Question

Recording Entries for Sales and Estimated Returns Lacey Company recorded sales of $2,000,000 for the year ended December 31, 2020. During 2020, the company recorded

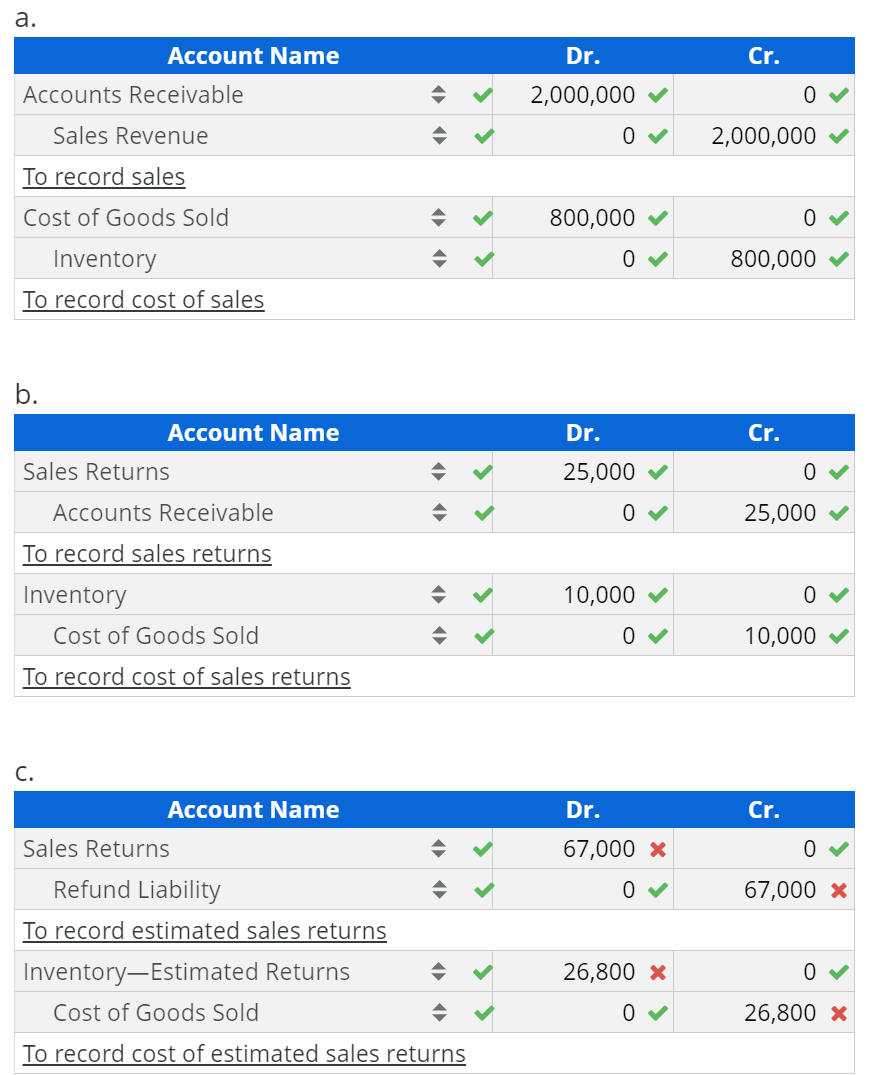

Recording Entries for Sales and Estimated Returns

Lacey Company recorded sales of $2,000,000 for the year ended December 31, 2020. During 2020, the company recorded actual returns and allowances of $25,000. As of December 31, 2020, Lacey estimates sales returns at 3% of current year sales. It is the companys policy to provide refunds on account. Lacey uses a perpetual inventory system and records estimated returns at the end of the period. The balance in Refund Liability is $18,000 and the balance in InventoryEstimated Returns is $7,200 on January 1, 2020.

a. Prepare the journal entries to record sales in 2020 assuming all sales are on account. Cost of goods sold is 40% of the selling price. b. Prepare the journal entries to record actual returns in 2020. c. Prepare the adjusting entries, if any, related to estimated returns on December 31, 2020.

Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero).

Please make the response detailed and easy to read, thank you

a. Account Name Cr. Dr. 2,000,000 V Accounts Receivable 0 Sales Revenue 0 2,000,000 To record sales Cost of Goods Sold 800,000 0 0 800,000 Inventory To record cost of sales b. Account Name Dr. Cr. Sales Returns 25,000 0 Accounts Receivable O 25,000 To record sales returns Inventory 10,000 0 Cost of Goods Sold 10,000 To record cost of sales returns C. Account Name Dr. Cr. 67,000 x 0 > 0 67,000 x Sales Returns Refund Liability To record estimated sales returns InventoryEstimated Returns Cost of Goods Sold 26,800 x 0 0 26,800 x To record cost of estimated sales returnsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started