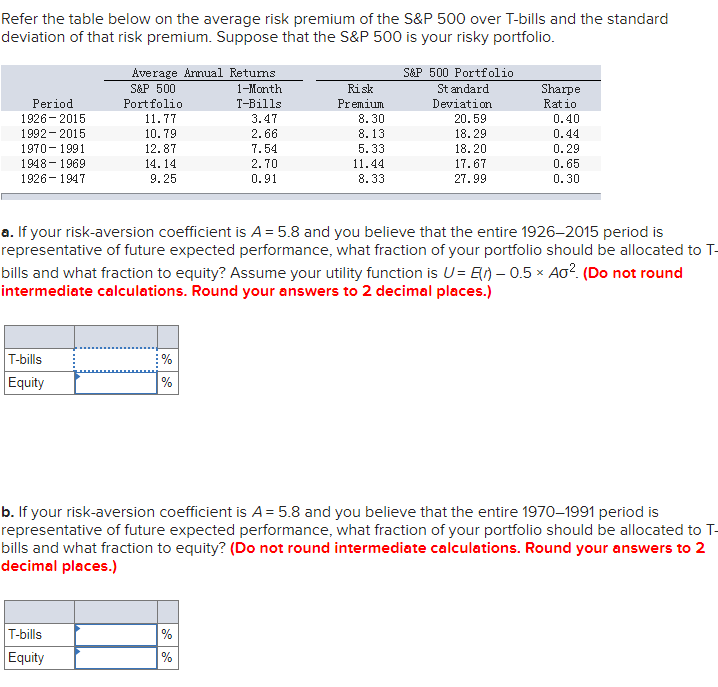

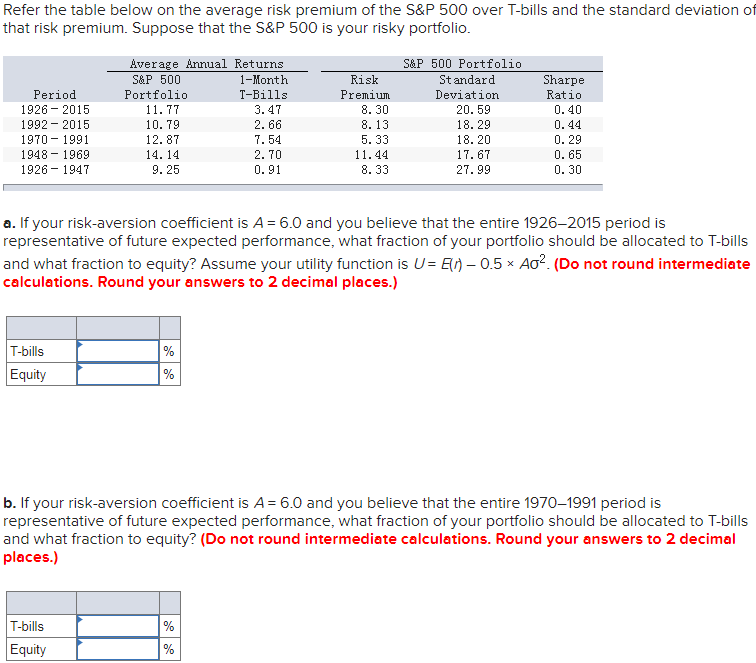

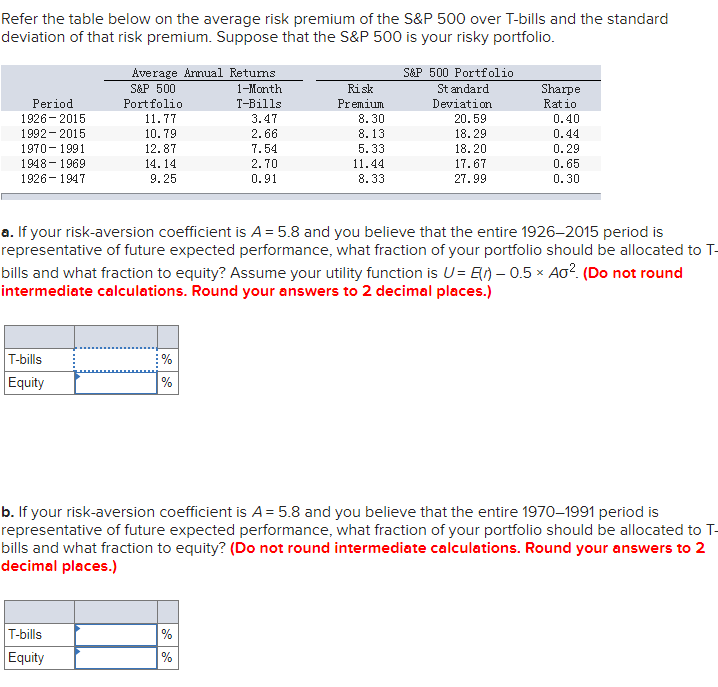

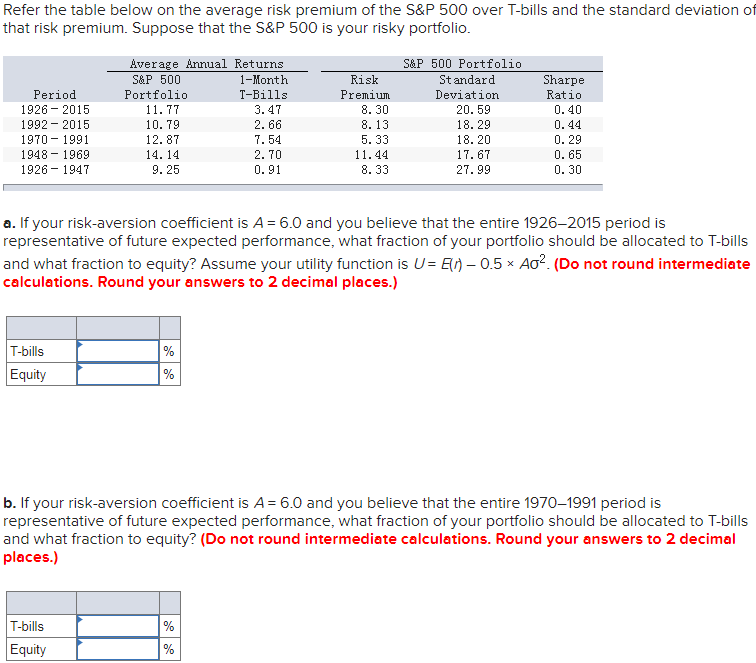

Refer the table below on the average risk premium of the S&P 500 over T-bills and the standard deviation of that risk premium. Suppose that the S&P 500 is your risky portfolio. Period 1926-2015 1992-2015 1970-1991 1948-1969 1926-1947 Average Annual Retums S&P 500 1-Month Portfolio T-Bills 11.77 3.47 10.79 2.66 12.87 7.54 14.14 2.70 9.25 0.91 Risk Premium 8.30 8.13 5.33 11.44 8.33 S&P 500 Portfolio Standard Deviation 20.59 18.29 18.20 17.67 27.99 Sharpe Ratio 0.40 0.44 0.29 0.65 0.30 a. If your risk-aversion coefficient is A=5.8 and you believe that the entire 19262015 period is representative of future expected performance, what fraction of your portfolio should be allocated to T- bills and what fraction to equity? Assume your utility function is U= 50 0.5 x 40? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity % b. If your risk-aversion coefficient is A=5.8 and you believe that the entire 19701991 period is representative of future expected performance, what fraction of your portfolio should be allocated to T- bills and what fraction to equity? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity % % Refer the table below on the average risk premium of the S&P 500 over T-bills and the standard deviation of that risk premium. Suppose that the S&P 500 is your risky portfolio. Period 1926 - 2015 1992 - 2015 1970 - 1991 1948 1969 1926 - 1947 Average Annual Returns S&P 500 1-Month Portfolio T-Bills 11.77 3.47 10. 79 2.66 12.87 7.54 14. 14 2. 70 9. 25 0.91 Risk Premium 8. 30 8.13 5. 33 11.44 8. 33 S&P 500 Portfolio Standard Deviation 20.59 18. 29 18.20 17.67 27.99 Sharpe Ratio 0.40 0.44 0.29 0.65 0.30 a. If your risk-aversion coefficient is A = 6.0 and you believe that the entire 1926-2015 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? Assume your utility function is U= EN - 0.5 x 402. (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity % % b. If your risk-aversion coefficient is A=6.0 and you believe that the entire 19701991 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity % %