Answered step by step

Verified Expert Solution

Question

1 Approved Answer

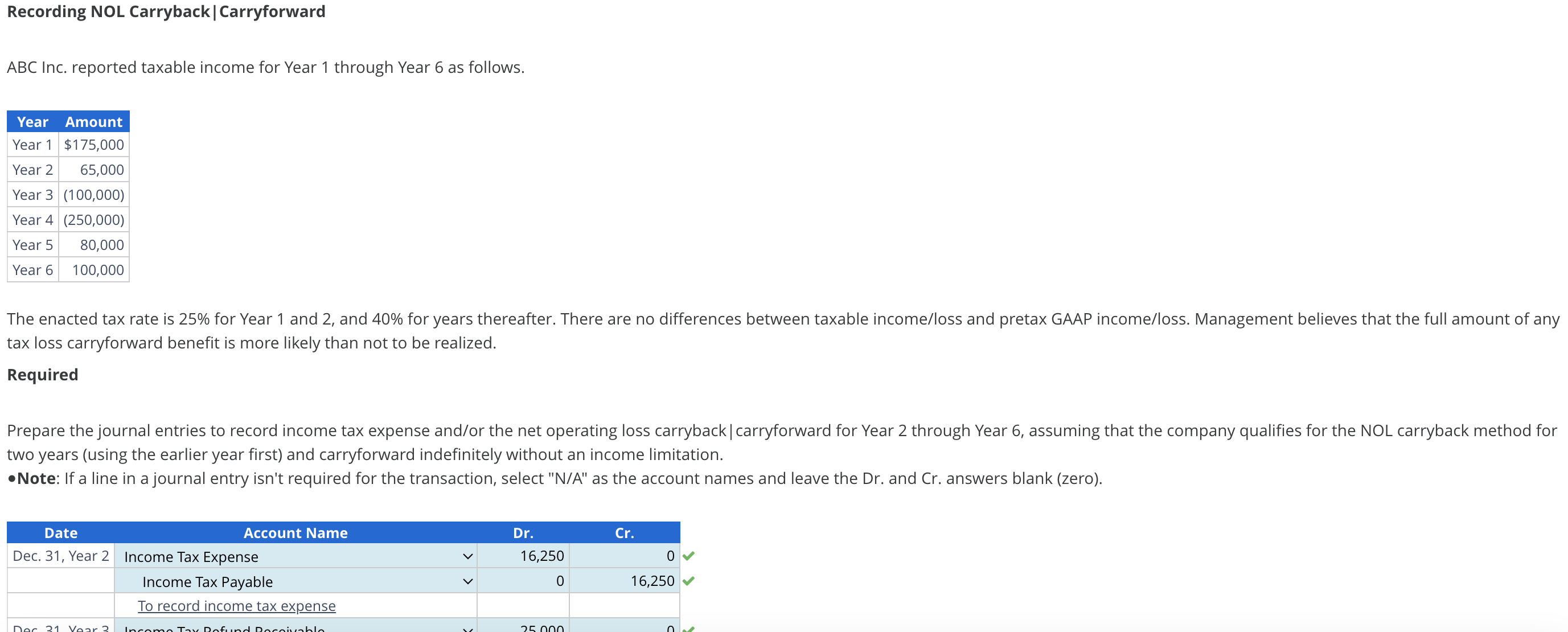

Recording NOL Carryback|Carryforward ABC Inc. reported taxable income for Year 1 through Year 6 as follows. tax loss carryforward benefit is more likely than not

