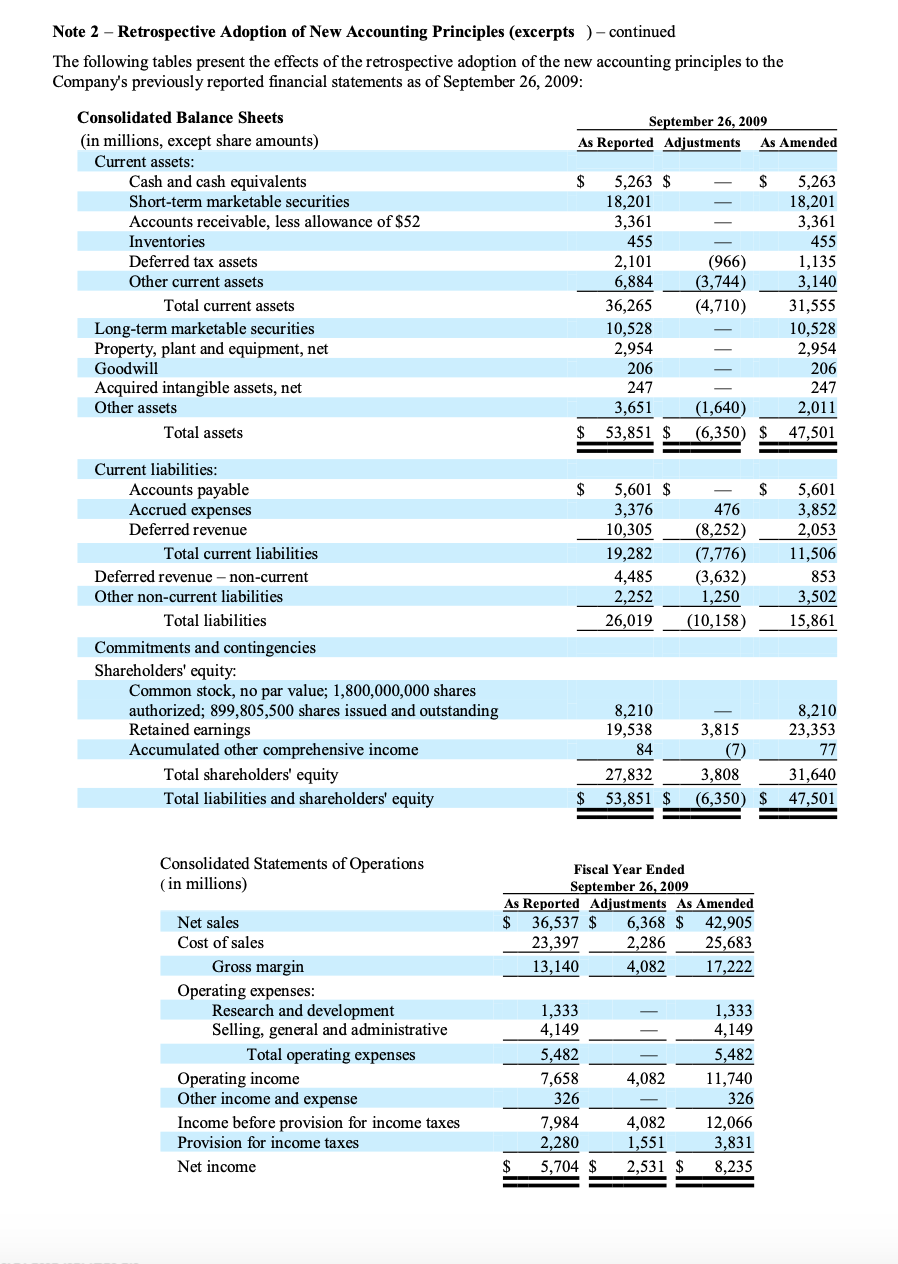

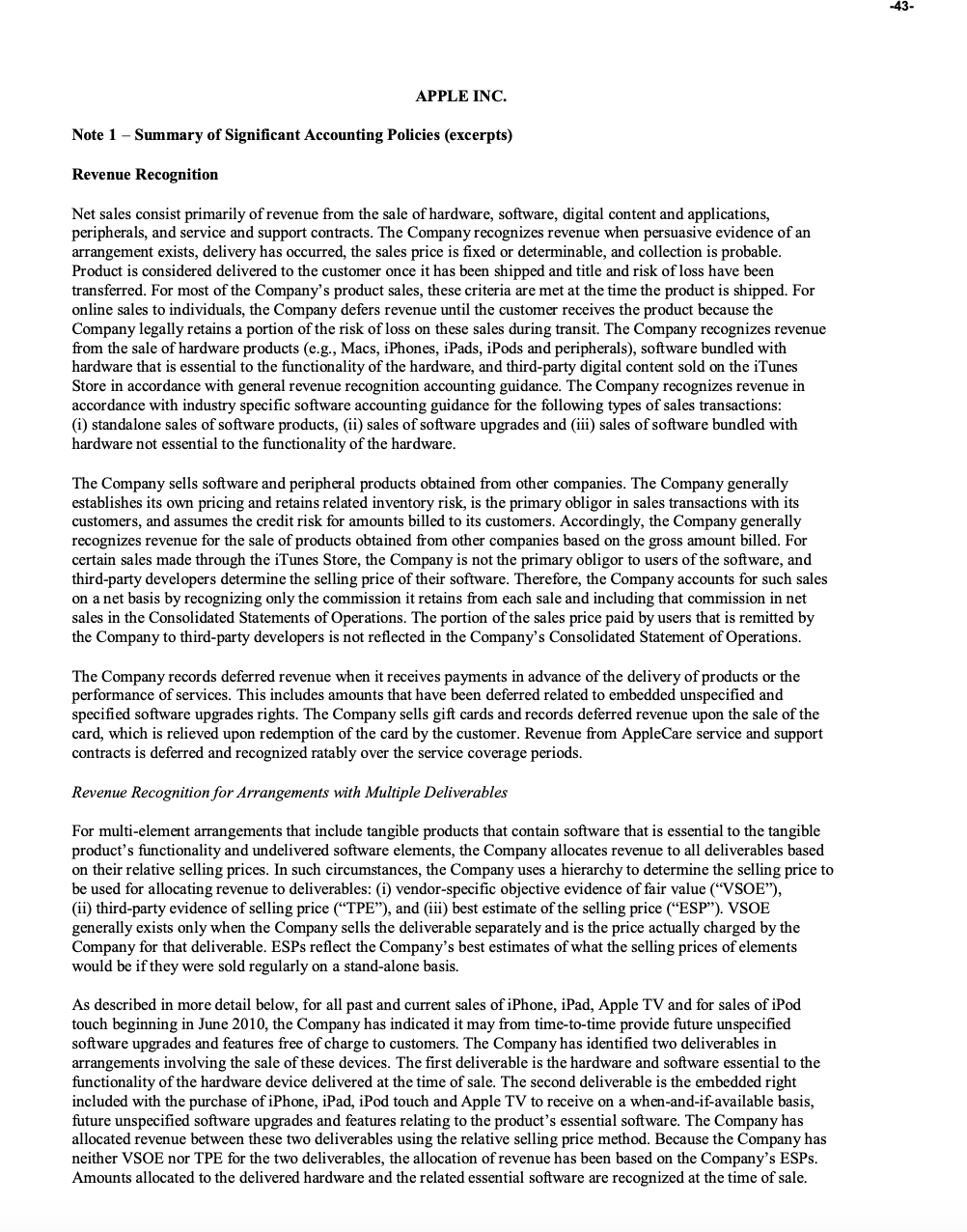

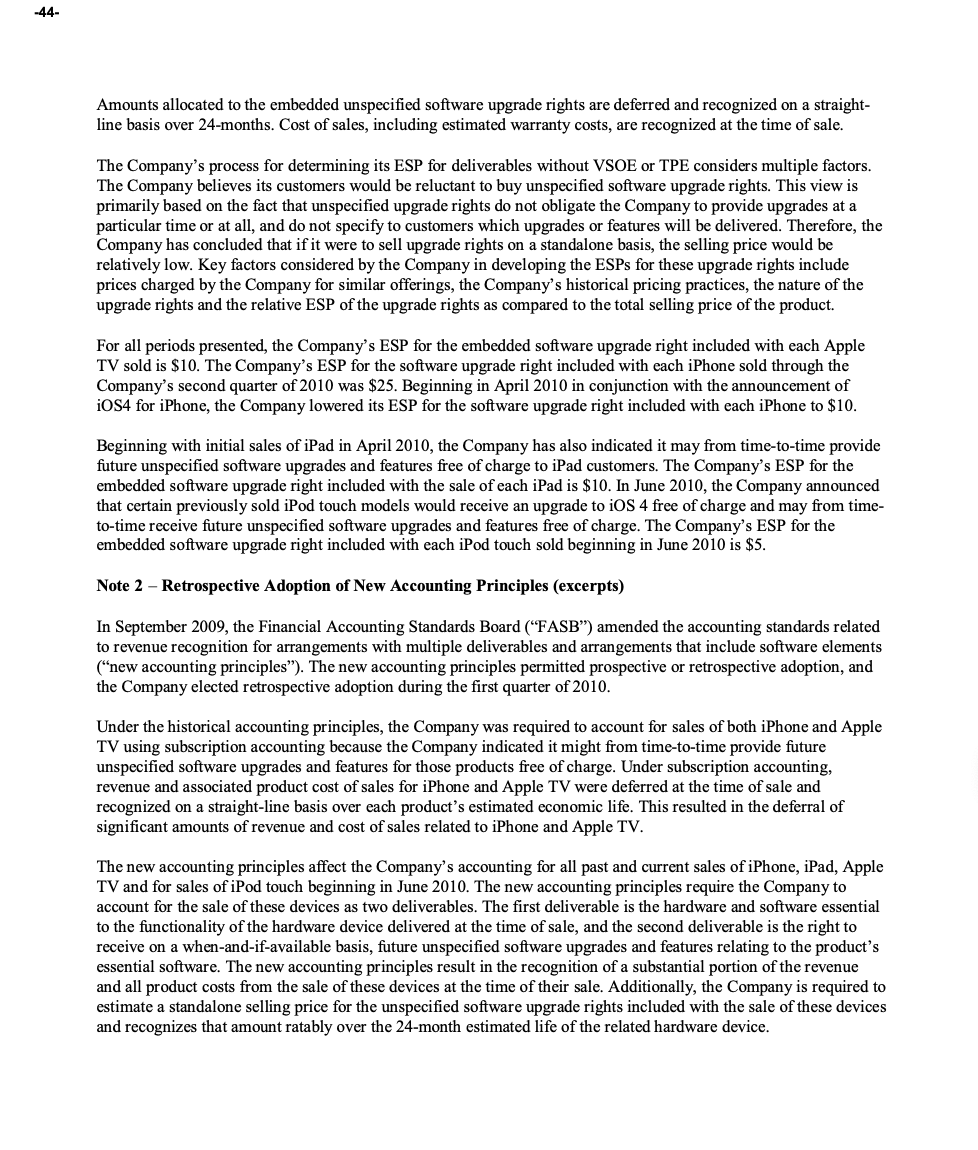

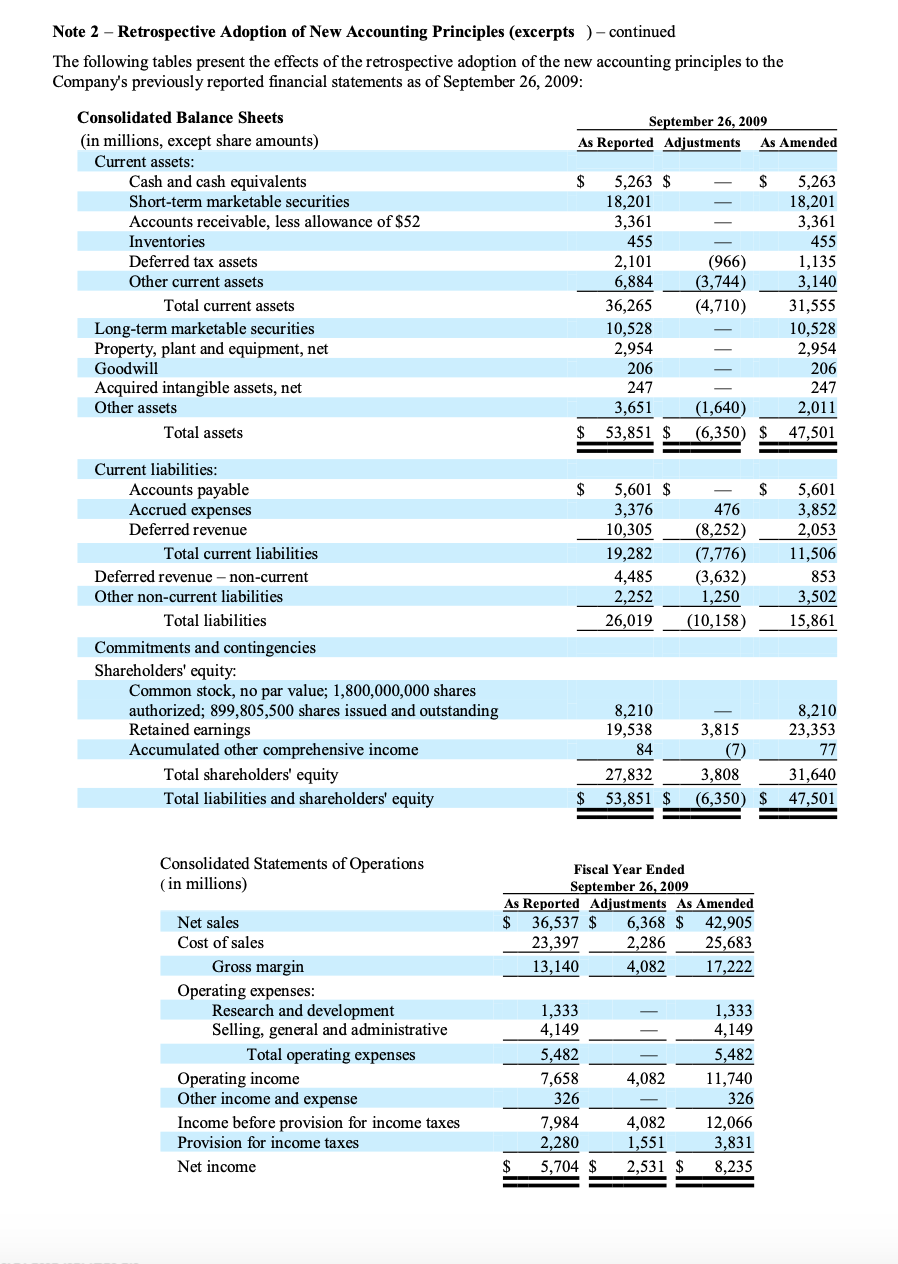

Refer to Apple's revenue recognition footnote. Consider the sale of peripheral products obtained from other companies, such as Logitech speakers. How would Apple determine the amount to record for such speakers sold from the Apple stores? What if the speakers were drop-shipped from Logitech for an online Apple-store order? Consider the following hypothetical sales scenario. A large community college buys and takes delivery of 50 iMac computers from a local Apple store. The invoiced price is $2,800 per unit and includes hardware, software essential to the functionality of the hardware, third-party software including Microsoft Office for Mac and Adobe Creative Suite, and two years of tech service and support. Apple uses vendor-specific objective evidence to determine unit prices of $2,500 and $300 for hardware and the essential software, respectively. The third-party software typically retails for $500 (but Apple purchases it at a 50% discount) and equivalent service and support contracts are $100 per year. The customer (the community college) can opt to purchase subsequent essential software and OS upgrades. Indicate how Apple should record gross revenue for the transaction at the time the customer takes delivery of the computers. Your response should include specific dollar amounts. APPLE INC. Note 1 - Summary of Significant Accounting Policies (excerpts) Revenue Recognition Net sales consist primarily of revenue from the sale of hardware, software, digital content and applications, peripherals, and service and support contracts. The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and collection is probable. Product is considered delivered to the customer once it has been shipped and title and risk of loss have been transferred. For most of the Company's product sales, these criteria are met at the time the product is shipped. For online sales to individuals, the Company defers revenue until the customer receives the product because the Company legally retains a portion of the risk of loss on these sales during transit. The Company recognizes revenue from the sale of hardware products (e.g., Macs, iPhones, iPads, iPods and peripherals), software bundled with hardware that is essential to the functionality of the hardware, and third-party digital content sold on the iTunes Store in accordance with general revenue recognition accounting guidance. The Company recognizes revenue in accordance with industry specific software accounting guidance for the following types of sales transactions: (i) standalone sales of software products, (ii) sales of software upgrades and (iii) sales of software bundled with hardware not essential to the functionality of the hardware. The Company sells software and peripheral products obtained from other companies. The Company generally establishes its own pricing and retains