Refer to C14-3.

At December 31, 2015, ExxonMobil had 4,156 million shares of outstanding common stock. The closing market price of each share of stock at December 31, 2015, was $77.95....

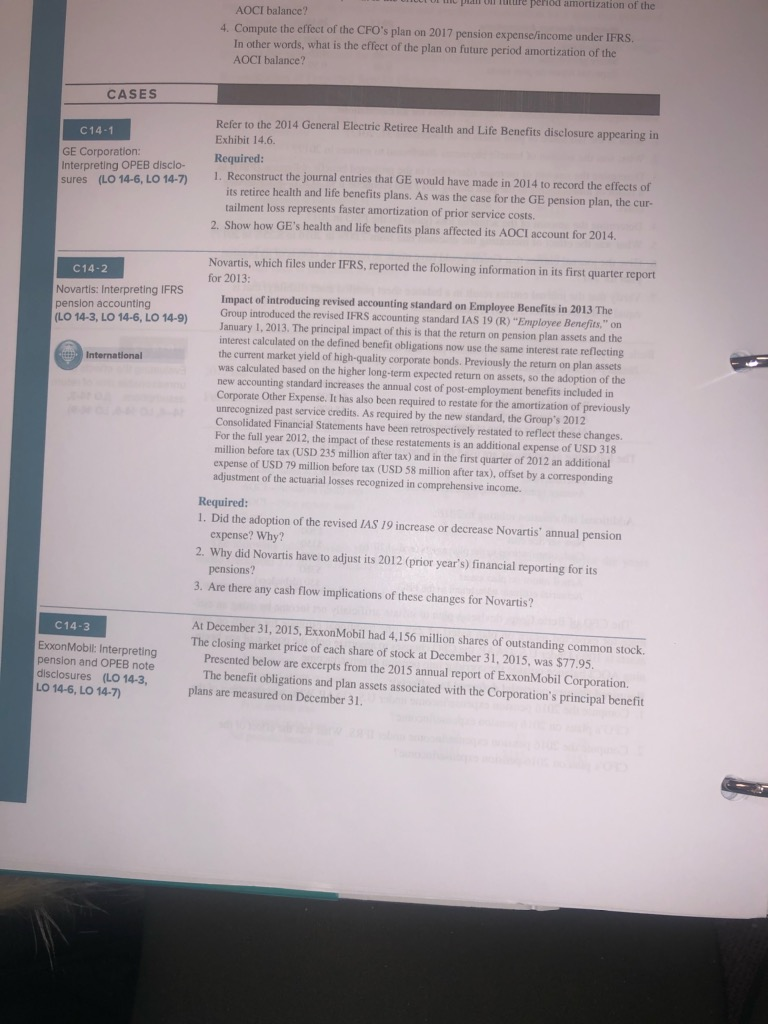

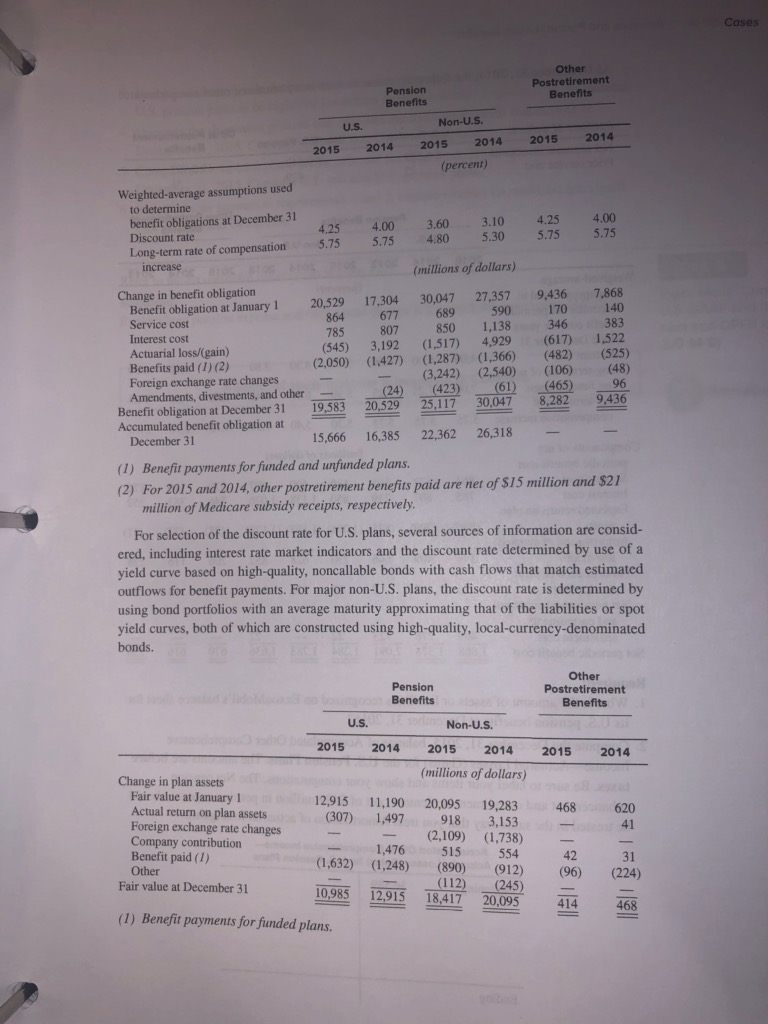

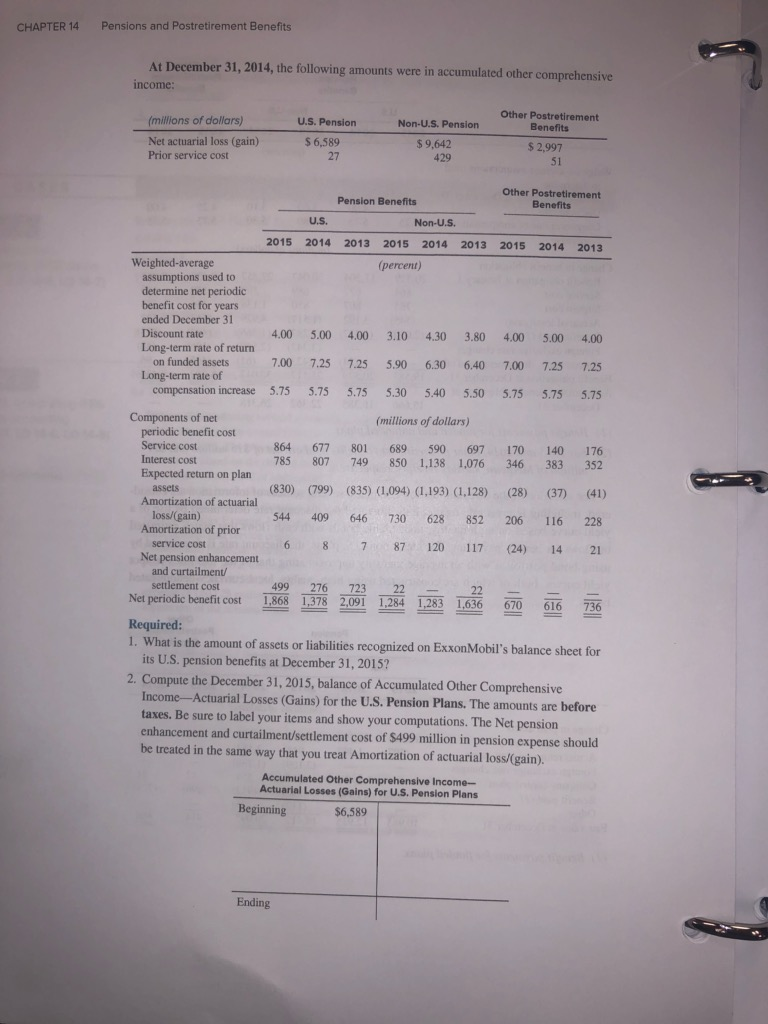

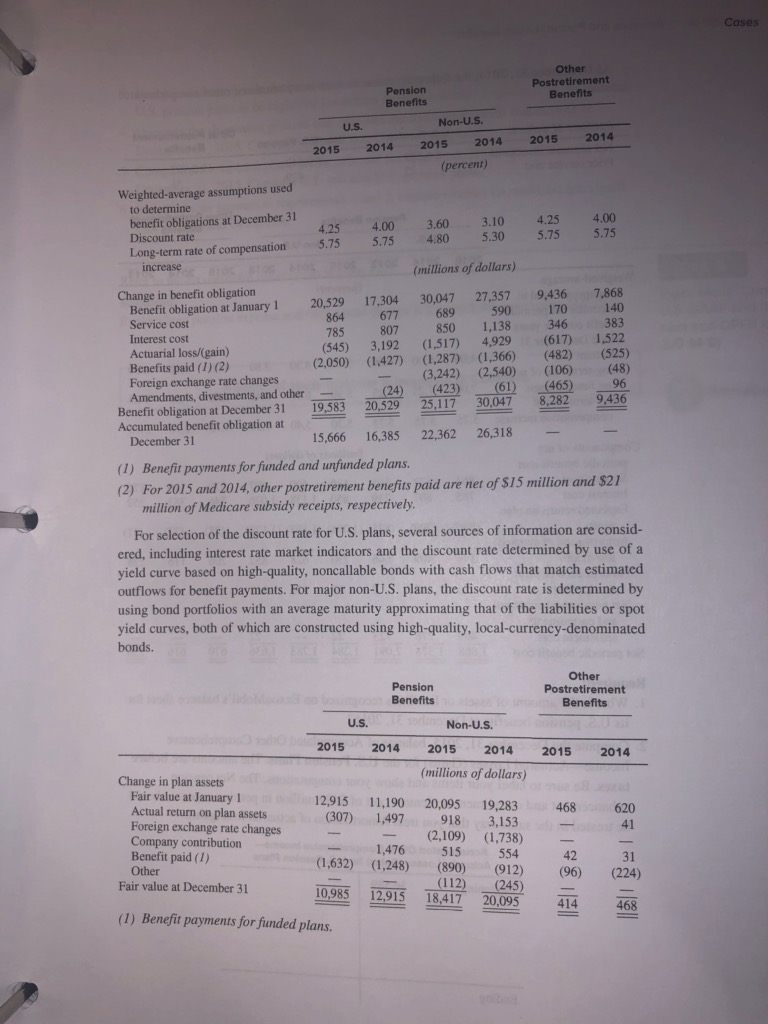

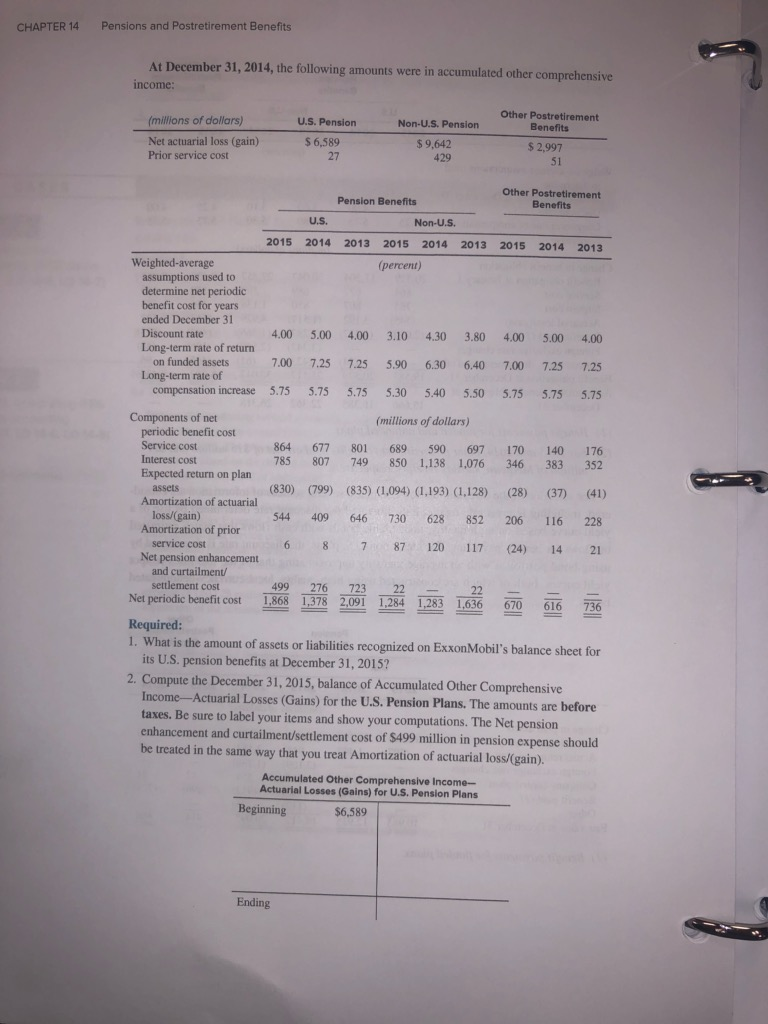

Tuture pefod amortization of t AOCI balance? 4. Compute the effect of the CFO's plan on 2017 pension expense/income under IFRS In other words, what is the effect of the plan on future period amortization of the AOCI balance? AERel CASES Refer to the 2014 General Electric Retiree Health and Life Benefits disclosure appearing in Exhibit 14.6 C14-1 Interpreting OPEB disclo-Required: sures (Lo 14-6, LO 14-7) GE Corporation: 1. Reconstruct the journal entries that GE would have made in 2014 to record the effects of its retiree health and life benefits plans. As was the case for the GE pension plan, the cur- tailment loss represents faster amortization of prior service costs. 2. Show how GE's health and life benefits plans affected its AOCI account for 2014. Novartis, which files under IFRS, reported the following information in its first quarter report for 2013 C14-2 Novartis: Interpreting IFRS penslon accounting (LO 14-3, LO 14-6, LO 14-9) Impact of introducing revised accounting standard on Employee Benefits in 2013 The Group introduced the revised IFRS accounting standard IAS 19 (R) "Employee Benefits," on January 1, 2013. The principal impact of this is that the return on pension plan assets and the interest calculated on the defined benefit obligations now use the same interest rate reflecting the current market yield of high-quality corporate bonds. Previously the return on plan assets was calculated based on the higher long-term expected return on assets, so the adoption of the new accounting standard increases the annual cost of post-employment benefits included in Corporate Other Expense. It has also been required to restate for the amortization of previously unrecognized past service credits. As required by the new standard, the Group's 2012 Consolidated Financial Statements have been retrospectively restated to reflect these changes. For the full year 2012, the impact