Question

Refer to 2019 Annual Report (Form 10-K) of Apple Inc. provided and answer the following questions relating to Apples Consolidated Statements of Cash Flows. Refer

Refer to 2019 Annual Report (Form 10-K) of Apple Inc. provided and answer the following questions relating to Apples Consolidated Statements of Cash Flows. Refer to the notes to financial statements for additional relevant information.

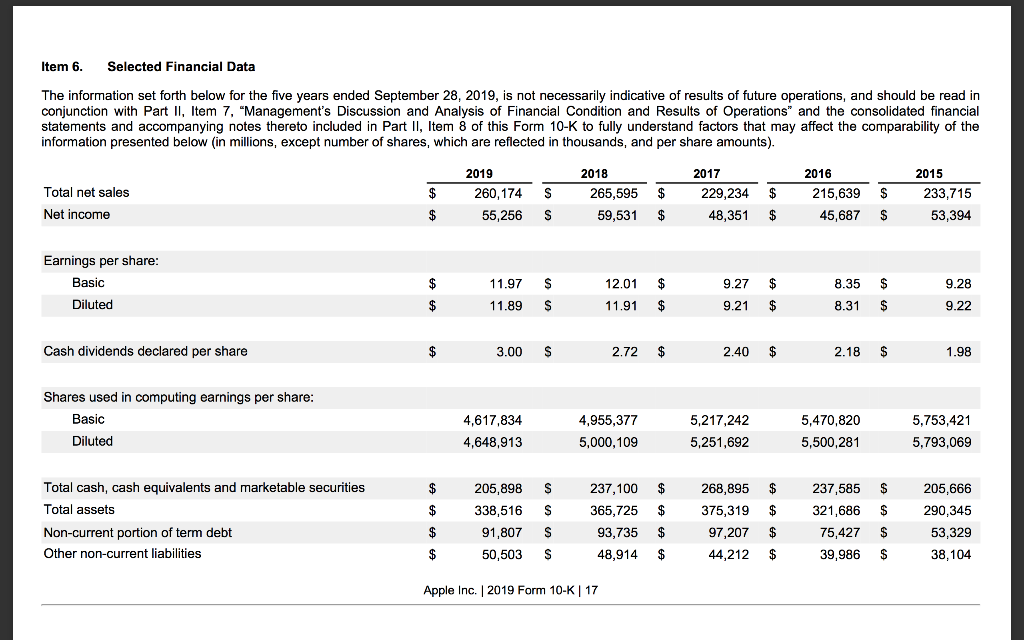

(a) Did Apples net cash used by investing activities increase or decrease between the year ended September 29, 2018, and the year ended September 28, 2019? By how much? What were the major causes of the change?

(b) What were the primary uses of cash by investing activities in the year ended September 28, 2019?

(c) Did Apples net cash used by financing activities increase or decrease between the year ended September 29, 2018, and the year ended September 28, 2019? By how much? What were the major causes of the change?

(d) What were the primary providers of cash or uses of cash by financing activities in the year ended September 28, 2019?

(e) Relate net cash flow from operations to investing and dividend payment needs in the year ended September 28, 2019. Locate Management's Discussion and Analysis. Look under the section titled Liquidity and Capital Resources. What does management have to say? What are your comments?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started