Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to Apple's financial statements in Appendix A to answer the following. 1. What percent of the original cost of Apple's Property. Plant and Equipment

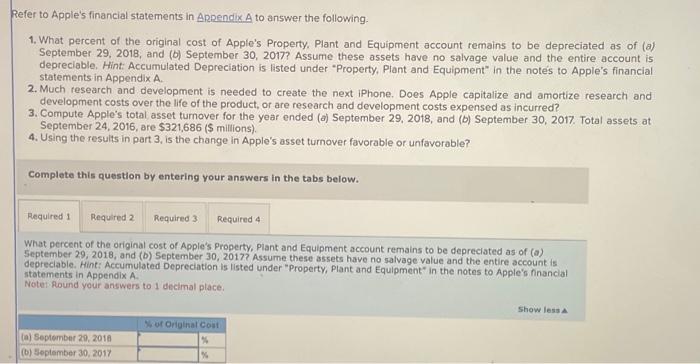

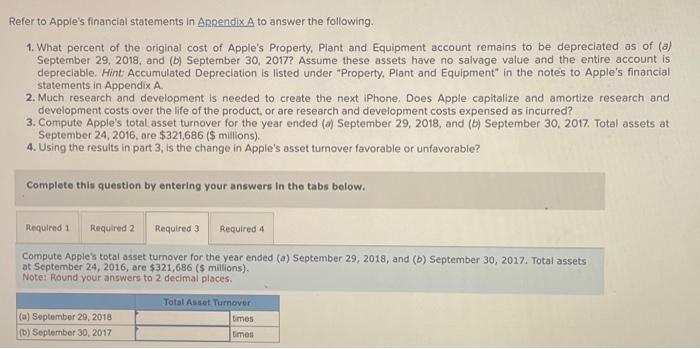

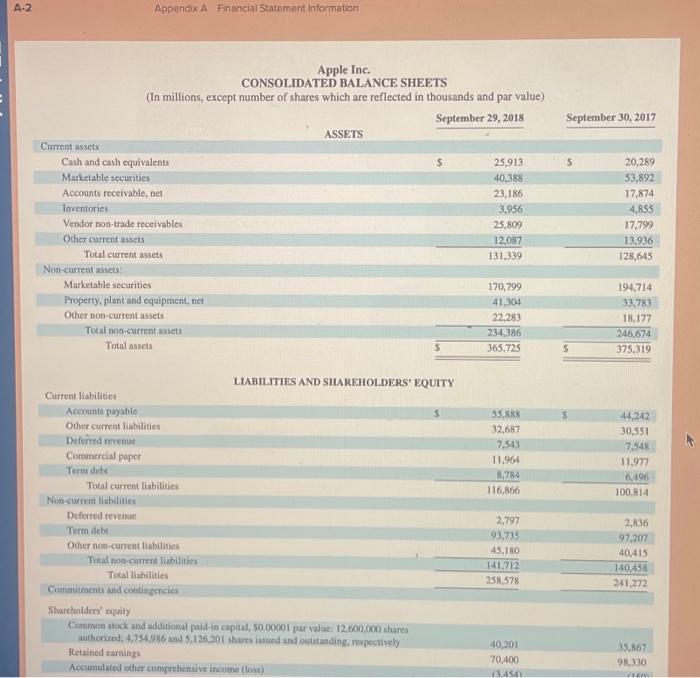

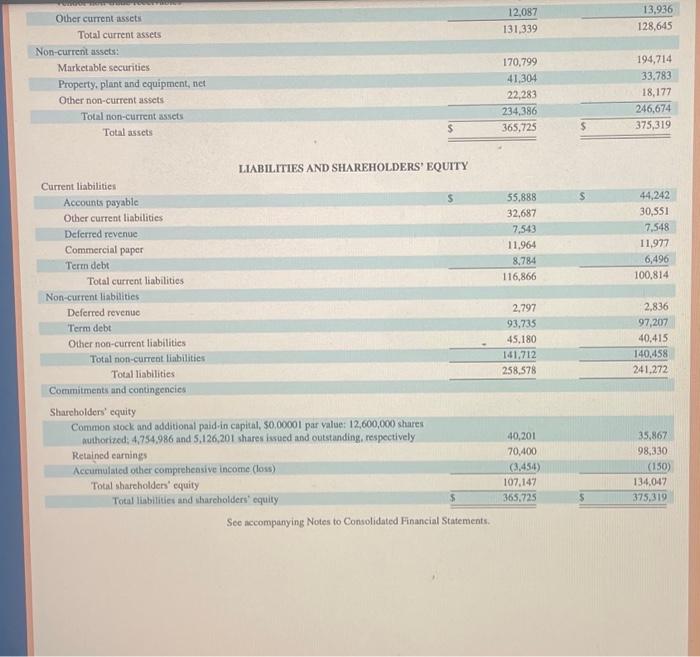

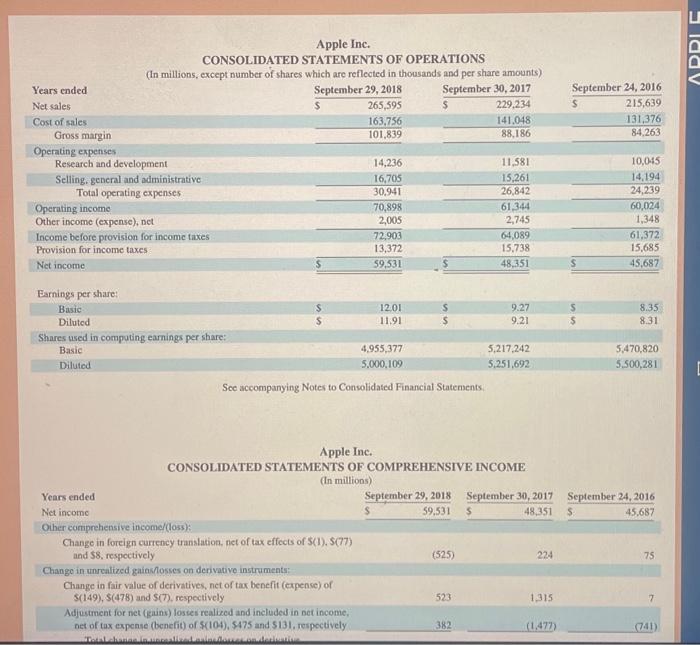

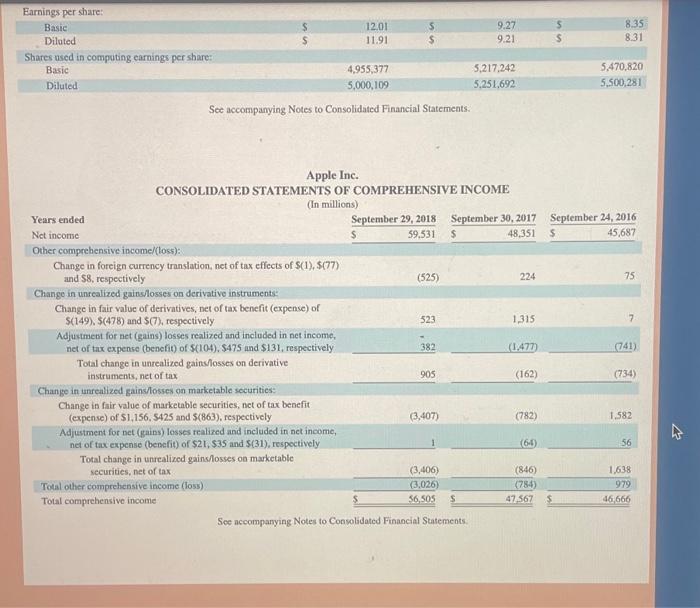

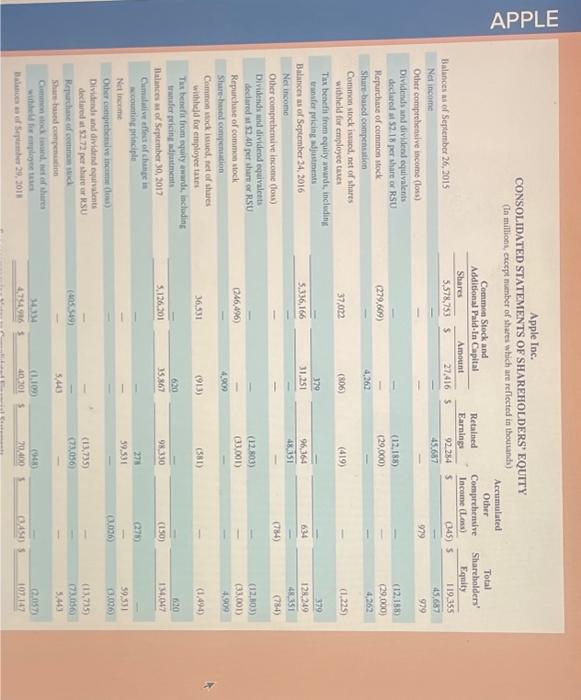

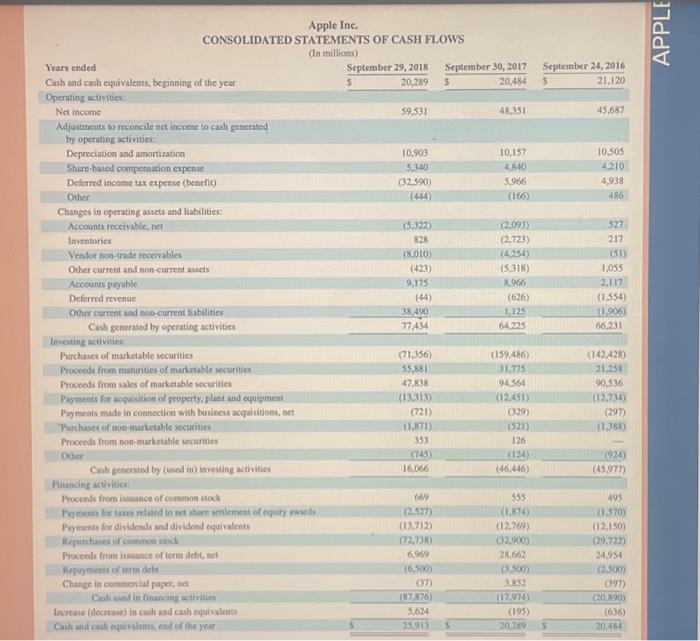

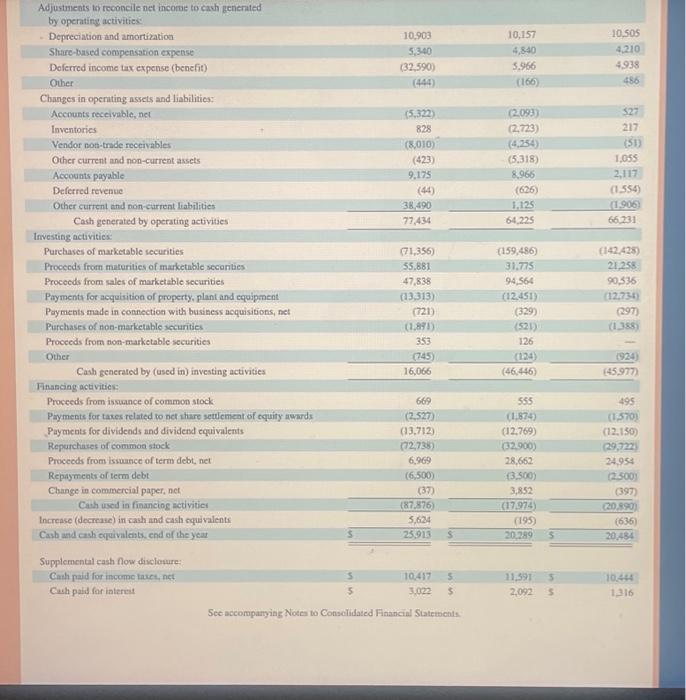

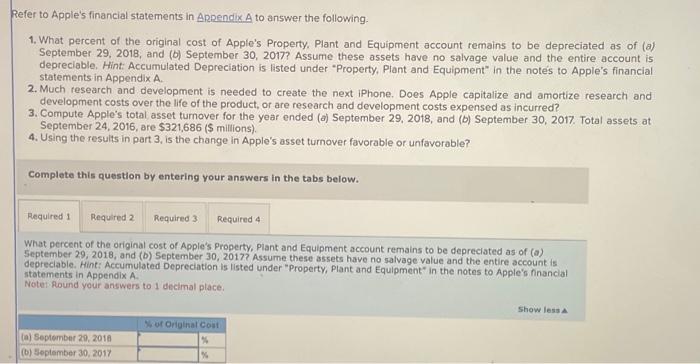

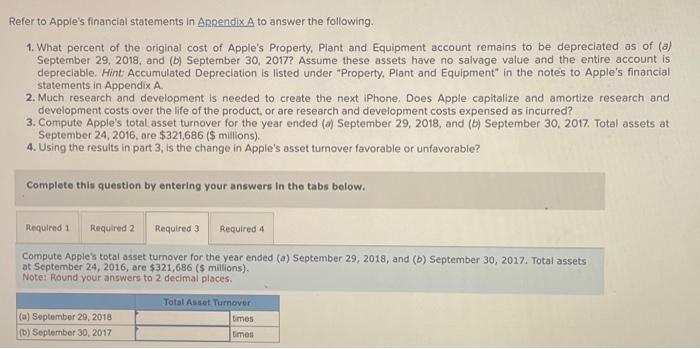

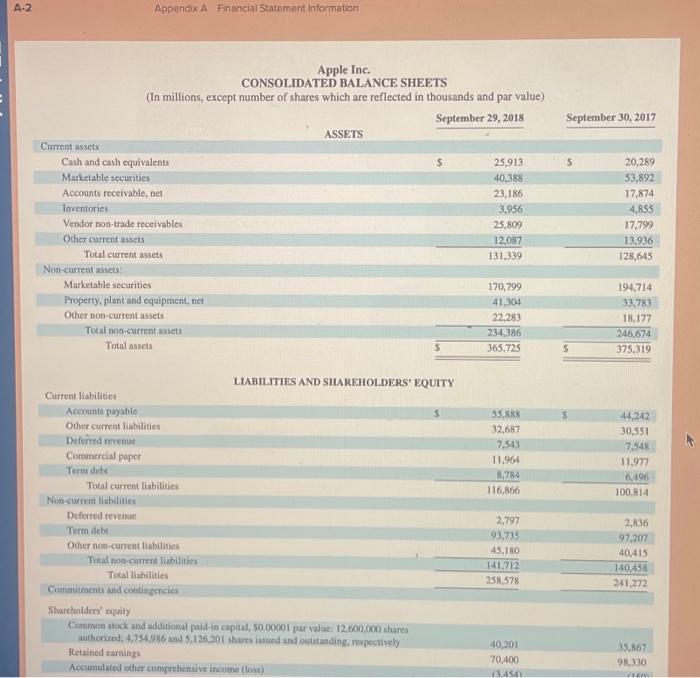

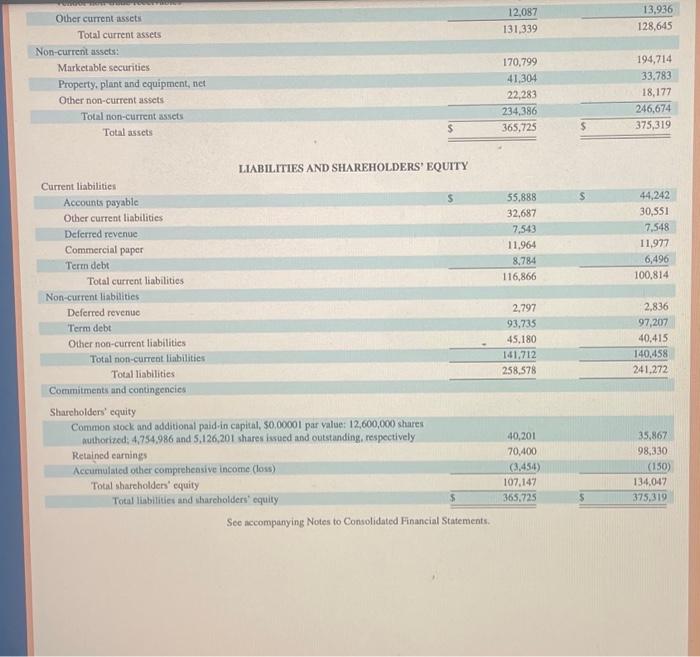

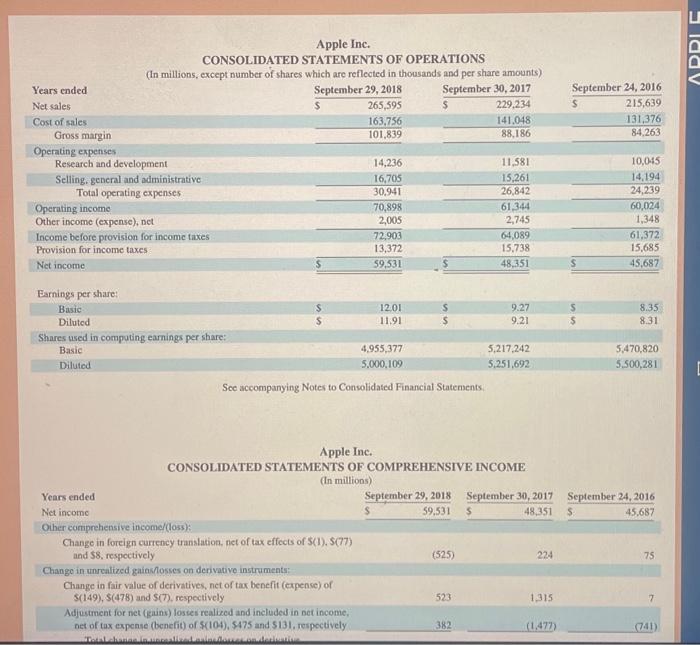

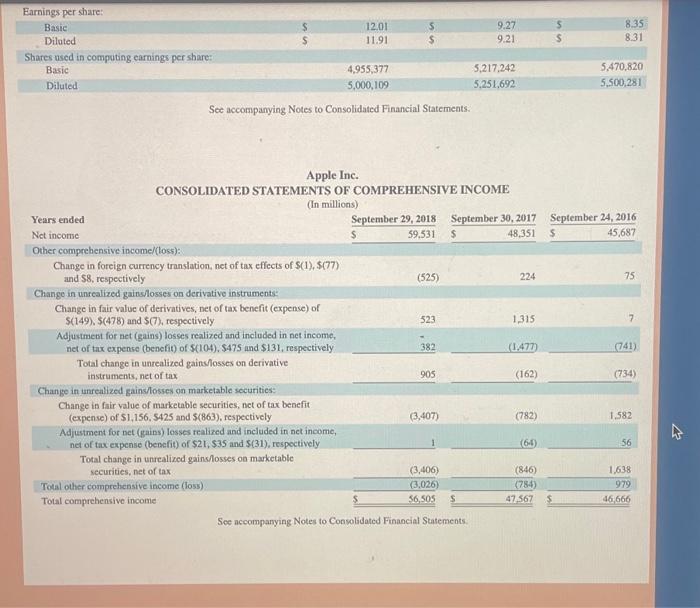

