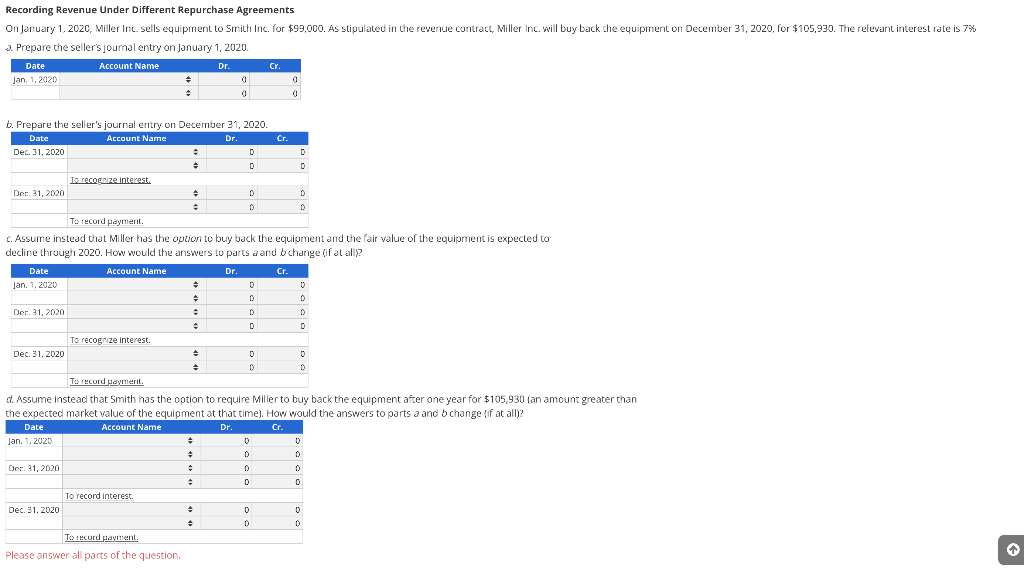

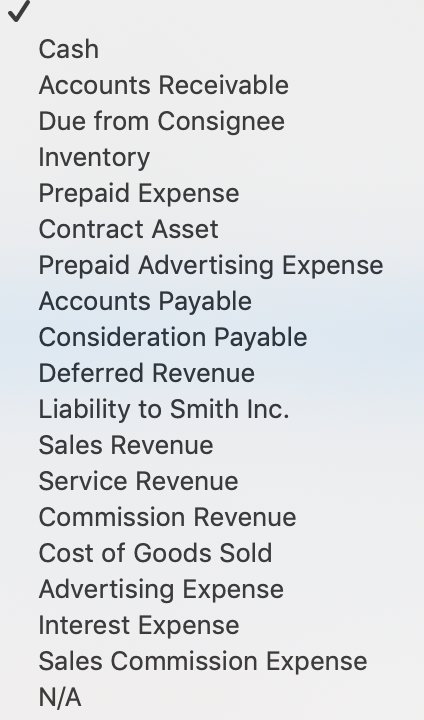

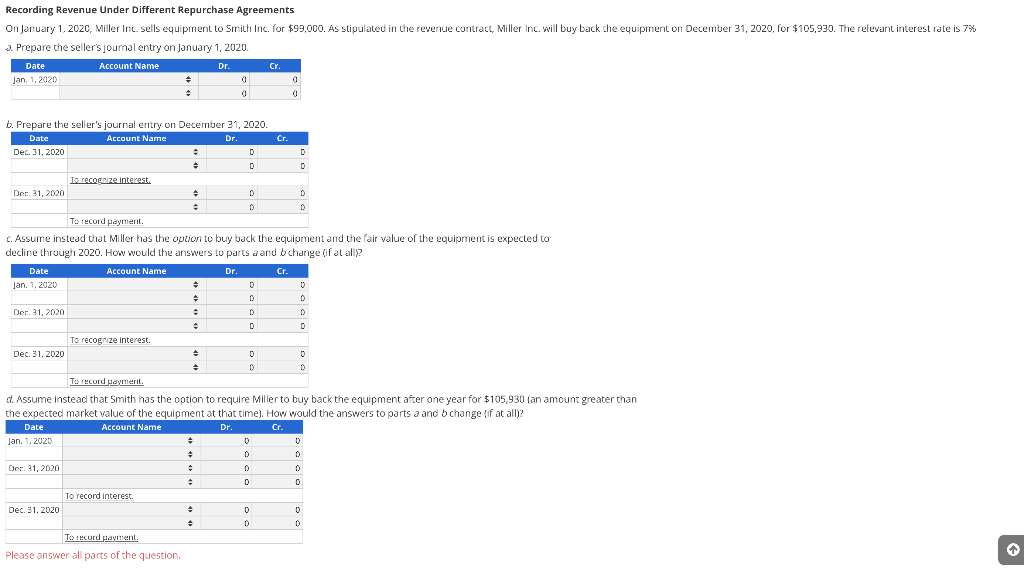

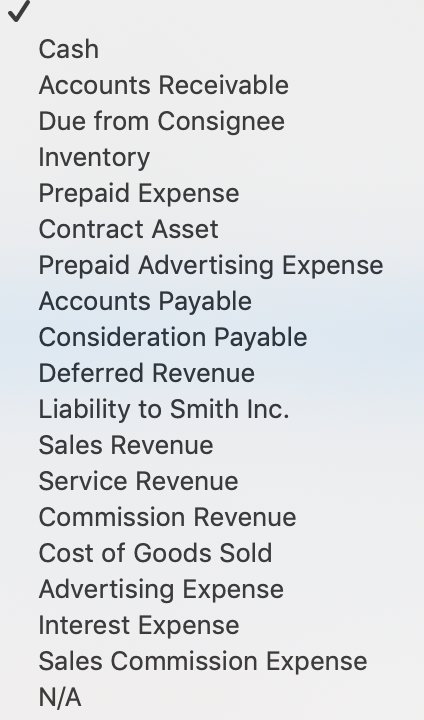

Recording Revenue Under Different Repurchase Agreements On January 1, 2020, Miller Inc. sells equipment to Smith Inc. for $99,000. As stipulated in the revenue contract, Miller Inc. will buy back the equipment on December 31, 2020 for $105,930. The relevant interest rate is 7% 3. Prepare the seller's joumal entry on January 1, 2020. Date Account Name Dr. CY. Jan, 1.2020 . 0 0 0 0 O D b. Prepare the seller's journal entry on December 31, 2020. Date Account Name Dr. Cr. Dec 31, 2020 0 0 Torcore interest Der 31, 2020 D D D D To record payment. C. Assume instead that Miller has the option to buy back the equipment and the fair value of the equipment is expected to decline through 2020. How would the answers to parts a and change (if at ally? Date Account Name Dr. Cr. Jan 1, 2020 D 0 . D 0 Der 31, 2020 D D D To recognize interest Dec 31, 2020 D D D D Tothcord payment, d. Assume instead that Smith has the option to require Miller to buy back the equipment after one year for $105,930 (an amount greater than the expected market value of the equipment at that time). How would the answers to parts a and b change (if at all? Date Account Name Dr. Cr. Jan. 1.2020 0 + 0 Der 31, 2020 . 0 0 0 To record interest. Dec 31, 2020 . D D D D To record layment Please answer all parts of the question D Cash Accounts Receivable Due from Consignee Inventory Prepaid Expense Contract Asset Prepaid Advertising Expense Accounts Payable Consideration Payable Deferred Revenue Liability to Smith Inc. Sales Revenue Service Revenue Commission Revenue