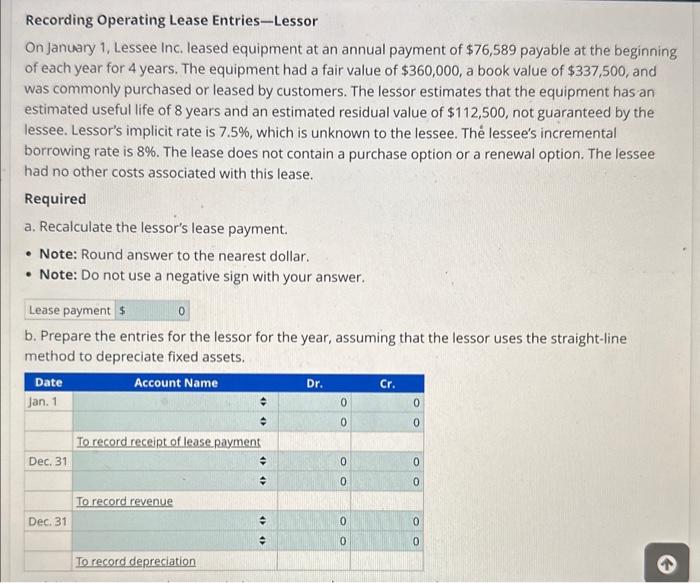

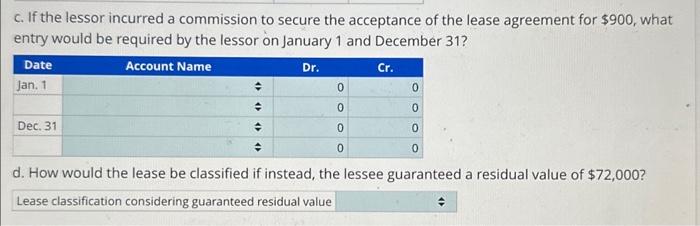

Recording Operating Lease Entries-Lessor On January 1, Lessee Inc. leased equipment at an annual payment of $76,589 payable at the beginning of each year for 4 years. The equipment had a fair value of $360,000, a book value of $337,500, and was commonly purchased or leased by customers. The lessor estimates that the equipment has an estimated useful life of 8 years and an estimated residual value of $112,500, not guaranteed by the lessee. Lessor's implicit rate is 7.5%, which is unknown to the lessee. Th lessee's incremental borrowing rate is 8%. The lease does not contain a purchase option or a renewal option. The lessee had no other costs associated with this lease. Required a. Recalculate the lessor's lease payment. - Note: Round answer to the nearest dollar. - Note: Do not use a negative sign with your answer. b. Prepare the entries for the lessor for the year, assuming that the lessor uses the straight-line method to depreciate fixed assets. c. If the lessor incurred a commission to secure the acceptance of the lease agreement for $900, what entry would be required by the lessor on January 1 and December 31 ? d. How would the lease be classified if instead, the lessee guaranteed a residual value of $72,000 ? Recording Operating Lease Entries-Lessor On January 1, Lessee Inc. leased equipment at an annual payment of $76,589 payable at the beginning of each year for 4 years. The equipment had a fair value of $360,000, a book value of $337,500, and was commonly purchased or leased by customers. The lessor estimates that the equipment has an estimated useful life of 8 years and an estimated residual value of $112,500, not guaranteed by the lessee. Lessor's implicit rate is 7.5%, which is unknown to the lessee. Th lessee's incremental borrowing rate is 8%. The lease does not contain a purchase option or a renewal option. The lessee had no other costs associated with this lease. Required a. Recalculate the lessor's lease payment. - Note: Round answer to the nearest dollar. - Note: Do not use a negative sign with your answer. b. Prepare the entries for the lessor for the year, assuming that the lessor uses the straight-line method to depreciate fixed assets. c. If the lessor incurred a commission to secure the acceptance of the lease agreement for $900, what entry would be required by the lessor on January 1 and December 31 ? d. How would the lease be classified if instead, the lessee guaranteed a residual value of $72,000