Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recovery Year 3-Year 5-Year 7-Year 1 0.3333 0.2 0.1429 2 0.4445 0.32 0.2449 3 0.1481 0.192 0.1749 4 0.0741 0.1152 0.1249 5 0.1152 0.0893 6

| Recovery Year | 3-Year | 5-Year | 7-Year |

| 1 | 0.3333 | 0.2 | 0.1429 |

| 2 | 0.4445 | 0.32 | 0.2449 |

| 3 | 0.1481 | 0.192 | 0.1749 |

| 4 | 0.0741 | 0.1152 | 0.1249 |

| 5 | 0.1152 | 0.0893 | |

| 6 | 0.0576 | 0.0893 | |

| 7 | 0.0892 | ||

| 8 | 0.0446 |

| Input | |

| Project Life (years) | 4 |

| Equipment | $550,000 |

| Initial Increase NWC | $28,000 |

| Salvage Value (Econ) | $45,000 |

| Cost Savings Year 1 | $250,000 |

| Cost Savings Year 2 | $150,000 |

| Cost Savings Year 3 | $75,000 |

| Cost Savings Year 4 | $75,000 |

| Tax Rate | 40% |

| WACC | 12.00% |

| 0.2 | 0.32 | 0.192 | 0.1152 | ||

| Year | 0 | 1 | 2 | 3 | 4 |

| Equipment | |||||

| Increase NWC | |||||

| Sales | |||||

| Cost Savings | |||||

| Dep | |||||

| EBIT/EBT | |||||

| Taxes | |||||

| NI | |||||

| OCF | |||||

| SV (After Taxes) | |||||

| Return NWC | |||||

| FCF | |||||

| Payback | |||||

| Model Decision | Explanation | ||||

| PB = | |||||

| NPV = | |||||

| IRR = | |||||

| Max. Equip Cost = | |||||

| Overall Decision: | |||||

| Explain: |

Please answer in Excell

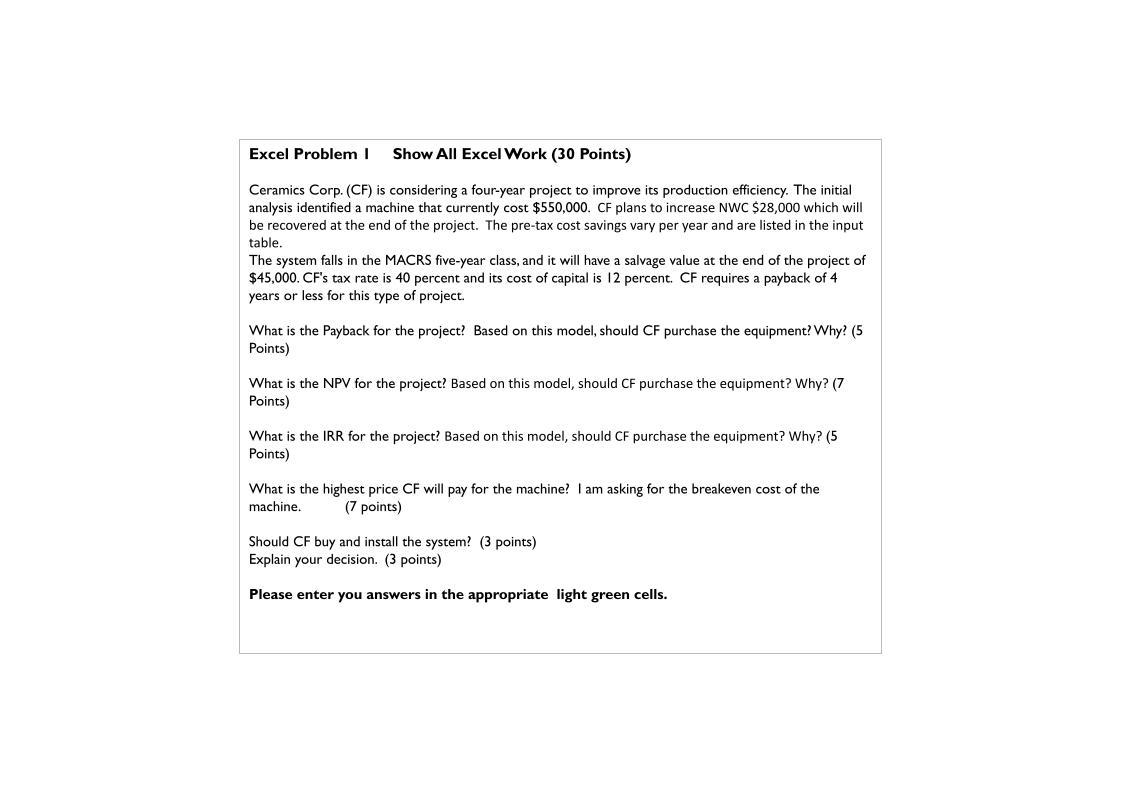

Excel Problem I Show All Excel Work (30 Points) Ceramics Corp. (CF) is considering a four-year project to improve its production efficiency. The initial analysis identified a machine that currently cost $550,000. CF plans to increase NWC $28,000 which will be recovered at the end of the project. The pre-tax cost savings vary per year and are listed in the input table. The system falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $45,000. CF's tax rate is 40 percent and its cost of capital is 12 percent. CF requires a payback of 4 years or less for this type of project. What is the Payback for the project? Based on this model, should CF purchase the equipment? Why? (5 Points) What is the NPV for the project? Based on this model, should CF purchase the equipment? Why? (7 Points) What is the IRR for the project? Based on this model, should CF purchase the equipment? Why? (5 Points) What is the highest price CF will pay for the machine? I am asking for the breakeven cost of the machine. (7 points) Should CF buy and install the system? ( 3 points) Explain your decision. ( 3 points) Please enter you answers in the appropriate light green cellsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started