Cost of Goods Sold Advertising Expense Interest Expense Sales Commission Expense N/A Recording Revenue Under Different Repurchase Agreements On January 1, 2020, Miller Inc. sells equipment to Smith Inc. for $99,000. As stipulated in the revenue contract, Miller Inc. will buy back the equipment on December 31, 2020 for $105,930. The relevant interest rate is 7% 3. Prepare the seller's joumal entry on January 1, 2020. Date Account Name Dr. CY. Jan, 1.2020 . 0 0 0 0 O D b. Prepare the seller's journal entry on December 31, 2020. Date Account Name Dr. Cr. Dec 31, 2020 0 0 Torcore interest Der 31, 2020 D D D D To record payment. C. Assume instead that Miller has the option to buy back the equipment and the fair value of the equipment is expected to decline through 2020. How would the answers to parts a and change (if at ally? Date Account Name Dr. Cr. Jan 1, 2020 D 0 . D 0 Der 31, 2020 D D D To recognize interest Dec 31, 2020 D D D D Tothcord payment, d. Assume instead that Smith has the option to require Miller to buy back the equipment after one year for $105,930 (an amount greater than the expected market value of the equipment at that time). How would the answers to parts a and b change (if at all? Date Account Name Dr. Cr. Jan. 1.2020 0 + 0 Der 31, 2020 . 0 0 0 To record interest. Dec 31, 2020 . D D D D To record layment Please answer all parts of the question D Cash Accounts Receivable Due from Consignee Inventory Prepaid Expense Contract Asset Prepaid Advertising Expense Accounts Payable Consideration Payable Deferred Revenue Liability to Smith Inc. Sales Revenue Service Revenue Commission Revenue Cost of Goods Sold Advertising Expense Interest Expense Sales Commission Expense N/A