Refer to Note 14: Company Sponsored Employee Benefit Plans

What is the TOTAL amount of Sysco's funded status of company-sponsored defined benefit plans at year end (July 3, 2021)?

(in $ thousands)

Group of answer choices

Under-funded by $461,070

Over-funded by $5,435,449

Under-funded by $4,974,379

Over-funded by $1,456,378

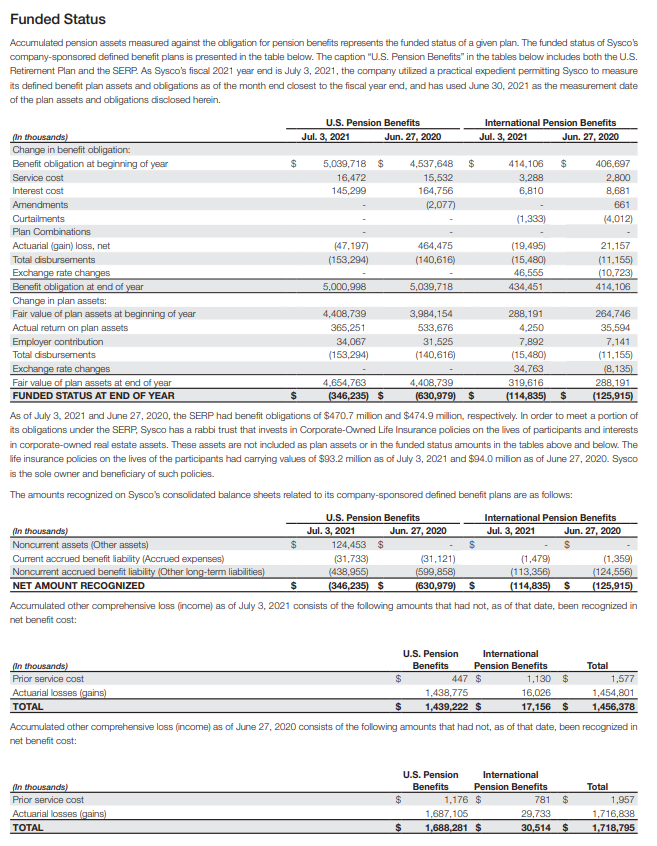

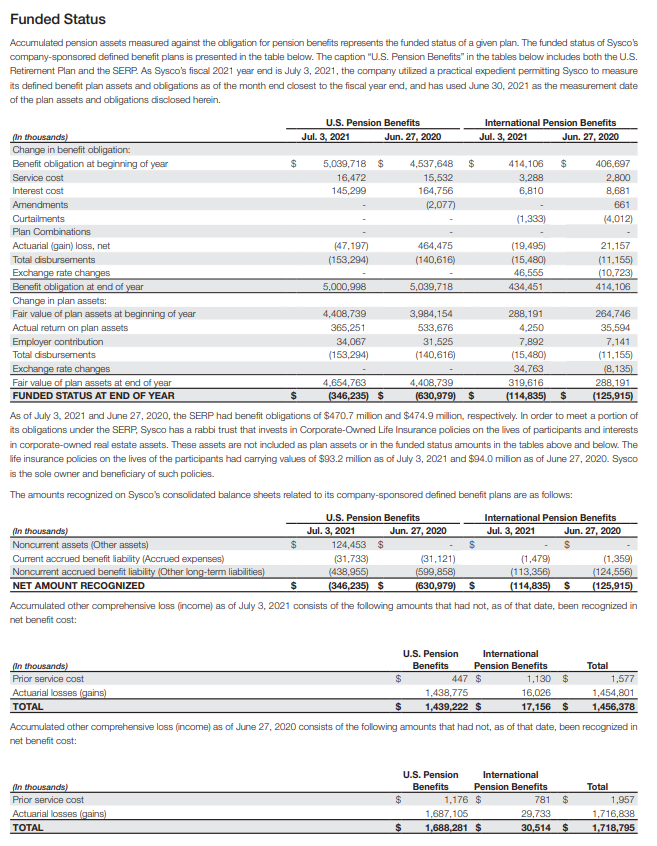

Funded Status Accumulated pension assets measured against the obligation for pension benefits represents the funded status of a given plan. The funded status of Sysco's company-sponsored defined benefit plans is presented in the table below. The caption "U.S. Pension Benefits" in the tables below includes both the U.S. Retirement Plan and the SERP. As Sysco's fiscal 2021 year end is July 3, 2021, the compary utilzed a practical expedient permitting Sysco to masure its defined benefit plan assets and obligations as of the month end closest to the fiscal year end, and has used June 30,2021 as the measurement date of the plan assets and obligations disclosed herein. As of July 3, 2021 and June 27, 2020, the SERP had benefit obligations of $470.7 milion and $474.9 milion, respectively. In order to meet a portion of its obligations under the SERP, Sysco has a rabbi trust that invests in Corporate-Owned Life Insurance policies on the lives of participants and interests in corporate-omned real estate assets. These assets are not included as plan assets or in the funded status amounts in the tables above and below. The life insurance policies on the lives of the participants had carrying values of $93.2 milion as of July 3,2021 and $94.0 milion as of June 27,2020 . Sysco is the sole owner and beneficiary of such policies. The amounts recognized on Sysco's consolidated balance sheets related to its company-sponsored defined benefit plans are as follows: Accumulated other comprehensive loss (income) as of July 3, 2021 consists of the following amounts that had not, as of that date, been recognized in nat benefit cost: Accumulated other comprehensive loss (income) as of June 27, 2020 consists of the following amounts that had not, as of that date, been recognized in nat benefit cost: Funded Status Accumulated pension assets measured against the obligation for pension benefits represents the funded status of a given plan. The funded status of Sysco's company-sponsored defined benefit plans is presented in the table below. The caption "U.S. Pension Benefits" in the tables below includes both the U.S. Retirement Plan and the SERP. As Sysco's fiscal 2021 year end is July 3, 2021, the compary utilzed a practical expedient permitting Sysco to masure its defined benefit plan assets and obligations as of the month end closest to the fiscal year end, and has used June 30,2021 as the measurement date of the plan assets and obligations disclosed herein. As of July 3, 2021 and June 27, 2020, the SERP had benefit obligations of $470.7 milion and $474.9 milion, respectively. In order to meet a portion of its obligations under the SERP, Sysco has a rabbi trust that invests in Corporate-Owned Life Insurance policies on the lives of participants and interests in corporate-omned real estate assets. These assets are not included as plan assets or in the funded status amounts in the tables above and below. The life insurance policies on the lives of the participants had carrying values of $93.2 milion as of July 3,2021 and $94.0 milion as of June 27,2020 . Sysco is the sole owner and beneficiary of such policies. The amounts recognized on Sysco's consolidated balance sheets related to its company-sponsored defined benefit plans are as follows: Accumulated other comprehensive loss (income) as of July 3, 2021 consists of the following amounts that had not, as of that date, been recognized in nat benefit cost: Accumulated other comprehensive loss (income) as of June 27, 2020 consists of the following amounts that had not, as of that date, been recognized in nat benefit cost