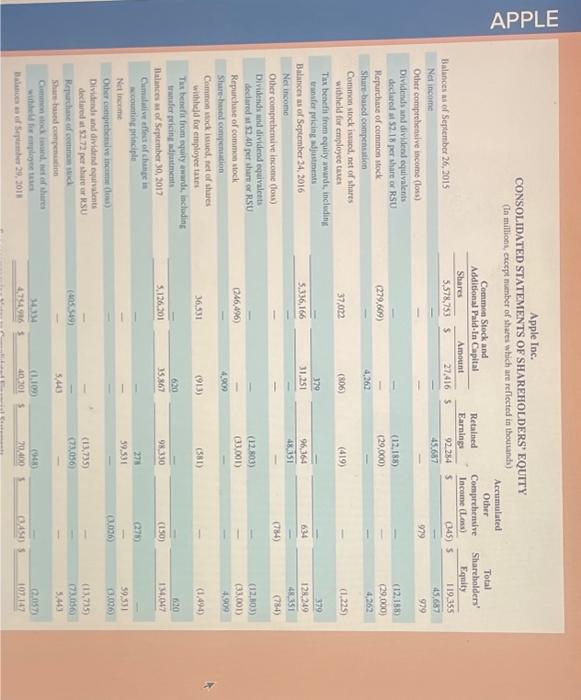

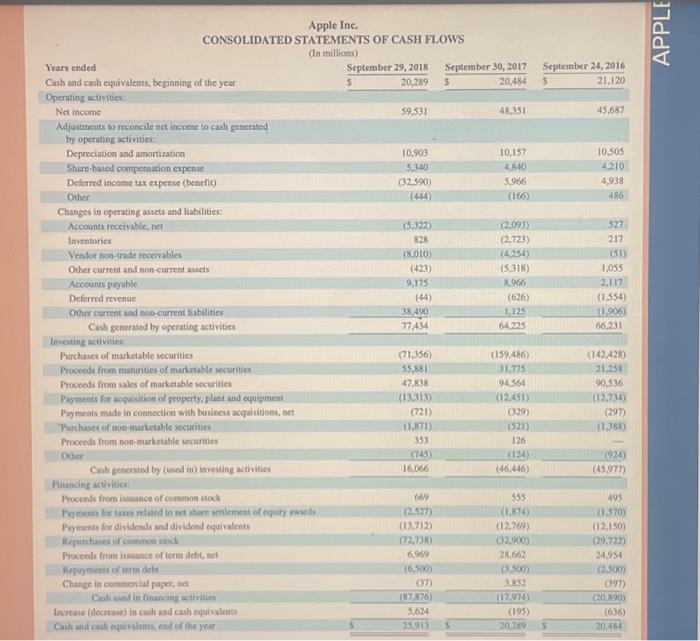

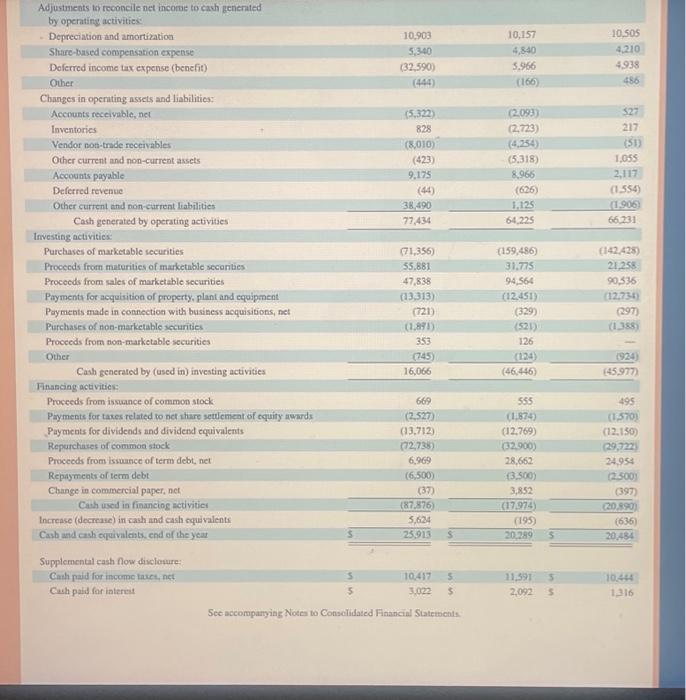

Refer to Apple's financial statements in Appendix A to answer the following. 1. What percent of the original cost of Apple's Property. Plant and Equipment account remains to be depreciated as of (a) September 29, 2018, and (b) September 30, 2017? Assume these assets have no salvage value and the entire account is depreciable. Hint: Accumulated Depreciation is listed under "Property. Plant and Equipment" in the nots to Apple's financial statements in Appendix A. 2. Much research and development is needed to create the next iPhone. Does Apple capitalize and amortize research and development costs over the life of the product, or are research and development costs expensed as incurred? 