Question

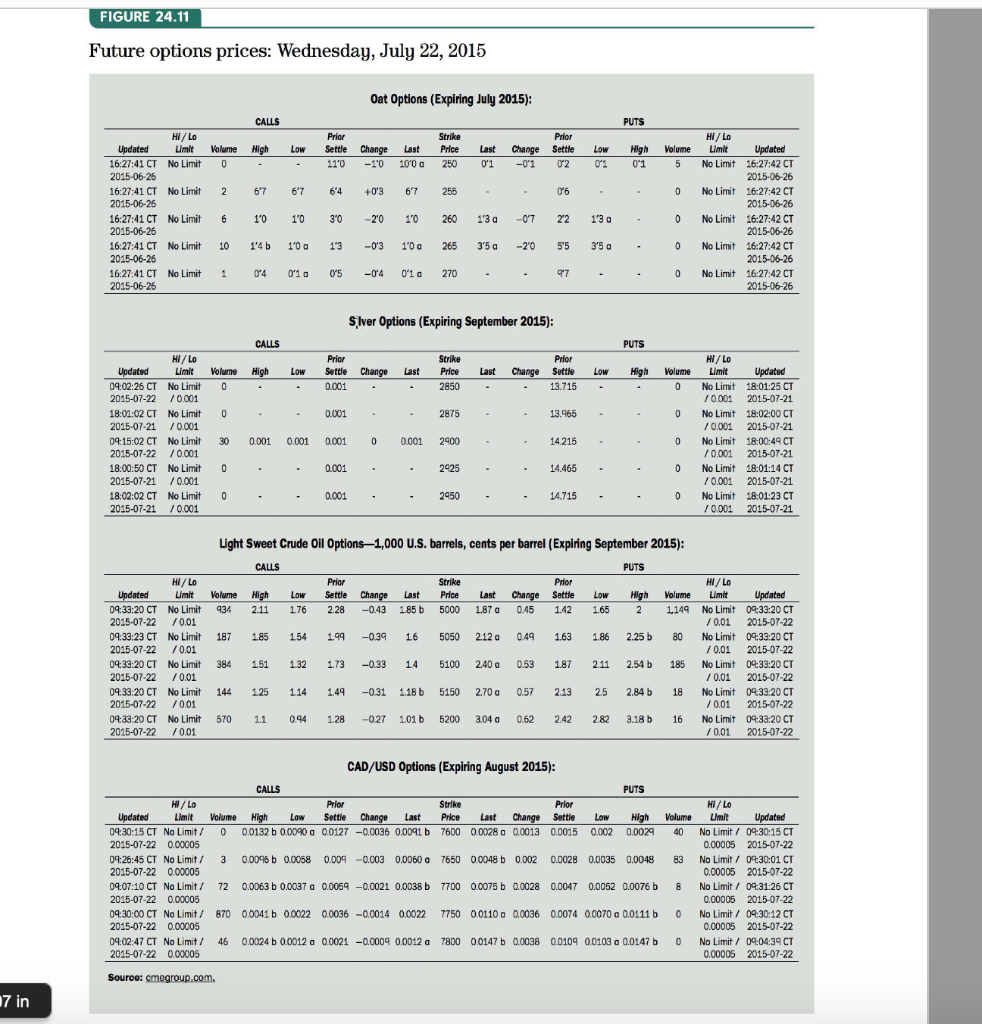

Refer to Figure 24.11 on page 939 of the text to answer this question. Suppose you had purchased one September 2015 put option contract on

Refer to Figure 24.11 on page 939 of the text to answer this question. Suppose you had purchased one September 2015 put option contract on light sweet crude oil futures with a strike/exercise price of 5,000 US cents per barrel.

Refer to Figure 24.11 on page 939 of the text to answer this question. Suppose you had purchased one September 2015 put option contract on light sweet crude oil futures with a strike/exercise price of 5,000 US cents per barrel.

a. How much would your option have cost per barrel of oil (using the Last price)?

Last price cost per barrel of oil=$1.6

b.What would have been the total cost of the one put option contract?

c.Suppose the price of oil futures was 5,100 US cents per barrel at expiration of the options contract. What would have been your net profit or loss from this position (including the cost of the contract)?

d.Suppose the price of oil futures was 4,900 US cents per barrel at expiration of the options contract. What would have been your net profit or loss from this position (including the cost of the contract)?

