Answered step by step

Verified Expert Solution

Question

1 Approved Answer

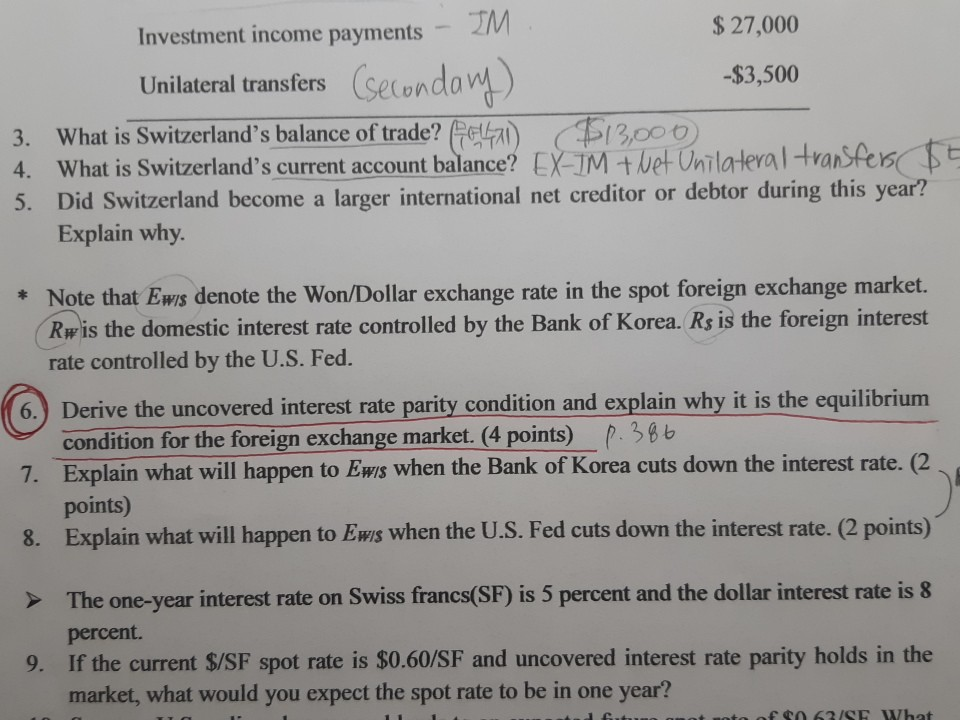

Red circled question #6. How canI derive the UIP using those given factors? please write in step by step. Thanks!! Investment income payments $ 27,000

Red circled question #6. How canI derive the UIP using those given factors? please write in step by step. Thanks!!

Investment income payments $ 27,000 Unilateral transfers Csecondary) Unilateral transfers -$3,500 3. What is Switzerland's balance of trade? (44) 113,000 4. What is Switzerland's current account balance? EX-TM + Wet Unilateral transfer ft 5. Did Switzerland become a larger international net creditor or debtor during this year? Explain why. * Note that Ews denote the Won/Dollar exchange rate in the spot foreign exchange market. Rw is the domestic interest rate controlled by the Bank of Korea. Rs is the foreign interest rate controlled by the U.S. Fed. Derive the uncovered interest rate parity condition and explain why it is the equilibrium condition for the foreign exchange market. (4 points) .386 7. Explain what will happen to Ewis when the Bank of Korea cuts down the interest rate. (2 points) 8. Explain what will happen to Ewis when the U.S. Fed cuts down the interest rate. (2 points) > The one-year interest rate on Swiss francs(SF) is 5 percent and the dollar interest rate is 8 percent. 9. If the current $/SF spot rate is $0.60/SF and uncovered interest rate parity holds in the market, what would you expect the spot rate to be in one year? Investment income payments $ 27,000 Unilateral transfers Csecondary) Unilateral transfers -$3,500 3. What is Switzerland's balance of trade? (44) 113,000 4. What is Switzerland's current account balance? EX-TM + Wet Unilateral transfer ft 5. Did Switzerland become a larger international net creditor or debtor during this year? Explain why. * Note that Ews denote the Won/Dollar exchange rate in the spot foreign exchange market. Rw is the domestic interest rate controlled by the Bank of Korea. Rs is the foreign interest rate controlled by the U.S. Fed. Derive the uncovered interest rate parity condition and explain why it is the equilibrium condition for the foreign exchange market. (4 points) .386 7. Explain what will happen to Ewis when the Bank of Korea cuts down the interest rate. (2 points) 8. Explain what will happen to Ewis when the U.S. Fed cuts down the interest rate. (2 points) > The one-year interest rate on Swiss francs(SF) is 5 percent and the dollar interest rate is 8 percent. 9. If the current $/SF spot rate is $0.60/SF and uncovered interest rate parity holds in the market, what would you expect the spot rate to be in one yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started