3. Compute Apple's total asset tumover for the year ended (a) September 29, 2018, and (b) September 30, 2017. Total assets at September 24, 2016, are \$321,686 (\$ millions). 4. Using the results in part 3 , is the change in Apple's asset turnover favorable or unfavorable? Complete this question by entering your answers in the tabs below. What percent of the original cost of Apple's Property, Plant and Equipment account remains to be depreciated as of (a) September 29,2018, and (b) September 30,20177 . Assume these assets have no salvage value and the entire account is depreciable. Hint: Accumulated Depreciation is listed under "Property, Plant and Equipment" in the notes to Apple's financia! statements in Appendix A. Note: Round your answers to 1 decimal place. Refer to Apple's financial statements in Appendix A to answer the following. 1. What percent of the original cost of Apple's Property, Plant and Equipment account remains to be depreciated as of (a) September 29, 2018, and (b) September 30, 2017? Assume these assets have no salvage value and the entire account is depreciable. Hint Accumulated Depreciation is listed under "Property, Plant and Equipment" in the notes to Apple's financial statements in Appendix A 2. Much research and development is needed to create the next iPhone. Does Apple capitalize and amortize research and development costs over the life of the product, or are research and development costs expensed as incurred? 3. Compute Apple's total asset turnover for the year ended (a) September 29, 2018, and (b) September 30, 2017. Total assets at September 24,2016 , are $321,686 (\$ millions). 