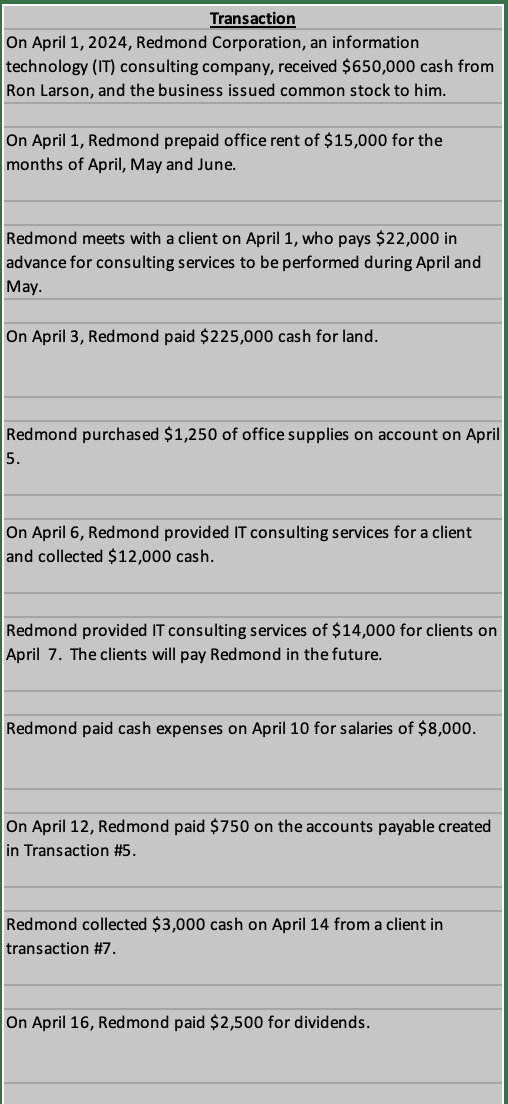

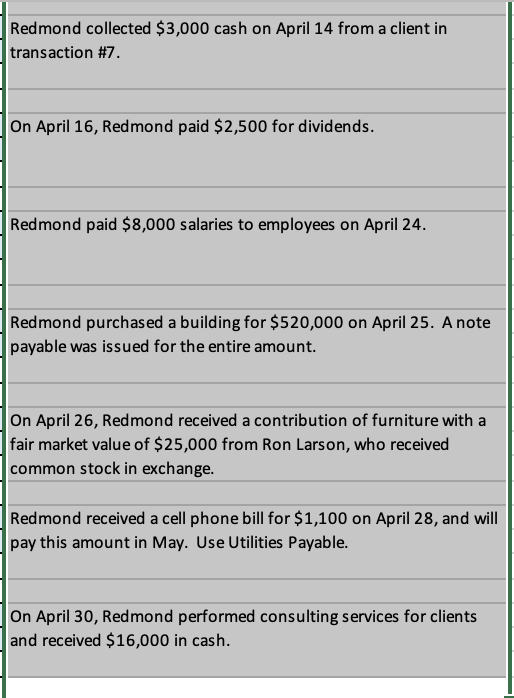

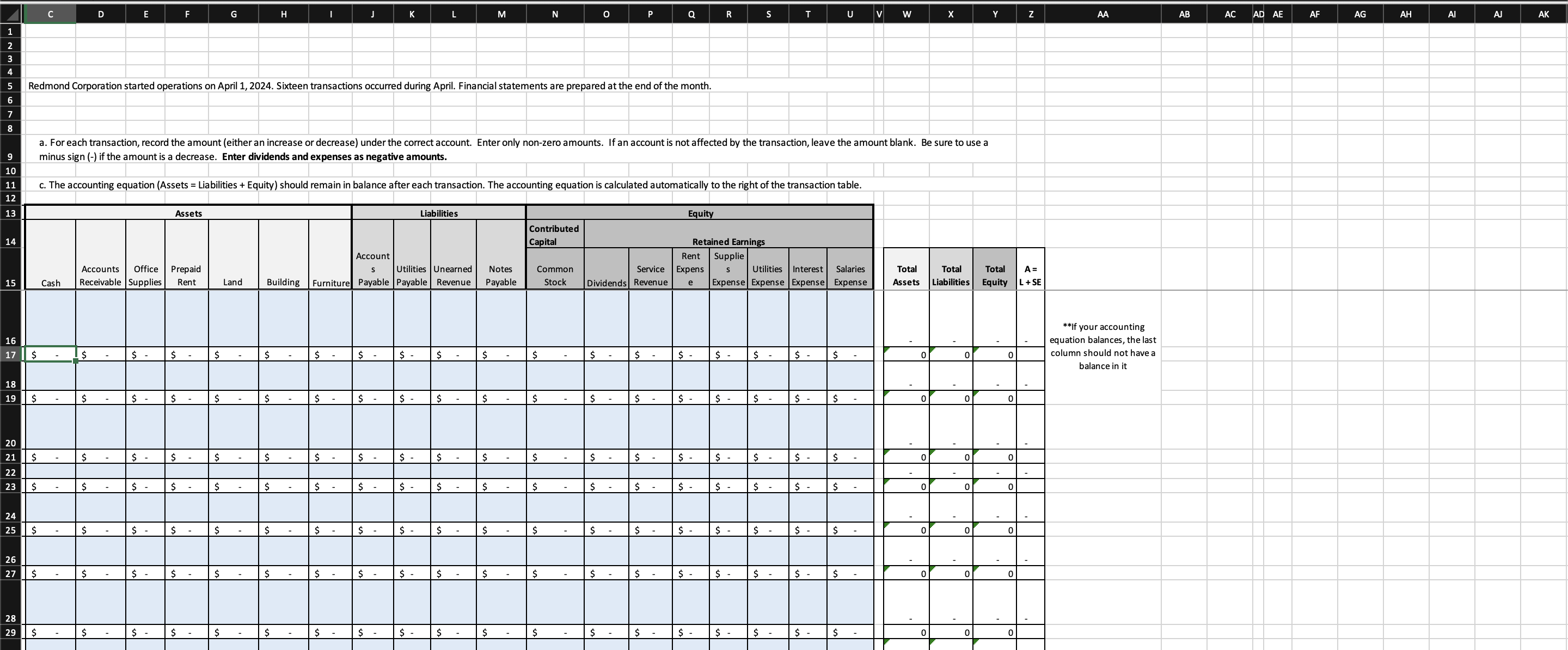

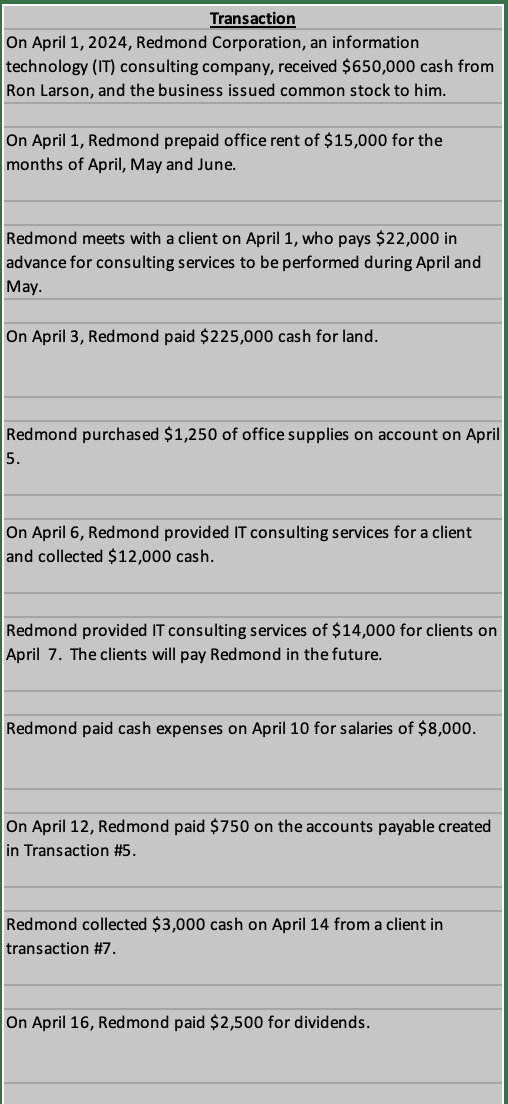

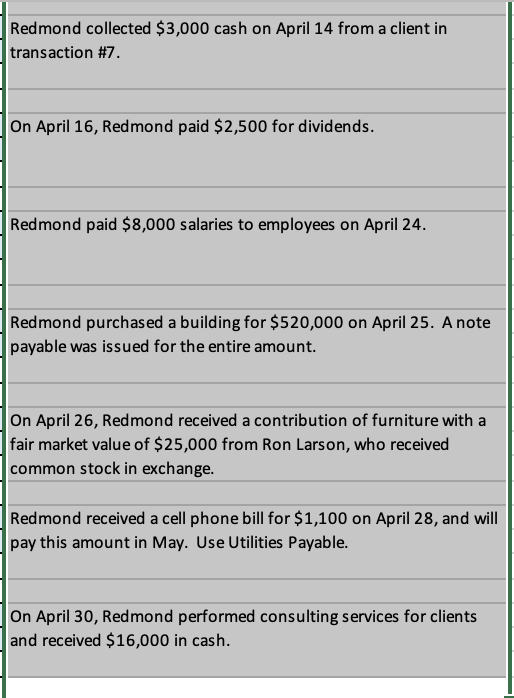

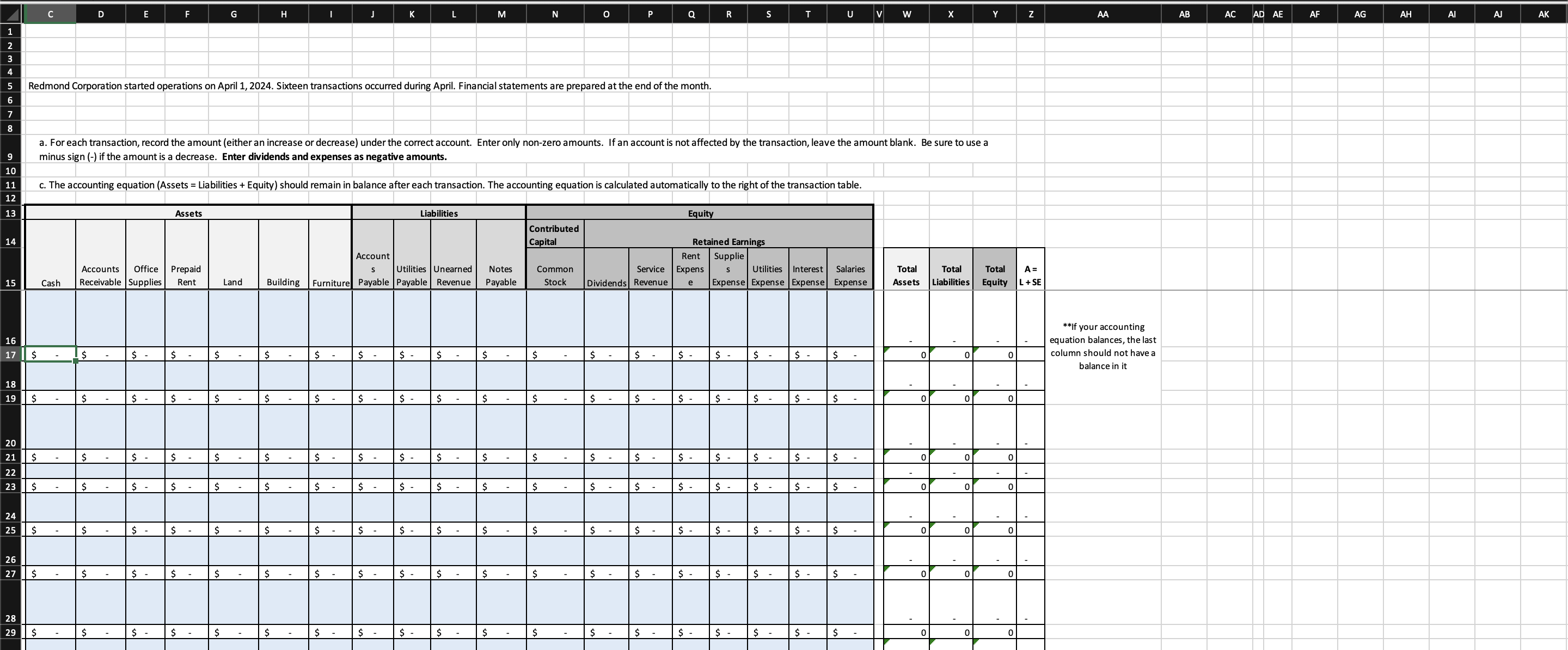

Redmond collected \\( \\$ 3,000 \\) cash on April 14 from a client in transaction \\#7. On April 16, Redmond paid \\( \\$ 2,500 \\) for dividends. Redmond paid \\$8,000 salaries to employees on April 24 . Redmond purchased a building for \\( \\$ 520,000 \\) on April 25 . A note payable was issued for the entire amount. On April 26, Redmond received a contribution of furniture with a fair market value of \\( \\$ 25,000 \\) from Ron Larson, who received common stock in exchange. Redmond received a cell phone bill for \\( \\$ 1,100 \\) on April 28 , and will pay this amount in May. Use Utilities Payable. On April 30, Redmond performed consulting services for clients and received \\( \\$ 16,000 \\) in cash. On April 1, 