of these restatements is an additional expense of USD 318 million before tax (USD 235 million after tax) and in the first quarter of 2012 an additional expense of USD 79 million before tax (USD 58 million after tax), offset by a corresponding adjustment of the actuarial losses recognized in comprehensive income. International Required: 1. Did the adoption of the revised IAS 19 increase or decrease Novartis' annual pension 2. Why did Novartis have to adjust its 2012 (prior year's) financial reporting for its 3. Are there any cash flow implications of these changes for Novartis? At December 31, 2015, ExxonMobil had 4,156 million shares of outstanding common stock. expense? Why? pensions? C14-3 The closing market price of each share of stock at December 31, 2015, was $77.95 ExxonMobll: Interpreting pension and OPEB note disclosures (LO 14-3, LO 14-6, LO 14-7) Presented below are excerpts from the 2015 annual report of ExxonMobil Corporation. The benefit obligations and plan assets associated with the Corporation's principal benefit plans are measured on December 31 Other Postretirement Benefits Pension Benefits Non-U.S U.S. 2015201420152014 2015 2014 (percent) Weighted-average assumptions used to determine benefit obligations at December 31 Discount rate 4.25 4.00 3.60 3.10 4.25 4.00 Long-term rate of compensation 5.75 5.75 4.80 5.305.75 5.75 (millions of dollars) Benefit obligation at January 1 20,529 17,304 30,047 27,357 9,436 7,868 Service cost Interest cost Change in benefit obligation 864 677 689 590 170140 785 807 850 1,138 346 383 Actuarial loss/(gain) Benefits paid (1)(2) Foreign exchange rate changes Amendments, divestments, and other (545) 3,192 (1,517) 4,929(617) 1,522 (2,050) (1,427) (1,287) (1.366) (482)(525) (3,242) (2,540) (106) (48) 61) (465) 96 423 032 Benefit obligation at December 31 19,583 20.529 25,117 30,047 8,282 9.436 Accumulated benefit obligation at December 31 15,666 16,385 22,362 26,318 (1) Benefit payments for fiunded and unfunded plans (2) For 2015 and 2014, other postretirement benefits paid are net of S15 million and $21 million of Medicare subsidy receipts, respectively For selection of the discount rate for U.S. plans, several sources of information are consid ered, including interest rate market indicators and the discount rate