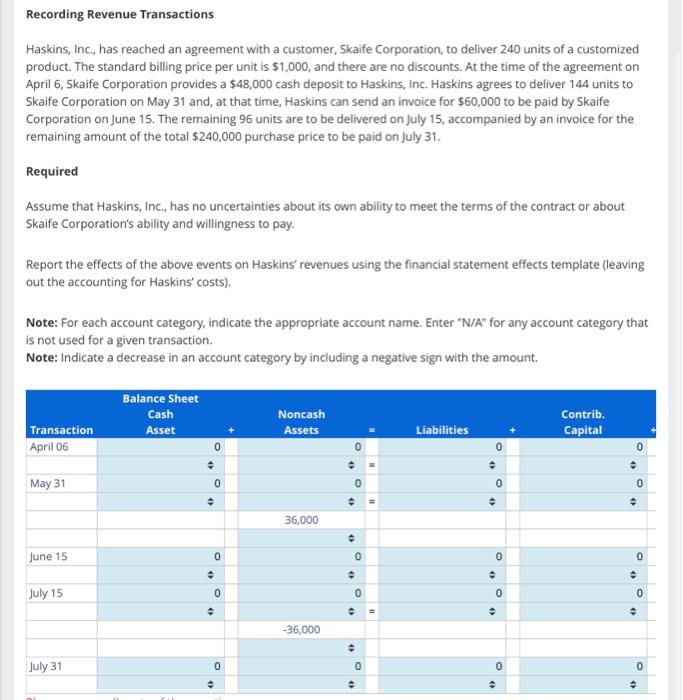

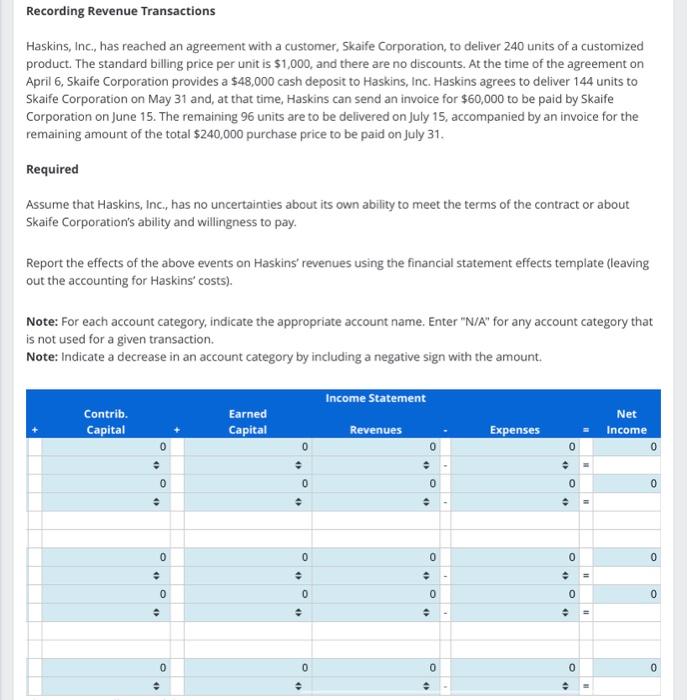

Recording Revenue Transactions Haskins, Inc., has reached an agreement with a customer, Skaife Corporation, to deliver 240 units of a customized product. The standard billing price per unit is $1,000, and there are no discounts. At the time of the agreement on April 6, Skaife Corporation provides a $48,000 cash deposit to Haskins, Inc. Haskins agrees to deliver 144 units to Skaife Corporation on May 31 and, at that time, Haskins can send an invoice for $60,000 to be paid by Skaife Corporation on June 15. The remaining 96 units are to be delivered on July 15 , accompanied by an invoice for the remaining amount of the total $240,000 purchase price to be paid on July 31 . Required Assume that Haskins, Inc., has no uncertainties about its own ability to meet the terms of the contract or about Skaife Corporation's ability and willingness to pay. Report the effects of the above events on Haskins' revenues using the financial statement effects template (leaving out the accounting for Haskins' costs). Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Recording Revenue Transactions Haskins, Inc., has reached an agreement with a customer, Skaife Corporation, to deliver 240 units of a customized product. The standard billing price per unit is $1,000, and there are no discounts. At the time of the agreement on April 6, Skaife Corporation provides a $48,000 cash deposit to Haskins, Inc. Haskins agrees to deliver 144 units to Skaife Corporation on May 31 and, at that time, Haskins can send an invoice for $60,000 to be paid by Skaife Corporation on June 15 . The remaining 96 units are to be delivered on July 15 , accompanied by an invoice for the remaining amount of the total $240,000 purchase price to be paid on July 31 . Required Assume that Haskins, Inc., has no uncertainties about its own ability to meet the terms of the contract or about Skaife Corporation's ability and willingness to pay. Report the effects of the above events on Haskins' revenues using the financial statement effects template (leaving out the accounting for Haskins' costs). Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount