Answered step by step

Verified Expert Solution

Question

1 Approved Answer

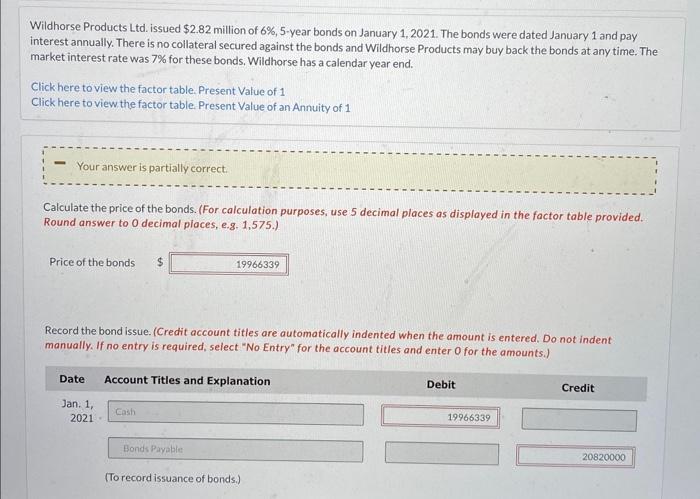

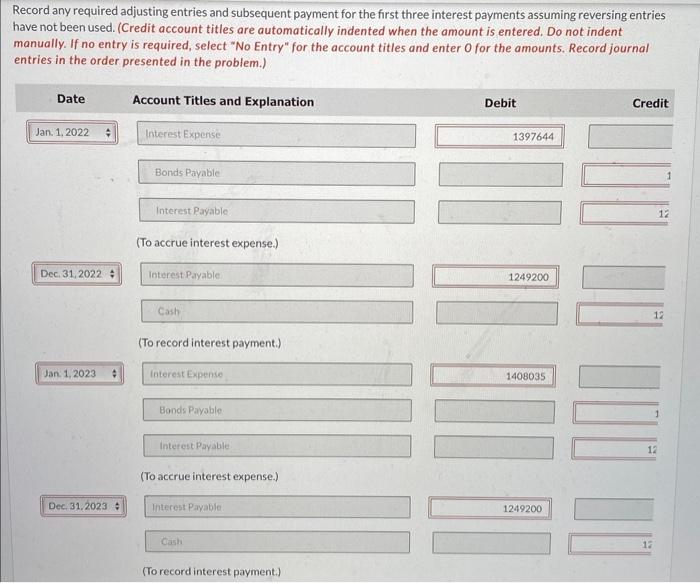

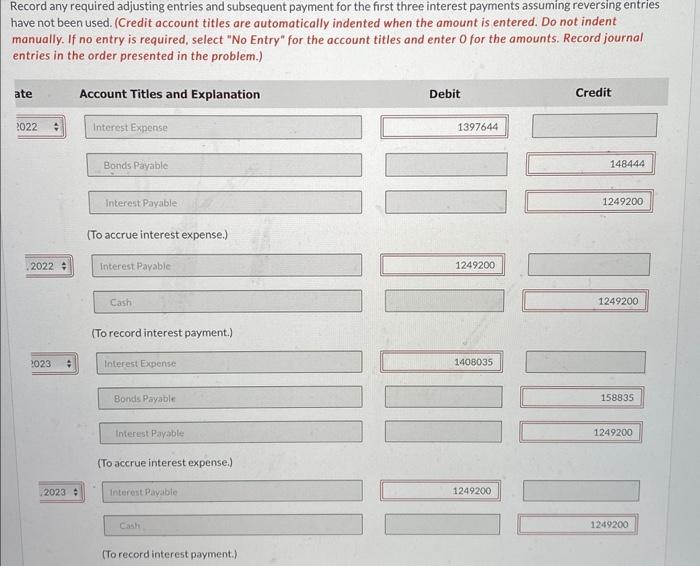

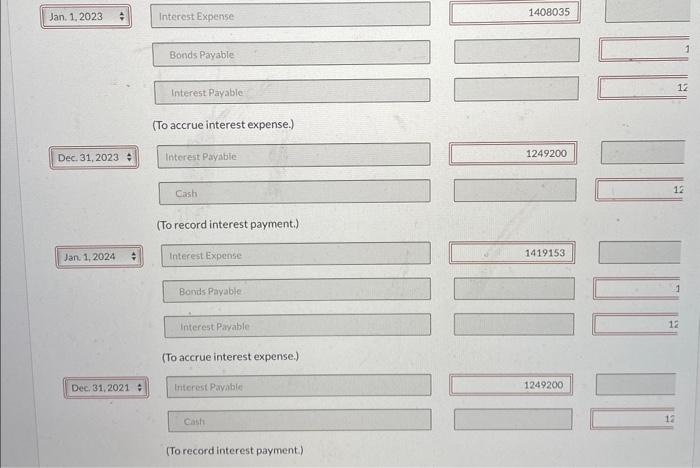

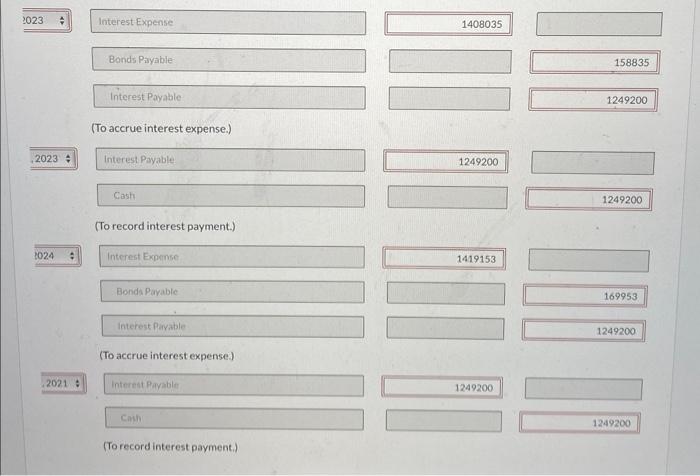

