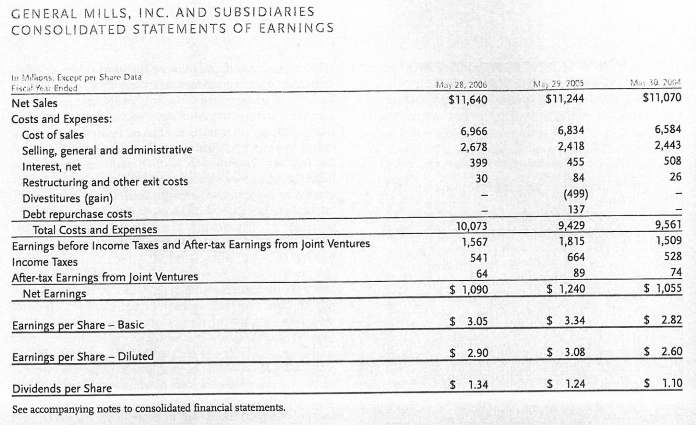

Refer to General Mills Statement of Earnings for fiscal 2006 (the year ended May 28, 2006) and to the common size income statement you developed in part 1 above.

Review the revenue recognition policies of GenEral Mills discussed in Note 1. (Summary of Significant AccountiNg Policies). Discuss how the recognition policies for recording net sales and the treatment of returns and promotions are consistent with the revenue recognition criteria under Generally Accepted Accounting Principle (GAAP).

What are General Mills major expenses?

Were there any significant changes in the cost structure during the most recent year?

In fiscal 2005, General Mills separately reports the following three items: Restructuring and other exit costs. Divestitures, and Debt repurchase costs. Why did not the company just include all of these amounts within the line item for selling cereal and administrative expenses?

Was the company profitable during 2006? During 2005? Explain your definition of profitable

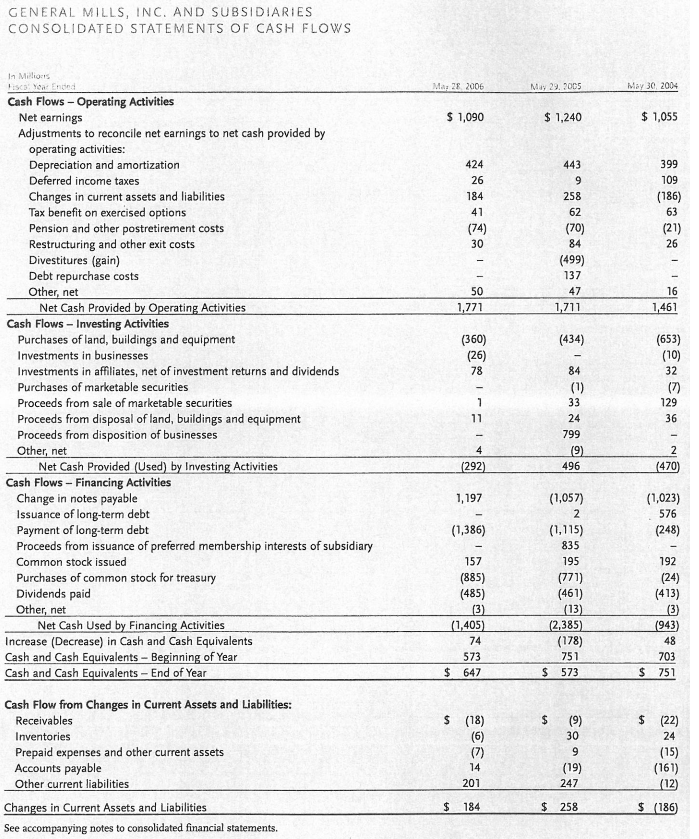

Compute the percentage change in net earnings from fiscal 2005 to 2006 and from fiscal 2004 to 2005. How would your answers change if the special items for Divestitures and Debt repurchase costs were excluded from fiscal 2005 net earnings? Caution: Divestitures and Debt repurchase costs are reported on the income statement before tax implications while net earnings is an after-tax number: Assume a marginal tax rate of 38.3% when considering the tax effects of the special items.

