Answered step by step

Verified Expert Solution

Question

1 Approved Answer

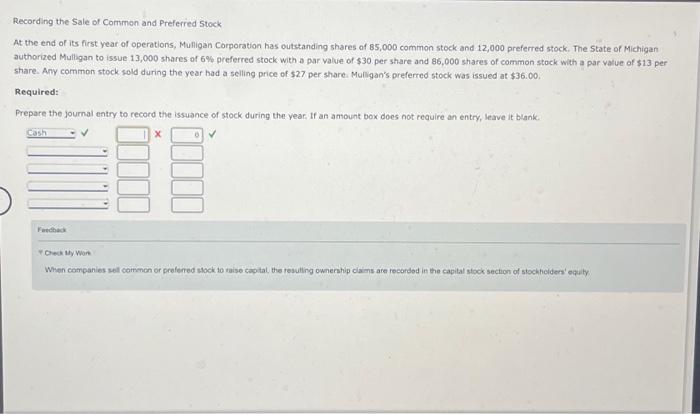

Recording the Sale of Common and Preferred Stock At the end of its first year of operations, Mulligan Corporation has outstanding shares of 85,000 common

Recording the Sale of Common and Preferred Stock At the end of its first year of operations, Mulligan Corporation has outstanding shares of 85,000 common stock and 12,000 preferred stock. The State of Michigan authorized Mulligan to issue 13,000 shares of 6% preferred stock with a par value of $30 per share and 86,000 shares of common stock with a par value of $13 per share. Any common stock sold during the year had a selling price of $27 per share. Mulligan's preferred stock was issued at $36.00. Required: Prepare the journal entry to record the issuance of stock during the year. If an amount box does not require an entry, leave it blank. Cash Feedback X 0 Check My Work When companies sell common or preferred stock to raise capital, the resulting ownership claims are recorded in the capital stock section of stockholders' equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started