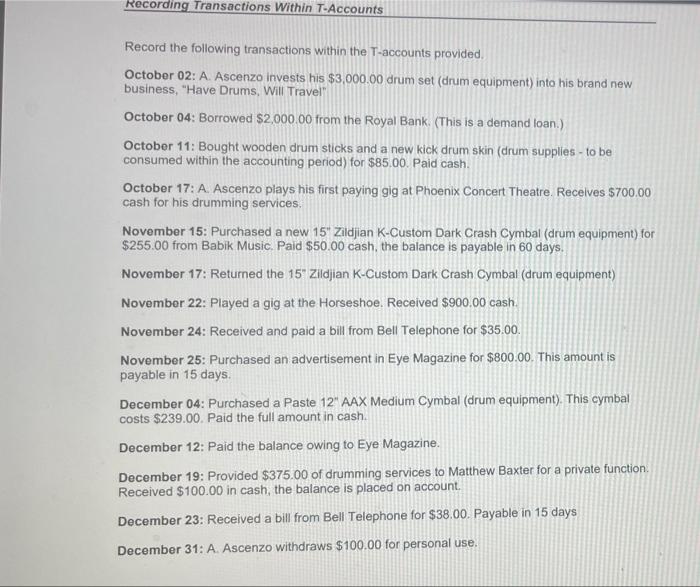

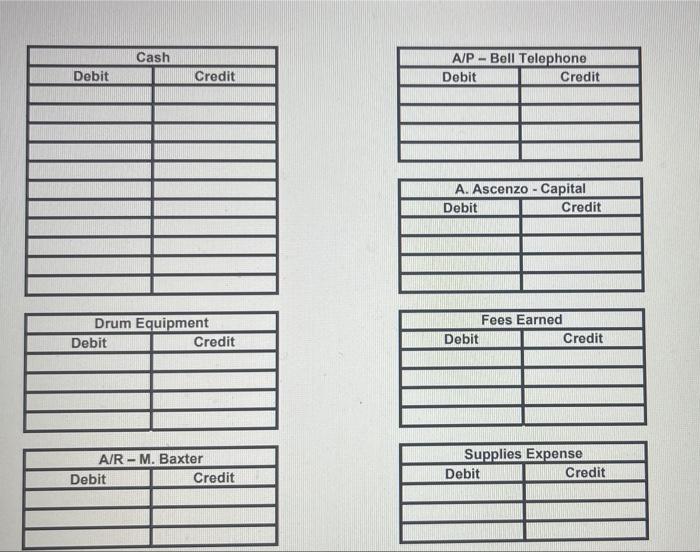

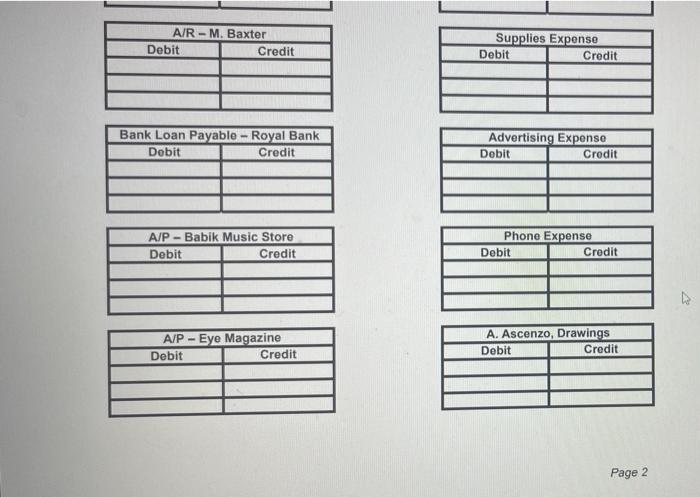

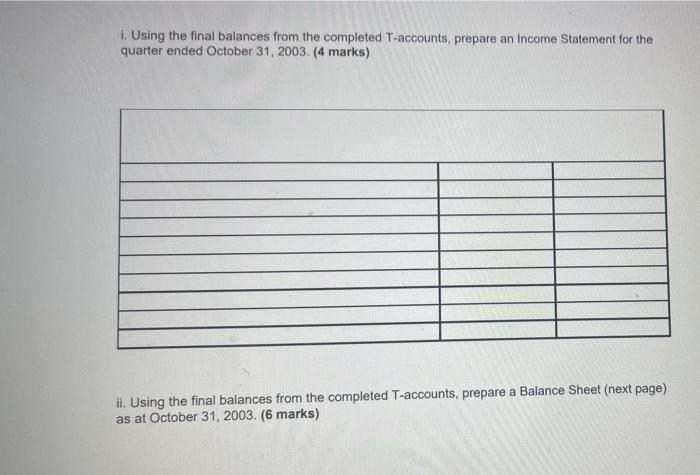

Recording Transactions within T-Accounts Record the following transactions within the T-accounts provided October 02: A. Ascenzo Invests his $3,000.00 drum set (drum equipment) into his brand new business, "Have Drums, Will Travel October 04: Borrowed $2,000.00 from the Royal Bank (This is a demand loan.) October 11: Bought wooden drum sticks and a new kick drum skin (drum supplies - to be consumed within the accounting period) for $85.00. Paid cash. October 17: A. Ascenzo plays his first paying gig at Phoenix Concert Theatre Receives $700.00 cash for his drumming services, Novem 15: Purchased a new 15" Zildjian K-Custom Dark Crash Cymbal (drum equipment) for $255.00 from Babik Music. Paid $50.00 cash, the balance is payable in 60 days. November 17: Returned the 15Zildjian K-Custom Dark Crash Cymbal (drum equipment) November 22: Played a gig at the Horseshoe. Received $900.00 cash. November 24: Received and paid a bill from Bell Telephone for $35.00. November 25: Purchased an advertisement in Eye Magazine for $800.00. This amount is payable in 15 days. December 04: Purchased a Paste 12" AAX Medium Cymbal (drum equipment). This cymbal costs $239.00. Paid the full amount in cash. December 12: Paid the balance owing to Eye Magazine. December 19: Provided $375.00 of drumming services to Matthew Baxter for a private function Received $100.00 in cash, the balance is placed on account. December 23: Received a bill from Bell Telephone for $38.00. Payable in 15 days December 31: A. Ascenzo withdraws $100.00 for personal use. Cash - A/P - Bell Telephone Debit Credit Debit Credit A. Ascenzo - Capital Debit Credit Drum Equipment Debit Credit Fees Earned Debit Credit - A/R - M. Baxter Debit Credit Supplies Expense Debit Credit A/R-M. Baxter Debit Credit Supplies Expense Debit Credit Bank Loan Payable - Royal Bank Dobit Credit Advertising Expense Dobit Credit A/P - Babik Music Store Debit Credit Phono Expense Debit Credit A/P - Eye Magazine Debit Credit A. Ascenzo, Drawings Dobit Credit Page 2 1. Using the final balances from the completed T-accounts, prepare an Income Statement for the quarter ended October 31, 2003. (4 marks) ii. Using the final balances from the completed T-accounts, prepare a Balance Sheet (next page) as at October 31, 2003. (6 marks)