Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Red Bird Inc. (RBI) in a Canadian company that applies IFRS for financial reporting purposes. The following information has been provided for Red Bird Inc.

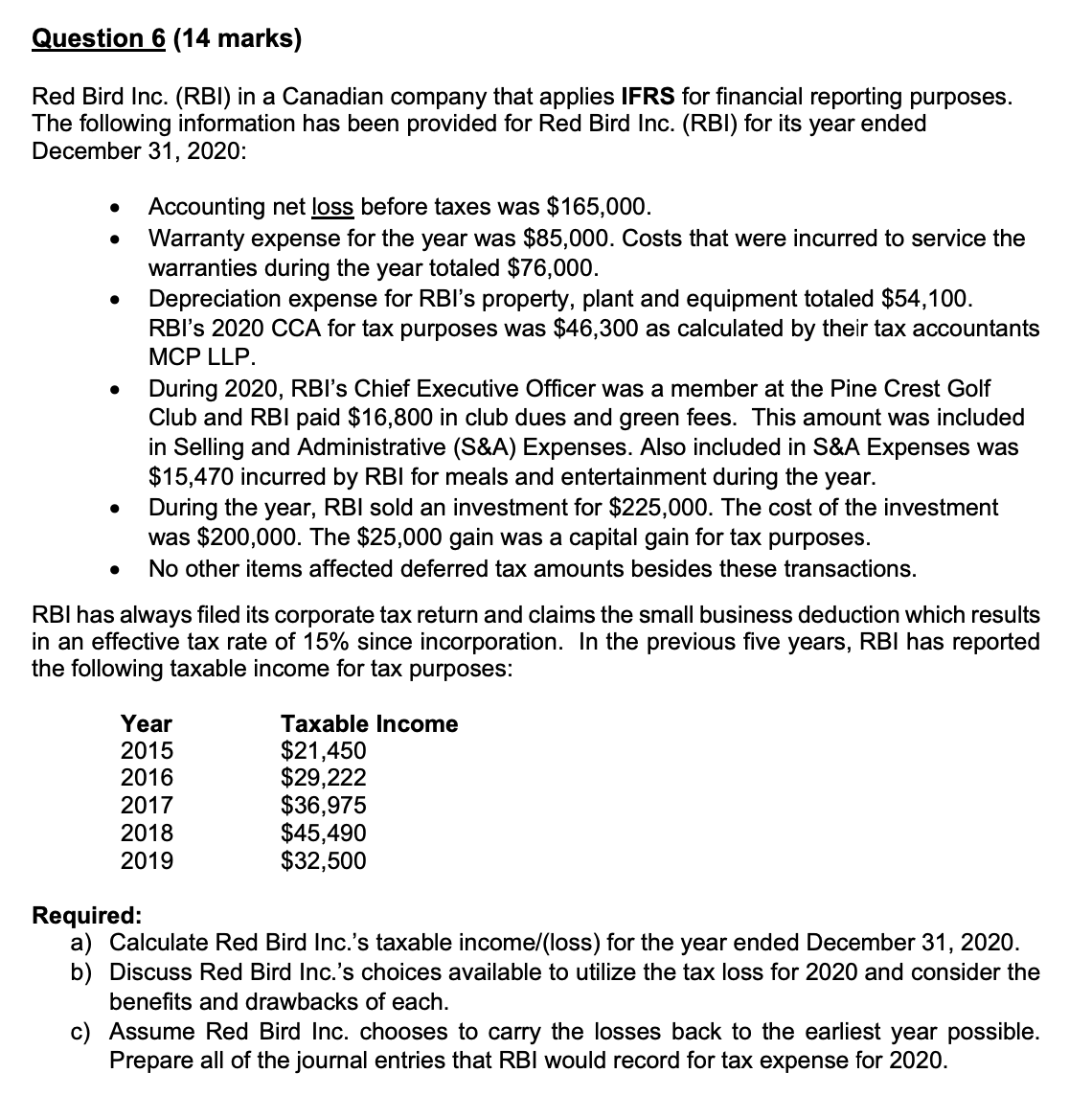

Red Bird Inc. (RBI) in a Canadian company that applies IFRS for financial reporting purposes. The following information has been provided for Red Bird Inc. (RBI) for its year ended December 31, 2020: - Accounting net loss before taxes was $165,000. - Warranty expense for the year was $85,000. Costs that were incurred to service the warranties during the year totaled $76,000. - Depreciation expense for RBl's property, plant and equipment totaled $54,100. RBl's 2020 CCA for tax purposes was $46,300 as calculated by their tax accountants MCP LLP. - During 2020, RBl's Chief Executive Officer was a member at the Pine Crest Golf Club and RBI paid $16,800 in club dues and green fees. This amount was included in Selling and Administrative (S\&A) Expenses. Also included in S\&A Expenses was $15,470 incurred by RBI for meals and entertainment during the year. - During the year, RBI sold an investment for $225,000. The cost of the investment was $200,000. The $25,000 gain was a capital gain for tax purposes. - No other items affected deferred tax amounts besides these transactions. RBI has always filed its corporate tax return and claims the small business deduction which results in an effective tax rate of 15% since incorporation. In the previous five years, RBI has reported the following taxable income for tax purposes: Required: a) Calculate Red Bird Inc.'s taxable income/(loss) for the year ended December 31, 2020. b) Discuss Red Bird Inc.'s choices available to utilize the tax loss for 2020 and consider the benefits and drawbacks of each. c) Assume Red Bird Inc. chooses to carry the losses back to the earliest year possible. Prepare all of the journal entries that RBI would record for tax expense for 2020

Red Bird Inc. (RBI) in a Canadian company that applies IFRS for financial reporting purposes. The following information has been provided for Red Bird Inc. (RBI) for its year ended December 31, 2020: - Accounting net loss before taxes was $165,000. - Warranty expense for the year was $85,000. Costs that were incurred to service the warranties during the year totaled $76,000. - Depreciation expense for RBl's property, plant and equipment totaled $54,100. RBl's 2020 CCA for tax purposes was $46,300 as calculated by their tax accountants MCP LLP. - During 2020, RBl's Chief Executive Officer was a member at the Pine Crest Golf Club and RBI paid $16,800 in club dues and green fees. This amount was included in Selling and Administrative (S\&A) Expenses. Also included in S\&A Expenses was $15,470 incurred by RBI for meals and entertainment during the year. - During the year, RBI sold an investment for $225,000. The cost of the investment was $200,000. The $25,000 gain was a capital gain for tax purposes. - No other items affected deferred tax amounts besides these transactions. RBI has always filed its corporate tax return and claims the small business deduction which results in an effective tax rate of 15% since incorporation. In the previous five years, RBI has reported the following taxable income for tax purposes: Required: a) Calculate Red Bird Inc.'s taxable income/(loss) for the year ended December 31, 2020. b) Discuss Red Bird Inc.'s choices available to utilize the tax loss for 2020 and consider the benefits and drawbacks of each. c) Assume Red Bird Inc. chooses to carry the losses back to the earliest year possible. Prepare all of the journal entries that RBI would record for tax expense for 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started