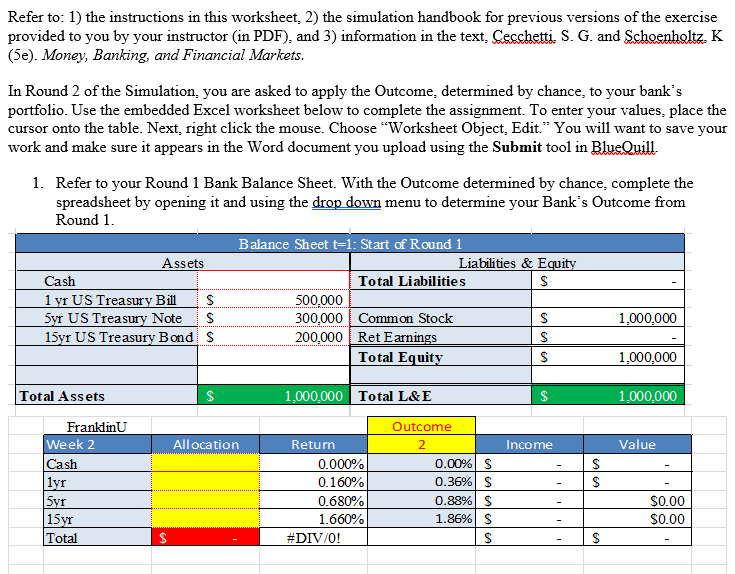

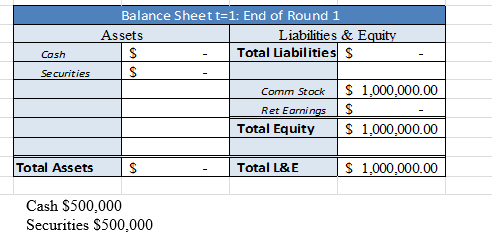

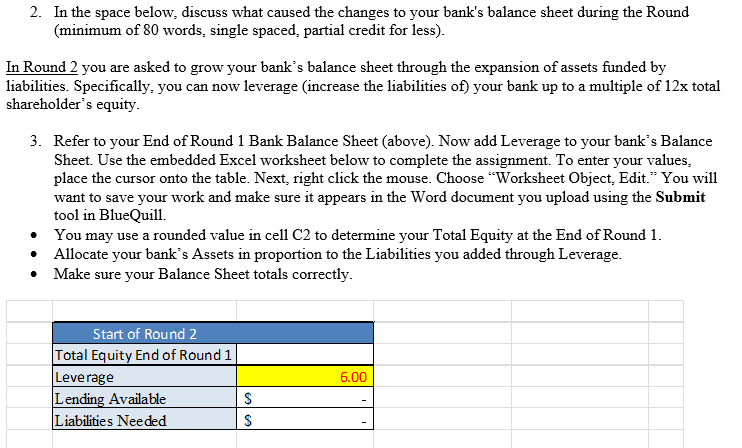

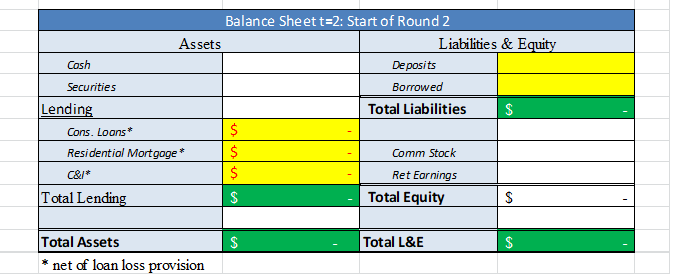

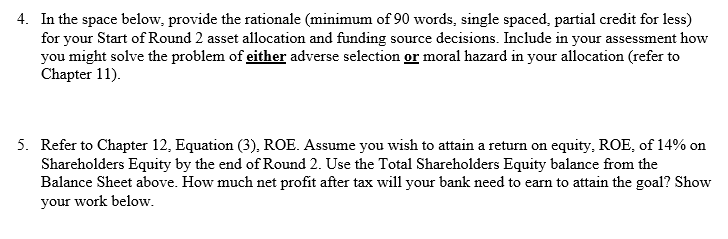

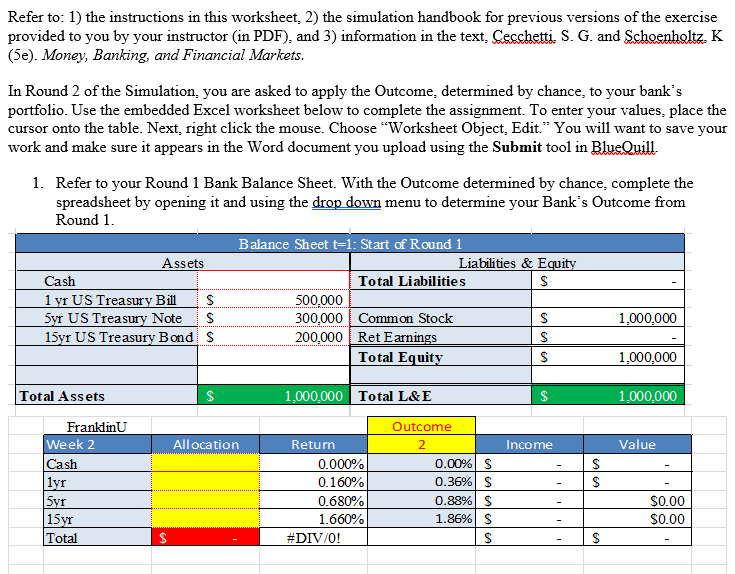

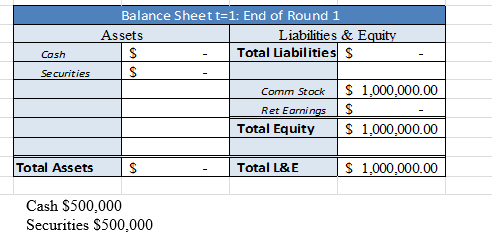

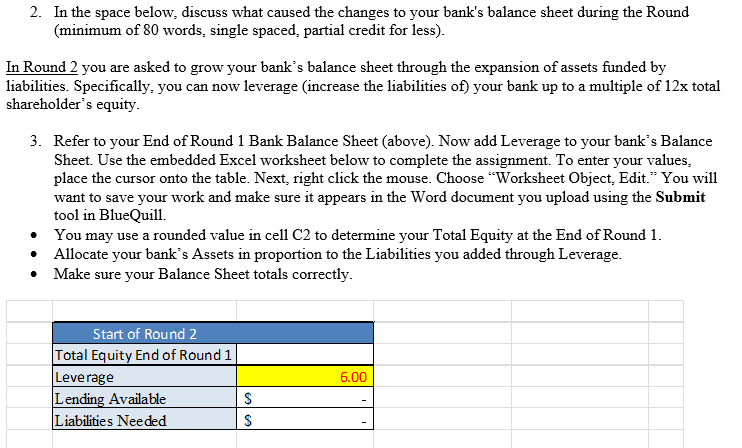

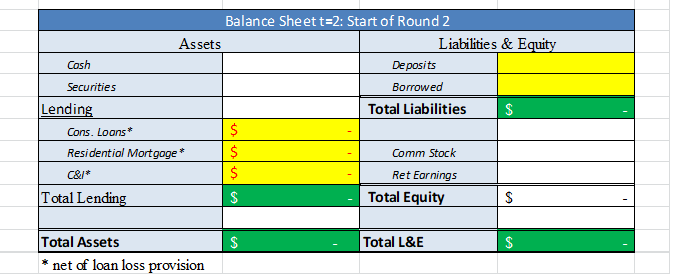

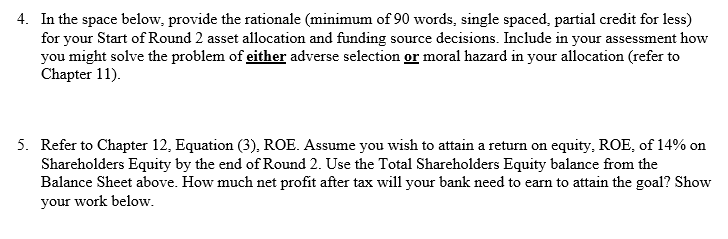

Refer to: 1) the instructions in this worksheet, 2) the simulation handbook for previous versions of the exercise provided to you by your instructor (in PDF), and 3) information in the text, Cecchetti. s. G. and Schoenholtz K (5e). Money, Banking, and Financial Markets In Round 2 of the Simulation, you are asked to apply the Outcome, determined by chance, to your bank's portfolio. Use the embedded Excel worksheet below to complete the assignment. To enter your values, place the cursor onto the table. Next, right click the mouse. Choose "Worksheet Object, Edit." You will want to save your work and make sure it appears in the Word document you upload using the Submit tool in BlueQuill 1. Refer to your Round 1 Bank Balance Sheet. With the Outcome determined by chance, complete the spreadsheet by opening it and using the drop down menu to determine your Bank's Outcome from Round 1 Balance Sheet t-1: Start of Round 1 Assets Liabilities & E Cash 1 vr US Treasury Bill Total Liabilities S US Treasury Note S 15yr US Treasury Bond S 500,000 300.000Common Stock 200.000Ret Earnings 1.000.000 1,000,000 1,000,000 Total Equit Total Ass ets 1,000,000 Total L&E FrankiinU Week 2 Cash Outcome All ocation Return Income Value 0.000% 0.160% 0.680% 1.660% 0.00%| 0.36%) 0.88%) 1.86%) $ $ $ $ S0.00 S0.00 15 Total #DIV/0! Balance Sheet t=1: End of Round 1 Assets Liabilities & Equity Cosh Total Liabilities S Securities Ret Earnings Total Equity S 1,000,000.00 Total Assets S S 1,000,000.00 Cash $500,000 Securities $500,000 2. In the space below, discuss what caused the changes to your bank's balance sheet during the Round (minimum of 80 words, single spaced, partial credit for less). In Round 2 you are asked to grow your bank's balance sheet through the expansion of assets funded by liabilities. Specifically, you can now leverage (increase the liabilities of) your bank up to a multiple of 12x total shareholder's equity. 