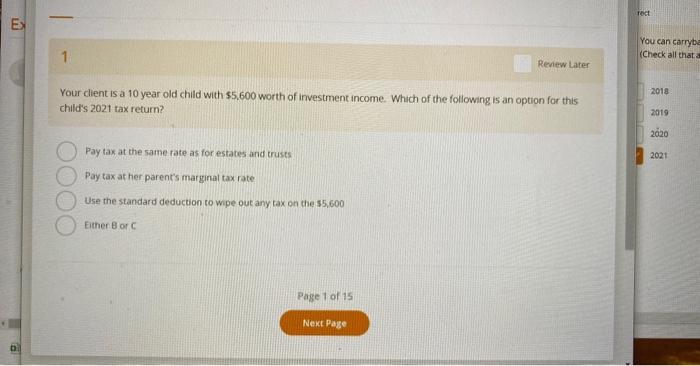

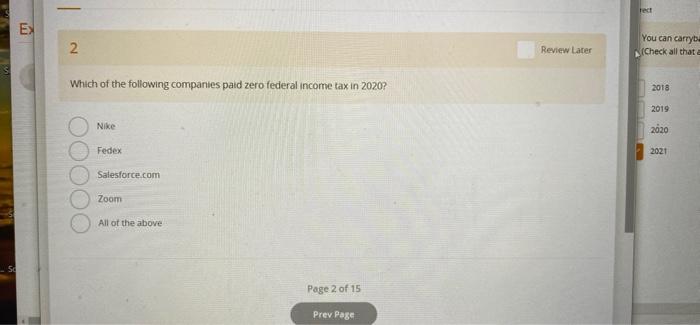

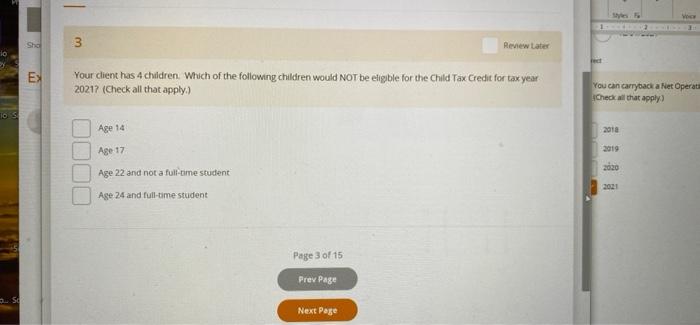

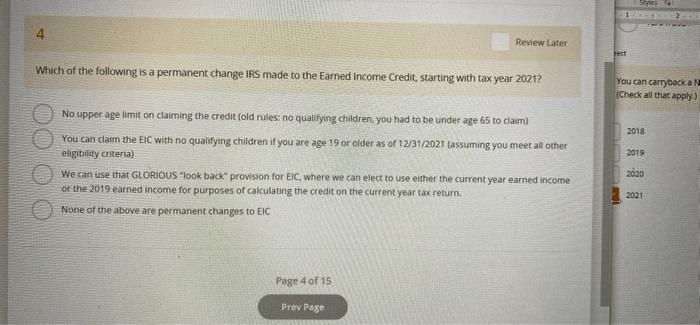

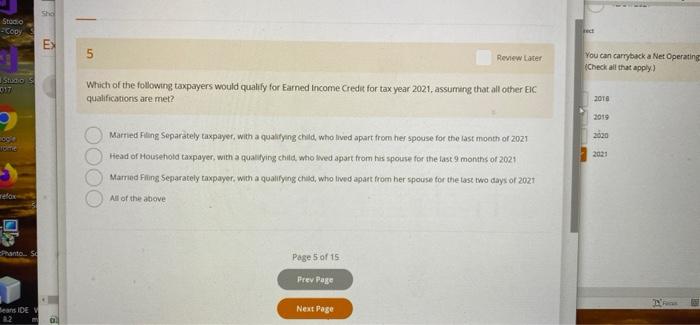

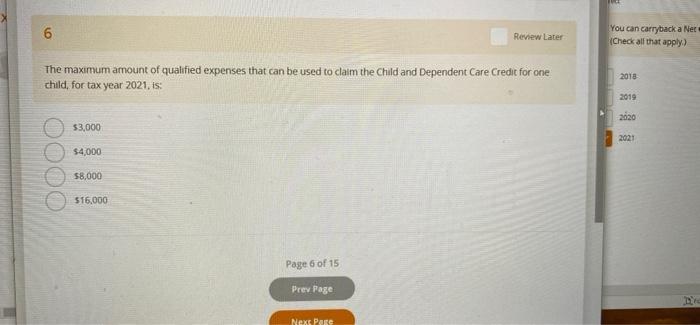

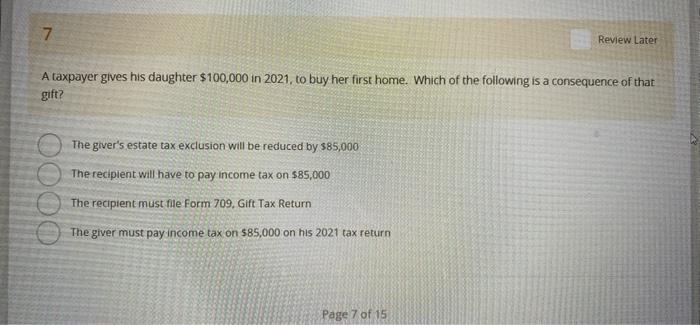

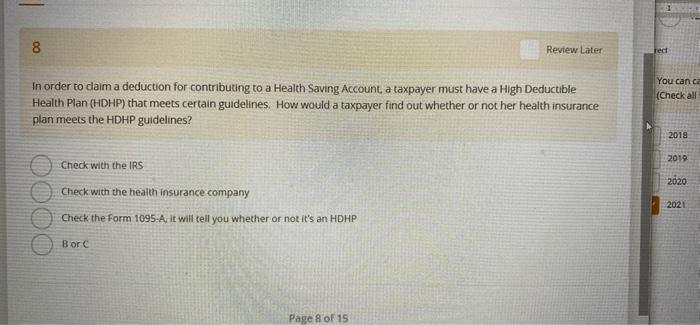

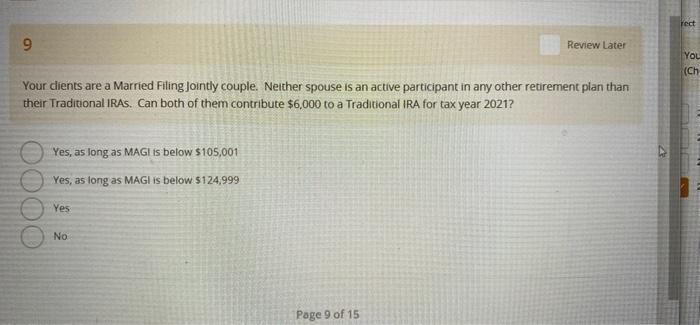

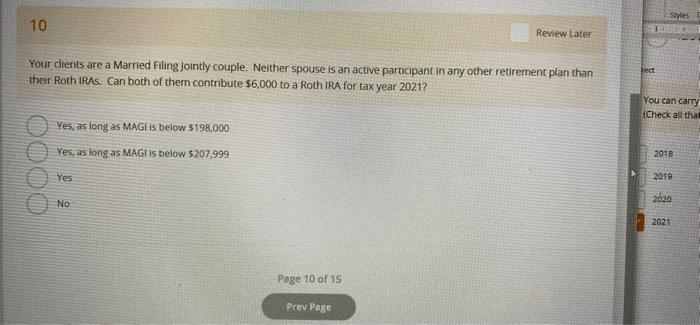

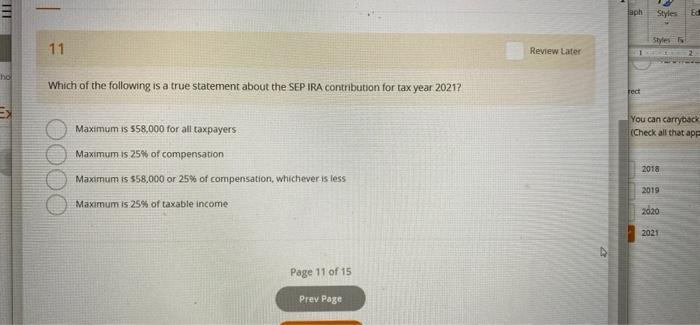

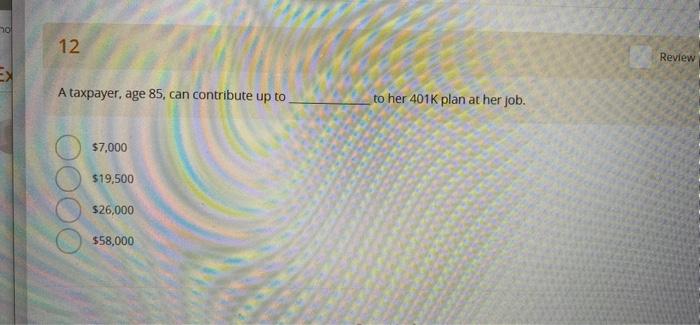

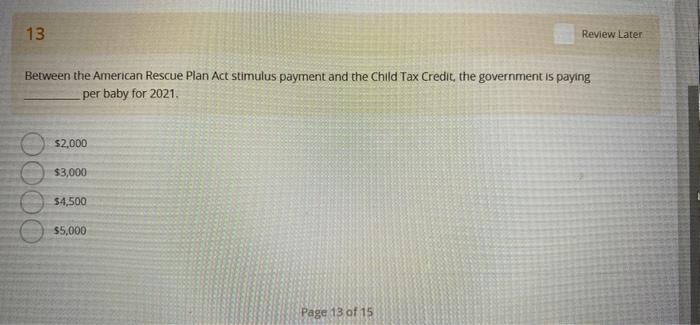

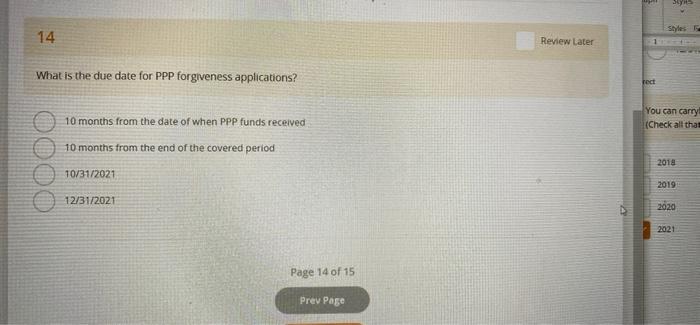

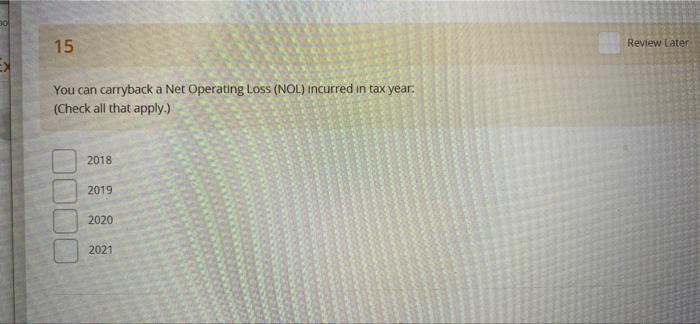

rect ES You can carrybe (Check all that a Review Later 2018 Your client is a 10 year old child with $5,600 worth of investment income. Which of the following is an option for this child's 2021 tax return? 2019 2020 Pay tax at the same rate as for estates and trusts 2021 Pay tax at her parent's marginal tax rate Use the standard deduction to wipe out any tax on the $5,600 Either Borc Page 1 of 15 Next Page E 2 Review Later You can carrybe Check all that Which of the following companies paid zero federal income tax in 2020? 2018 2019 Nike 2020 Fedex 2021 Salesforce.com Zoom All of the above Page 2 of 15 Prev Page Sha 3 Review Later EX Your client has 4 children. Which of the following children would NOT be eligible for the Child Tax Credit for tax year 2021? (Check all that apply.) You can carrybacka Net Operat Check all that apply TOS Ace 14 2018 Age 17 Age 22 and not a full-time student 2021 