related inventory risk, is the primary obligor in sales transactions with its customers, and assumes the credit risk for amounts billed to its customers. Accordingly, the Company generally recognizes revenue for the sale of products obtained from other companies based on the gross amount billed. For certain sales made through the iTunes Store, the Company is not the primary obligor to users of the software, and third-party developers determine the selling price of their software. Therefore, the Company accounts for such sales on a net basis by recognizing only the commission it retains from each sale and including that commission in net sales in the Consolidated Statements of Operations. The portion of the sales price paid by users that is remitted by the Company to third-party developers is not reflected in the Company's Consolidated Statement of Operations. The Company records deferred revenue when it receives payments in advance of the delivery of products or the performance of services. This includes amounts that have been deferred related to embedded unspecified and specified software upgrades rights. The Company sells gift cards and records deferred revenue upon the sale of the card, which is relieved upon redemption of the card by the customer. Revenue from AppleCare service and support contracts is deferred and recognized ratably over the service coverage periods. Revenue Recognition for Arrangements with Multiple Deliverables For multi-element arrangements that include tangible products that contain software that is essential to the tangible product's functionality and undelivered software elements, the Company allocates revenue to all deliverables based on their relative selling prices. In such circumstances, the Company uses a hierarchy to determine the selling price to be used for allocating revenue to deliverables: (i) vendor-specific objective evidence of fair value ("VSOE"), (ii) third-party evidence of selling price ("TPE"), and (iii) best estimate of the selling price ("ESP"). VSOE generally exists only when the Company sells the deliverable separately and is the price actually charged by the Company for that deliverable. ESPs reflect the Company's best estimates of what the selling prices of elements would be if they were sold regularly on a stand-alone basis. As described in more detail below, for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010, the Company has indicated it may from time-to-time provide future unspecified software upgrades and features free of charge to customers. The Company has identified two deliverables in arrangements involving the sale of these devices. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale. The second deliverable is the embedded right included with the purchase of iPhone, iPad, iPod touch and Apple TV to receive on a when-and-if-available basis, future unspecified software upgrades and features relating to the product's essential software. The Company has allocated revenue between these two deliverables using the relative selling price method. Because the Company has neither VSOE nor TPE for the two deliverables, the allocation of revenue has been based on the Company's ESPs. Amounts allocated to the delivered hardware and the related essential software are recognized at the time of sale. Amounts allocated to the embedded unspecified software upgrade rights are deferred and recognized on a straightline basis over 24-months. Cost of sales, including estimated warranty costs, are recognized at the time of sale. The Company's process for determining its ESP for deliverables without VSOE or TPE considers multiple factors. The Company believes its customers would be reluctant to buy unspecified software upgrade rights. This view is primarily based on the fact that unspecified upgrade rights do not obligate the Company to provide upgrades at a particular time or at all, and do not specify to customers which upgrades or features will be delivered. Therefore, the Company has concluded that if it were to sell upgrade rights on a standalone basis, the selling price would be relatively low. Key factors considered by the Company in developing the ESPs for these upgrade rights include prices charged by the Company for similar offerings, the Company's historical pricing practices, the nature of the upgrade rights and the relative ESP of the upgrade rights as compared to the total selling price of the product. For all periods presented, the Company's ESP for the embedded software upgrade right included with each Apple TV sold is $10. The Company's ESP for the software upgrade right included with each iPhone sold through the Company's second quarter of 2010 was \$25. Beginning in April 2010 in conjunction with the announcement of iOS4 for iPhone, the Company lowered its ESP for the software upgrade right included with each iPhone to $10. Beginning with initial sales of iPad in April 2010, the Company has also indicated it may from time-to-time provide future unspecified software upgrades and features free of charge to iPad customers. The Company's ESP for the embedded software upgrade right included with the sale of each iPad is $10. In June 2010 , the Company announced that certain previously sold iPod touch models would receive an upgrade to iOS 4 free of charge and may from timeto-time receive future unspecified software upgrades and features free of charge. The Company's ESP for the embedded software upgrade right included with each iPod touch sold beginning in June 2010 is $5. Note 2 - Retrospective Adoption of New Accounting Principles (excerpts) In September 2009, the Financial Accounting Standards Board ("FASB") amended the accounting standards related to revenue recognition for arrangements with multiple deliverables and arrangements that include software elements ("new accounting principles"). The new accounting principles permitted prospective or retrospective adoption, and the Company elected retrospective adoption during the first quarter of 2010. Under the historical accounting