Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to Badger Enterprises' balance sheet. Assume that the retained earnings value at the beginning of 20X0 is R12,354,726. This value is not shown on

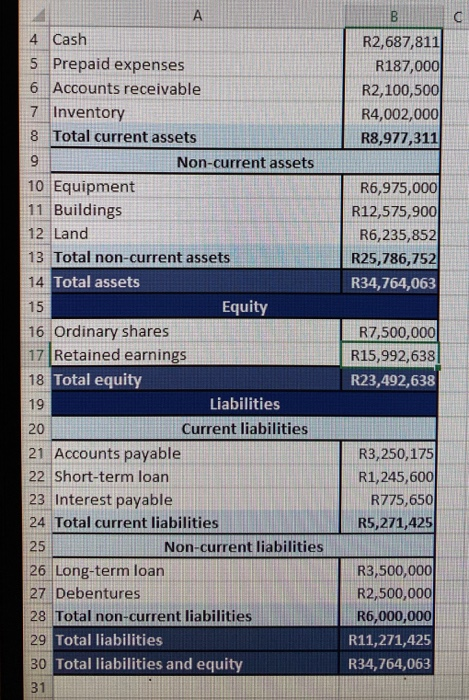

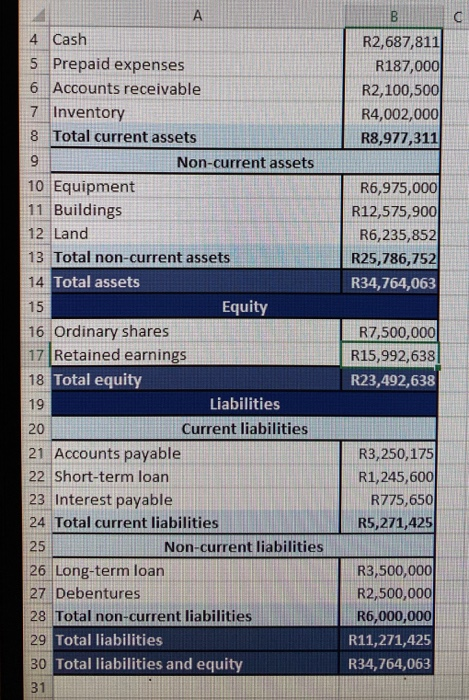

Refer to Badger Enterprises' balance sheet. Assume that the retained earnings value at the beginning of 20X0 is R12,354,726. This value is not shown on any of the statements. At the end of that year, the retained earnings value is R15,992,638. The difference in value of R3,637,912 comes from the cash flow statement. Select one: O True False U R2,687,811 R187,000 R2,100,500 R4,002,000 R8,977,311 R6,975,000 R12,575,900 R6,235,852 R25,786,752 R34,764,063 4 Cash 5 Prepaid expenses 6 Accounts receivable 7 Inventory 8 Total current assets 9 Non-current assets 10 Equipment 11 Buildings 12 Land 13 Total non-current assets 14 Total assets 15 Equity 16 Ordinary shares 17 Retained earnings 18 Total equity 19 Liabilities 20 Current liabilities 21 Accounts payable 22 Short-term loan 23 Interest payable 24 Total current liabilities Non-current liabilities 26 Long-term loan 27 Debentures 28 Total non-current liabilities 29 Total liabilities 30 Total liabilities and equity 31 R7,500,000 R15,992,638 R23,492,638 R3,250,175 R1,245,600 R775,650 R5,271,425 2 5 R3,500,000 R2,500,000 R6,000,000 R11,271,425 R34,764,063 3

Refer to Badger Enterprises' balance sheet. Assume that the retained earnings value at the beginning of 20X0 is R12,354,726. This value is not shown on any of the statements. At the end of that year, the retained earnings value is R15,992,638. The difference in value of R3,637,912 comes from the cash flow statement. Select one: O True False U R2,687,811 R187,000 R2,100,500 R4,002,000 R8,977,311 R6,975,000 R12,575,900 R6,235,852 R25,786,752 R34,764,063 4 Cash 5 Prepaid expenses 6 Accounts receivable 7 Inventory 8 Total current assets 9 Non-current assets 10 Equipment 11 Buildings 12 Land 13 Total non-current assets 14 Total assets 15 Equity 16 Ordinary shares 17 Retained earnings 18 Total equity 19 Liabilities 20 Current liabilities 21 Accounts payable 22 Short-term loan 23 Interest payable 24 Total current liabilities Non-current liabilities 26 Long-term loan 27 Debentures 28 Total non-current liabilities 29 Total liabilities 30 Total liabilities and equity 31 R7,500,000 R15,992,638 R23,492,638 R3,250,175 R1,245,600 R775,650 R5,271,425 2 5 R3,500,000 R2,500,000 R6,000,000 R11,271,425 R34,764,063 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started