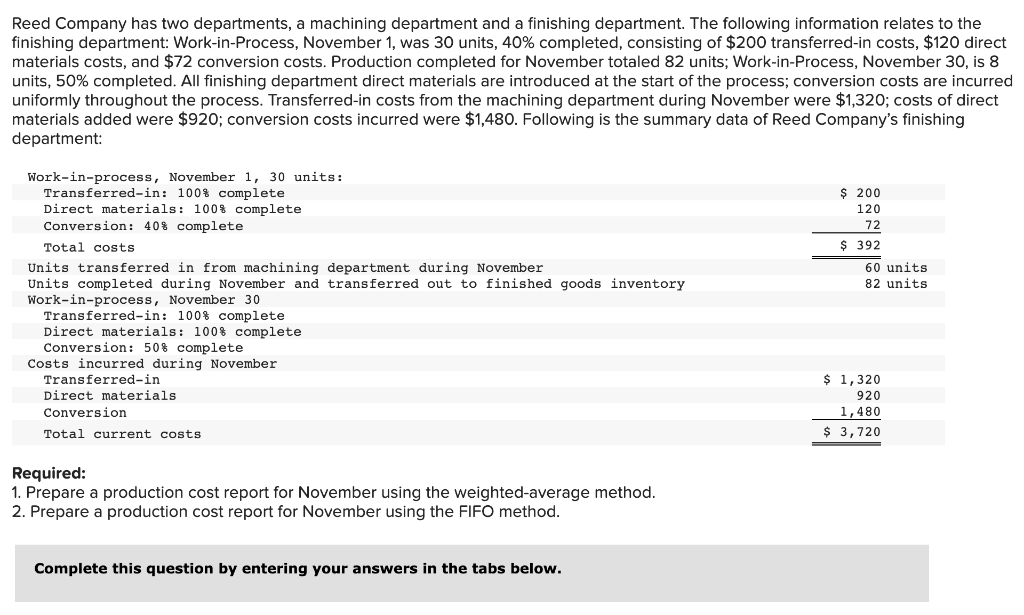

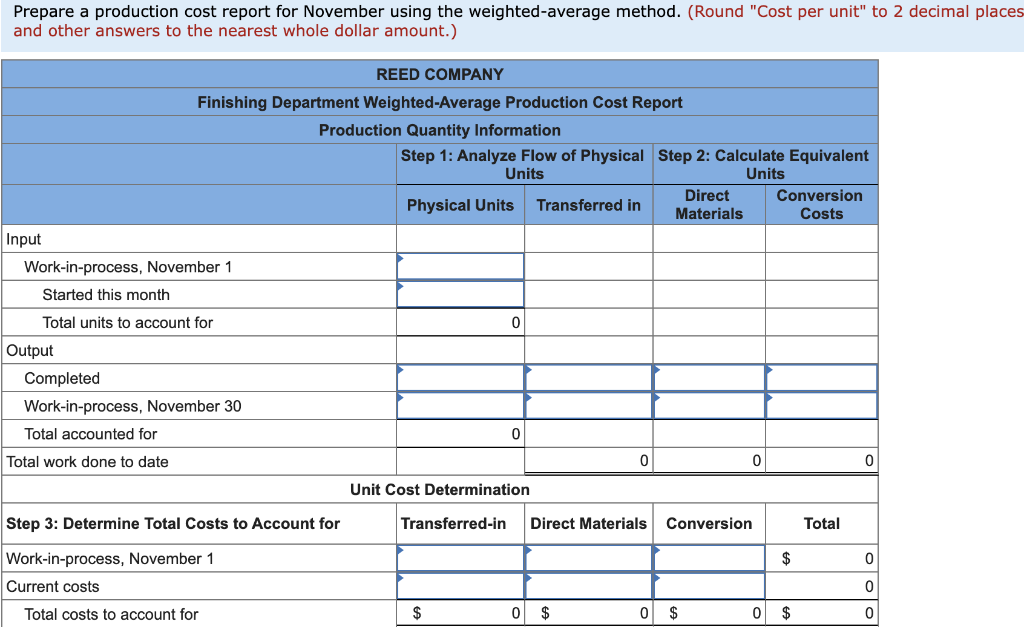

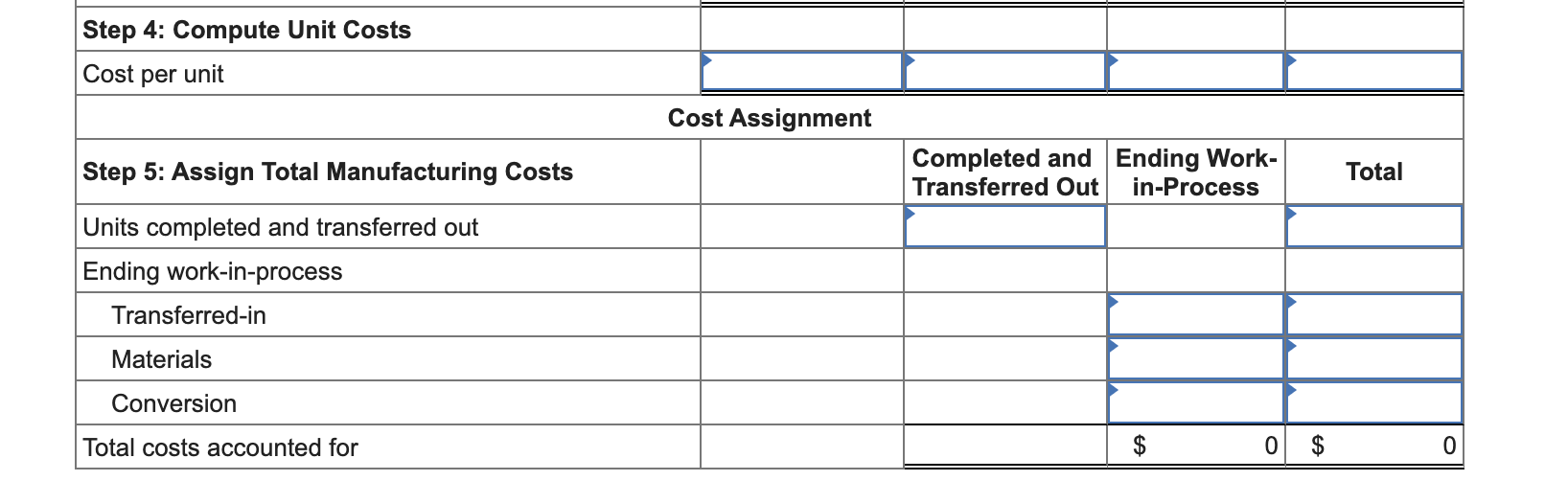

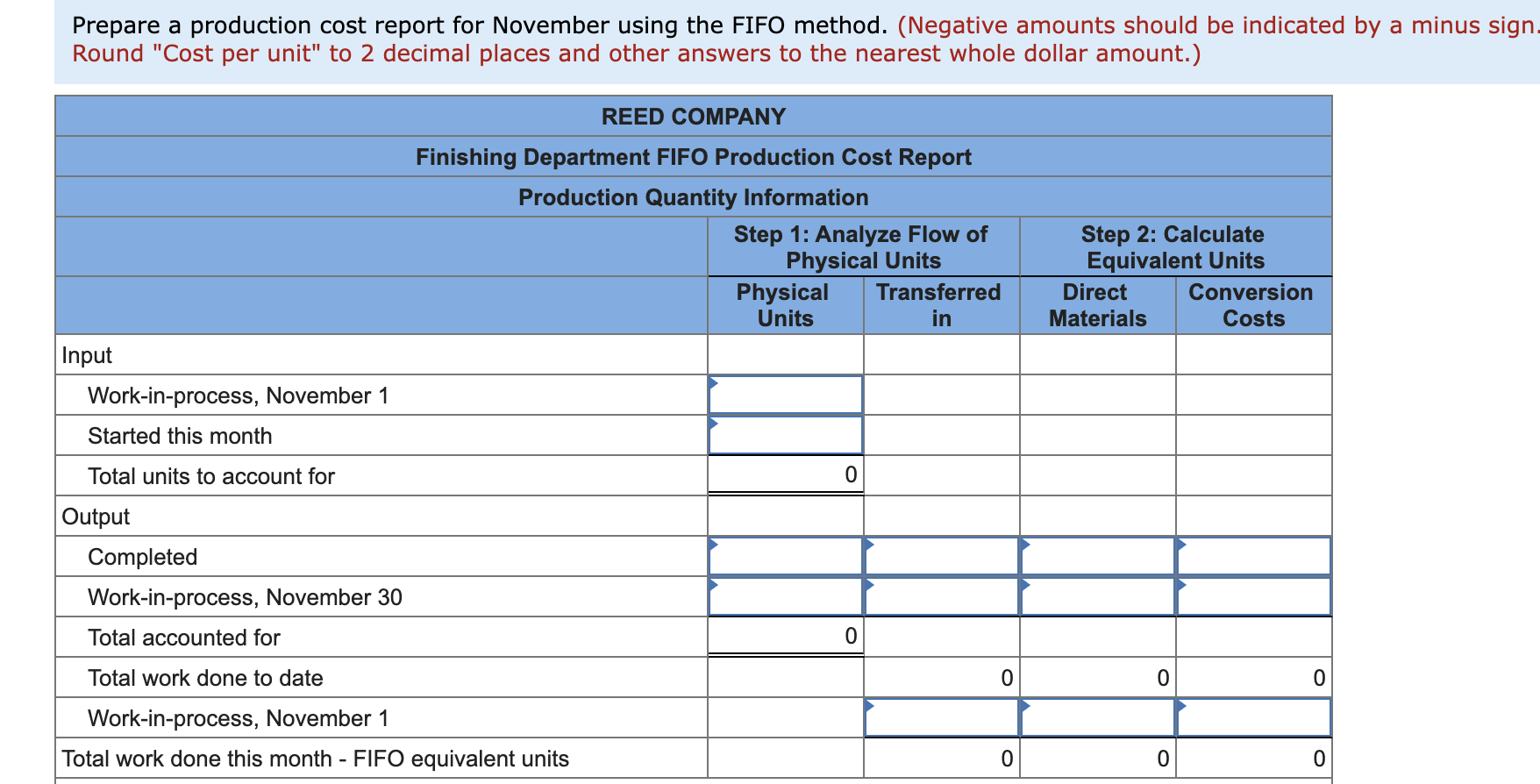

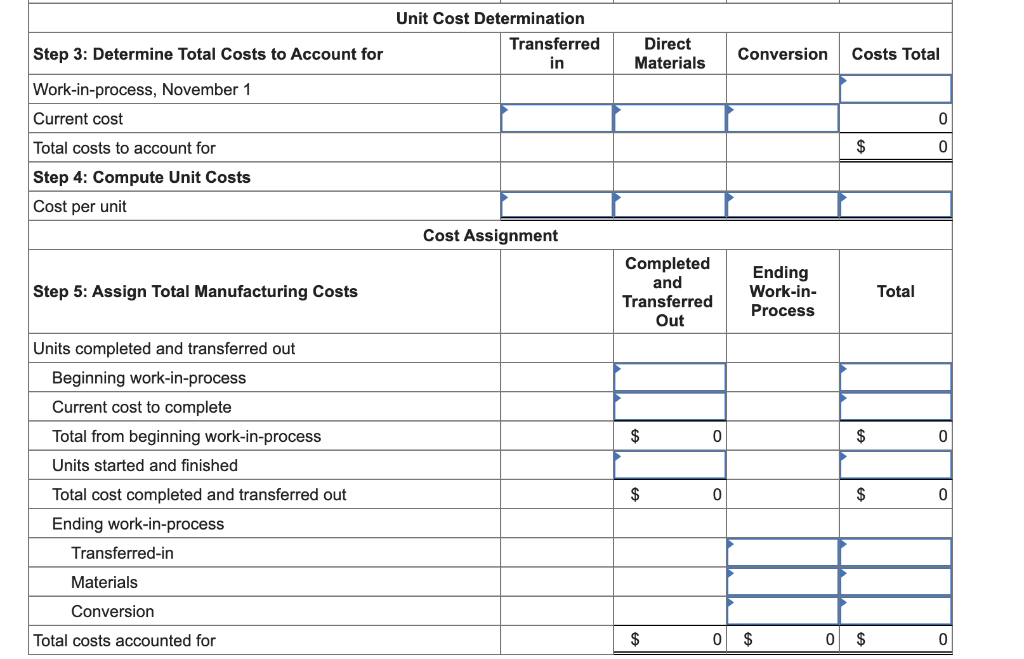

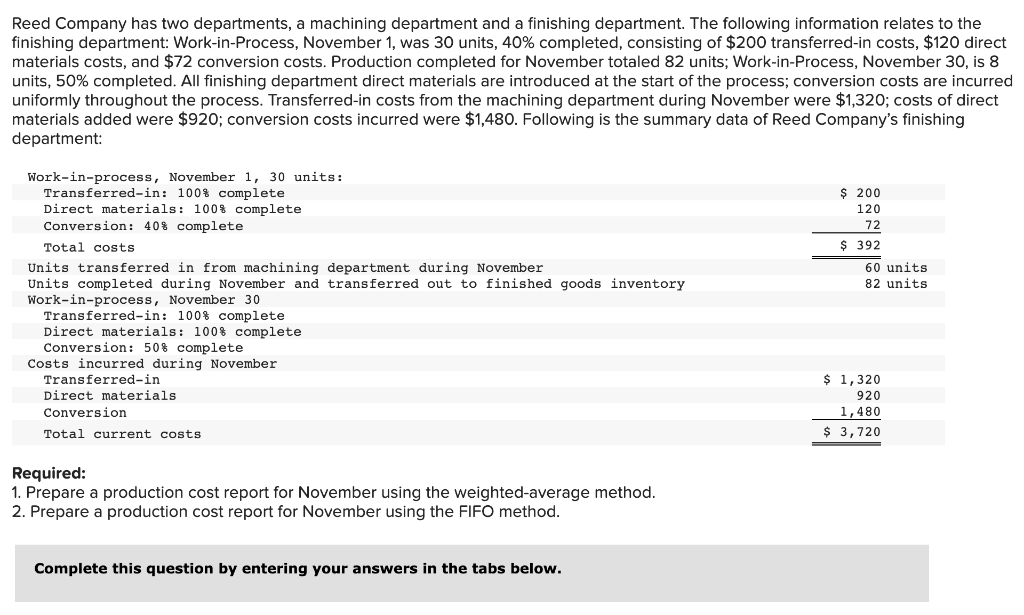

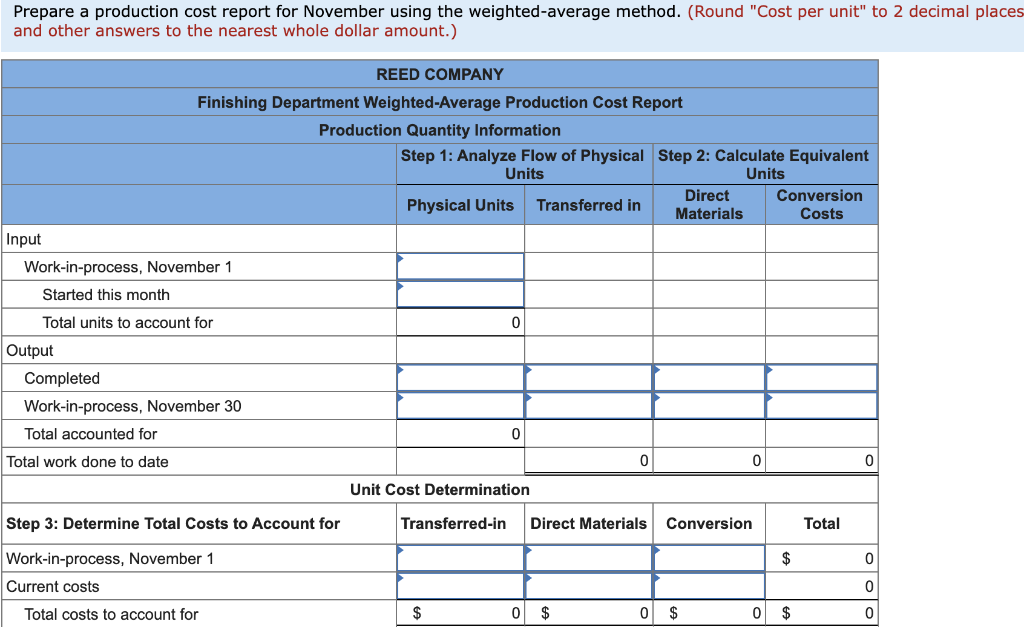

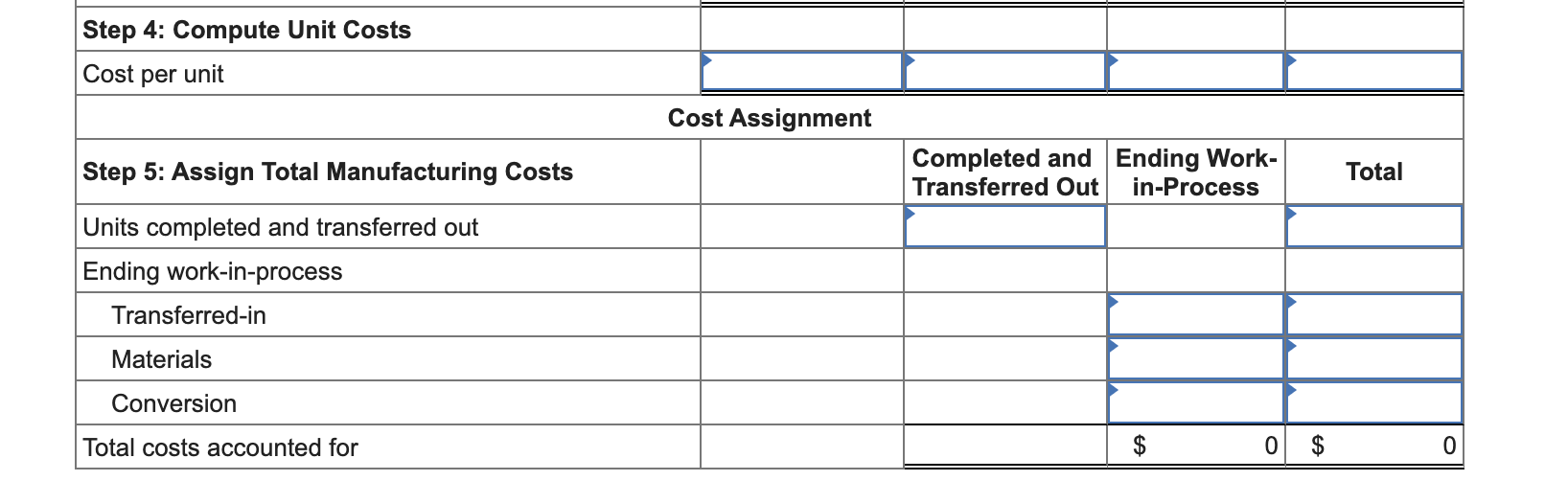

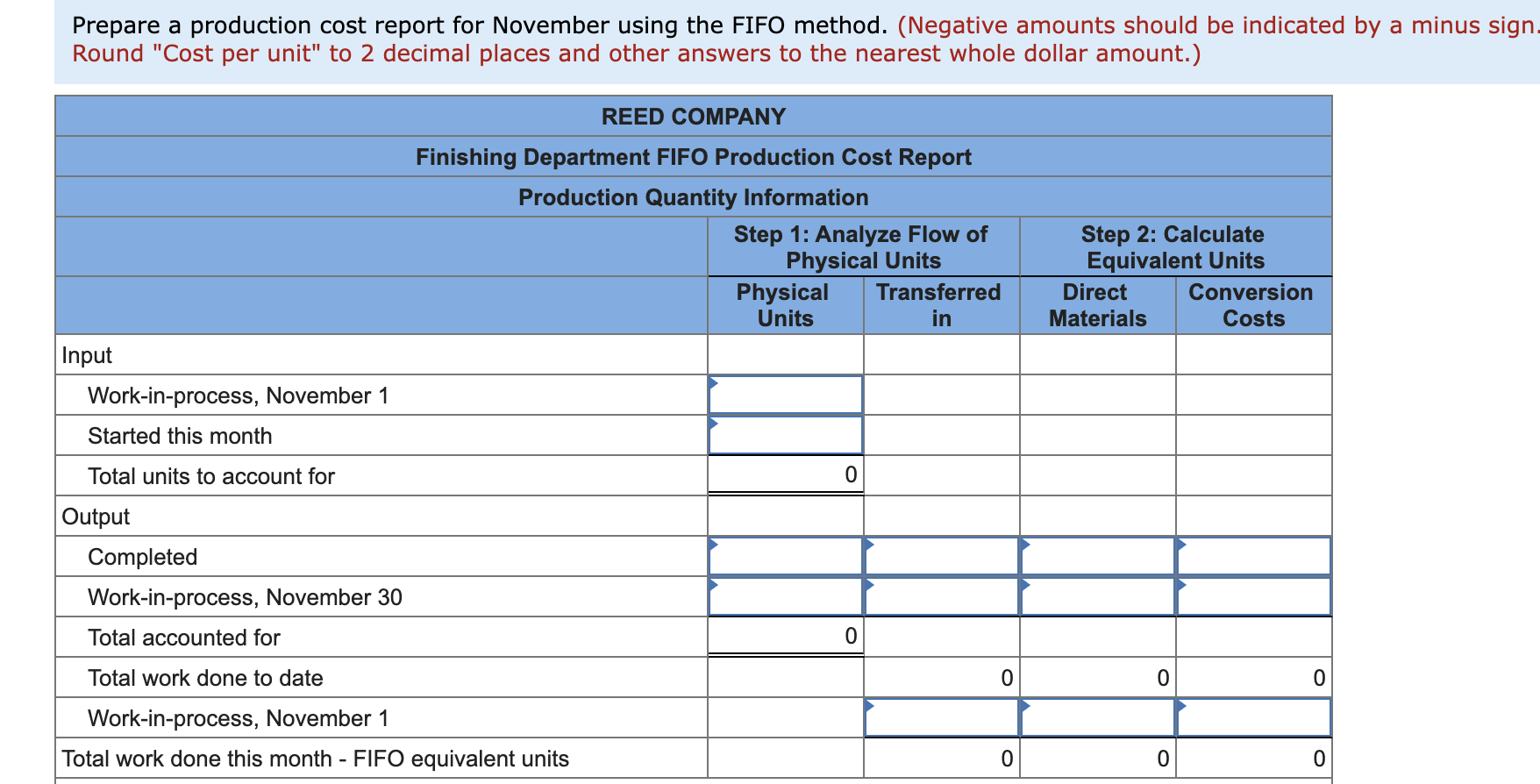

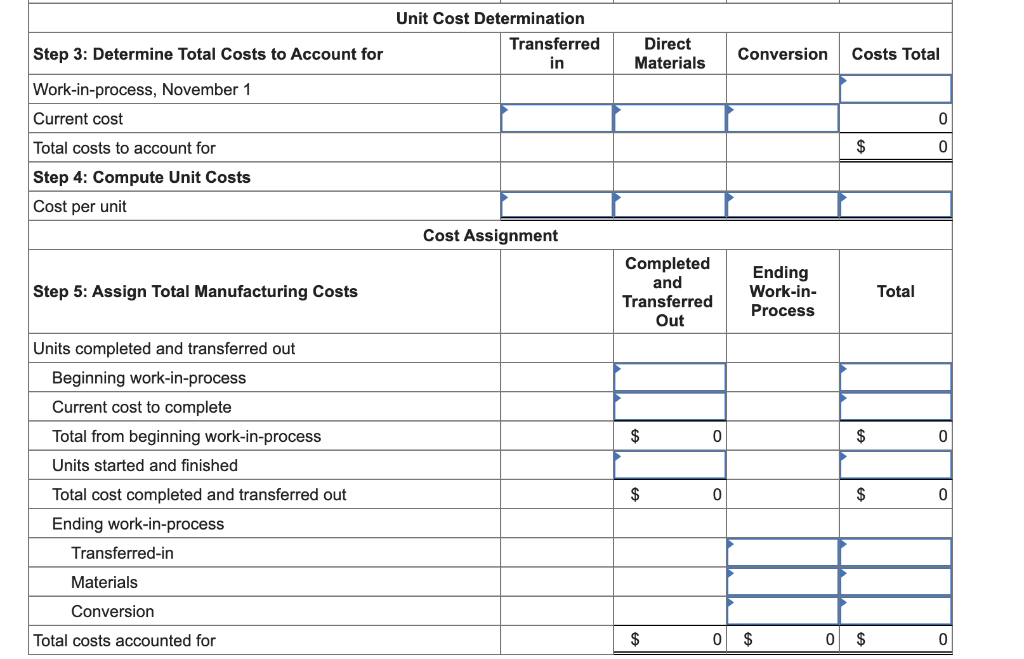

Reed Company has two departments, a machining department and a finishing department. The following information relates to the finishing department: Work-in-process, November 1, was 30 units, 40% completed, consisting of $200 transferred-in costs, $120 direct materials costs, and $72 conversion costs. Production completed for November totaled 82 units; Work-in-process, November 30, is 8 units, 50% completed. All finishing department direct materials are introduced at the start of the process; conversion costs are incurred uniformly throughout the process. Transferred-in costs from the machining department during November were $1,320; costs of direct materials added were $920; conversion costs incurred were $1,480. Following is the summary data of Reed Company's finishing department: $ 200 120 72 $ 392 60 units 82 units Work-in-process, November 1, 30 units: Transferred-in: 100% complete Direct materials: 100% complete Conversion: 40% complete Total costs Units transferred in from machining department during November Units completed during November and transferred out to finished goods inventory Work-in-process, November 30 Transferred-in: 100% complete Direct materials: 100% complete Conversion: 50% complete una Costs incurred during November Transferred-in Direct materials Conversion Total current costs $ 1,320 920 1,480 $ 3,720 Required: 1. Prepare a production cost report for November using the weighted average method. 2. Prepare a production cost report for November using the FIFO method. Complete this question by entering your answers in the tabs below. Prepare a production cost report for November using the weighted average method. (Round "Cost per unit" to 2 decimal places and other answers to the nearest whole dollar amount.) REED COMPANY Finishing Department Weighted-Average Production Cost Report Production Quantity Information Step 1: Analyze Flow of Physical Step 2: Calculate Equivalent Units Units Direct Conversion Physical Units Transferred in Materials Costs Input Work-in-process, November 1 Started this month 0 Total units to account for Output Completed Work-in-process, November 30 Total