principles, the Company was required to account for sales of both iPhone and Apple TV using subscription accounting because the Company indicated it might from time-to-time provide future unspecified software upgrades and features for those products free of charge. Under subscription accounting, revenue and associated product cost of sales for iPhone and Apple TV were deferred at the time of sale and recognized on a straight-line basis over each product's estimated economic life. This resulted in the deferral of significant amounts of revenue and cost of sales related to iPhone and Apple TV. The new accounting principles affect the Company's accounting for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010. The new accounting principles require the Company to account for the sale of these devices as two deliverables. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale, and the second deliverable is the right to receive on a when-and-if-available basis, future unspecified software upgrades and features relating to the product's essential software. The new accounting principles result in the recognition of a substantial portion of the revenue and all product costs from the sale of these devices at the time of their sale. Additionally, the Company is required to estimate a standalone selling price for the unspecified software upgrade rights included with the sale of these devices and recognizes that amount ratably over the 24-month estimated life of the related hardware device. Note 2 - Retrospective Adoption of New Accounting Principles (excerpts )-continued Tr Cr Refer to Apple's revenue recognition footnote. Consider the sale of peripheral products obtained from other companies, such as Logitech speakers. How would Apple determine the amount to record for such speakers sold from the Apple stores? What if the speakers were drop-shipped from Logitech for an online Apple-store order? Consider the following hypothetical sales scenario. A large community college buys and takes delivery of 50 iMac computers from a local Apple store. The invoiced price is $2,800 per unit and includes hardware, software essential to the functionality of the hardware, third-party software including Microsoft Office for Mac and Adobe Creative Suite, and two years of tech service and support. Apple uses vendor-specific objective evidence to determine unit prices of $2,500 and $300 for hardware and the essential software, respectively. The third-party software typically retails for $500 (but Apple purchases it at a 50% discount) and equivalent service and support contracts are $100 per year. The customer (the community college) can opt to purchase subsequent essential software and OS upgrades. Indicate how Apple should record gross revenue for the transaction at the time the customer takes delivery of the computers. Your response should include specific dollar amounts. APPLE INC. Note 1 - Summary of Significant Accounting Policies (excerpts) Revenue Recognition Net sales consist primarily of