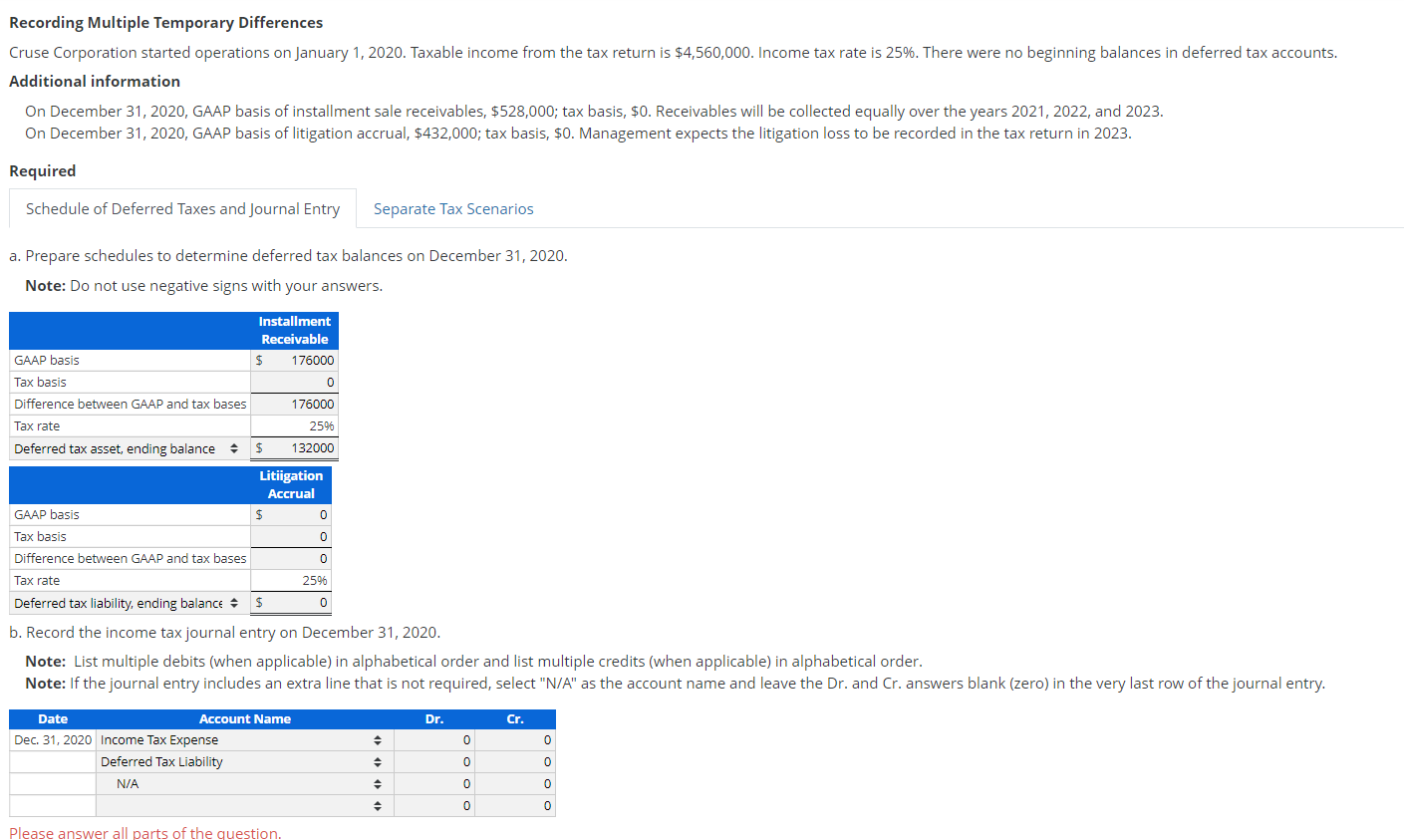

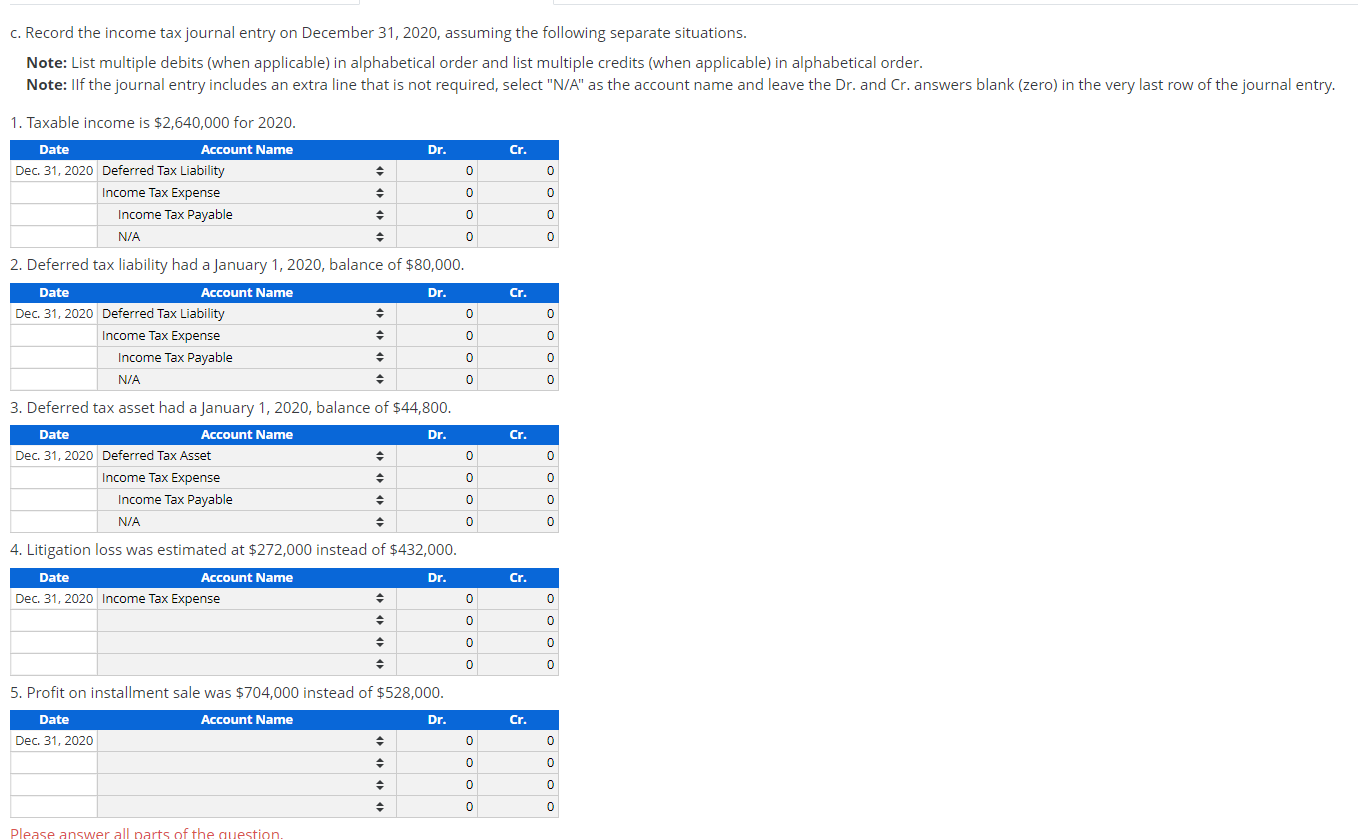

Recording Multiple Temporary Differences Cruse Corporation started operations on January 1, 2020. Taxable income from the tax return is $4,560,000. Income tax rate is 25%. There were no beginning balances in deferred tax accounts. Additional information On December 31, 2020, GAAP basis of installment sale receivables, $528,000; tax basis, $0. Receivables will be collected equally over the years 2021, 2022, and 2023. On December 31, 2020, GAAP basis of litigation accrual, $432,000; tax basis, $0. Management expects the litigation loss to be recorded in the tax return in 2023. Required Schedule of Deferred Taxes and Journal Entry Separate Tax Scenarios a. Prepare schedules to determine deferred tax balances on December 31, 2020. Note: Do not use negative signs with your answers. 0 Installment Receivable GAAP basis 176000 Tax basis 0 Difference between GAAP and tax bases 176000 Tax rate 2596 Deferred tax asset, ending balance $ 132000 Litigation Accrual GAAP basis 0 Tax basis Difference between GAAP and tax bases Tax rate 2596 Deferred tax liability, ending balance - $ 0 b. Record the income tax journal entry on December 31, 2020. