Answered step by step

Verified Expert Solution

Question

1 Approved Answer

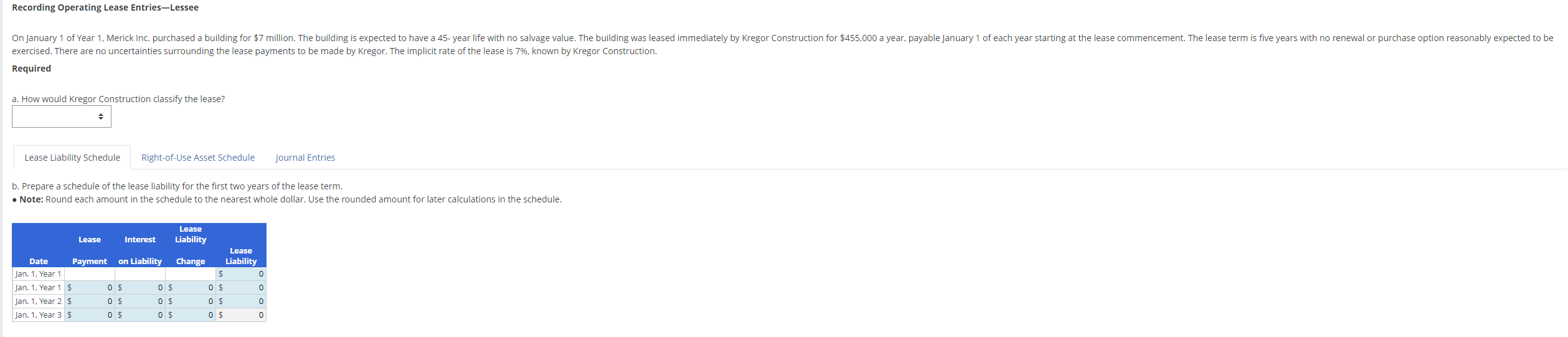

Recording Operating Lease Entries - Lessee Recording Operating Lease Entries - Lessee exercised. There are no uncertainties surrounding the lease payments to be made by

Recording Operating Lease EntriesLessee Recording Operating Lease EntriesLessee

exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is known by Kregor Construction

Required

a How would Kregor Construction classify the lease?

Lease Liability Schedule

Journal Entries

c Prepare a schedule of the rightofuse asset for the first two years of the lease term

Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule.

Please answer all parts of the question. Recording Operating Lease EntriesLessee

exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is known by Kregor Construction.

Required

a How would Kregor Construction classify the lease?

Lease Liability Schedule RightofUse Asset Schedule

d Prepare the entries for Kregor Construction on January and December for the first two years of the lease term, assuming its accounting year ends December

Note: Round your answers to the nearest whole dollar.

exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is known by Kregor Construction.

Required

a How would Kregor Construction classify the lease?

Lease Liability Schedule

RightofUse Asset Schedule

Journal Entries

b Prepare a schedule of the lease liability for the first two years of the lease term.

Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started