4. Using the results in part 3 , is the change in Apple's asset turnover favorable or unfavorable? Complete this question by entering your answers in the tabs below. Compute Apples total asset turnover for the year ended (a) September 29, 2018, and (b) September 30, 2017. Total assets at September 24,2016 , are $321,686 ( $ millions). Note: Round your answers to 2 decimal places. Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying Notes to Consolidated Financial Statements Apple Ine. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) See accompanying Notes to Consolidated Financial Statements. Apple Inc. See accompanying Notes to Coovolidated Financial Statements. Apple Inc. CONSOI.IDATED STATFMENTS OF SHARFHOLDERS' ROUITY Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (Is millions) Years ended Cah and cash equivalents, beginning of the year Operating actuvites: Net income Adjustments to roconcile nct incoene to cash genernted by operatiog activities: Depreciation and amortization Shire basod compensation crpense Deferred incorne tax expense (benefit) Other 20,2895September29,2018 20,4845September30,201748,351,1205September24,2016 Changes in operating assets and liabelities: Accounts roceivabic, net Inventories Vendor non-trade recervables Other currest and non-current aucts 10.903 10,157 10.505 Accounts payable 5,340 Deferred revenue (32,590) 4,210 Other curtent and noo-curreat liabilities Cash generated by operating activitie (44) 4,938 Cash generated by operating sctivities Inverting actuvities: Purchases of marketable securities Procecds from maturities of marketable securities Procects from sales of marketable securities Payments har acquistion of property, plant and equipmeat (5,322) Paymeats made in consection with budiness acquikitions, net Turchaser of non-marketable securitics 828 5,966 486 Proceodi from oon-marketable securities (8,010) (166) (423) 9.175 Other (44) 38,49077,434 (2.093) 527 (2.723) 217 (4,254) (51) (5.318) 1.055 8.966 2.117 (626) (1.554) (1,906) 6.2,25 66,231 Adjustments to teconcile net income to cash generated by openting activities: Depreciation and amortination Shture-based compensation expense Deferred income tax expense (benefit) Other Changes in openating assets and liabilities: Acenunts receivable, net Inventories Vendor noth-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities 10,903 10,157 10,505 4,840 4,210 (32,590) 5,966 4.938 (166) 486 Supplemental cash now dixclosure: Canh paid for income taxes, net Cuch paid for iateres 5 10.417 5 3,022 11.391 2,092 10.444 1316 See accomparying Notea to Consolidated Financial Statements