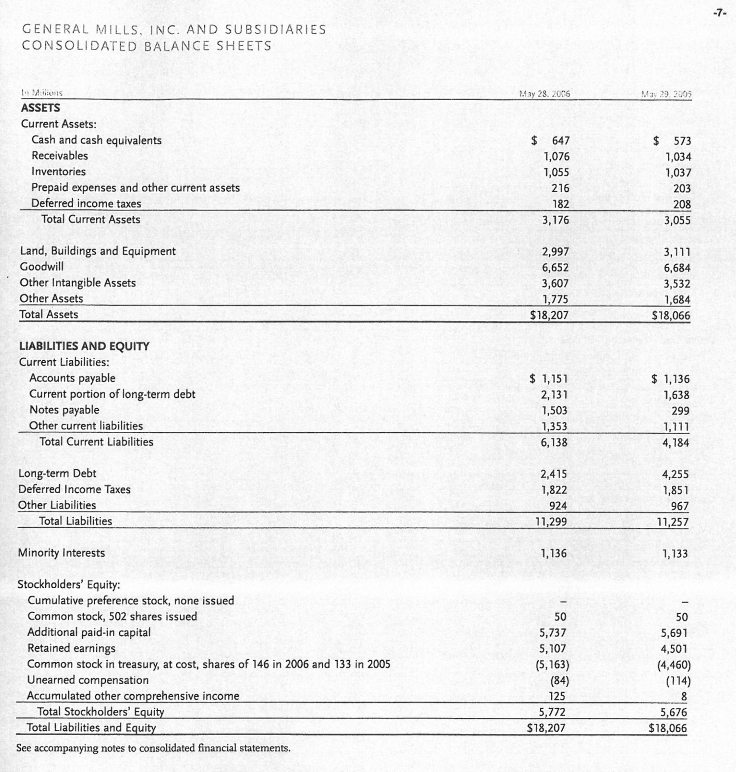

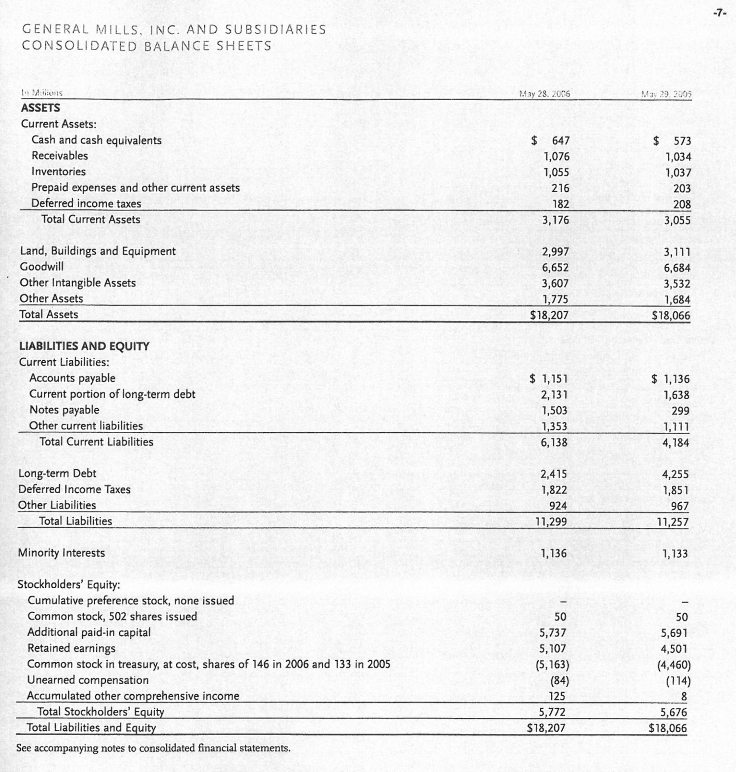

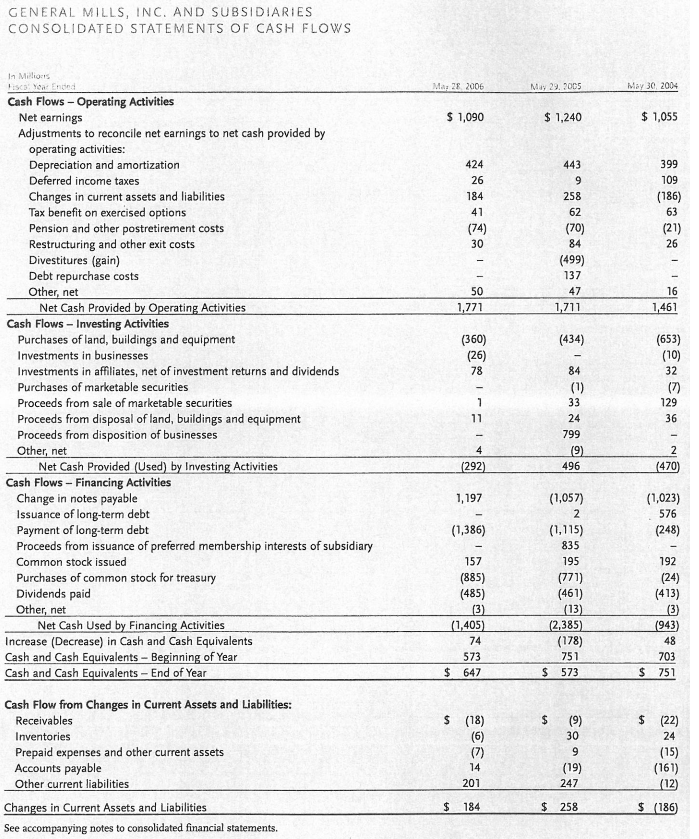

GENERAL MILLS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS In Mlaons, Excep pri Share Data May 28, 2006 Fisci,-.ll Ended Net Sales Costs and Expenses: 11,640 $11,244 $11,070 Cost of sales Selling, general and administrative Interest, net Restructuring and other exit costs Divestitures (gain) Debt repurchase costs 6,966 2,678 399 30 6,834 2,418 455 84 (499) 137 6,584 2,443 508 26 94299,561 10,073 1,567 541 Total Costs and Expenses ,509 528 74 $ 1,055 Earnings before Income Taxes and After-tax Earnings from Joint Ventures Income Taxes 1,815 664 6489 $1,240 After-tax Earnings from Joint Ventures $1,090 $ 3.34 S 3.08 1.24 $ 2.82 2.60 1.10 Earnings per Share Basic $3.05 $ 2.90 Earnings per Share Diluted S 1.34 See accompanying notes to consolidated financial statements. 7- GENERAL MILLS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS May 28. 2006 May 29, 2805 ASSETS Current Assets Cash and cash equivalents Receivables $647 1 ,076 1,055 216 182 3,176 $573 1,034 1,037 203 208 3,055 Prepaid expenses and other current assets Deferred income taxes Total Current Assets Land, Buildings and Equipment Goodwill Other Intangible Assets Other Assets Total Assets 2,997 6,652 3,607 1.775 $18,207 3,111 6,684 3,532 1,684 $18,066 LIABILITIES AND EQUITY Current Liabilities: Accounts payable Current portion of long-term debt Notes payable Other current liabilities $1,151 2,131 1,503 1,353 6,138 $1,136 1,638 299 1,111 4,184 Total Current Liabilities Long-term Debt Deferred Income Taxes Other Liabilities 2,415 1,822 924 11,299 4,255 1,851 967 11,257 Total Liabilities Minority Interests 1,136 1,133 Stockholders' Equity: Cumulative preference stock, none issued Common stock, 502 shares issued Additional paid-in capital Retained earnings Common stock in treasury, at cost, shares of 146 in 2006 and 133 in 2005 Unearned compensation Accumulated other comprehensive income 50 5,737 5,107 (5,163) (84) 125 5,772 $18,207 50 5,691 4,501 (4,460) (114) Total Stockholders' Equi Total Liabilities and Equi 5,676 $18,066 