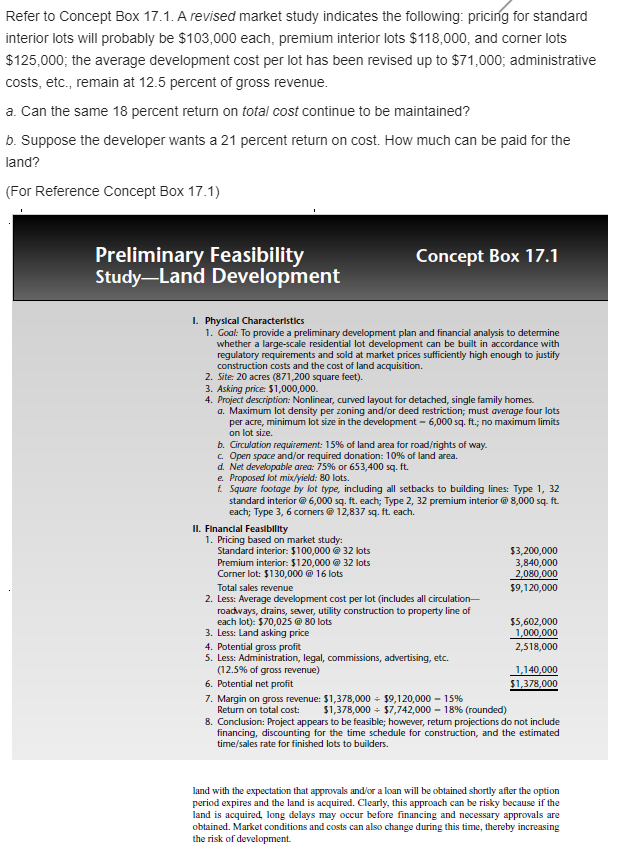

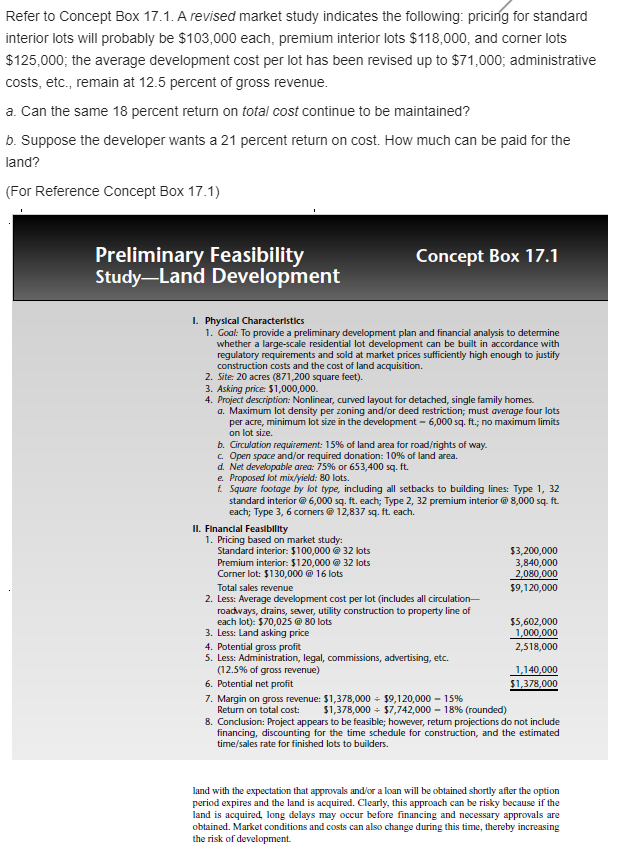

Refer to Concept Box 17.1. A revised market study indicates the following: pricing for standard interior lots will probably be $103,000 each, premium interior lots $118,000, and corner lots $125,000; the average development cost per lot has been revised up to $71,000; administrative costs, etc., remain at 12.5 percent of gross revenue. a Can the same 18 percent return on total cost continue to be maintained? b. Suppose the developer wants a 21 percent return on cost. How much can be paid for the land? (For Reference Concept Box 17.1) Preliminary Feasibility Study-Land Development Concept Box 17.1 1. Physical Characteristics 1. Goal: To provide a preliminary development plan and financial analysis to determine whether a large-scale residential lot development can be built in accordance with regulatory requirements and sold at market prices sufficiently high enough to justify construction costs and the cost of land acquisition. 2. Site: 20 acres (871,200 square feet). 3. Asking price: $1,000,000 4. Project description: Nonlinear, curved layout for detached, single family homes. a. Maximum lot density per zoning and/or deed restriction; must average four lots per acre, minimum lot size in the development - 6,000 sq. ft.; no maximum limits on lot size b. Circulation requirement: 15% of land area for road/rights of way. c Open space and/or required donation: 10% of land area. d. Net developable area: 75% or 653,400 sq. ft. e. Proposed lot mix/yield: 80 lots. Square footage by lot type, including all setbacks to building lines: Type 1, 32 standard interior @ 6,000 sq. ft. each; Type 2, 32 premium interior @ 8,000 sq. ft. each; Type 3, 6 corners @ 12,837 sq. ft. each. II. Financial Feasibility 1. Pricing based on market study: Standard interior: $100,000 @32 lots $3,200,000 Premium interior: $120,000 @ 32 lots 3,840,000 Corner lot: $130,000 @ 16 lots 2,080,000 Total sales revenue $9,120,000 2. Less: Average development cost per lot (includes all circulation, roadways, drains, sewer, utility construction to property line of each lot): $70,025 @ 80 lots $5,602,000 3. Less: Land asking price 1,000,000 4. Potential gross profit 2,518,000 5. Less: Administration, legal, commissions, advertising, etc. (12.5% of gross revenue) 1.140,000 6. Potential net profit $1,378,000 7. Margin on gross revenue: $1,378,000 = $9,120,000 -15% Return on total cost: $1,378,000 = $7,742,000 - 18% (rounded) 8. Conclusion: Project appears to be feasible; however, retur projections do not include financing, discounting for the time schedule for construction, and the estimated time/sales rate for finished lots to builders. land with the expectation that approvals and/or a loan will be obtained shortly after the option period expires and the land is acquired. Clearly, this approach can be risky because if the land is acquired long delays may occur before financing and necessary approvals are obtained. Market conditions and costs can also change during this