Refer to Apple's financial statements in Appendix A to answer the following. 1. What percent of the original cost of Apple's Property. Plant and Equipment account remains to be depreciated as of (a) September 29, 2018, and (b) September 30, 2017? Assume these assets have no salvage value and the entire account is depreciable. Hint: Accumulated Depreciation is listed under "Property. Plant and Equipment" in the nots to Apple's financial statements in Appendix A. 2. Much research and development is needed to create the next iPhone. Does Apple capitalize and amortize research and development costs over the life of the product, or are research and development costs expensed as incurred? 3. Compute Apple's total asset tumover for the year ended (a) September 29, 2018, and (b) September 30, 2017. Total assets at September 24, 2016, are \$321,686 (\$ millions). 4. Using the results in part 3 , is the change in Apple's asset turnover favorable or unfavorable? Complete this question by entering your answers in the tabs below. What percent of the original cost of Apple's Property, Plant and Equipment account remains to be depreciated as of (a) September 29,2018, and (b) September 30,20177 . Assume these assets have no salvage value and the entire account is depreciable. Hint: Accumulated Depreciation is listed under "Property, Plant and Equipment" in the notes to Apple's financia! statements in Appendix A. Note: Round your answers to 1 decimal place. Refer to Apple's financial statements in Appendix A to answer the following. 1. What percent of the original cost of Apple's Property, Plant and Equipment account remains to be depreciated as of (a) September 29, 2018, and (b) September 30, 2017? Assume these assets have no salvage value and the entire account is depreciable. Hint Accumulated Depreciation is listed under "Property, Plant and Equipment" in the notes to Apple's financial statements in Appendix A 2. Much research and development is needed to create the next iPhone. Does Apple capitalize and amortize research and development costs over the life of the product, or are research and development costs expensed as incurred? 3. Compute Apple's total asset turnover for the year ended (a) September 29, 2018, and (b) September 30, 2017. Total assets at September 24,2016 , are $321,686 (\$ millions). 4. Using the results in part 3 , is the change in Apple's asset turnover favorable or unfavorable? Complete this question by entering your answers in the tabs below. Compute Apples total asset turnover for the year ended (a) September 29, 2018, and (b) September 30, 2017. Total assets at September 24,2016 , are $321,686 ( $ millions). Note: Round your answers to 2 decimal places. Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying Notes to Consolidated Financial Statements Apple Ine. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) See accompanying Notes to Consolidated Financial Statements. Apple Inc. See accompanying Notes to Coovolidated Financial Statements. Apple Inc. CONSOI.IDATED STATFMENTS OF SHARFHOLDERS' ROUITY Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (Is millions) Years ended Cah and cash equivalents, beginning of the year Operating actuvites: Net income Adjustments to roconcile nct incoene to cash genernted by operatiog activities: Depreciation and amortization Shire basod compensation crpense Deferred incorne tax expense (benefit) Other 20,2895September29,2018 20,4845September30,201748,351,1205September24,2016 Changes in operating assets and liabelities: Accounts roceivabic, net Inventories Vendor non-trade recervables Other currest and non-current aucts 10.903 10,157 10.505 Accounts payable 5,340 Deferred revenue (32,590) 4,210 Other curtent and noo-curreat liabilities Cash generated by operating activitie (44) 4,938 Cash generated by operating sctivities Inverting actuvities: Purchases of marketable securities Procecds from maturities of marketable securities Procects from sales of marketable securities Payments har acquistion of property, plant and equipmeat (5,322) Paymeats made in consection with budiness acquikitions, net Turchaser of non-marketable securitics 828 5,966 486 Proceodi from oon-marketable securities (8,010) (166) (423) 9.175 Other (44) 38,49077,434 (2.093) 527 (2.723) 217 (4,254) (51) (5.318) 1.055 8.966 2.117 (626) (1.554) (1,906) 6.2,25 66,231 Adjustments to teconcile net income to cash generated by openting activities: Depreciation and amortination Shture-based compensation expense Deferred income tax expense (benefit) Other Changes in openating assets and liabilities: Acenunts receivable, net Inventories Vendor noth-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities 10,903 10,157 10,505 4,840 4,210 (32,590) 5,966 4.938 (166) 486 Supplemental cash now dixclosure: Canh paid for income taxes, net Cuch paid for iateres 5 10.417 5 3,022 11.391 2,092 10.444 1316 See accomparying Notea to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started