Answered step by step

Verified Expert Solution

Question

1 Approved Answer

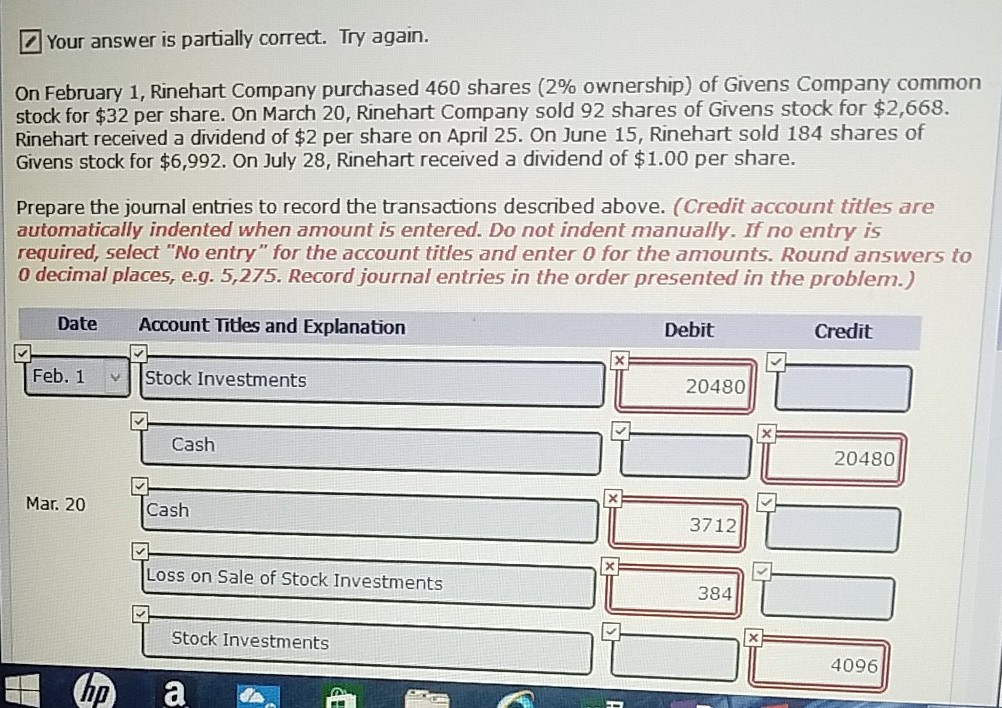

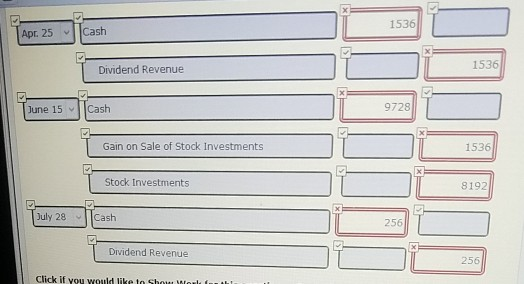

red markings are wrong Your answer is partially correct. Try again. On February 1, Rinehart Company purchased 460 shares (2% ownership of Givens Company common

red markings are wrong

Your answer is partially correct. Try again. On February 1, Rinehart Company purchased 460 shares (2% ownership of Givens Company common stock for $32 per share. On March 20, Rinehart Company sold 92 shares of Givens stock for $2,668. Rinehart received a dividend of $2 per share on April 25. On June 15, Rinehart sold 184 shares of Givens stock for $6,992. On July 28, Rinehart received a dividend of $1.00 per share. Prepare the journal entries to record the transactions described above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Feb. 1 Stock Investments 20480 Cash 20480 Mar. 20 Cash 3712 Loss on Sale of Stock Investments 384 Stock Investments 4096 , cash | Dividend Revenue 1536 Cash Gain on Sale of Stock Investments Stock Investments 8192 Il cash Dividend Revenue Click if you would like to Show WorldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started