Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording Sales-Type Lease, Purchase Option-Lessor Flint Company leased equipment to Land Company for a five-year period. Flint paid $112,716 for the equipment, which equals its

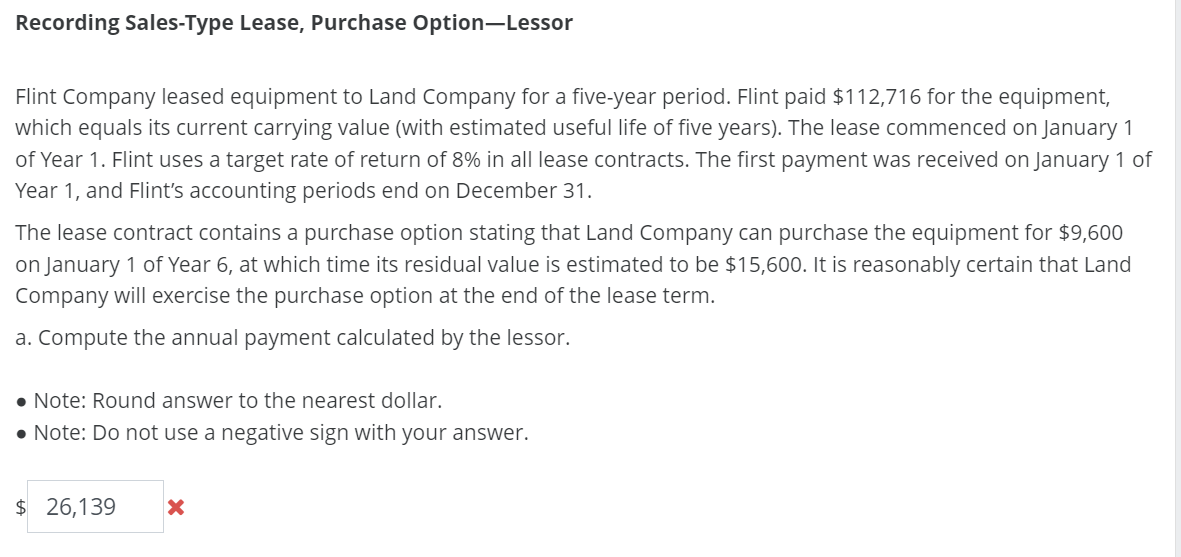

Recording Sales-Type Lease, Purchase Option-Lessor Flint Company leased equipment to Land Company for a five-year period. Flint paid \$112,716 for the equipment, which equals its current carrying value (with estimated useful life of five years). The lease commenced on January 1 of Year 1 . Flint uses a target rate of return of 8% in all lease contracts. The first payment was received on January 1 of Year 1, and Flint's accounting periods end on December 31. The lease contract contains a purchase option stating that Land Company can purchase the equipment for $9,600 on January 1 of Year 6 , at which time its residual value is estimated to be $15,600. It is reasonably certain that Land Company will exercise the purchase option at the end of the lease term. a. Compute the annual payment calculated by the lessor. - Note: Round answer to the nearest dollar. - Note: Do not use a negative sign with your

Recording Sales-Type Lease, Purchase Option-Lessor Flint Company leased equipment to Land Company for a five-year period. Flint paid \$112,716 for the equipment, which equals its current carrying value (with estimated useful life of five years). The lease commenced on January 1 of Year 1 . Flint uses a target rate of return of 8% in all lease contracts. The first payment was received on January 1 of Year 1, and Flint's accounting periods end on December 31. The lease contract contains a purchase option stating that Land Company can purchase the equipment for $9,600 on January 1 of Year 6 , at which time its residual value is estimated to be $15,600. It is reasonably certain that Land Company will exercise the purchase option at the end of the lease term. a. Compute the annual payment calculated by the lessor. - Note: Round answer to the nearest dollar. - Note: Do not use a negative sign with your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started