Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to Figure 2.3 and look at the Treasury bond maturing in February 2039. Required: a. How much would you have to pay to purchase

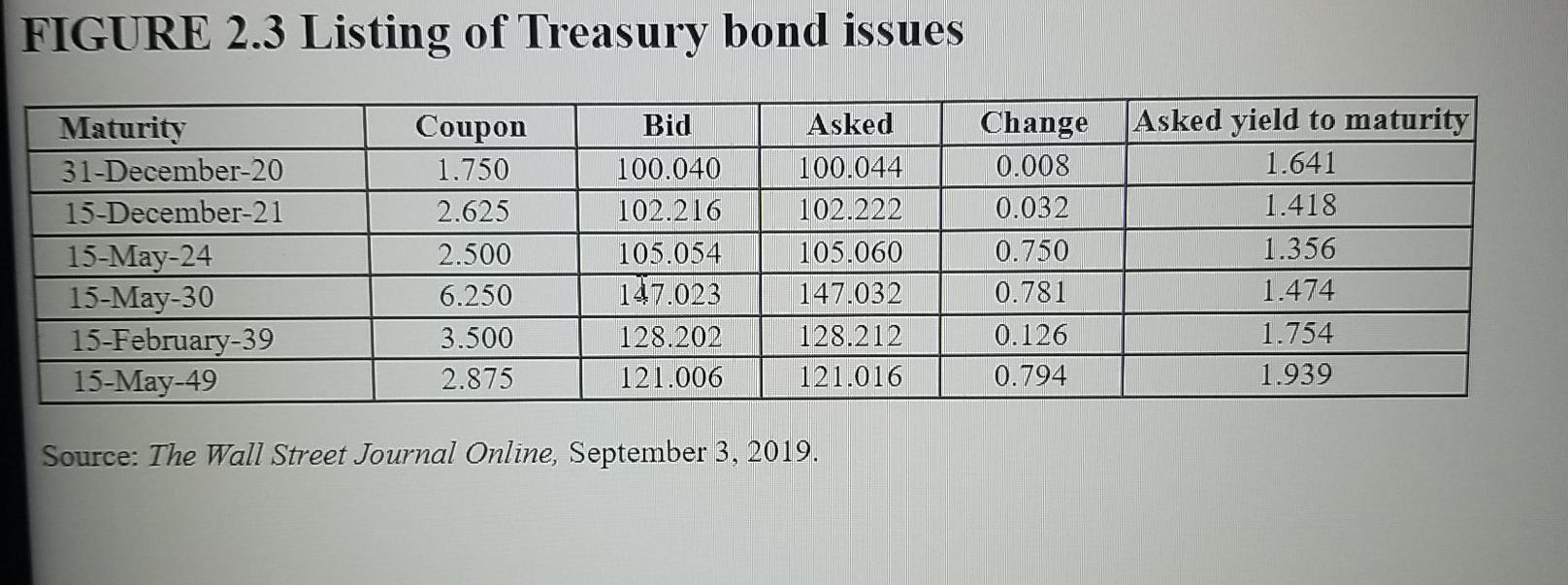

Refer to Figure 2.3 and look at the Treasury bond maturing in February 2039. Required: a. How much would you have to pay to purchase one of these bonds? (Round your answer to 2 decimal places.) Purchase price b. What is its coupon rate? (Round your answer to 1 decimal places.) Coupon rate % c. What is the current yield (i.e., coupon income as a fraction of bond price) of the bond? (Round your answer to 2 decimal places.) Current yield % FIGURE 2.3 Listing of Treasury bond issues Maturity 31-December-20 15-December-21 15-May-24 15-May-30 15-February-39 15-May-49 Coupon 1.750 2.625 2.500 6.250 3.500 2.875 Bid 100.040 102.216 105.054 147.023 128.202 121.006 Asked 100.044 102.222 105.060 147.032 128.212 121.016 Change 0.008 0.032 0.750 0.781 0.126 0.794 Asked yield to maturity 1.641 1.418 1.356 1.474 1.754 1.939 Source: The Wall Street Journal Online, September 3, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started