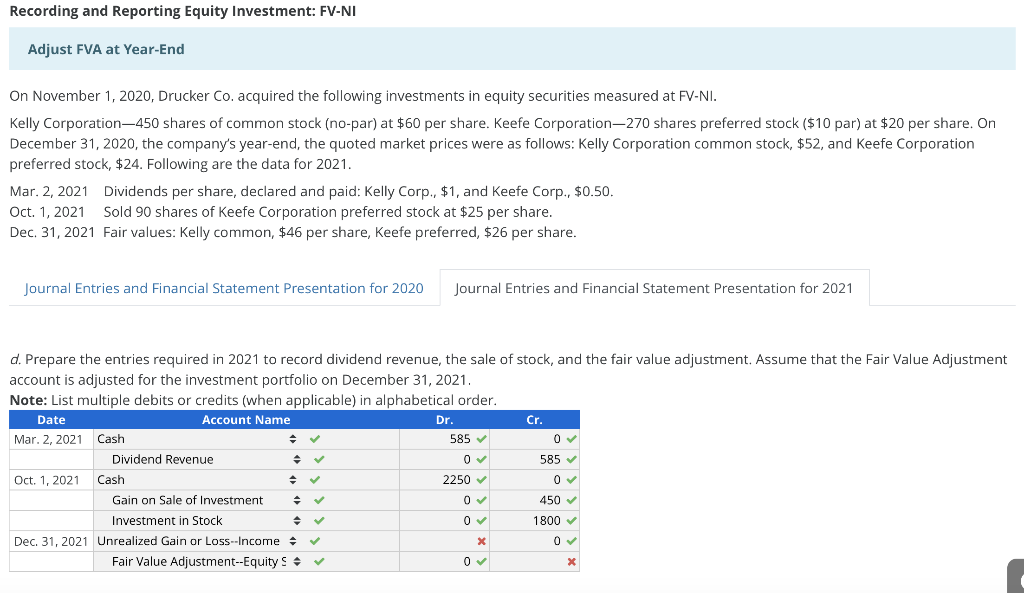

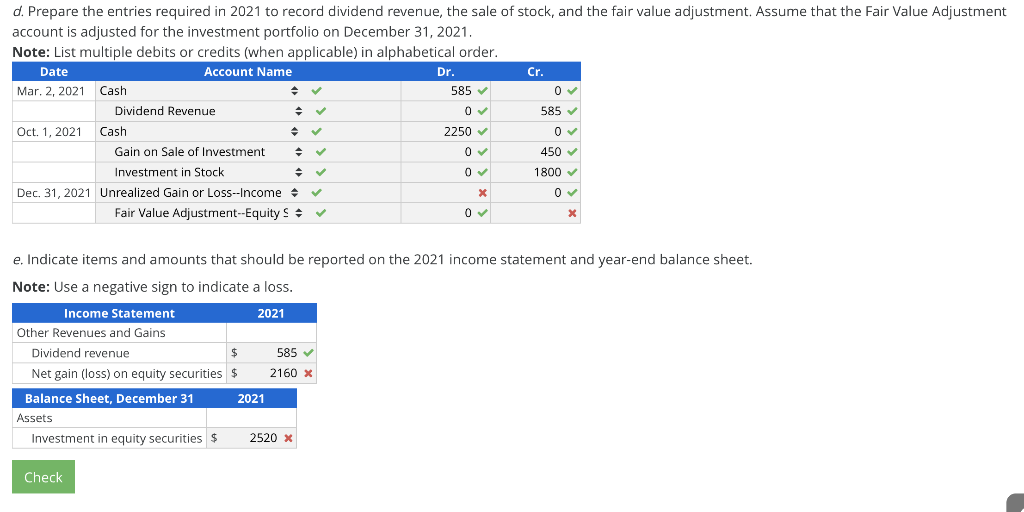

Recording and Reporting Equity Investment: FV-NI Adjust FVA at Year-End On November 1, 2020, Drucker Co. acquired the following investments in equity securities measured at FV-NI. Kelly Corporation-450 shares of common stock (no-par) at $60 per share. Keefe Corporation-270 shares preferred stock ($10 par) at $20 per share. On December 31, 2020, the company's year-end, the quoted market prices were as follows: Kelly Corporation common stock, $52, and Keefe Corporation preferred stock, $24. Following are the data for 2021. Mar. 2, 2021 Dividends per share, declared and paid: Kelly Corp., $1, and Keefe Corp., $0.50. Oct. 1, 2021 Sold 90 shares of Keefe Corporation preferred stock at $25 per share. Dec 31, 2021 Fair values: Kelly common, $46 per share, Keefe preferred, $26 per share. Journal Entries and Financial Statement Presentation for 2020 Journal Entries and Financial Statement Presentation for 2021 d. Prepare the entries required in 2021 to record dividend revenue, the sale of stock, and the fair value adjustment. Assume that the Fair Value Adjustment account is adjusted for the investment portfolio on December 31, 2021 Note: List multiple debits or credits (when applicable) in alphabetical order. Date Account Name Dr. Mar. 2, 2021 Cash 585 Dividend Revenue 0 585 Oct. 1, 2021 Cash 2250 0 Gain on Sale of Investment - 0 450 Investment in Stock 0 1800 Dec. 31, 2021 Unrealized Gain or Loss--Income Fair Value Adjustment--Equity S. Dr. d. Prepare the entries required in 2021 to record dividend revenue, the sale of stock, and the fair value adjustment. Assume that the Fair Value Adjustment account is adjusted for the investment portfolio on December 31, 2021. Note: List multiple debits or credits (when applicable) in alphabetical order. Date Account Name Cr. Mar. 2, 2021 Cash 585 0 Dividend Revenue O 585 Oct. 1, 2021 Cash 2250 0 Gain on Sale of Investment 450 Investment in Stock - 1800 Dec 31, 2021 Unrealized Gain or Loss--Income 0 Fair Value Adjustment--Equity 0v ov 0 e. Indicate items and amounts that should be reported on the 2021 income statement and year-end balance sheet. Note: Use a negative sign to indicate a loss. Income Statement 2021 Other Revenues and Gains Dividend revenue $ 585 Net gain (loss) on equity securities $ 2160 x Balance Sheet, December 31 2021 Assets Investment in equity securities $ 2520 X Check