Answered step by step

Verified Expert Solution

Question

1 Approved Answer

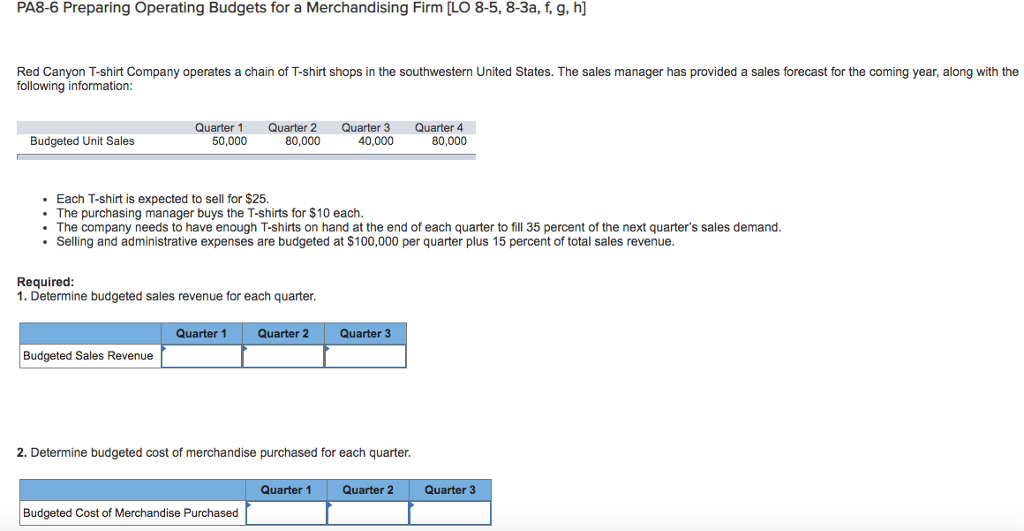

Red Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the

Red Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the coming year, along with the following information:

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | ||||

| Budgeted Unit Sales | 50,000 | 80,000 | 40,000 | 80,000 | |||

Each T-shirt is expected to sell for $25.

The purchasing manager buys the T-shirts for $10 each.

The company needs to have enough T-shirts on hand at the end of each quarter to fill 35 percent of the next quarters sales demand.

Selling and administrative expenses are budgeted at $100,000 per quarter plus 15 percent of total sales revenue.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started