Age 24 and full-time student Page 3 of 15 Prev Page Next Page Styles 4 Review Later ect Which of the following is a permanent change IRS made to the Earned Income Credit, starting with tax year 2021? You can carrybacka Check all that apply.) 2018 2019 No upper age limit on claiming the credit (old rules: no qualifying children, you had to be under age 65 to claim) You can claim the EC with no qualifying children if you are age 19 or older as of 12/31/2021 tassuming you meet all other eligibility criteria) We can use that GLORIOUS "look back provision for EIC, where we can elect to use either the current year earned income of the 2019 earned income for purposes of calculating the credit on the current year tax return None of the above are permanent changes to EIC 2020 2021 Page 4 of 15 Prev Page Stodo COPY ES 5 Review Later You can carryback a Net Operating (Check all that apply) Stacto 097 Which of the following taxpayers would qualify for Earned Income Credit for tax year 2021, assuming that all other BIC qualifications are met 2018 2019 2020 OC Married Fling Separately taxpayet, with a qualifying child who lived apart from her spouse for the last month of 2021 Head of Household taxpayer, with a qualifying child, who lived apart from his spouse for the last 9 months of 2021 Married Filing Separately taxpayer, with a qualifying child, who lived apart from her spouse for the last two days of 2027 2021 3 All of the above Panto Page 5 of 15 Prev Page Beans IDE Next Page 6 Review Later You can carryback a Net (Check all that apply The maximum amount of qualified expenses that can be used to claim the Child and Dependent Care Credit for one child, for tax year 2021. is: 2018 2020 53,000 2021 $4.000 $8,000 516,000 Page 6 of 15 Prev Page Nexe Pure 7 Review Later A taxpayer gives his daughter $100,000 in 2021, to buy her first home. Which of the following is a consequence of that gift? The giver's estate tax exclusion will be reduced by $85,000 The recipient will have to pay income tax on $85,000 0000 The recipient must nie Form 709, Gift Tax Return The giver must pay income tax on 585,000 on his 2021 tax return Page 7 of 15 8 Review Later rect You can ca (Check all In order to claim a deduction for contributing to a Health Saving Account, a taxpayer must have a High Deductible Health Plan (HDHP) that meets certain guidelines. How would a taxpayer find out whether or not her health insurance plan meets the HDHP guidelines? 2018 2019 Check with the IRS 2020 Check with the health insurance company 0000 2021 Check the Form 1095-A, I will tell you whether or not it's an HDHP Borc Page 8 of 15 rect 9 Review Later You (ch Your dients are a Married Filing Jointly couple. Neither spouse is an active participant in any other retirement plan than their Traditional IRAs. Can both of them contribute $6,000 to a Traditional IRA for tax year 2021? Yes, as long as MAGI is below 105,001 Yes, as long as MAGI is below 5124,999 Yes No Page 9 of 15 Styles 10 Review Later Your clients are a Married Filing Jointly couple. Neither spouse is an