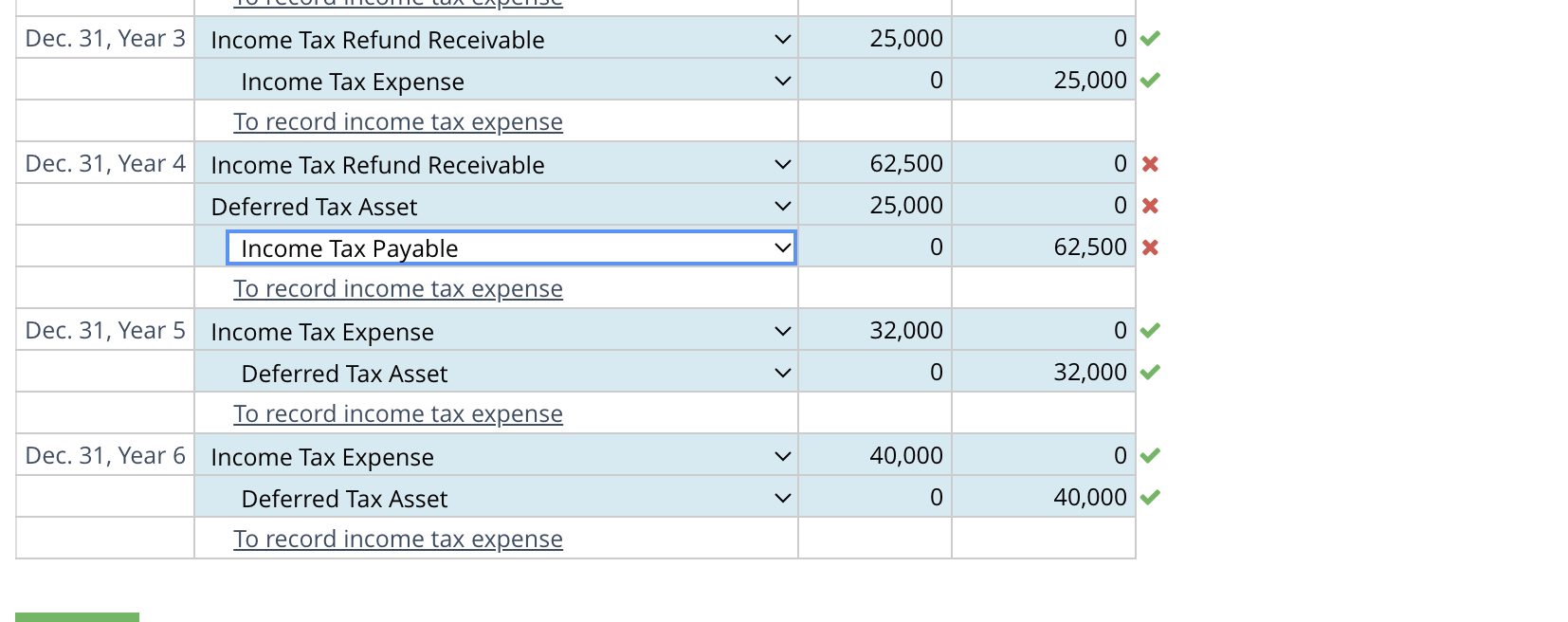

Recording NOL Carryback|Carryforward ABC Inc. reported taxable income for Year 1 through Year 6 as follows. tax loss carryforward benefit is more likely than not to be realized. Required two years (using the earlier year first) and carryforward indefinitely without an income limitation. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). \begin{tabular}{|c|c|c|c|c|} \hline & & & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 3} & Income Tax Refund Receivable & v & 25,000 & 0 \\ \hline & Income Tax Expense & v & 0 & 25,000 \\ \hline & Torecordincometaxexpense & & & \\ \hline \multirow[t]{4}{*}{ Dec. 31, Year 4} & Income Tax Refund Receivable & v & 62,500 & 0 \\ \hline & Deferred Tax Asset & v & 25,000 & 0 \\ \hline & Income Tax Payable & v & 0 & 62,500 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 5} & Income Tax Expense & v & 32,000 & 0 \\ \hline & Deferred Tax Asset & & 0 & 32,000 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 6} & Income Tax Expense & & 40,000 & 0 \\ \hline & Deferred Tax Asset & v & 0 & 40,000 \\ \hline & To record income tax expense & & & \\ \hline \end{tabular}

Recording NOL Carryback|Carryforward ABC Inc. reported taxable income for Year 1 through Year 6 as follows. tax loss carryforward benefit is more likely than not to be realized. Required two years (using the earlier year first) and carryforward indefinitely without an income limitation. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). \begin{tabular}{|c|c|c|c|c|} \hline & & & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 3} & Income Tax Refund Receivable & v & 25,000 & 0 \\ \hline & Income Tax Expense & v & 0 & 25,000 \\ \hline & Torecordincometaxexpense & & & \\ \hline \multirow[t]{4}{*}{ Dec. 31, Year 4} & Income Tax Refund Receivable & v & 62,500 & 0 \\ \hline & Deferred Tax Asset & v & 25,000 & 0 \\ \hline & Income Tax Payable & v & 0 & 62,500 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 5} & Income Tax Expense & v & 32,000 & 0 \\ \hline & Deferred Tax Asset & & 0 & 32,000 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 6} & Income Tax Expense & & 40,000 & 0 \\ \hline & Deferred Tax Asset & v & 0 & 40,000 \\ \hline & To record income tax expense & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started