Question

Recording Entries for Short-term Notes Payable Masys Store supported its operations for the year through short-term note financing as follows: May 10: The Company entered

Recording Entries for Short-term Notes Payable

Masys Store supported its operations for the year through short-term note financing as follows:

May 10: The Company entered into a new credit agreement with certain financial institutions providing for revolving credit borrowings and letters of credit in an aggregate amount not to exceed $1,800,000 million. Interest rates are adjustable.

Sep. 30: The company borrowed $600,000 on the revolving credit line, payable in 6 months, at an interest rate of 7.25%, due upon maturity.

Nov. 30: Additional cash needed during peak holiday sale period was funded through the issuance of 60- day, $240,000 commercial paper, discounted at 4%.

Jan. 29: Paid off the commercial paper debt on due date.

Mar. 31: Paid off the balance of $600,000 on the revolving credit line plus interest.

Required

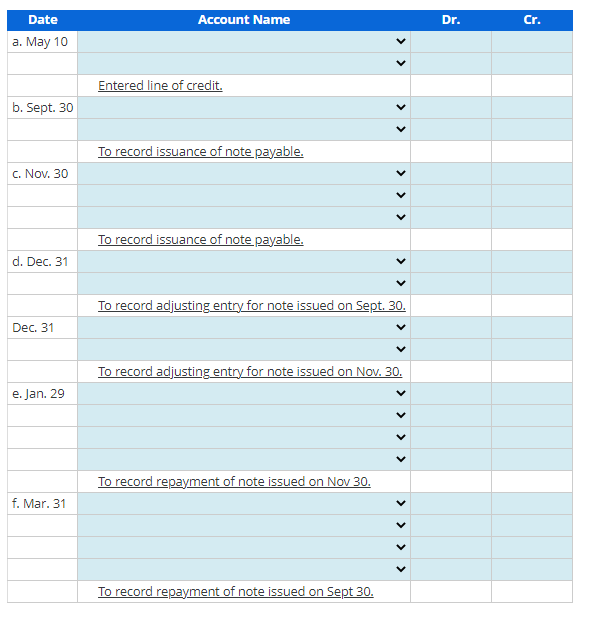

Record the following journal entries, assuming a 360-day year for interest computations:

a. May 10Entered into credit line agreement.

b. September 30Issuance of $600,000 note payable.

c. November 30Issuance of $240,000 commercial paper. Compute the discount on note payable using 360 days as the base for prorating interest. For the $240,000 note, compute the interest accrual based upon the exact number of days outstanding.

d. December 31Adjusting entries.

e. January 29Payment of $240,000 commercial paper.

f. March 31Payment of $600,000 note payable.

Note: Round your answers to the nearest whole dollar. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started