Question

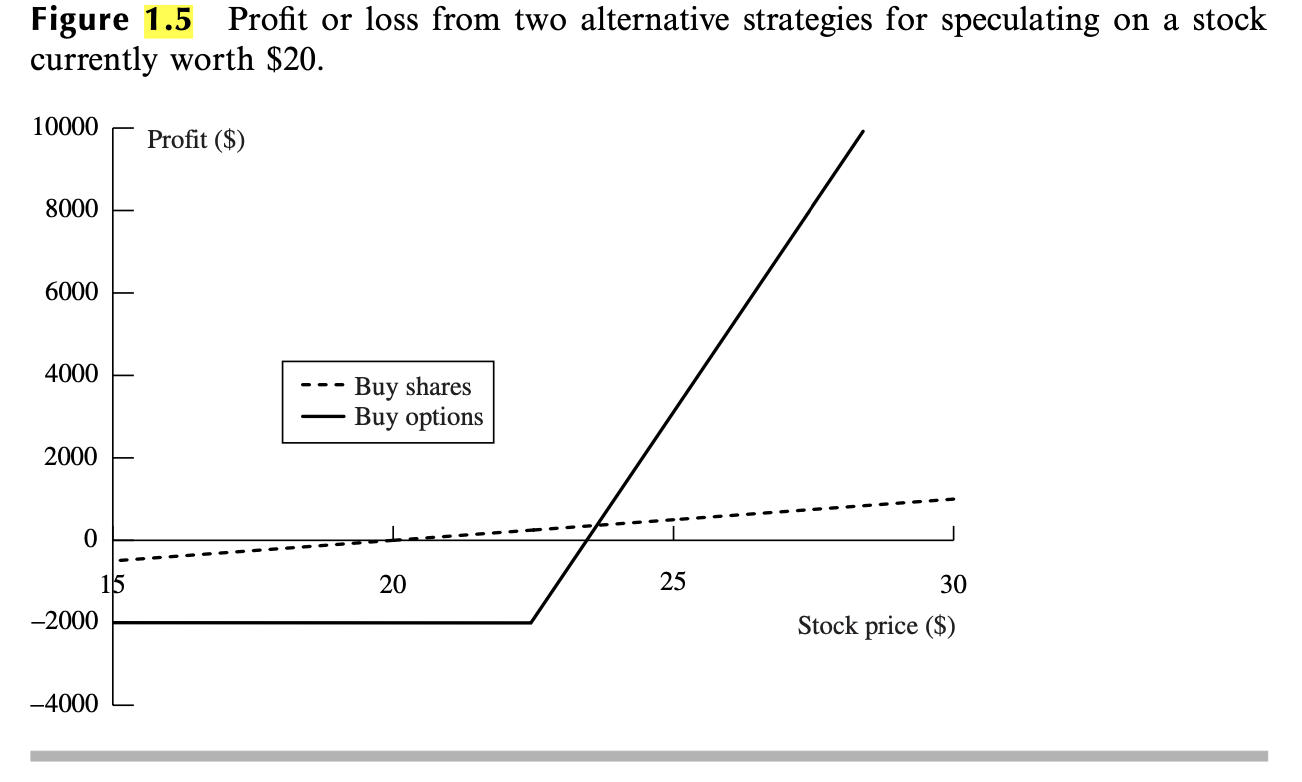

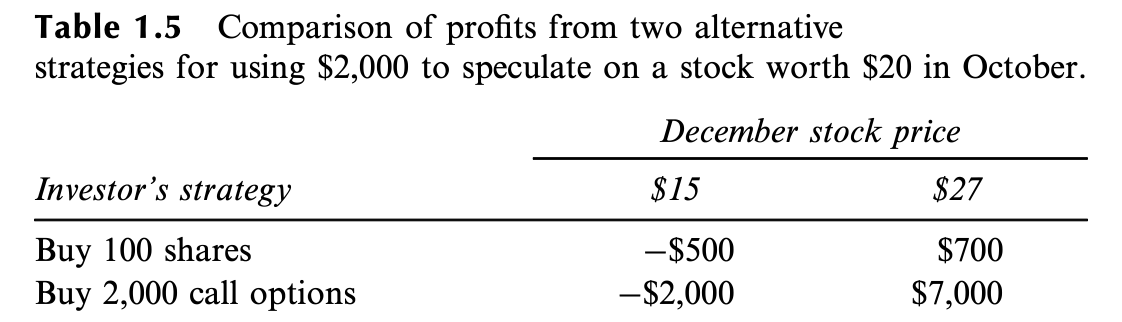

Redraw for the case where you compare the purchase of 100 shares of stock to the purchase of 200 call options (not 2000). In particular,

Redraw for the case where you compare the purchase of 100 shares of stock to the purchase of 200 call options (not 2000). In particular, compute precisely the stock price at maturity for which the profit is the same for both strategies (the stock price where the dotted line crosses the solid line). Use the same data as in the book except for the different number of call options. The tables are provided below

Figure 1.5 Profit or loss from two alternative strategies for speculating on a stock currently worth $20. 10000 Profit ($) 8000 6000 4000 2000 Buy shares Buy options 0 15 20 25 30 Stock price ($) -2000 -4000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations to redraw the graph comparing 100 shares vs 200 call opti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Engineering Economics

Authors: Chan S. Park

5th edition

136118488, 978-8120342095, 8120342097, 978-0136118480

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App