FIGURE 24.11 Future options prices: Wednesday, July 22, 2015 Oat Options (Expiring July 2015) Prior Prior Hi/Lo Updated Limit Volume High Low Settle Change Last Price Last Change Settle Lo High Volume Limit Updated 16:27:41 CT No Limit 2015-06-25 16:27:41 CT No Limit 2 67 67 6'4 +0'3 67 255 2015-06-25 16:27:41 CT No Limit 6 1010 30 110 -10 100 a 250 0'1 -01 02 5 No Limit 16:27:42 CT 0 No Limit 16:27:42 CT 20 10 260 13a -0722 13 a 16:27:41 CT N Limit 10 1,4 b l'oa 1'3-03 1'0 a 265 3'5 a -20 5'5 3'5 a 2015-06-26 16:27:41 CT No Limit 10'4 1a 05 -0'4 0'1a 270 2015-06-25 0 No Limit 16:27:42 CT 2015-06-26 0 No Limit 16:27:42 CT 2015-06-26 0 No Limit 16:27:42 CT 2015-06-26 . SIver Options (Expiring September 2015) PUTS Hi/ Lo Prior HI Lo Updated Limit Volume High Low Settle Change Last Price Last Change Settle Low High Volume Limit Updated 09:02:26 CT No Limit 0 2015-07-22 10.001 18:01:02 CT No Limit 2015-07-21 10001 04:15:02 CT No Limit 30 0.001 0.001 0001 0 0001 200- 2015-07-22 10001 18:00:50 CT NoLimit 0 2015-07-21 10001 18:02:02 CT No Limit 2015-07-21 /0001 0 No Limit 18:01:25 CT /0.001 2015-07-21 0 No Limit 18:02:00 CT 0.001 2015-07-21 0 No Limit 18:00:49 CT /0001 2015-07-21 0 No Limit 18:01:14 CT 0.001 2015-07-21 0 No Limit 18:01:23 CT /0.001 2015-07-21 2850 13.715 13.965 14215 2875 0.001 2925 14.465 14.715- Light Sweet Crude Oil Options-1,000 U.S. barrels, cents per barrel (Expiring September 2015) PUTS Hi/ Lo HI/ Lo Updated LimitVolume High Low Settle Change Last Price Last Change Settle ow High lume Limit Updated 09:33:20 CT NoLimit q34 2.11 176 2.28-0.43 1.85 b 5000 L87 a 0.45 1.42 1.65 2 14q No Limit 09:33:20 CT 2015-07-22 1001 09:33:23 CT No Limit 187 185 154 1 -03 16 5050 212 a 0.4 163 186 2.25b 80 No Limit 0933:20 CT 2015-07-22 10.01 09:33:20 CT NoLimit 384 151 132 1.73-033 14 5100 240 a 053 1.87 2.11 2.54 b 185 No Limit 09:33:20 CT 2015-07-22 /0.01 09.33:20 CT No Limit 144 125 114 149 -031 118 b 5150 2.70 a 057 213 25 2.84 b 18 No Limit 09:33:20 CT 2015-07-22 1001 09:33:20 CT No Limit 570 11 094 128-027 1.01b 5200 3.04 a 0.62 2.42 282 3.18b 16 No Limit 09:33:20 CT 2015-07-22 1001 0.01 2015-07-22 0.01 2015-07-22 /001 2015-07-22 /0,01 2015-07-22 0.01 2015-07-22 CAD/USD Options (Expiring August 2015) CALLS PUTS Strike Prior UpdatedLimit Volume High Low Settle Change LastPrice Last Change Settie Lo HighVolumeLimitUpdated 09:30:15 CT NoLimit / 0 00132 b00090 a 00127-0.0036 0.0091 b 760000028 0.0013 0.0015 0.002 0.0029 40 No Limit / 09:30:15CT 2015-07-22 0.00005 09:26:45 CT No Limit 1 3 0.00% b 0.0058 0.009-0.003 0.0060 a 765000048 b 0.002 0.0028 0.003500048 83 NoLimit /0430:01 CT 2015-07-22 0.00005 09:07:10 CT NoLimit / 72 00063 b 0.0037 a 0.005q-0.0021 0.0038 b 770000075 b 0.0028 0.0047 0.0052 0.0076 b 8 No Limit /0q31:26 CT 2015-07-22 0.00005 09:30:00 CT No Limit 870 00041 b 00022 00036-0.0014 00022 7750 00110 a 00036 00074 00070 a 0.0111b 0 No Limit 09:30:12 CT 2015-07-22 0.00005 09:02:47 CT No Limit 46 00024 b 0.0012 a 0.0021-0.0009 0.0012 a 7800 00147 b 0.0038 0.0109 0.0103 a 0.0147 b No Limit/0904:3 CT 2015-07-22 0.00005 0.00005 2015-07-22 0.00005 2015-07-22 0.00005 2015-07-22 0.00005 2015-07-22 0.00005 2015-07-22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started