Answered step by step

Verified Expert Solution

Question

1 Approved Answer

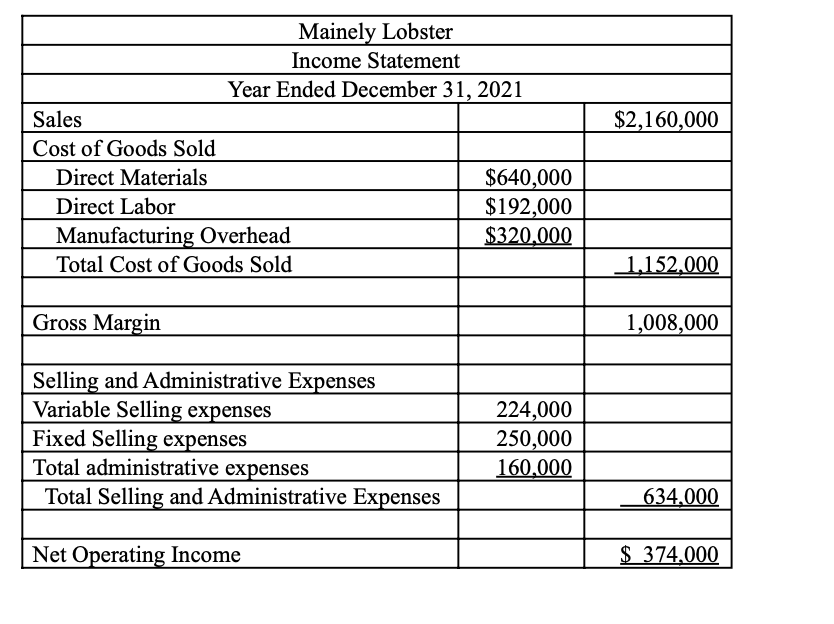

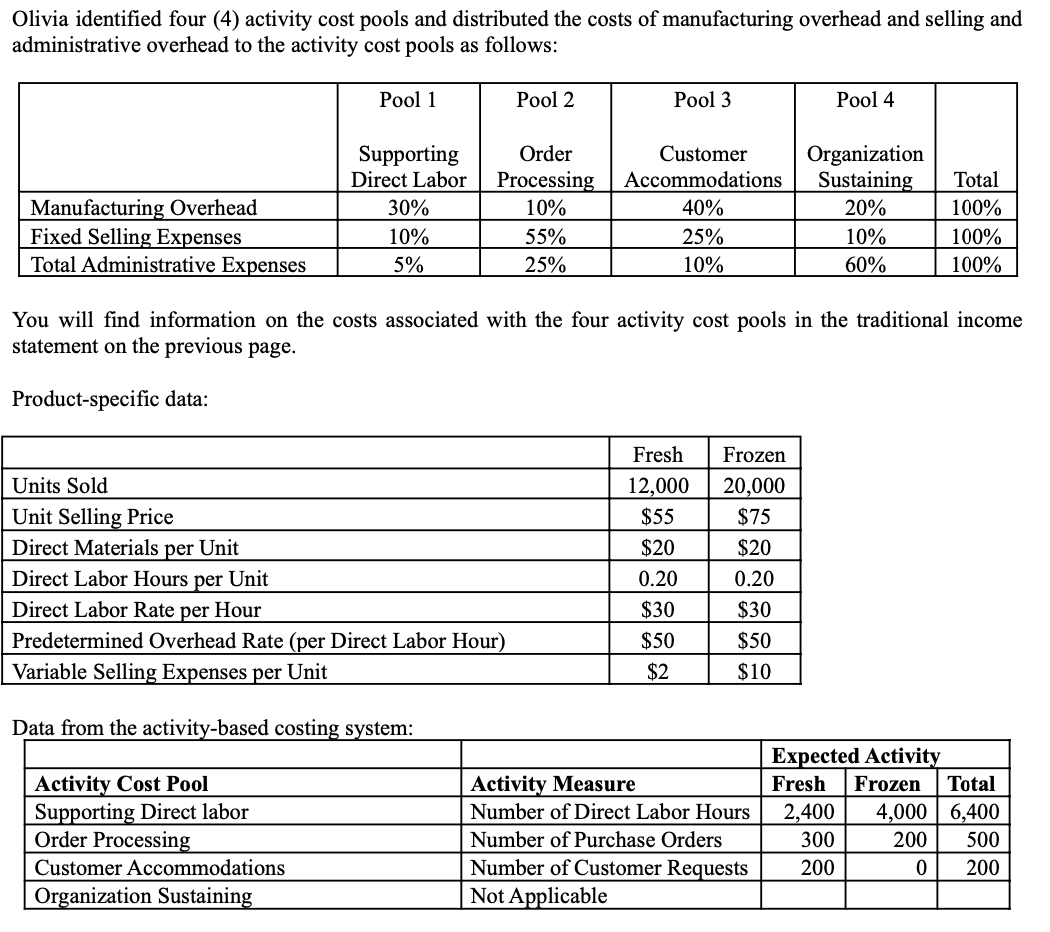

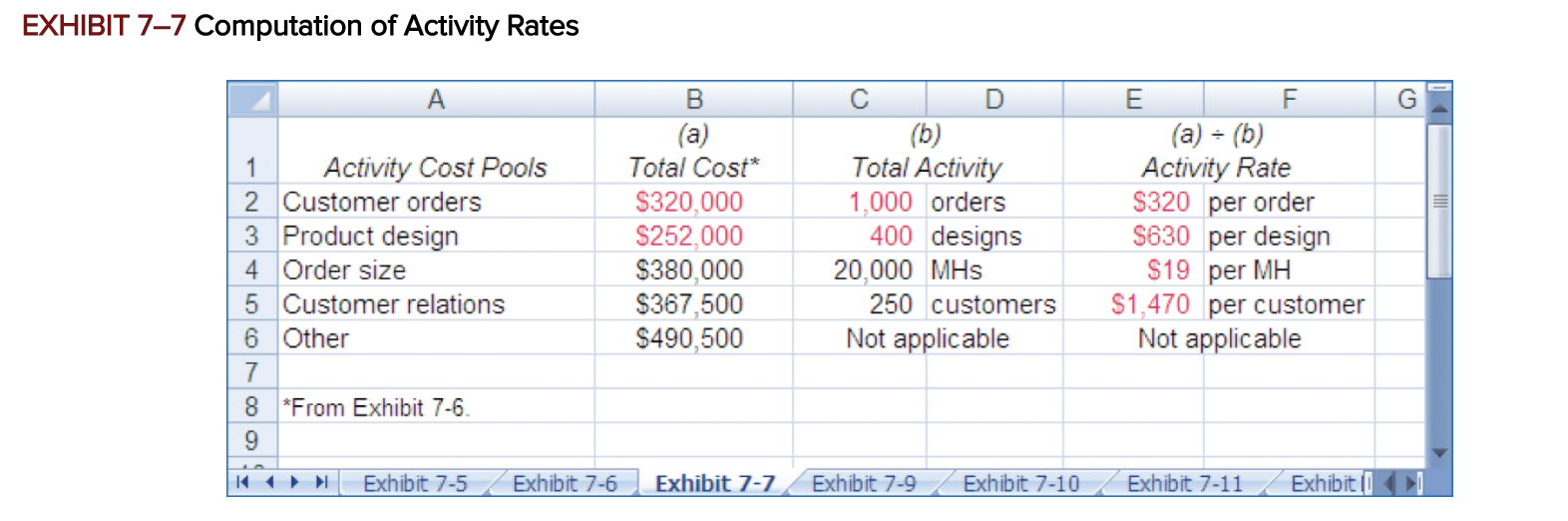

* Refer to Exhibit 7-7 and make a chart showing the calculation of the three activity rates under the activity-based costing system. $2,160,000 Mainely Lobster

* Refer to Exhibit 7-7 and make a chart showing the calculation of the three activity rates under the activity-based costing system.

$2,160,000 Mainely Lobster Income Statement Year Ended December 31, 2021 Sales Cost of Goods Sold Direct Materials $640,000 Direct Labor $192,000 Manufacturing Overhead $320,000 Total Cost of Goods Sold 1.152.000 Gross Margin 1,008,000 Selling and Administrative Expenses Variable Selling expenses Fixed Selling expenses Total administrative expenses Total Selling and Administrative Expenses 224,000 250,000 160,000 634,000 Net Operating Income $ 374,000 Olivia identified four (4) activity cost pools and distributed the costs of manufacturing overhead and selling and administrative overhead to the activity cost pools as follows: Pool 1 Pool 2 Pool 3 Pool 4 Manufacturing Overhead Fixed Selling Expenses Total Administrative Expenses Supporting Direct Labor 30% 10% Order Processing 10% 55% 25% Customer Accommodations 40% 25% 10% Organization Sustaining 20% 10% 