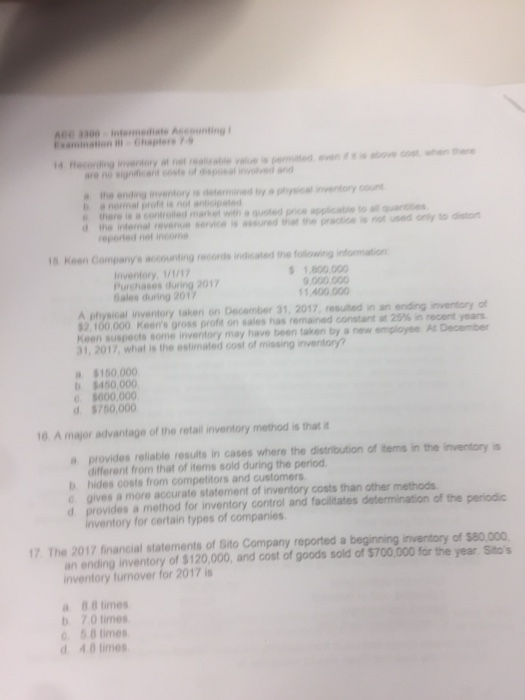

Recording inventory at net realizable value is permitted, even if it is above cost, when there are no significant costs of disposal involved and a. the ending inventory is determined by a physical inventory count. b. a normal profit is not anticipated. c. there is a controlled market with a quoted price applicable to all quantities. d. the internal revenue service is assured that the practice is not used only to distort reported net income. Keen Company's accounting records indicated the following information: A physical inventory taken on December 31, 2017, resulted in an ending inventory of $2, 100,000. Keen's gross profit on sales has remained constant at 25% in recent years. Keen suspects some inventory may have been taken by a new employee. At December 31, 2017, what is the estimated cost of missing inventory? a. $150,000. b. $450,000. c. $600,000. d. $750,000. A major advantage of the retail inventory method is that it a. provides reliable results in cases where the distribution of items in the inventory is different from that of items sold during the period. b. hides costs from competitors and customers. c. gives a more accurate statement of inventory costs than other methods. d. provides a method for inventory control and facilitates determination of the periodic inventory for certain types of companies. The 2017 financial of Sito Company reported a beginning inventory of $80,000, an ending inventory of $120,000, and cost of goods sold of $700,000 for the year. Sito's inventory turnover for 2017 is a. 8.8 times. b. 7.0 times. c. 5.8 times. d. 4.8 times. Recording inventory at net realizable value is permitted, even if it is above cost, when there are no significant costs of disposal involved and a. the ending inventory is determined by a physical inventory count. b. a normal profit is not anticipated. c. there is a controlled market with a quoted price applicable to all quantities. d. the internal revenue service is assured that the practice is not used only to distort reported net income. Keen Company's accounting records indicated the following information: A physical inventory taken on December 31, 2017, resulted in an ending inventory of $2, 100,000. Keen's gross profit on sales has remained constant at 25% in recent years. Keen suspects some inventory may have been taken by a new employee. At December 31, 2017, what is the estimated cost of missing inventory? a. $150,000. b. $450,000. c. $600,000. d. $750,000. A major advantage of the retail inventory method is that it a. provides reliable results in cases where the distribution of items in the inventory is different from that of items sold during the period. b. hides costs from competitors and customers. c. gives a more accurate statement of inventory costs than other methods. d. provides a method for inventory control and facilitates determination of the periodic inventory for certain types of companies. The 2017 financial of Sito Company reported a beginning inventory of $80,000, an ending inventory of $120,000, and cost of goods sold of $700,000 for the year. Sito's inventory turnover for 2017 is a. 8.8 times. b. 7.0 times. c. 5.8 times. d. 4.8 times