Question

Redmon gathers the following information for adjusting entries on December 31: a) Accrued service revenue, $400. b) Earned 1/3 of the service revenue collected in

Redmon gathers the following information for adjusting entries on December 31:

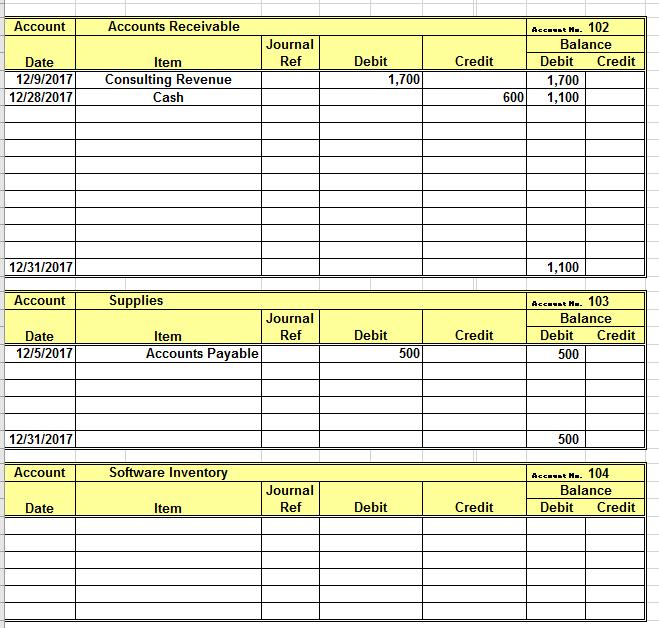

a) Accrued service revenue, $400.

b) Earned 1/3 of the service revenue collected in advance on December 22.

c) Supplies on hand, $100.

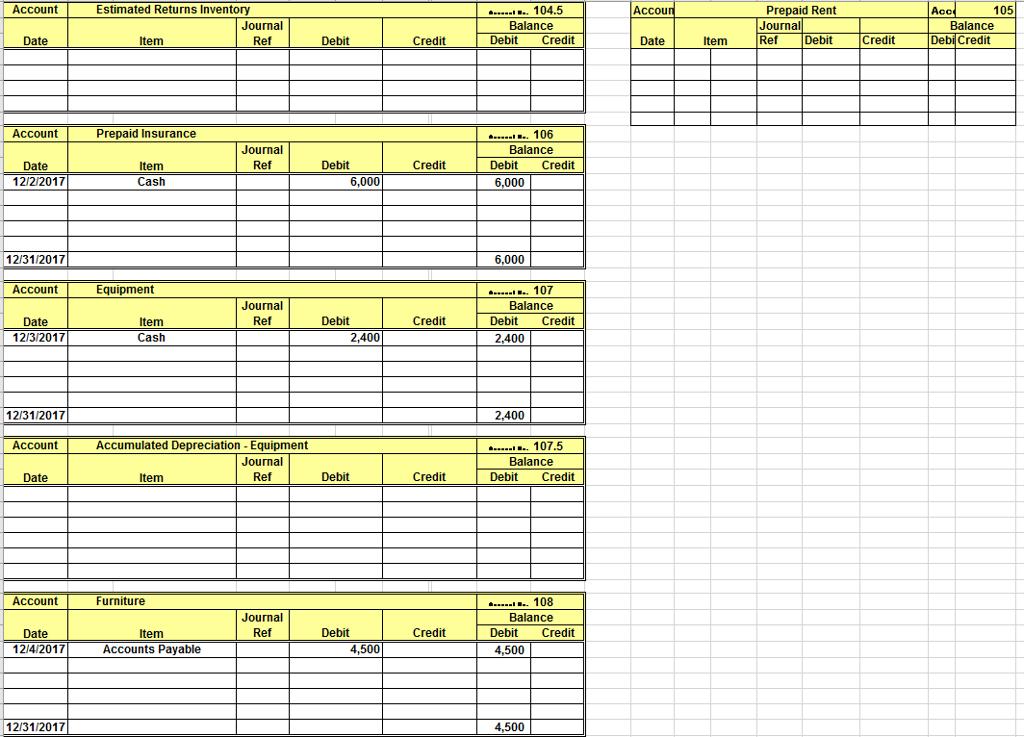

d) Both the computer and the furniture need to be depreciated for a full month.

e) Record the secretary’s salary since being hired; she has now worked 1/3 of the month.

f) Record expiration of prepaid insurance.

1a) Prepare adjusting entries for the above transactions.