accounted for 0 Total work done to date 0 0 0 Unit Cost Determination Step 3: Determine Total Costs to Account for Transferred-in Direct Materials Conversion Total Work-in-process, November 1 $ 0 Current costs 0 Total costs to account for $ 0 $ 0 $ 0 $ 0 Step 4: Compute Unit Costs Cost per unit Cost Assignment Step 5: Assign Total Manufacturing Costs Completed and Ending Work- Transferred Out in-Process Total Units completed and transferred out Ending work-in-process Transferred-in Materials Conversion Total costs accounted for 0 0 Prepare a production cost report for November using the FIFO method. (Negative amounts should be indicated by a minus sign. Round "Cost per unit" to 2 decimal places and other answers to the nearest whole dollar amount.) REED COMPANY Finishing Department FIFO Production Cost Report Production Quantity Information Step 1: Analyze Flow of Physical Units Physical Transferred Units in Step 2: Calculate Equivalent Units Direct Conversion Materials Costs Input Work-in-process, November 1 Started this month Total units to account for 0 Output Completed Work-in-process, November 30 Total accounted for 0 Total work done to date 0 O 0 Work-in-process, November 1 Total work done this month - FIFO equivalent units 0 O 0 Unit Cost Determination Transferred in Step 3: Determine Total Costs to Account for Direct Materials Conversion Costs Total Work-in-process, November 1 Current cost 0 Total costs to account for $ 0 Step 4: Compute Unit Costs Cost per unit Cost Assignment Step 5: Assign Total Manufacturing Costs Completed and Transferred Out Ending Work-in- Process Total $ 0 $ 0 Units completed and transferred out Beginning work-in-process Current cost to complete Total from beginning work-in-process Units started and finished Total cost completed and transferred out Ending work-in-process Transferred-in $ 0 $ 0 Materials Conversion Total costs accounted for $ 0 $ 0 $ 0