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Date Account Name Dr. Cr. Dec 31, 2020 Income Tax Expense 0 0 Deferred Tax Liability 0 N/A 0 0 0 0 0 Please answer all parts of the question. c. Record the income tax journal entry on December 31, 2020, assuming the following separate situations. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: IIf the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Dr. Cr. o o o o 1. Taxable income is $2,640,000 for 2020. Date Account Name Dec 31, 2020 Deferred Tax Liability Income Tax Expense 0 Income Tax Payable N/A 2. Deferred tax liability had a January 1, 2020, balance of $80,000. Date Account Name Dr. Dec 31, 2020 Deferred Tax Liability 0 Income Tax Expense Income Tax Payable 0 N/A 0 Cr. 0 0 0 0 0 Cr. 0 0 0 0 3. Deferred tax asset had a January 1, 2020, balance of $44,800. Date Account Name Dr. Dec 31, 2020 Deferred Tax Asset Income Tax Expense Income Tax Payable N/A 4. Litigation loss was estimated at $272,000 instead of $432,000. Date Account Name Dr. Dec 31, 2020 Income Tax Expense 0 0 0 0 Cr. 0 0 0 0 0 0 0 0 5. Profit on installment sale was $704,000 instead of $528,000. Date Account Name Dr. Dec 31, 2020 Cr. 0 0 0 0 0 0 0 0 0 Please answer all parts of the