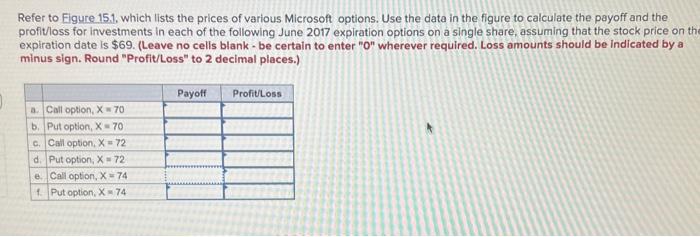

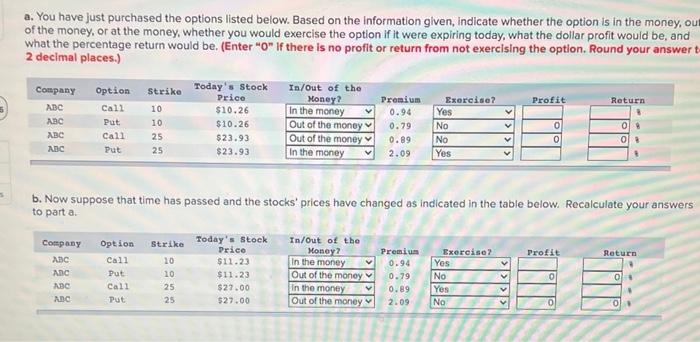

Refer to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following June 2017 expiration options on a single share, assuming that the stock price on the expiration date is $69. (Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.) Payoff Profit loss Call option,X70 b. Put option,X-70 c. Call option,X72 d. Put option, X.72 e Call option, X74 1. Put option,X74 a. You have just purchased the options listed below. Based on the information given, indicate whether the option is in the money, ou of the money, or at the money, whether you would exercise the option if it were expiring today, what the dollar profit would be, and what the percentage return would be. (Enter "O" If there is no profit or return from not exercising the option. Round your answert 2 decimal places.) Company Profit Return ABC ABC ABC ABC Option Call Put Call Put Strike 10 10 25 25 Today's Stock Price $10.26 $10.26 $23.93 $23.93 In/Out of the Money? In the money Out of the money Out of the money In the money Premium 0.94 0.79 0.89 2.09 Exercise? Yes No No Yes 0 09 ol b. Now suppose that time has passed and the stocks' prices have changed as indicated in the table below. Recalculate your answers to part a Strike Profit Return Company ABC Ana ABC ABC Option Call Put Call Put Today's Stock Price $11.23 $11.23 $27.00 $27.00 10 10 25 25 In/out of the Money2 In the money Out of the money in the money Out of the money Premium 0.94 0.79 0.89 2.09 Exercise Yes No Yes No V 0 0 0 Refer to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following June 2017 expiration options on a single share, assuming that the stock price on the expiration date is $69. (Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.) Payoff Profit loss Call option,X70 b. Put option,X-70 c. Call option,X72 d. Put option, X.72 e Call option, X74 1. Put option,X74 a. You have just purchased the options listed below. Based on the information given, indicate whether the option is in the money, ou of the money, or at the money, whether you would exercise the option if it were expiring today, what the dollar profit would be, and what the percentage return would be. (Enter "O" If there is no profit or return from not exercising the option. Round your answert 2 decimal places.) Company Profit Return ABC ABC ABC ABC Option Call Put Call Put Strike 10 10 25 25 Today's Stock Price $10.26 $10.26 $23.93 $23.93 In/Out of the Money? In the money Out of the money Out of the money In the money Premium 0.94 0.79 0.89 2.09 Exercise? Yes No No Yes 0 09 ol b. Now suppose that time has passed and the stocks' prices have changed as indicated in the table below. Recalculate your answers to part a Strike Profit Return Company ABC Ana ABC ABC Option Call Put Call Put Today's Stock Price $11.23 $11.23 $27.00 $27.00 10 10 25 25 In/out of the Money2 In the money Out of the money in the money Out of the money Premium 0.94 0.79 0.89 2.09 Exercise Yes No Yes No V 0 0 0