Refer to Figure 2.3 and look at the Treasury bond maturing in February 2036. a. How much would you have to pay to purchase

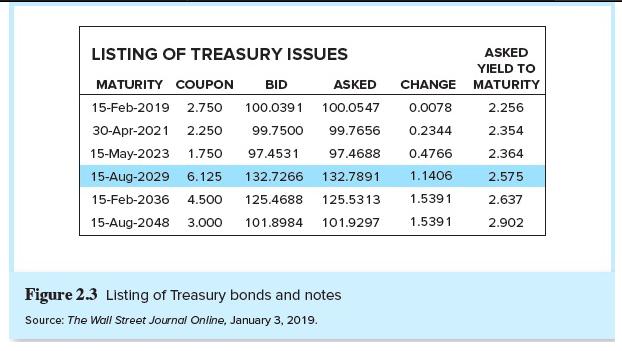

Refer to Figure 2.3 and look at the Treasury bond maturing in February 2036. a. How much would you have to pay to purchase one of these bonds? (Do not round intermediate calculations. Round your answer to 3 decimal places.) Price paid b. What is its coupon rate? (Round your answer to 3 decimal places.) Coupon rate % c. What is the yield to maturity of the bond? (Do not round intermediate calculations. Round your answer to 3 decimal places.) Yield to maturity % LISTING OF TREASURY ISSUES MATURITY COUPON BID ASKED CHANGE 15-Feb-2019 2.750 100.0391 100.0547 0.0078 30-Apr-2021 2.250 99.7500 99.7656 0.2344 15-May-2023 1.750 97.4531 97.4688 0.4766 15-Aug-2029 6.125 132.7266 132.7891 1.1406 15-Feb-2036 4.500 125.4688 125.5313 1.5391 15-Aug-2048 3.000 101.8984 101.9297 1.5391 Figure 2.3 Listing of Treasury bonds and notes Source: The Wall Street Journal Online, January 3, 2019. ASKED YIELD TO MATURITY 2.256 2.354 2.364 2.575 2.637 2.902

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Based on the images youve provided we are dealing with questions about a Treasury bond that matures ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started