active participant in any other retirement plan than their Roth IRAs. Can both of them contribute $6,000 to a Roth IRA for tax year 2021? rect You can carry Check all that Yes, as long as MAG is below 5198,000 Yes, as long as MAG is below $207,999 2018 0000 Yes 2019 2020 NO 2021 Page 10 of 15 Prev Page TIT taph Styles Ed 11 Review Later ho Which of the following is a true statement about the SEP IRA contribution for tax year 2021? rect E Maximum is 558,000 for all taxpayers You can carryback (Check all that app Maximum is 25% of compensation 2018 Maximum is 558,000 or 25% of compensation, whichever is less 2019 Maximum is 25% of taxable income 2020 2021 Page 11 of 15 Prev Page 0 12 Review EX A taxpayer, age 85, can contribute up to to her 401K plan at her job. $7,000 $19,500 OOOO $26,000 $58,000 13 Review Later Between the American Rescue Plan Act stimulus payment and the Child Tax Credit, the government is paying per baby for 2021 $2,000 $3,000 0000 $4,500 $5,000 Page 13 of 15 SCH Styles 14 Review Later What is the due date for PPP forgiveness applications? rect You can carry (Check all that 10 months from the date of when PPP funds received 10 months trom the end of the covered period 2018 10/31/2021 2019 12/31/2021 2020 2021 Page 14 of 15 Prev Page 30 15 Review Later You can carryback a Net Operating Loss (NOL) incurred in tax year: (Check all that apply.) 2018 2019 2020 2021 Sho 15 Review Later EX You can carryback a Net Operating LOSS (NOL) incurred in tax year (Check all that apply.) 2018 2019 2020 2021