See accompanying notes to consolidated financial statements. GENERAL MILLS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS In Mlaons, Excep pri Share Data May 28, 2006 Fisci,-.ll Ended Net Sales Costs and Expenses: 11,640 $11,244 $11,070 Cost of sales Selling, general and administrative Interest, net Restructuring and other exit costs Divestitures (gain) Debt repurchase costs 6,966 2,678 399 30 6,834 2,418 455 84 (499) 137 6,584 2,443 508 26 94299,561 10,073 1,567 541 Total Costs and Expenses ,509 528 74 $ 1,055 Earnings before Income Taxes and After-tax Earnings from Joint Ventures Income Taxes 1,815 664 6489 $1,240 After-tax Earnings from Joint Ventures $1,090 $ 3.34 S 3.08 1.24 $ 2.82 2.60 1.10 Earnings per Share Basic $3.05 $ 2.90 Earnings per Share Diluted S 1.34 See accompanying notes to consolidated financial statements. 7- GENERAL MILLS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS May 28. 2006 May 29, 2805 ASSETS Current Assets Cash and cash equivalents Receivables $647 1 ,076 1,055 216 182 3,176 $573 1,034 1,037 203 208 3,055 Prepaid expenses and other current assets Deferred income taxes Total Current Assets Land, Buildings and Equipment Goodwill Other Intangible Assets Other Assets Total Assets 2,997 6,652 3,607 1.775 $18,207 3,111 6,684 3,532 1,684 $18,066 LIABILITIES AND EQUITY Current Liabilities: Accounts payable Current portion of long-term debt Notes payable Other current liabilities $1,151 2,131 1,503 1,353 6,138 $1,136 1,638 299 1,111 4,184 Total Current Liabilities Long-term Debt Deferred Income Taxes Other Liabilities 2,415 1,822 924 11,299 4,255 1,851 967 11,257 Total Liabilities Minority Interests 1,136 1,133 Stockholders' Equity: Cumulative preference stock, none issued Common stock, 502 shares issued Additional paid-in capital Retained earnings Common stock in treasury, at cost, shares of 146 in 2006 and 133 in 2005 Unearned compensation Accumulated other comprehensive income 50 5,737 5,107 (5,163) (84) 125 5,772 $18,207 50 5,691 4,501 (4,460) (114) Total Stockholders' Equi Total Liabilities and Equi 5,676 $18,066 See accompanying notes to consolidated financial statements