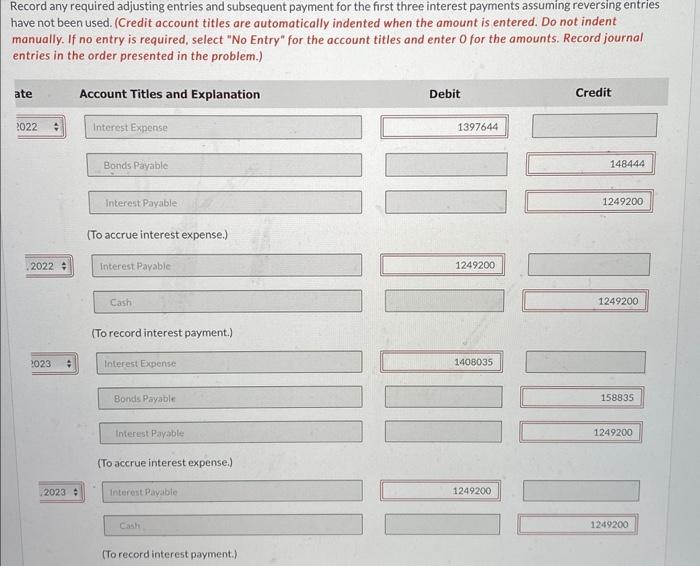

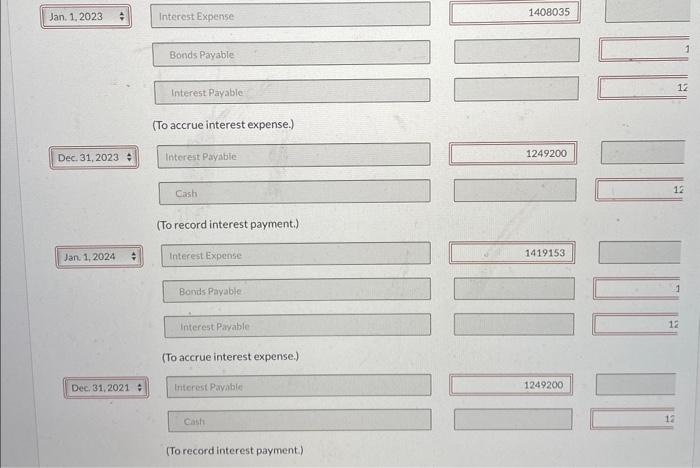

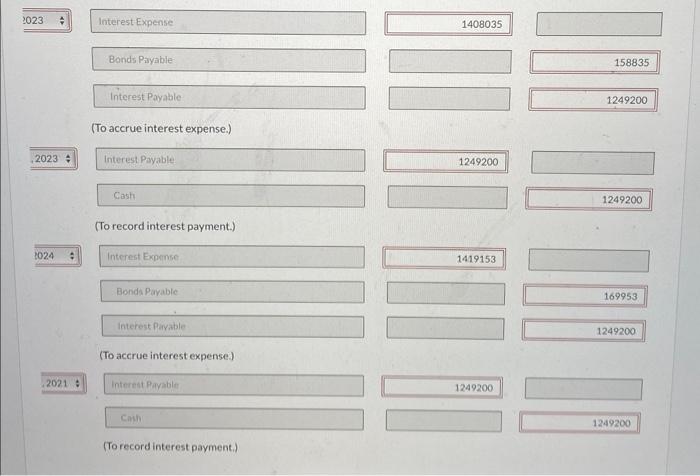

red box correct answers? Wildhorse Products Ltd. issued $2.82 million of 6%,5-year bonds on January 1, 2021. The bonds were dated January 1 and pay

red box correct answers?

