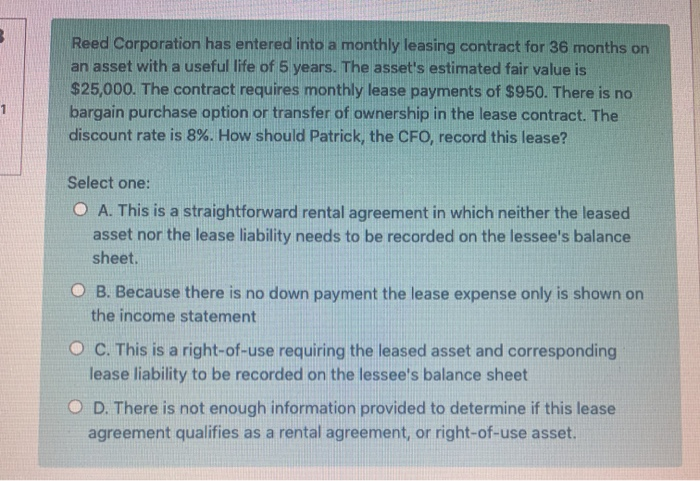

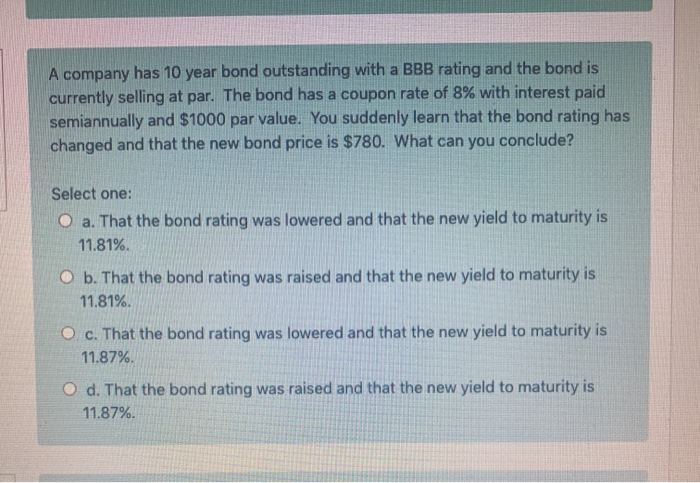

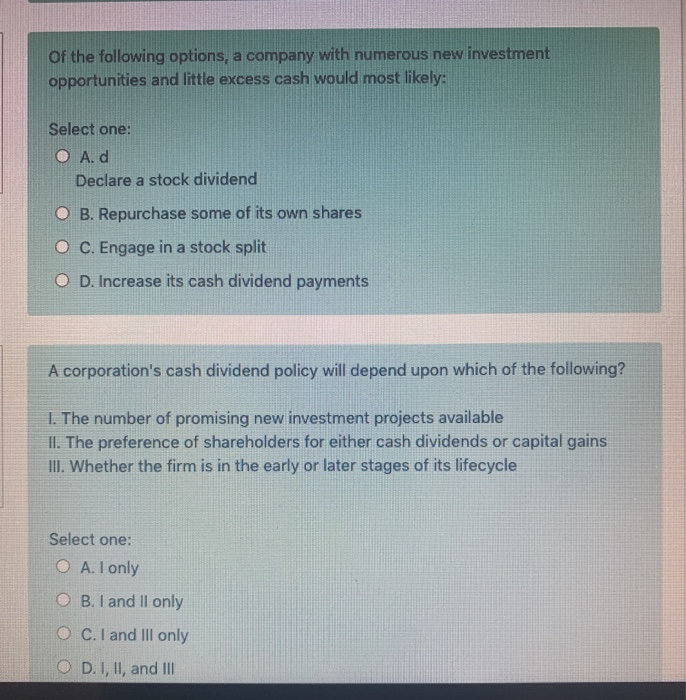

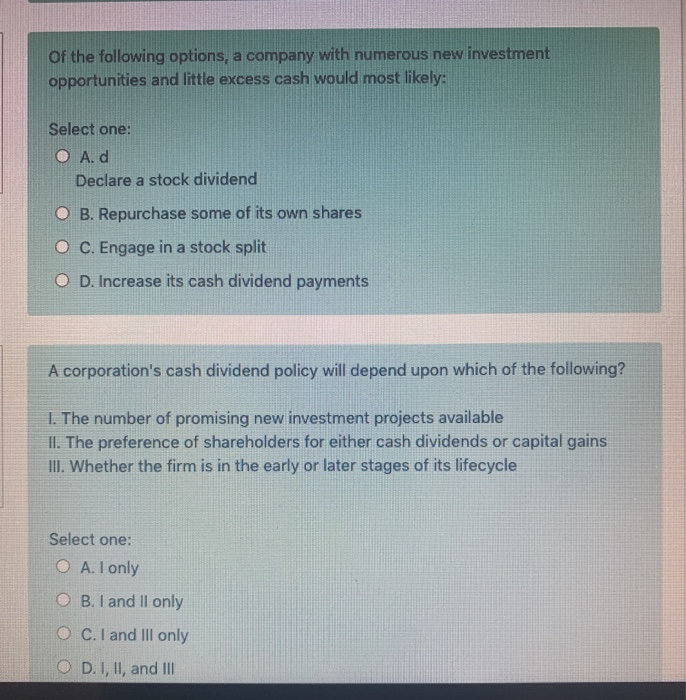

Reed Corporation has entered into a monthly leasing contract for 36 months on an asset with a useful life of 5 years. The asset's estimated fair value is $25,000. The contract requires monthly lease payments of $950. There is no bargain purchase option or transfer of ownership in the lease contract. The discount rate is 8%. How should Patrick, the CFO, record this lease? Select one: O A. This is a straightforward rental agreement in which neither the leased asset nor the lease liability needs to be recorded on the lessee's balance sheet. O B. Because there is no down payment the lease expense only is shown on the income statement O C. This is a right-of-use requiring the leased asset and corresponding lease liability to be recorded on the lessee's balance sheet O D. There is not enough information provided to determine if this lease agreement qualifies as a rental agreement, or right-of-use asset. A company has 10 year bond outstanding with a BBB rating and the bond is currently selling at par. The bond has a coupon rate of 8% with interest paid semiannually and $1000 par value. You suddenly learn that the bond rating has changed and that the new bond price is $780. What can you conclude? Select one: O a. That the bond rating was lowered and that the new yield to maturity is 11.81% O b. That the bond rating was raised and that the new yield to maturity is 11.81%. O c. That the bond rating was lowered and that the new yield to maturity is 11.87% O d. That the bond rating was raised and that the new yield to maturity is 11.87% of the following options, a company with numerous new investment opportunities and little excess cash would most likely: Select one: O A. d Declare a stock dividend OB. Repurchase some of its own shares O C. Engage in a stock split O D. Increase its cash dividend payments A corporation's cash dividend policy will depend upon which of the following? 1. The number of promising new investment projects available II. The preference of shareholders for either cash dividends or capital gains III. Whether the firm is in the early or later stages of its lifecycle Select one: O A. I only OB. I and II only O C. I and Ill only O D.1, II, and