Answered step by step

Verified Expert Solution

Question

1 Approved Answer

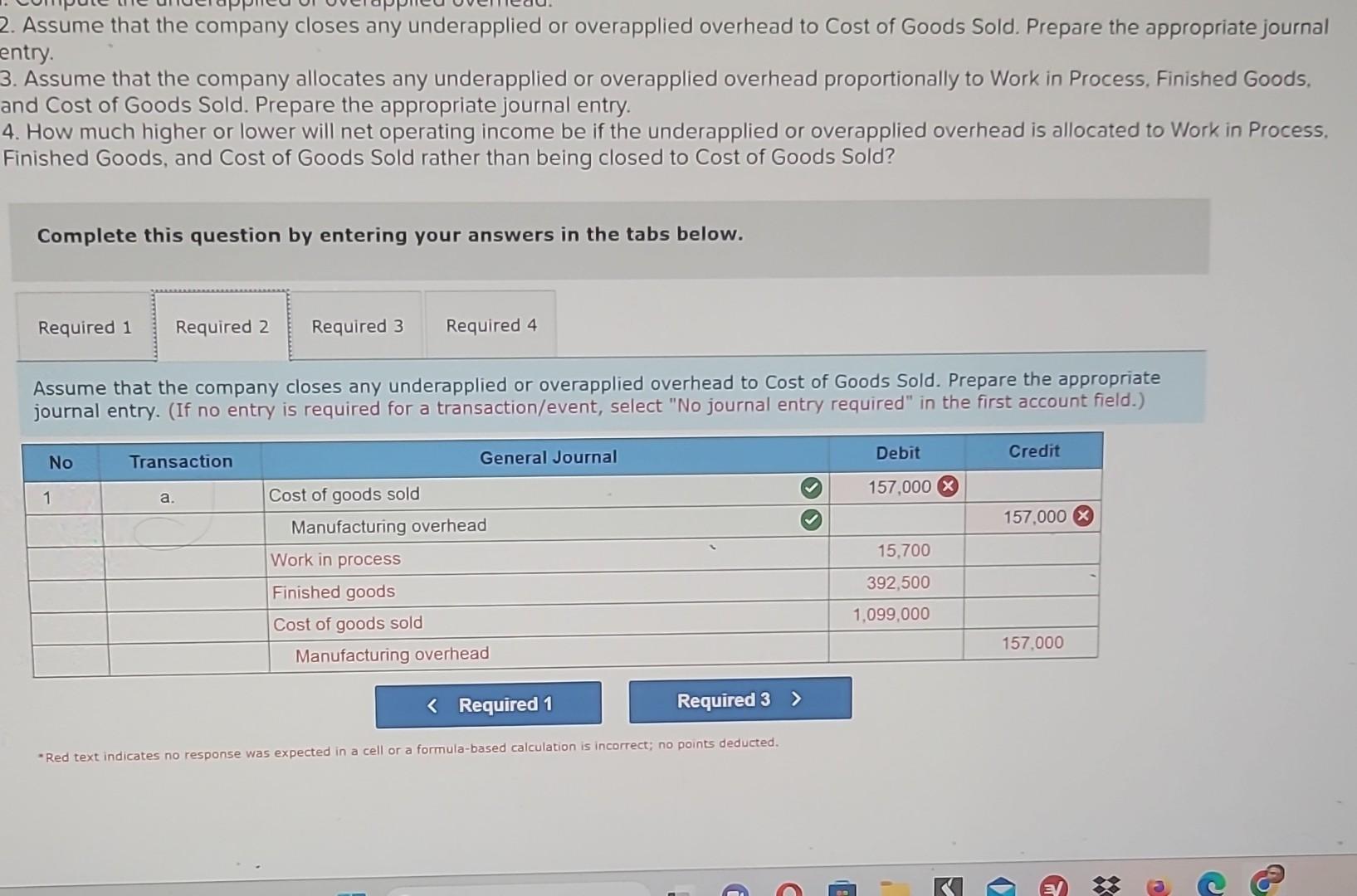

red mark are wrong. the green marks are correct. could you please fix it oblem 3-12 (Static) Predetermined Overhead Rate; Disposing of Underapplied or Overapplied