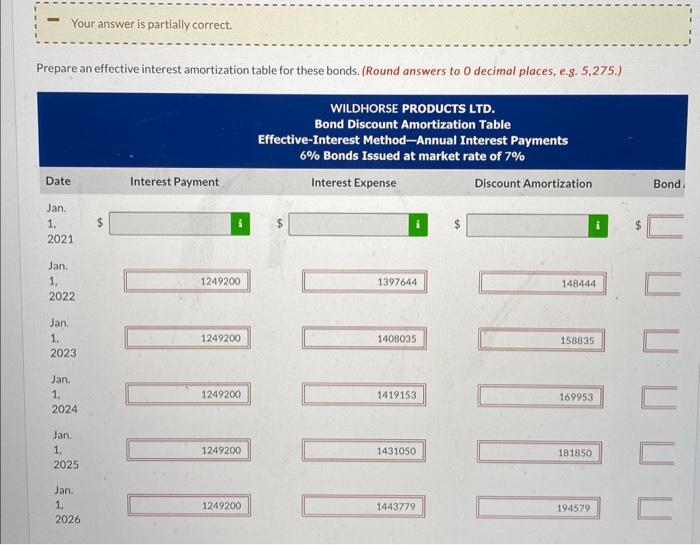

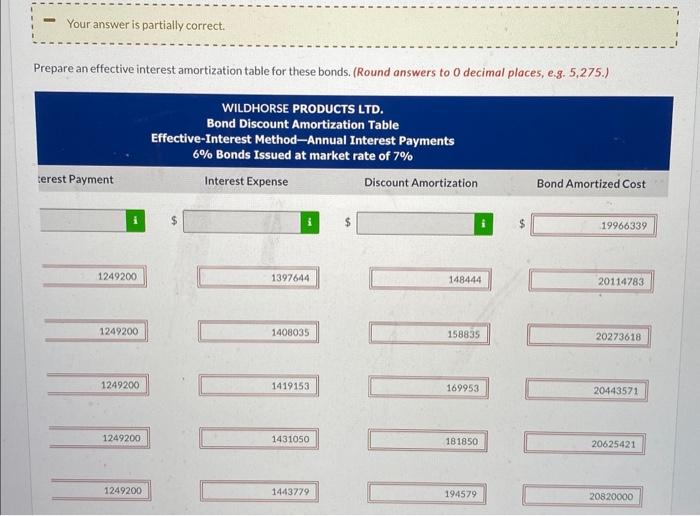

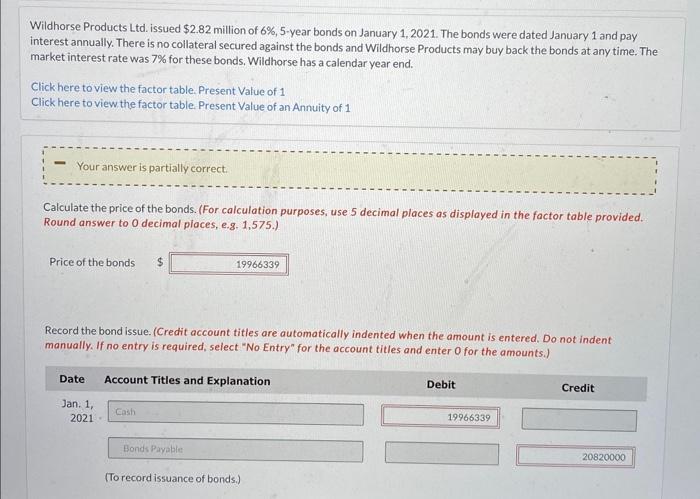

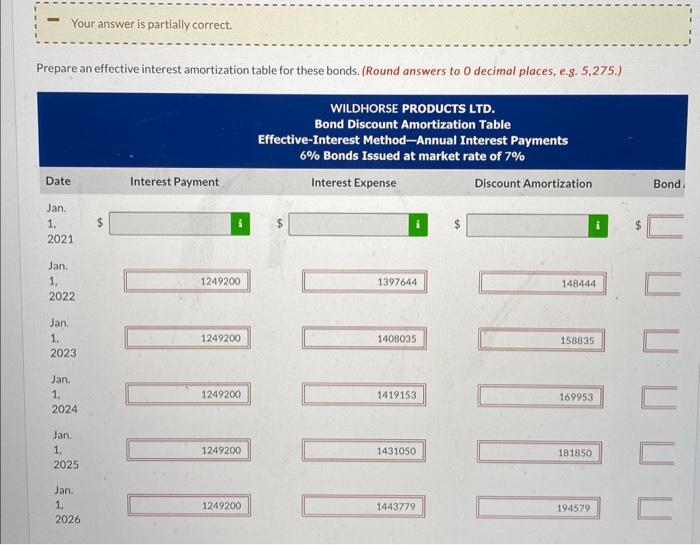

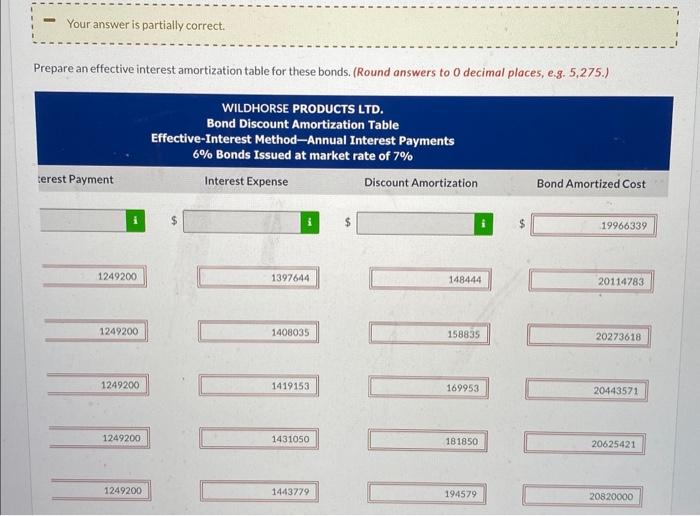

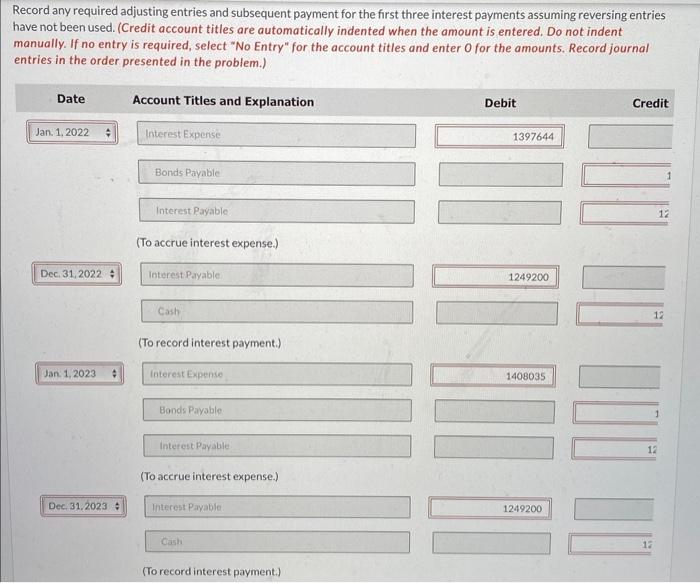

Wildhorse Products Ltd. issued $2.82 million of 6%,5-year bonds on January 1, 2021. The bonds were dated January 1 and pay interest annually. There is no collateral secured against the bonds and Wildhorse Products may buy back the bonds at any time. The market interest rate was 7% for these bonds. Wildhorse has a calendar year end. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 Calculate the price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 0 decimal piaces, e.g. 1,575.) Price of the bonds $ Record the bond issue. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No. Entry" for the account titles and enter 0 for the amounts.) Your answer is partially correct. Prepare an effective interest amortization table for these bonds. (Round answers to 0 decimal places, e.g. 5, 275.) WILDHORSE PRODUCTS LTD. Bond Discount Amortization Table Effective-Interest Method-Annual Interest Payments 6% Bonds Issued at market rate of 7% \begin{tabular}{l|l|} Jan. \\ 1, & 1249200 \\ 2024 & \end{tabular} Jan: 1. 2025 Wepar castertetive miter est amortization table ror these bonds, (Kound answers to 0 decimal places, e.g. 5,275.) Record any required adjusting entries and subsequent payment for the first three interest payments assuming reversing entries have not been used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Record any required adjusting entries and subsequent payment for the first three interest payments assuming reversing entries have not been used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Bonds Payable Interest Payable: (To accrue interest expense.) Dec. 31,2023 Interest Payable \begin{tabular}{|l|} \hline 1249200 \\ \hline \end{tabular} (To record interest payment.) Jan1,2024 Interest Expense Bonids Payable Interest payable (To accrue interest expense.) Dec, 31,2021; Interest Payible 1249200 Casth (To record interest payment.) 2023 Interest Expense 1408035 Bonds Payable 158835 Interest Payable 1249200 (To accrue interest expense.) 2023 Interest Payable 1249200 Cash 1249200 (To record interest payment.) Interest Expense 1419153 Bonda Payable 169953 1249200 (To accrue interest expense) 2021 : Interet Pavable 1249200 Camh 1249200 (To record interest payment.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started