revenue from the sale of hardware, software, digital content and applications, peripherals, and service and support contracts. The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and collection is probable. Product is considered delivered to the customer once it has been shipped and title and risk of loss have been transferred. For most of the Company's product sales, these criteria are met at the time the product is shipped. For online sales to individuals, the Company defers revenue until the customer receives the product because the Company legally retains a portion of the risk of loss on these sales during transit. The Company recognizes revenue from the sale of hardware products (e.g., Macs, iPhones, iPads, iPods and peripherals), software bundled with hardware that is essential to the functionality of the hardware, and third-party digital content sold on the iTunes Store in accordance with general revenue recognition accounting guidance. The Company recognizes revenue in accordance with industry specific software accounting guidance for the following types of sales transactions: (i) standalone sales of software products, (ii) sales of software upgrades and (iii) sales of software bundled with hardware not essential to the functionality of the hardware. The Company sells software and peripheral products obtained from other companies. The Company generally establishes its own pricing and retains related inventory risk, is the primary obligor in sales transactions with its customers, and assumes the credit risk for amounts billed to its customers. Accordingly, the Company generally recognizes revenue for the sale of products obtained from other companies based on the gross amount billed. For certain sales made through the iTunes Store, the Company is not the primary obligor to users of the software, and third-party developers determine the selling price of their software. Therefore, the Company accounts for such sales on a net basis by recognizing only the commission it retains from each sale and including that commission in net sales in the Consolidated Statements of Operations. The portion of the sales price paid by users that is remitted by the Company to third-party developers is not reflected in the Company's Consolidated Statement of Operations. The Company records deferred revenue when it receives payments in advance of the delivery of products or the performance of services. This includes amounts that have been deferred related to embedded unspecified and specified software upgrades rights. The Company sells gift cards and records deferred revenue upon the sale of the card, which is relieved upon redemption of the card by the customer. Revenue from AppleCare service and support contracts is deferred and recognized ratably over the service coverage periods. Revenue Recognition for Arrangements with Multiple Deliverables For multi-element arrangements that include tangible products that contain software that is essential to the tangible product's functionality