3. Refer to your End of Round 1 Bank Balance Sheet (above). Now add Leverage to your bank's Balance Sheet. Use the embedded Excel worksheet below to complete the assignment. To enter your values, place the cursor onto the table. Next, right click the mouse. Choose "Worksheet Object, Edit." You will want to save your work and make sure it appears in the Word document you upload using the Submit tool in BlueQuil You may use a rounded value in cell C2 to determine your Total Equity at the End of Round 1. Allocate your bank's Assets in proportion to the Liabilities you added through Leverage. Make sure your Balance Sheet totals correctly. Start of Round 2 Total Equity End of Round 1 Leverage Lending Available Liabilities Needed 6.00 Balance Sheet t=2: Start of Round 2 Assets Liabilities & Equity Cash Securities Borrowed Total Liabilities Cons. Loans Residential Mortgoge* Comm Stock Ret Eornings Total Lending Total Equity Total Assets Total L&E * net of loan loss provision of 90 words, single spaced for your Start of Round 2 asset allocation and funding source decisions. Include in your assessment how you might solve the problem of either adverse selection or moral hazard in your allocation (refer to Chapter 11). 5. Refer to Chapter 12, Equation (3), ROE. Assume you wish to attain a return on equity, ROE, of 14% on Shareholders Equity by the end of Round 2. Use the Total Shareholders Equity balance from the Balance Sheet above. How much net profit after tax will your bank need to earn to attain the goal? Show vour work below Refer to: 1) the instructions in this worksheet, 2) the simulation handbook for previous versions of the exercise provided to you by your instructor (in PDF), and 3) information in the text, Cecchetti. s. G. and Schoenholtz K (5e). Money, Banking, and Financial Markets In Round 2 of the Simulation, you are asked to apply the Outcome, determined by chance, to your bank's portfolio. Use the embedded Excel worksheet below to complete the assignment. To enter your values, place the cursor onto the table. Next, right click the mouse. Choose "Worksheet Object, Edit." You will want to save your work and make sure it appears in the Word document you upload using the Submit tool in BlueQuill 1. Refer to your Round 1 Bank Balance Sheet. With the Outcome determined by chance, complete the spreadsheet by opening it and using the drop down menu to determine your Bank's Outcome from Round 1 Balance Sheet t-1: Start of Round 1 Assets Liabilities & E Cash 1 vr US Treasury Bill Total Liabilities S US Treasury Note S 