Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to Table 6.4. Assume an asset value of $1. What is the NPV of the depreciation tax shields in the five-year and seven-year classes?

Refer to Table 6.4. Assume an asset value of $1. What is the NPV of the depreciation tax shields in the five-year and seven-year classes? (Do not round intermediate calculations. Round your answers to 4 decimal places.)

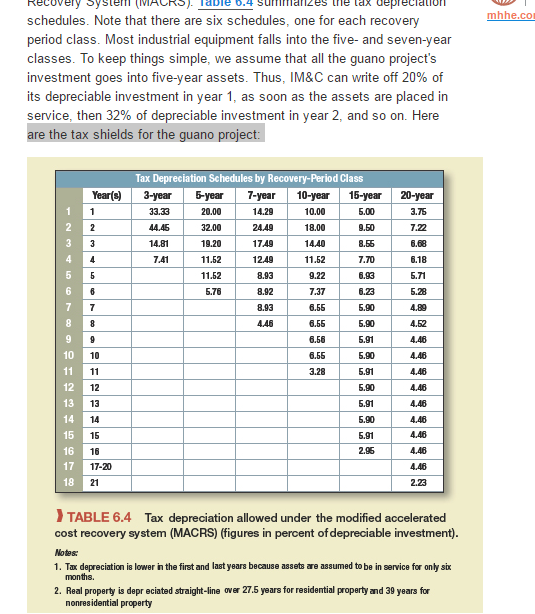

Recovery system (MACRS). Table -4 summarizes the tax depreciation schedules. Note that there are six schedules, one for each recovery period class. Most industrial equipment falls into the five- and seven-year classes. To keep things simple, we assume that all the guano project's investment goes into five-year assets. Thus, lM&C can write off 20% of its depreciable investment in year 1, as soon as the assets are placed in service, then 32% of depreciable investment in year 2, and so on. Here are the tax shields for the guano project: Tax Depreciation Schedules by Recovery-Period Class 1 20.00 14.29 10.00 5.00 375 32.00 2440 18.00 72 1152 893 922 10 12 13 14 15 2.95 16 18 TABLE 6.4 Tax depreciation allowed under the modified accelerated cost recovery system (MACRS) (figures in percent of depreciable investment). Notes: 1. Tax depreciation is lower inthe first and last years because assets are assumed to be in service for only six months. 2. Real property is depr eciated straight-line over 27.5 years for residential propertyand 39 years for nonresidential property mhhe.coStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started