time, thereby increasing the risk of development Refer to Concept Box 17.1. A revised market study indicates the following: pricing for standard interior lots will probably be $103,000 each, premium interior lots $118,000, and corner lots $125,000; the average development cost per lot has been revised up to $71,000; administrative costs, etc., remain at 12.5 percent of gross revenue. a Can the same 18 percent return on total cost continue to be maintained? b. Suppose the developer wants a 21 percent return on cost. How much can be paid for the land? (For Reference Concept Box 17.1) Preliminary Feasibility Study-Land Development Concept Box 17.1 1. Physical Characteristics 1. Goal: To provide a preliminary development plan and financial analysis to determine whether a large-scale residential lot development can be built in accordance with regulatory requirements and sold at market prices sufficiently high enough to justify construction costs and the cost of land acquisition. 2. Site: 20 acres (871,200 square feet). 3. Asking price: $1,000,000 4. Project description: Nonlinear, curved layout for detached, single family homes. a. Maximum lot density per zoning and/or deed restriction; must average four lots per acre, minimum lot size in the development - 6,000 sq. ft.; no maximum limits on lot size b. Circulation requirement: 15% of land area for road/rights of way. c Open space and/or required donation: 10% of land area. d. Net developable area: 75% or 653,400 sq. ft. e. Proposed lot mix/yield: 80 lots. Square footage by lot type, including all setbacks to building lines: Type 1, 32 standard interior @ 6,000 sq. ft. each; Type 2, 32 premium interior @ 8,000 sq. ft. each; Type 3, 6 corners @ 12,837 sq. ft. each. II. Financial Feasibility 1. Pricing based on market study: Standard interior: $100,000 @32 lots $3,200,000 Premium interior: $120,000 @ 32 lots 3,840,000 Corner lot: $130,000 @ 16 lots 2,080,000 Total sales revenue $9,120,000 2. Less: Average development cost per lot (includes all circulation, roadways, drains, sewer, utility construction to property line of each lot): $70,025 @ 80 lots $5,602,000 3. Less: Land asking price 1,000,000 4. Potential gross profit 2,518,000 5. Less: Administration, legal, commissions, advertising, etc. (12.5% of gross revenue) 1.140,000 6. Potential net profit $1,378,000 7. Margin on gross revenue: $1,378,000 = $9,120,000 -15% Return on total cost: $1,378,000 = $7,742,000 - 18% (rounded) 8. Conclusion: Project appears to be feasible; however, retur projections do not include financing, discounting for the time schedule for construction, and the estimated time/sales rate for finished lots to builders. land with the expectation that approvals and/or a loan will be obtained shortly after the option period expires and the land is acquired. Clearly, this approach can be risky because if the land is acquired long delays may occur before financing and necessary approvals are obtained. Market conditions and costs can also change during this time, thereby increasing the risk of development