and undelivered software elements, the Company allocates revenue to all deliverables based on their relative selling prices. In such circumstances, the Company uses a hierarchy to determine the selling price to be used for allocating revenue to deliverables: (i) vendor-specific objective evidence of fair value ("VSOE"), (ii) third-party evidence of selling price ("TPE"), and (iii) best estimate of the selling price ("ESP"). VSOE generally exists only when the Company sells the deliverable separately and is the price actually charged by the Company for that deliverable. ESPs reflect the Company's best estimates of what the selling prices of elements would be if they were sold regularly on a stand-alone basis. As described in more detail below, for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010, the Company has indicated it may from time-to-time provide future unspecified software upgrades and features free of charge to customers. The Company has identified two deliverables in arrangements involving the sale of these devices. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale. The second deliverable is the embedded right included with the purchase of iPhone, iPad, iPod touch and Apple TV to receive on a when-and-if-available basis, future unspecified software upgrades and features relating to the product's essential software. The Company has allocated revenue between these two deliverables using the relative selling price method. Because the Company has neither VSOE nor TPE for the two deliverables, the allocation of revenue has been based on the Company's ESPs. Amounts allocated to the delivered hardware and the related essential software are recognized at the time of sale. Amounts allocated to the embedded unspecified software upgrade rights are deferred and recognized on a straightline basis over 24-months. Cost of sales, including estimated warranty costs, are recognized at the time of sale. The Company's process for determining its ESP for deliverables without VSOE or TPE considers multiple factors. The Company believes its customers would be reluctant to buy unspecified software upgrade rights. This view is primarily based on the fact that unspecified upgrade rights do not obligate the Company to provide upgrades at a particular time or at all, and do not specify to customers which upgrades or features will be delivered. Therefore, the Company has concluded that if it were to sell upgrade rights on a standalone basis, the selling price would be relatively low. Key factors considered by the Company in developing the ESPs for these upgrade rights include prices charged by the Company for similar offerings, the Company's historical pricing practices, the nature of the upgrade rights and the relative ESP of the upgrade rights as compared to the total selling price of the product. For all periods presented, the Company's ESP for the embedded software upgrade right included with each Apple TV sold is $10. The Company's ESP for the software upgrade right included