15yr US Treasury Bond S 500,000 300.000Common Stock 200.000Ret Earnings 1.000.000 1,000,000 1,000,000 Total Equit Total Ass ets 1,000,000 Total L&E FrankiinU Week 2 Cash Outcome All ocation Return Income Value 0.000% 0.160% 0.680% 1.660% 0.00%| 0.36%) 0.88%) 1.86%) $ $ $ $ S0.00 S0.00 15 Total #DIV/0! Balance Sheet t=1: End of Round 1 Assets Liabilities & Equity Cosh Total Liabilities S Securities Ret Earnings Total Equity S 1,000,000.00 Total Assets S S 1,000,000.00 Cash $500,000 Securities $500,000 2. In the space below, discuss what caused the changes to your bank's balance sheet during the Round (minimum of 80 words, single spaced, partial credit for less). In Round 2 you are asked to grow your bank's balance sheet through the expansion of assets funded by liabilities. Specifically, you can now leverage (increase the liabilities of) your bank up to a multiple of 12x total shareholder's equity. 3. Refer to your End of Round 1 Bank Balance Sheet (above). Now add Leverage to your bank's Balance Sheet. Use the embedded Excel worksheet below to complete the assignment. To enter your values, place the cursor onto the table. Next, right click the mouse. Choose "Worksheet Object, Edit." You will want to save your work and make sure it appears in the Word document you upload using the Submit tool in BlueQuil You may use a rounded value in cell C2 to determine your Total Equity at the End of Round 1. Allocate your bank's Assets in proportion to the Liabilities you added through Leverage. Make sure your Balance Sheet totals correctly. Start of Round 2 Total Equity End of Round 1 Leverage Lending Available Liabilities Needed 6.00 Balance Sheet t=2: Start of Round 2 Assets Liabilities & Equity Cash Securities Borrowed Total Liabilities Cons. Loans Residential Mortgoge* Comm Stock Ret Eornings Total Lending Total Equity Total Assets Total L&E * net of loan loss provision of 90 words, single spaced for your Start of Round 2 asset allocation and funding source decisions. Include in your assessment how you might solve the problem of either adverse selection or moral hazard in your allocation (refer to Chapter 11). 5. Refer to Chapter 12, Equation (3), ROE. Assume you wish to attain a return on equity, ROE, of 14% on Shareholders Equity by the end of Round 2. Use the Total Shareholders Equity balance from the Balance Sheet above. How much net profit after tax will your bank need to earn to attain the goal? Show vour work below