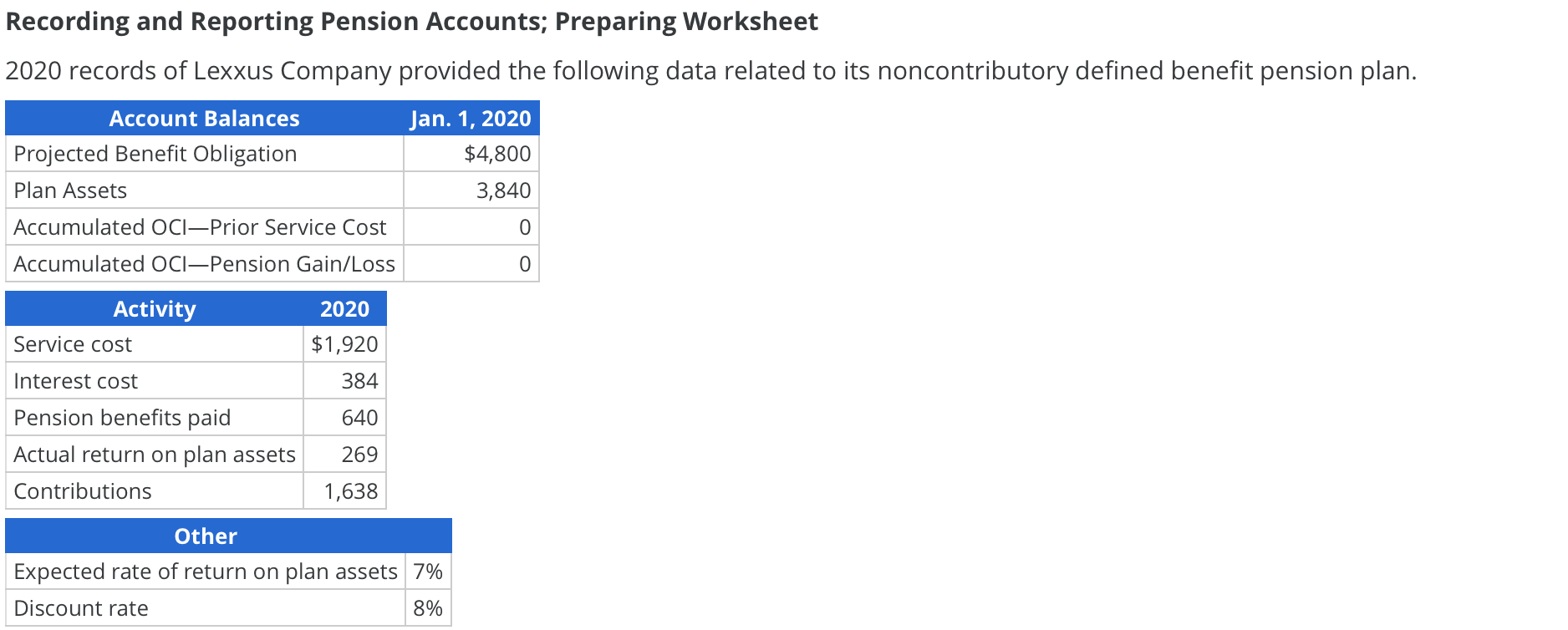

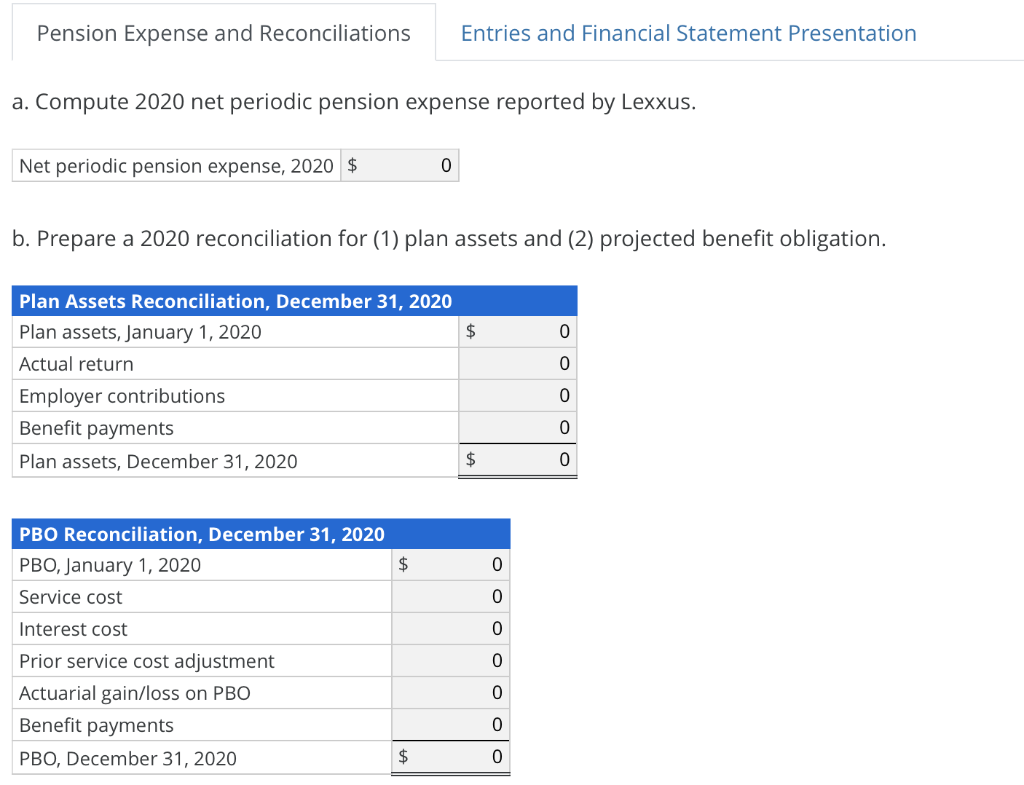

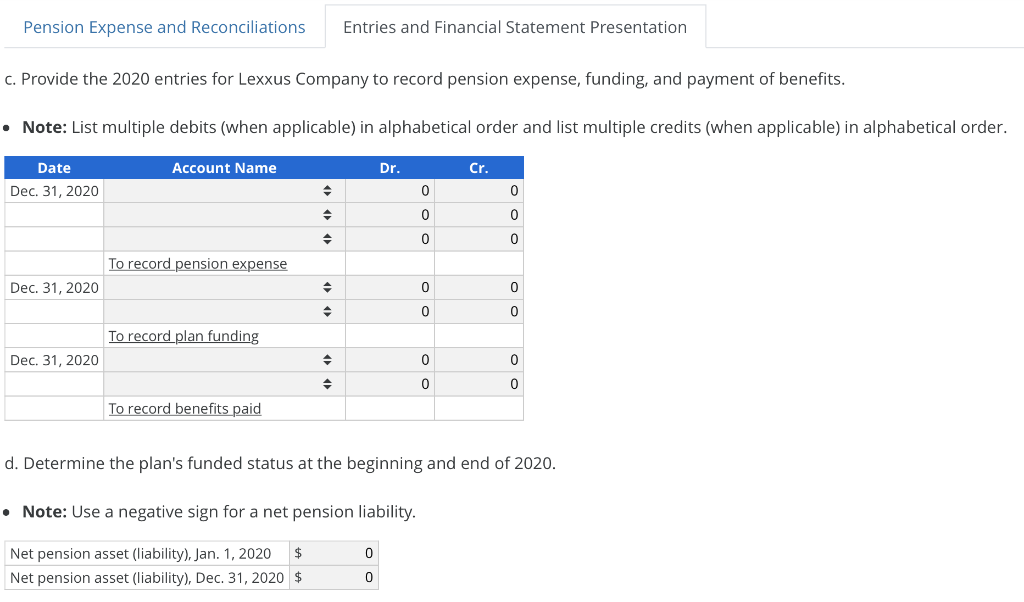

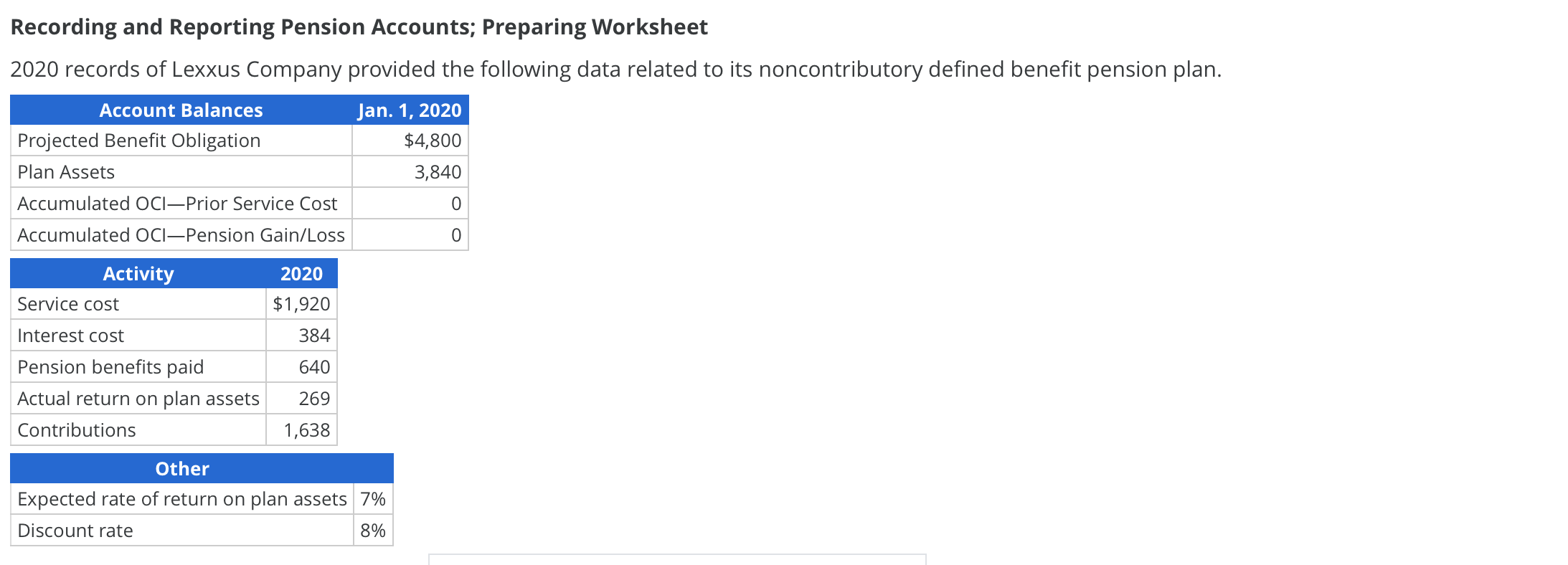

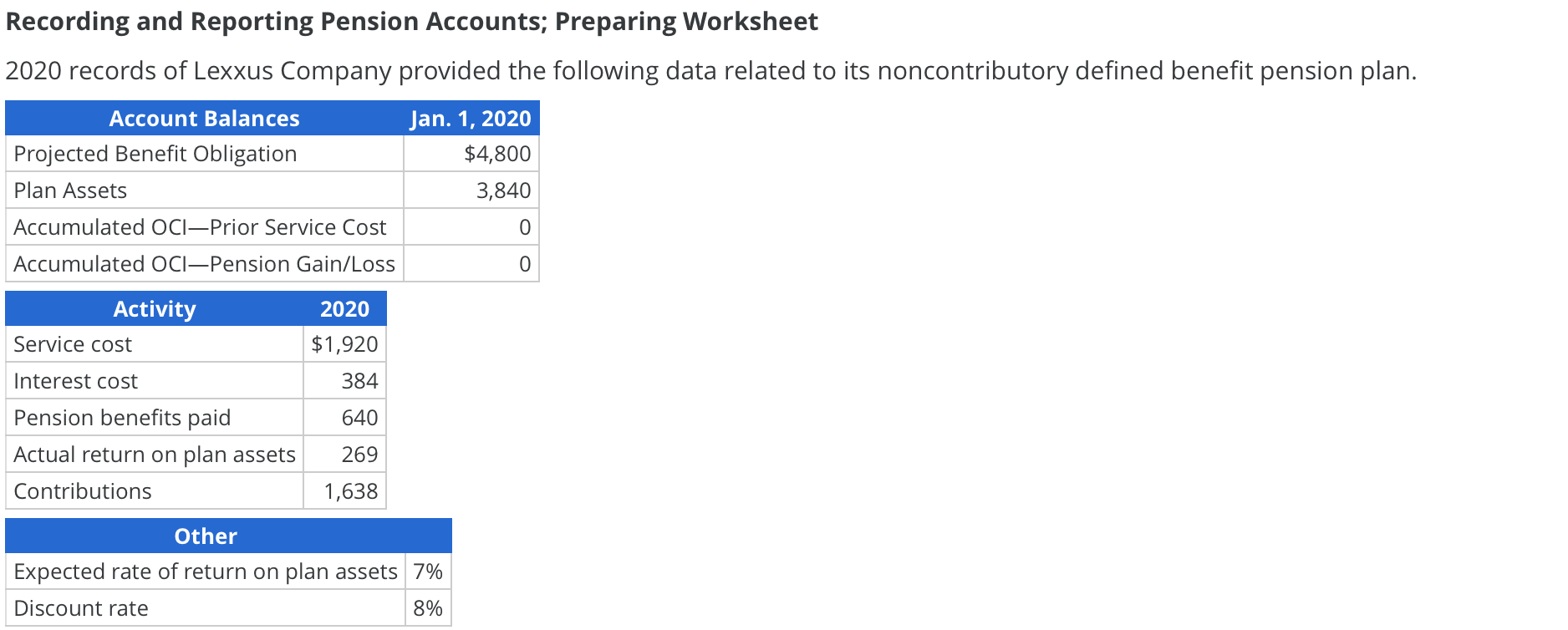

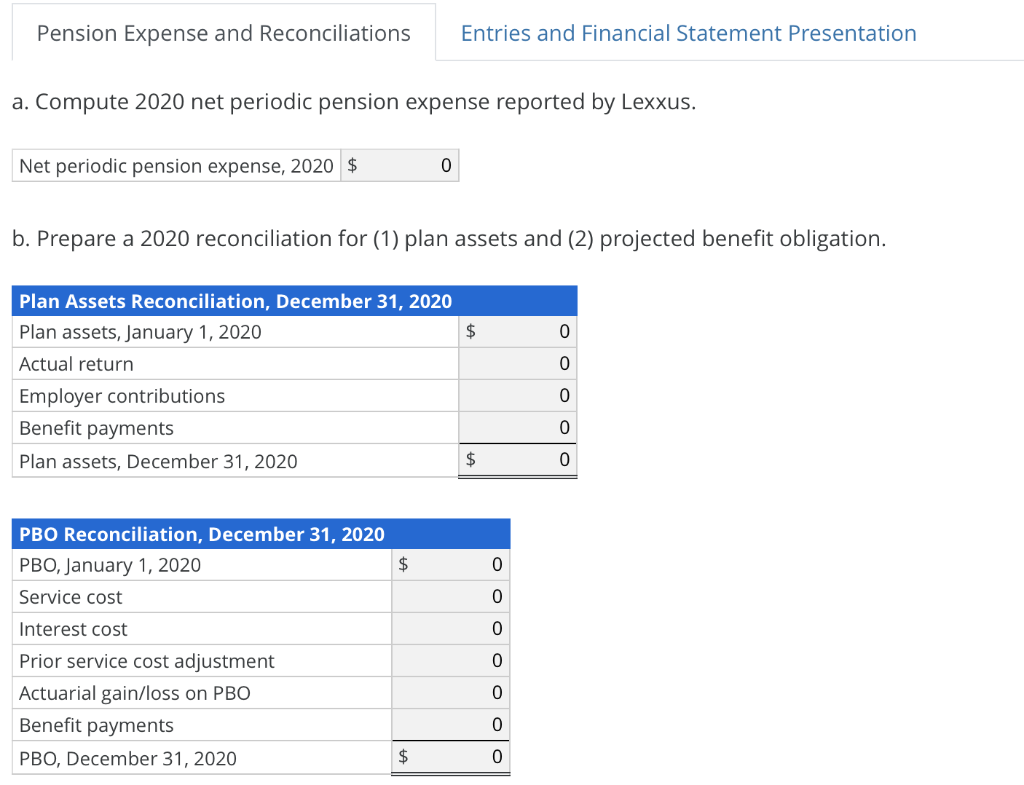

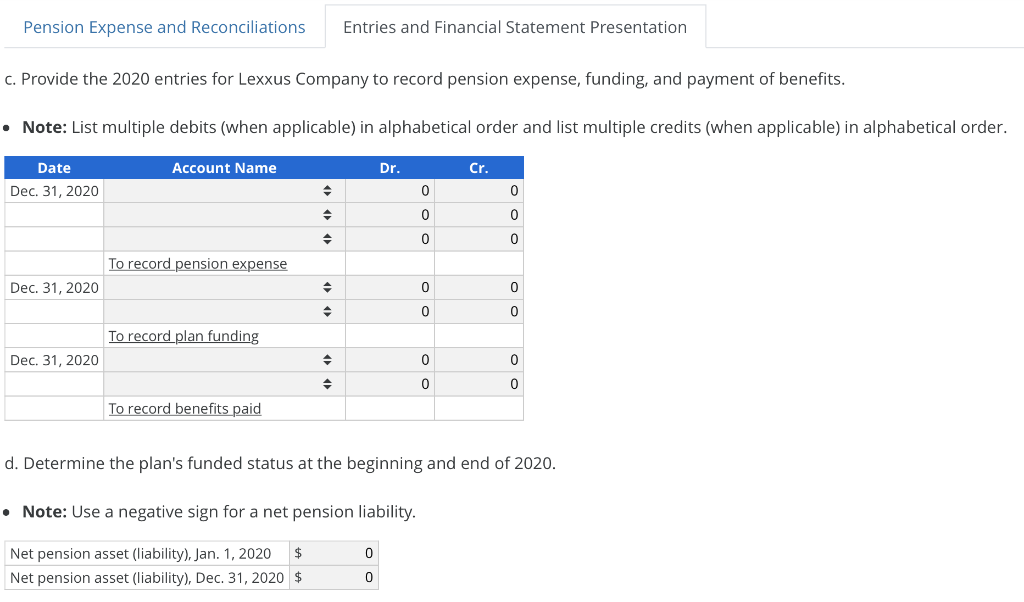

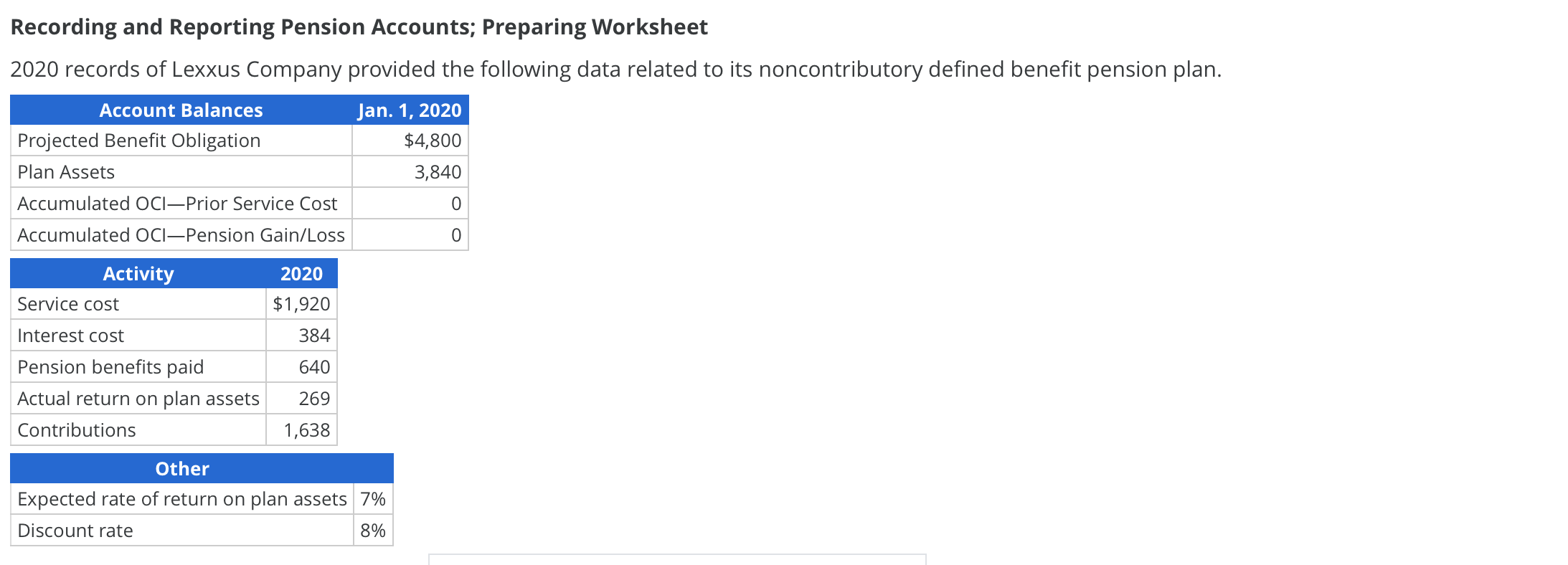

Recording and Reporting Pension Accounts; Preparing Worksheet 2020 records of Lexxus Company provided the following data related to its noncontributory defined benefit pension plan. Account Balances Jan. 1, 2020 Projected Benefit Obligation $4,800 Plan Assets 3,840 Accumulated OCIPrior Service Cost 0 Accumulated OCI Pension Gain/Loss 0 2020 Activity Service cost $1,920 384 640 Interest cost Pension benefits paid Actual return on plan assets Contributions 269 1,638 Other Expected rate of return on plan assets 7% Discount rate 8% Pension Expense and Reconciliations Entries and Financial Statement Presentation a. Compute 2020 net periodic pension expense reported by Lexxus. Net periodic pension expense, 2020 $ 0 b. Prepare a 2020 reconciliation for (1) plan assets and (2) projected benefit obligation. $ 0 Plan Assets Reconciliation, December 31, 2020 Plan assets, January 1, 2020 Actual return Employer contributions Benefit payments Plan assets, December 31, 2020 PBO Reconciliation, December 31, 2020 PBO, January 1, 2020 Service cost 0 Interest cost Prior service cost adjustment Actuarial gain/loss on PBO Benefit payments PBO, December 31, 2020 Pension Expense and Reconciliations Entries and Financial Statement Presentation C. Provide the 2020 entries for Lexxus Company to record pension expense, funding, and payment of benefits. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Account Name Dr. Date Dec 31, 2020 0 0 0 0 0 0 To record pension expense Dec 31, 2020 To record plan funding Dec. 31, 2020 To record benefits paid d. Determine the plan's funded status at the beginning and end of 2020. Note: Use a negative sign for a net pension liability. Net pension asset (liability), Jan. 1, 2020 $ Net pension asset (liability), Dec. 31, 2020 $ 0 0 Recording and Reporting Pension Accounts; Preparing Worksheet 2020 records of Lexxus Company provided the following data related to its noncontributory defined benefit pension plan. Account Balances Jan. 1, 2020 Projected Benefit Obligation $4,800 Plan Assets 3,840 Accumulated OCIPrior Service Cost Accumulated OCIPension Gain/Loss 0 Activity 2020 Service cost $1,920 Interest cost 384 Pension benefits paid 640 Actual return on plan assets 269 Contributions 1,638 Other Expected rate of return on plan assets 7% Discount rate 8%