determined by use of a yield curve based on high-quality, noncallable bonds with cash flows that match estimated outflows for benefit payments. For major non-U.S. plans, the discount rate is determined by using bond portfolios with an average maturity approximating that of the liabilities or spot yield curves, both of which are constructed using high-quality, local-currency-denominated bonds. Pension Benefits Other Postretirement Benefits U.S. Non-U.S. 2015 2014 2015 2014 2015 2014 (millions of dollars) Change in plan assets Fair value at January1 Actual return on plan assets Foreign exchange rate changes Company contribution Benefit paid (l) Other 12,915 11,190 20,095 19,283 468620 (307) 1,497 918 3,153 41 - (2,109) (1,738) - 1,476 515 554 31 (1,632) (1,248) (890) (912) (96 (224) (112) (245 Fair value at December 31 10,985 12,915 18,417 20,095 414 (1) Benefit payments for funded plans. CHAPTER 14 Pensions and Postretirement Benefits At December 31, 2014, the following amounts were in accumulated other comprehensive income: Other Postretirement millions of dollars) U.S. Pension $ 6,589 Non-U.S. Pension Benefits Net actuarial loss (gain) Prior service cost $ 9,642 429 $ 2,997 27 51 Other Postretirement Benefits Pension Benefits U.S. Non-U.S. 2015 2014 2013 2015 2014 2013 2015 2014 2013 Weighted-average percent) assumptions used to determine net periodic benefit cost for years ended December 31 Discount rate Long-term rate of return 4.00 5.00 4.00 3.10 4.30 3.80 4.00 5.00 4.00 on funded assets 7.00 7.25 7.25 590 6.30 6.40 7.00 7.25 7.25 Long-term rate of compensation increase 5.75 5.75 5.75 5.30 5.40 5.50 5.75 5.75 5.75 Components of net (millions of dollars) periodic benefit cost Service cost Interest cost Expected return on plan 864 677 801 689 590 697 170 140 176 785 807 749 850 1,138 1,076 346 383 352 (830) (799) (835) (1,094) (1,193) (1.128) (28) (37) (41) 544 409 646 730 628 852 206 116 228 6 87 87 120 117 (24) 14 21 assets Amortization of actuarial loss/(gain) Amortization of prior service cost Net pension enhancement and curtailment/ settlement cost 499 276 723 22 _ Net periodic benefit cost 1868 1378 209 1284 1283 1.636 670 616 736 Required 1. What is the amount of assets or liabilities recognized on ExxonMobil's balance sheet for its U.S. pension benefits at December 31, 2015? 2. Compute the December 31, 2015, balance of Accumulated Other Comprehensive Income-Actuarial Losses (Gains) for the U.S. Pension Plans. The amounts are before taxes. Be sure to label your items and show your computations. The Net pension enhancement and curtailment/settlement cost of $499 million in pension expense should be treated in the same way that you treat Amortization of actuarial loss/(gain). Accumulated Other Comprehensive Income- Actuarial Losses (Gains) for U.S. Pension Plans Beginning $6,589 Ending 3. Based on information in the pension note, would you expect the 2016 expense for the U.S. pension plans to be higher or lower than its 2015 amount? Explain Compute the short-term pension risk ratio and the short-term OPEB risk ratio as of December 31, 2015. Consider U.S. and non-U.S. pension plans. 4. 5. Compute the long-term pension risk ratio and the long-term OPEB risk ratio as of December 31, 2015. Consider U.S. and non-U.S. pension plans. 6. Based on your answers to requirements 4 and 5, explain whether ExxonMobil has signifi- cant pension and OPEB risk. Refer to the ExxonMobil information in Case 14-3. Required: Explain how pension expense and OCI would change if ExxonMobil were using IAS 19 C14-4 ExxonMobi U.S. GAAP sion and O LO 14-9) Additional study material is available in Connect. Inter Tuture pefod amortization of t AOCI balance? 4. Compute the effect of the CFO's plan on 2017 pension expense/income under IFRS In other words, what is the effect of the plan on future period amortization of the AOCI balance? AERel CASES Refer to the 2014 General Electric Retiree Health and Life Benefits disclosure appearing in Exhibit 14.6 C14-1 Interpreting OPEB disclo-Required: sures (Lo 14-6, LO 14-7) GE Corporation: 1. Reconstruct the journal entries that GE would have made in 2014 to record the effects of its retiree health and life benefits plans. As was the case for the GE pension plan, the cur- tailment loss represents faster amortization of prior service costs. 