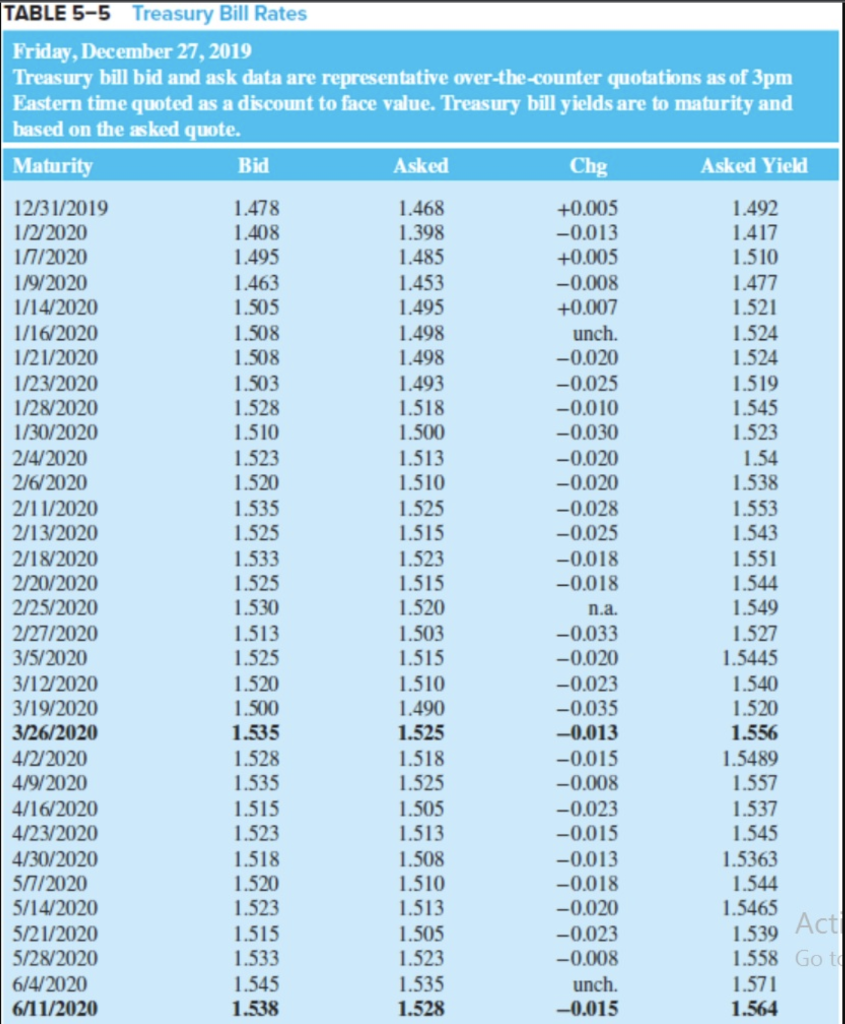

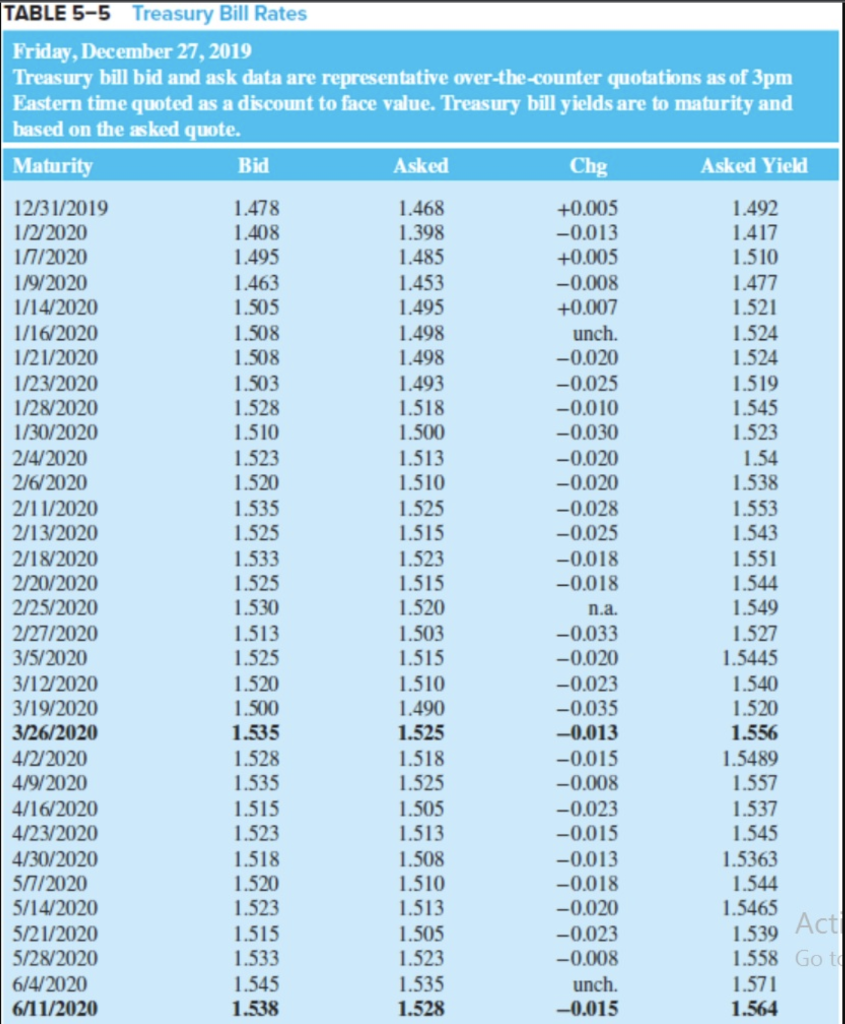

Refer to Assume a face value of $10,000. a. Calculate the ask price of the Treasury bill maturing on 28 January 2020 , as of December 27,2019. b. Calculate the bid price of the Treasury bill maturing on 16 April 2020, as of December 27,2019. (For all requirements, use 360 days in a year. Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) TABLE 5-5 Treasury Bill Rates Friday, December 27, 2019 Treasury bill bid and ask data are representative over-the-counter quotations as of 3pm Bastern time quoted as a discount to face value. Treasury bill yields are to maturity and based on the asked quote. \begin{tabular}{lrrrr|} \hline Maturity & Bid & Asked & Chg & Asked Yiehd \\ \hline 12/31/2019 & 1.478 & 1.468 & +0.005 & 1.492 \\ 1/2/2020 & 1.408 & 1.398 & 0.013 & 1.417 \\ 1///2020 & 1.495 & 1.485 & +0.005 & 1.510 \\ 1/9/2020 & 1.463 & 1.453 & 0.008 & 1.477 \\ 1/14/2020 & 1.505 & 1.495 & +0.007 & 1.521 \\ 1/16/2020 & 1.508 & 1.498 & unch. & 1.524 \\ 1/21/2020 & 1.508 & 1.498 & 0.020 & 1.524 \\ 1/23/2020 & 1.503 & 1.493 & 0.025 & 1.519 \\ 1/28/2020 & 1.528 & 1.518 & 0.010 & 1.545 \\ 1/30/2020 & 1.510 & 1.500 & 0.030 & 1.523 \\ 2/4/2020 & 1.523 & 1.513 & 0.020 & 1.54 \\ 2/6/2020 & 1.520 & 1.510 & 0.020 & 1.538 \\ 2/11/2020 & 1.535 & 1.525 & 0.028 & 1.553 \\ 2/13/2020 & 1.525 & 1.515 & 0.025 & 1.543 \\ 2/18/2020 & 1.533 & 1.523 & 0.018 & 1.551 \\ 2/20/2020 & 1.525 & 1.515 & 0.018 & 1.544 \\ 2/25/2020 & 1.530 & 1.520 & n.a. & 1.549 \\ 2/27/2020 & 1.513 & 1.503 & 0.033 & 1.527 \\ 3/5/2020 & 1.525 & 1.515 & 0.020 & 1.5445 \\ 3/12/2020 & 1.520 & 1.510 & 0.023 & 1.540 \\ 3/19/2020 & 1.500 & 1.490 & 0.035 & 1.520 \\ 3/26/2020 & 1.535 & 1.525 & 0.013 & 1.556 \\ 4/2/2020 & 1.528 & 1.518 & 0.015 & 1.5489 \\ 4/9/2020 & 1.535 & 1.525 & 0.008 & 1.557 \\ 4/16/2020 & 1.515 & 1.505 & 0.023 & 1.537 \\ 4/23/2020 & 1.523 & 1.513 & 0.015 & 1.545 \\ 4/30/2020 & 1.518 & 1.508 & 0.013 & 1.5363 \\ 5//2020 & 1.520 & 1.510 & 0.018 & 1.544 \\ 5/14/2020 & 1.523 & 1.513 & 0.020 & 1.5465 \\ 5/21/2020 & 1.515 & 1.505 & 0.023 & 1.539 \\ 5/28/2020 & 1.533 & 1.523 & 0.008 & 1.558 \\ 6/4/2020 & 1.545 & 1.535 & unch. & 1.571 \\ 6/11/2020 & 1.538 & 1.528 & 0.015 & 1.564 \end{tabular}