2024, Redmond Corporation, an information technology (IT) consulting company, received \\( \\$ 650,000 \\) cash from Ron Larson, and the business issued common stock to him. On April 1, Redmond prepaid office rent of \\( \\$ 15,000 \\) for the months of April, May and June. Redmond meets with a client on April 1, who pays \\( \\$ 22,000 \\) in advance for consulting services to be performed during April and May. On April 3, Redmond paid \\( \\$ 225,000 \\) cash for land. Redmond purchased \\( \\$ 1,250 \\) of office supplies on account on April 5. On April 6, Redmond provided IT consulting services for a client and collected \\( \\$ 12,000 \\) cash. Redmond provided IT consulting services of \\( \\$ 14,000 \\) for clients on April 7. The clients will pay Redmond in the future. Redmond paid cash expenses on April 10 for salaries of \\( \\$ 8,000 \\). On April 12, Redmond paid \\( \\$ 750 \\) on the accounts payable created in Transaction \\( \\# 5 \\). Redmond collected \\( \\$ 3,000 \\) cash on April 14 from a client in transaction \\#7. On April 16, Redmond paid \\( \\$ 2,500 \\) for dividends. Redmond collected \\( \\$ 3,000 \\) cash on April 14 from a client in transaction \\#7. On April 16, Redmond paid \\( \\$ 2,500 \\) for dividends. Redmond paid \\$8,000 salaries to employees on April 24 . Redmond purchased a building for \\( \\$ 520,000 \\) on April 25 . A note payable was issued for the entire amount. On April 26, Redmond received a contribution of furniture with a fair market value of \\( \\$ 25,000 \\) from Ron Larson, who received common stock in exchange. Redmond received a cell phone bill for \\( \\$ 1,100 \\) on April 28 , and will pay this amount in May. Use Utilities Payable. On April 30, Redmond performed consulting services for clients and received \\( \\$ 16,000 \\) in cash. On April 1, 2024, Redmond Corporation, an information technology (IT) consulting company, received \\( \\$ 650,000 \\) cash from Ron Larson, and the business issued common stock to him. On April 1, Redmond prepaid office rent of \\( \\$ 15,000 \\) for the months of April, May and June. Redmond meets with a client on April 1, who pays \\( \\$ 22,000 \\) in advance for consulting services to be performed during April and May. On April 3, Redmond paid \\( \\$ 225,000 \\) cash for land. Redmond purchased \\( \\$ 1,250 \\) of office supplies on account on April 5. On April 6, Redmond provided IT consulting services for a client and collected \\( \\$ 12,000 \\) cash. Redmond provided IT consulting services of \\( \\$ 14,000 \\) for clients on April 7. The clients will pay Redmond in the future. Redmond paid cash expenses on April 10 for salaries of \\( \\$ 8,000 \\). On April 12, Redmond paid \\( \\$ 750 \\) on the accounts payable created in Transaction \\( \\# 5 \\). Redmond collected \\( \\$ 3,000 \\) cash on April 14 from a client in transaction \\#7. On April 16, Redmond paid \\( \\$ 2,500 \\) for dividends