Answered step by step

Verified Expert Solution

Question

1 Approved Answer

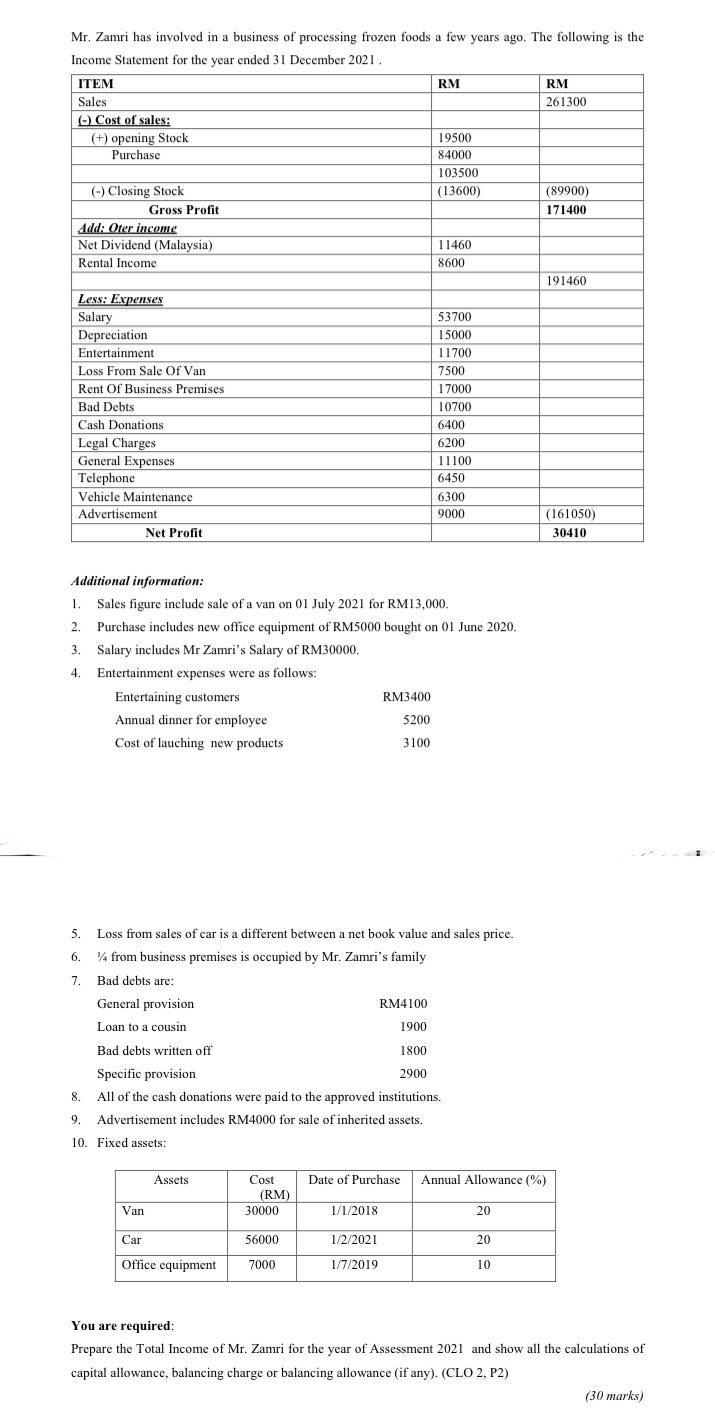

Mr. Zamri has involved in a business of processing frozen foods a few years ago. The following is the Income Statement for the year

Mr. Zamri has involved in a business of processing frozen foods a few years ago. The following is the Income Statement for the year ended 31 December 2021. ITEM Sales (-) Cost of sales: (+) opening Stock Purchase (-) Closing Stock Gross Profit Add: Oter income Net Dividend (Malaysia) Rental Income Less: Expenses Salary Depreciation Entertainment Loss From Sale Of Van Rent Of Business Premises Bad Debts Cash Donations Legal Charges General Expenses Telephone Vehicle Maintenance Advertisement. Net Profit 3. Salary includes Mr Zamri's Salary of RM30000. 4. Entertainment expenses were as follows: Entertaining customers Annual dinner for employee Cost of lauching new products Van Assets Additional information: 1. Sales figure include sale of a van on 01 July 2021 for RM13,000. 2. Purchase includes new office equipment of RM5000 bought on 01 June 2020. Cost (RM) 30000 Car 56000 Office equipment 7000 5. Loss from sales of car is a different between a net book value and sales price. 6. 1/4 from business premises is occupied by Mr. Zamri's family 7. Bad debts are: General provision Loan to a cousin RM RM3400 5200 3100 RM4100 1900 Bad debts written off 1800 Specific provision 2900 8. All of the cash donations were paid to the approved institutions. 9. Advertisement includes RM4000 for sale of inherited assets. 10. Fixed assets: 1/1/2018 19500 84000 103500 (13600) 1/2/2021 11460 8600 1/7/2019 53700 15000 11700 7500 17000 10700 6400 6200 11100 6450 6300 9000 Date of Purchase Annual Allowance (%) 20 20 RM 261300 10 (89900) 171400 191460 (161050) 30410 You are required: Prepare the Total Income of Mr. Zamri for the year of Assessment 2021 and show all the calculations of capital allowance, balancing charge or balancing allowance (if any). (CLO 2, P2) (30 marks)

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Total Income of Mr Zamri for the year of Assessment 2021 Sales RM261300 Less Cost of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started