2. Show how GE's health and life benefits plans affected its AOCI account for 2014. Novartis, which files under IFRS, reported the following information in its first quarter report for 2013 C14-2 Novartis: Interpreting IFRS penslon accounting (LO 14-3, LO 14-6, LO 14-9) Impact of introducing revised accounting standard on Employee Benefits in 2013 The Group introduced the revised IFRS accounting standard IAS 19 (R) "Employee Benefits," on January 1, 2013. The principal impact of this is that the return on pension plan assets and the interest calculated on the defined benefit obligations now use the same interest rate reflecting the current market yield of high-quality corporate bonds. Previously the return on plan assets was calculated based on the higher long-term expected return on assets, so the adoption of the new accounting standard increases the annual cost of post-employment benefits included in Corporate Other Expense. It has also been required to restate for the amortization of previously unrecognized past service credits. As required by the new standard, the Group's 2012 Consolidated Financial Statements have been retrospectively restated to reflect these changes. For the full year 2012, the impact of these restatements is an additional expense of USD 318 million before tax (USD 235 million after tax) and in the first quarter of 2012 an additional expense of USD 79 million before tax (USD 58 million after tax), offset by a corresponding adjustment of the actuarial losses recognized in comprehensive income. International Required: 1. Did the adoption of the revised IAS 19 increase or decrease Novartis' annual pension 2. Why did Novartis have to adjust its 2012 (prior year's) financial reporting for its 3. Are there any cash flow implications of these changes for Novartis? At December 31, 2015, ExxonMobil had 4,156 million shares of outstanding common stock. expense? Why? pensions? C14-3 The closing market price of each share of stock at December 31, 2015, was $77.95 ExxonMobll: Interpreting pension and OPEB note disclosures (LO 14-3, LO 14-6, LO 14-7) Presented below are excerpts from the 2015 annual report of ExxonMobil Corporation. The benefit obligations and plan assets associated with the Corporation's principal benefit plans are measured on December 31 Other Postretirement Benefits Pension Benefits Non-U.S U.S. 2015201420152014 2015 2014 (percent) Weighted-average assumptions used to determine benefit obligations at December 31 Discount rate 4.25 4.00 3.60 3.10 4.25 4.00 Long-term rate of compensation 5.75 5.75 4.80 