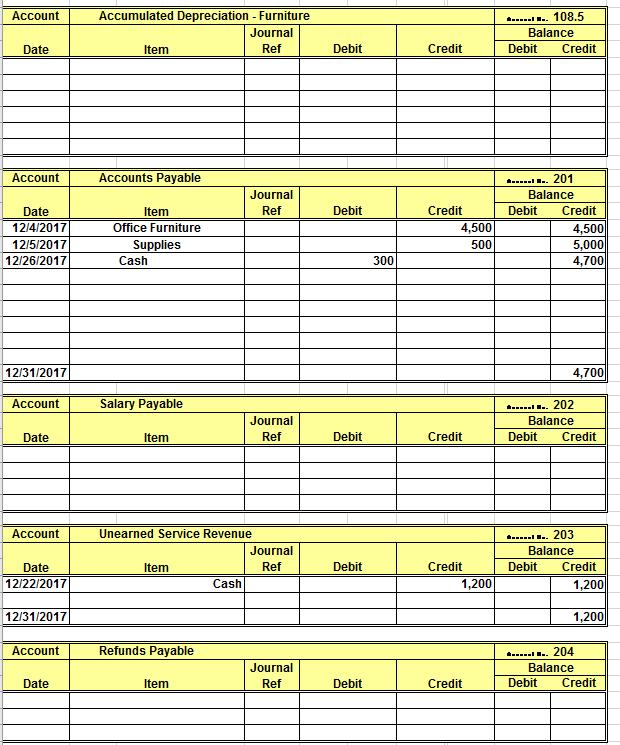

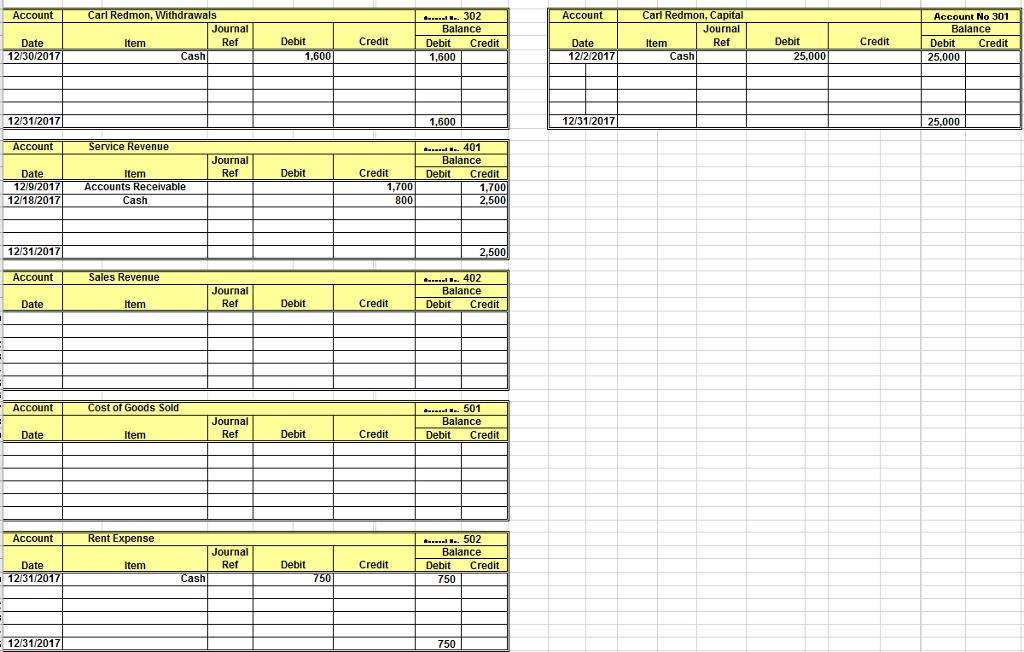

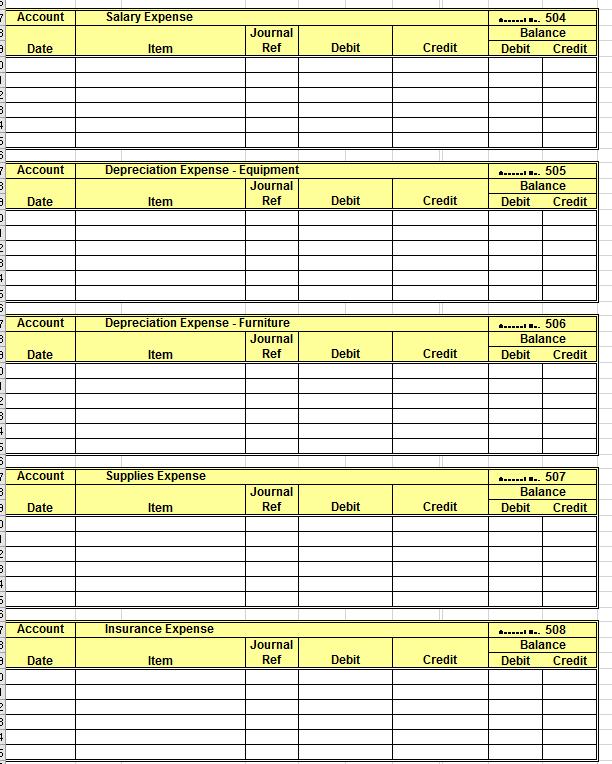

b) Post these entries to the ledger.