red mark are wrong. the green marks are correct. could you please fix it

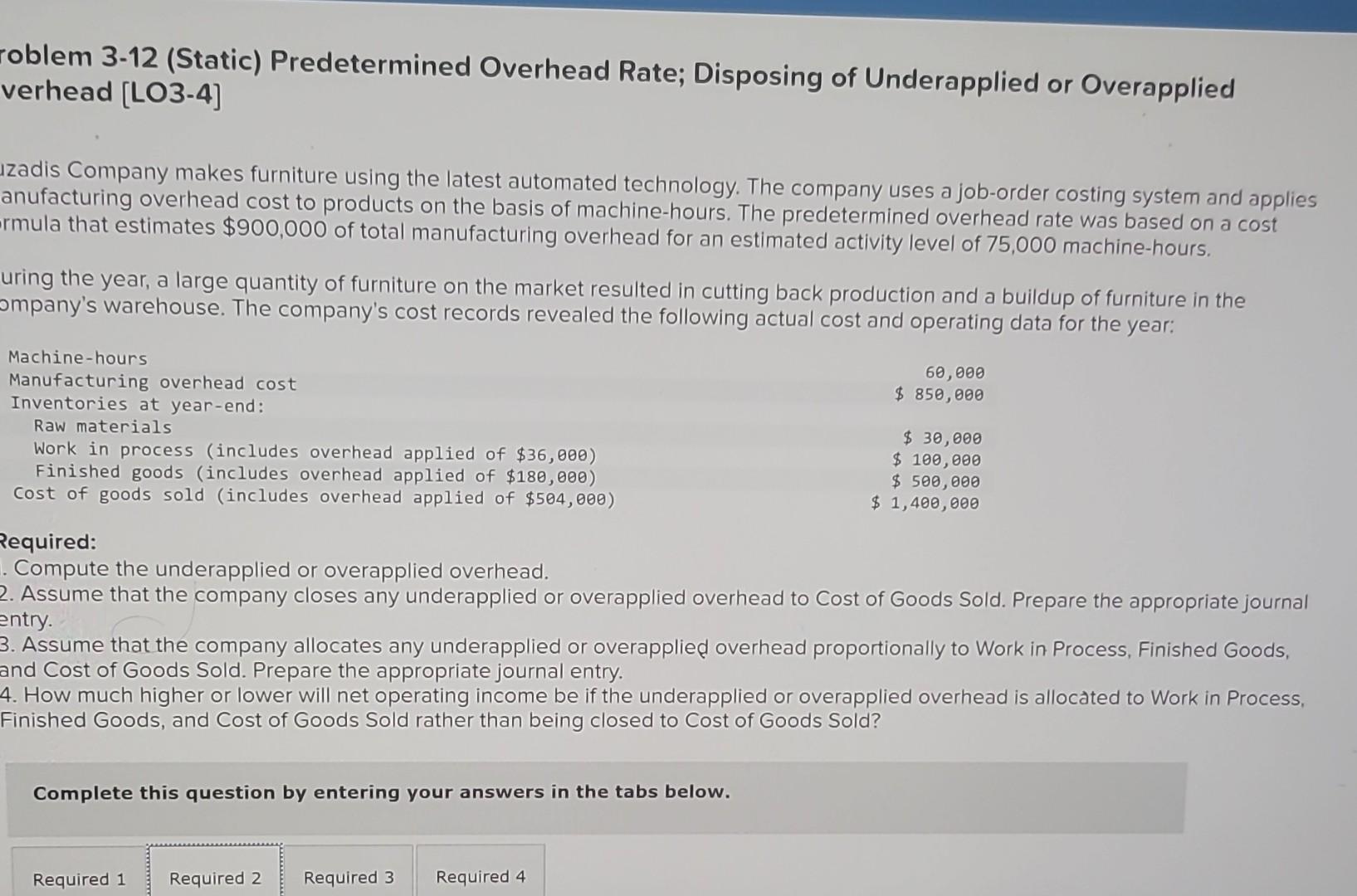

oblem 3-12 (Static) Predetermined Overhead Rate; Disposing of Underapplied or Overapplied verhead [LO3-4] zadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies anufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost rmula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. uring the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the ompany's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Required: Compute the underapplied or overapplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal intry. . Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods. and Cost of Goods Sold. Prepare the appropriate journal entry. H. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) - Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deductedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started