with each iPhone sold through the Company's second quarter of 2010 was \$25. Beginning in April 2010 in conjunction with the announcement of iOS4 for iPhone, the Company lowered its ESP for the software upgrade right included with each iPhone to $10. Beginning with initial sales of iPad in April 2010, the Company has also indicated it may from time-to-time provide future unspecified software upgrades and features free of charge to iPad customers. The Company's ESP for the embedded software upgrade right included with the sale of each iPad is $10. In June 2010 , the Company announced that certain previously sold iPod touch models would receive an upgrade to iOS 4 free of charge and may from timeto-time receive future unspecified software upgrades and features free of charge. The Company's ESP for the embedded software upgrade right included with each iPod touch sold beginning in June 2010 is $5. Note 2 - Retrospective Adoption of New Accounting Principles (excerpts) In September 2009, the Financial Accounting Standards Board ("FASB") amended the accounting standards related to revenue recognition for arrangements with multiple deliverables and arrangements that include software elements ("new accounting principles"). The new accounting principles permitted prospective or retrospective adoption, and the Company elected retrospective adoption during the first quarter of 2010. Under the historical accounting principles, the Company was required to account for sales of both iPhone and Apple TV using subscription accounting because the Company indicated it might from time-to-time provide future unspecified software upgrades and features for those products free of charge. Under subscription accounting, revenue and associated product cost of sales for iPhone and Apple TV were deferred at the time of sale and recognized on a straight-line basis over each product's estimated economic life. This resulted in the deferral of significant amounts of revenue and cost of sales related to iPhone and Apple TV. The new accounting principles affect the Company's accounting for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010. The new accounting principles require the Company to account for the sale of these devices as two deliverables. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale, and the second deliverable is the right to receive on a when-and-if-available basis, future unspecified software upgrades and features relating to the product's essential software. The new accounting principles result in the recognition of a substantial portion of the revenue and all product costs from the sale of these devices at the time of their sale. Additionally, the Company is required to estimate a standalone selling price for the unspecified software upgrade rights included with the sale of these devices and recognizes that amount ratably over the 24-month estimated life of the related hardware device. Note 2 - Retrospective Adoption of New Accounting Principles (excerpts )-continued Tr Cr