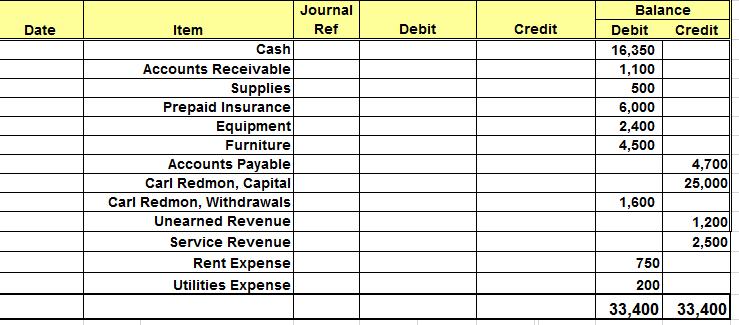

c) Prepare an adjusted trial balance, an income statement, a statement of owner’s equity, and a balance sheet as of / on December 31, 2017.

d) Prepare closing entries at December 31, 2017 and post to the ledger.

e) Prepare a post-closing trial balance on December 31, 2017.

The secretary is to be paid for 10 days out of 30 so 1/3 of her monthly salary. She is to be paid $4000 for 30 days. If she worked 10 days (since the 20th of the month) she should receive 1/3 of the $4000

e

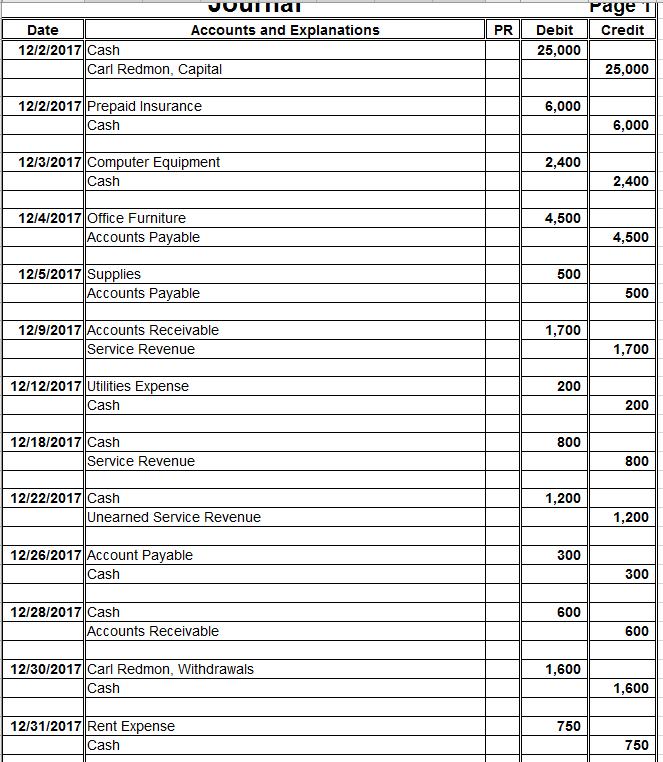

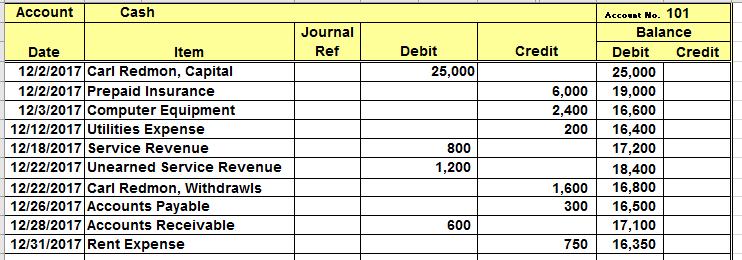

Date 12/2/2017 Cash Carl Redmon, Capital 12/2/2017 Prepaid Insurance Cash 12/3/2017 Computer Equipment Cash 12/4/2017 Office Furniture Accounts Payable 12/5/2017 Supplies Accounts and Explanations Accounts Payable 12/9/2017 Accounts Receivable Service Revenue 12/12/2017 Utilities Expense Cash 12/18/2017 Cash Service Revenue 12/22/2017 Cash Unearned Service Revenue 12/26/2017 Account Payable Cash 12/28/2017 Cash Accounts Receivable 12/30/2017 Carl Redmon, Withdrawals Cash 12/31/2017 Rent Expense Cash PR Page T Debit Credit 25,000 6,000 2,400 4,500 500 1,700 200 800 1,200 300 600 1,600 750 25,000 6,000 2,400 4,500 500 1,700 200 800 1,200 300 600 1,600 750

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started