5.305.75 5.75 (millions of dollars) Benefit obligation at January 1 20,529 17,304 30,047 27,357 9,436 7,868 Service cost Interest cost Change in benefit obligation 864 677 689 590 170140 785 807 850 1,138 346 383 Actuarial loss/(gain) Benefits paid (1)(2) Foreign exchange rate changes Amendments, divestments, and other (545) 3,192 (1,517) 4,929(617) 1,522 (2,050) (1,427) (1,287) (1.366) (482)(525) (3,242) (2,540) (106) (48) 61) (465) 96 423 032 Benefit obligation at December 31 19,583 20.529 25,117 30,047 8,282 9.436 Accumulated benefit obligation at December 31 15,666 16,385 22,362 26,318 (1) Benefit payments for fiunded and unfunded plans (2) For 2015 and 2014, other postretirement benefits paid are net of S15 million and $21 million of Medicare subsidy receipts, respectively For selection of the discount rate for U.S. plans, several sources of information are consid ered, including interest rate market indicators and the discount rate determined by use of a yield curve based on high-quality, noncallable bonds with cash flows that match estimated outflows for benefit payments. For major non-U.S. plans, the discount rate is determined by using bond portfolios with an average maturity approximating that of the liabilities or spot yield curves, both of which are constructed using high-quality, local-currency-denominated bonds. Pension Benefits Other Postretirement Benefits U.S. Non-U.S. 2015 2014 2015 2014 2015 2014 (millions of dollars) Change in plan assets Fair value at January1 Actual return on plan assets Foreign exchange rate changes Company contribution Benefit paid (l) Other 12,915 11,190 20,095 19,283 468620 (307) 1,497 918 3,153 41 - (2,109) (1,738) - 1,476 515 554 31 (1,632) (1,248) (890) (912) (96 (224) (112) (245 Fair value at December 31 10,985 12,915 18,417 20,095 414 (1) Benefit payments for funded plans. CHAPTER 14 Pensions and Postretirement Benefits At December 31, 2014, the following amounts were in accumulated other comprehensive income: Other Postretirement millions of dollars) U.S. Pension $ 6,589 Non-U.S. Pension Benefits Net actuarial loss (gain) Prior service cost $ 9,642 429 $ 2,997 27 51 Other Postretirement Benefits Pension Benefits U.S. Non-U.S. 2015 2014 2013 2015 2014 2013 2015 2014 2013 Weighted-average percent) assumptions used to