60% Total 100% 100% 100% 5% You will find information on the costs associated with the four activity cost pools in the traditional income statement on the previous page. Product-specific data: Fresh 12,000 $55 $20 Frozen 20,000 $75 $20 Units Sold Unit Selling Price Direct Materials per Unit Direct Labor Hours per Unit Direct Labor Rate per Hour Predetermined Overhead Rate (per Direct Labor Hour) Variable Selling Expenses per Unit 0.20 0.20 $30 $30 $50 $50 $2 $10 Data from the activity-based costing system: Activity Cost Pool Supporting Direct labor Order Processing Customer Accommodations Organization Sustaining Activity Measure Number of Direct Labor Hours Number of Purchase Orders Number of Customer Requests Not Applicable Expected Activity Fresh Frozen Total 2,400 4,000 6,400 300 200 500 200 0 200 EXHIBIT 77 Computation of Activity Rates G 1 Activity Cost Pools 2 Customer orders 3 Product design 4 Order size 5 Customer relations 6 Other 7 8 *From Exhibit 7-6. 9 B (a) Total Cost* $320,000 $252,000 $380,000 $367,500 $490,500 D (b) Total Activity 1,000 orders 400 designs 20,000 MHs 250 customers Not applicable E F (a) = (b) Activity Rate $320 per order $630 per design $19 per MH $1,470 per customer Not applicable Exhibit 7-5 Exhibit 7-6 Exhibit 7-7 Exhibit 7-9 Exhibit 7-10 Exhibit 7-11 Exhibit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started