determine net periodic benefit cost for years ended December 31 Discount rate Long-term rate of return 4.00 5.00 4.00 3.10 4.30 3.80 4.00 5.00 4.00 on funded assets 7.00 7.25 7.25 590 6.30 6.40 7.00 7.25 7.25 Long-term rate of compensation increase 5.75 5.75 5.75 5.30 5.40 5.50 5.75 5.75 5.75 Components of net (millions of dollars) periodic benefit cost Service cost Interest cost Expected return on plan 864 677 801 689 590 697 170 140 176 785 807 749 850 1,138 1,076 346 383 352 (830) (799) (835) (1,094) (1,193) (1.128) (28) (37) (41) 544 409 646 730 628 852 206 116 228 6 87 87 120 117 (24) 14 21 assets Amortization of actuarial loss/(gain) Amortization of prior service cost Net pension enhancement and curtailment/ settlement cost 499 276 723 22 _ Net periodic benefit cost 1868 1378 209 1284 1283 1.636 670 616 736 Required 1. What is the amount of assets or liabilities recognized on ExxonMobil's balance sheet for its U.S. pension benefits at December 31, 2015? 2. Compute the December 31, 2015, balance of Accumulated Other Comprehensive Income-Actuarial Losses (Gains) for the U.S. Pension Plans. The amounts are before taxes. Be sure to label your items and show your computations. The Net pension enhancement and curtailment/settlement cost of $499 million in pension expense should be treated in the same way that you treat Amortization of actuarial loss/(gain). Accumulated Other Comprehensive Income- Actuarial Losses (Gains) for U.S. Pension Plans Beginning $6,589 Ending 3. Based on information in the pension note, would you expect the 2016 expense for the U.S. pension plans to be higher or lower than its 2015 amount? Explain Compute the short-term pension risk ratio and the short-term OPEB risk ratio as of December 31, 2015. Consider U.S. and non-U.S. pension plans. 4. 5. Compute the long-term pension risk ratio and the long-term OPEB risk ratio as of December 31, 2015. Consider U.S. and non-U.S. pension plans. 6. Based on your answers to requirements 4 and 5, explain whether ExxonMobil has signifi- cant pension and OPEB risk. Refer to the ExxonMobil information in Case 14-3. Required: Explain how pension expense and OCI would change if ExxonMobil were using IAS 19 C14-4 ExxonMobi U.S. GAAP sion and O LO 14-9) Additional study material is available in Connect. Inter