Refer to the 10-K for Lowes

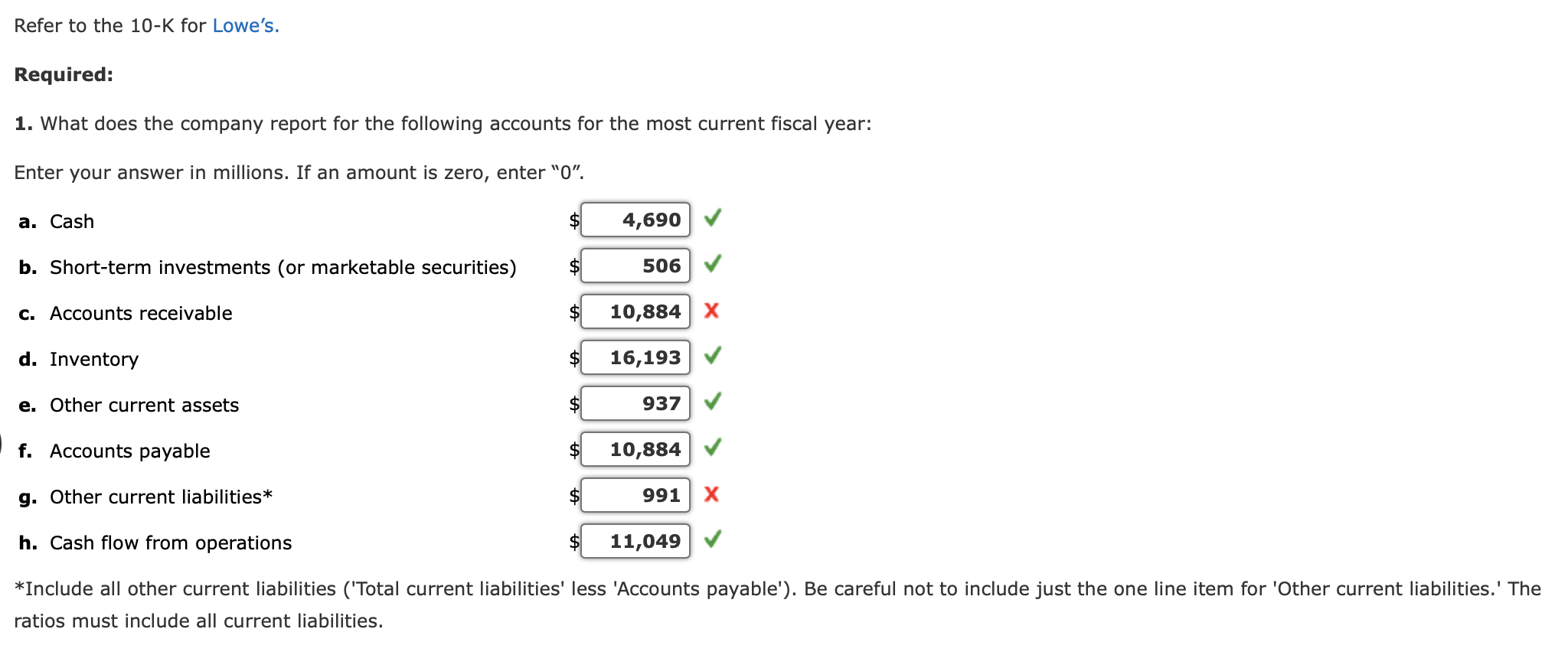

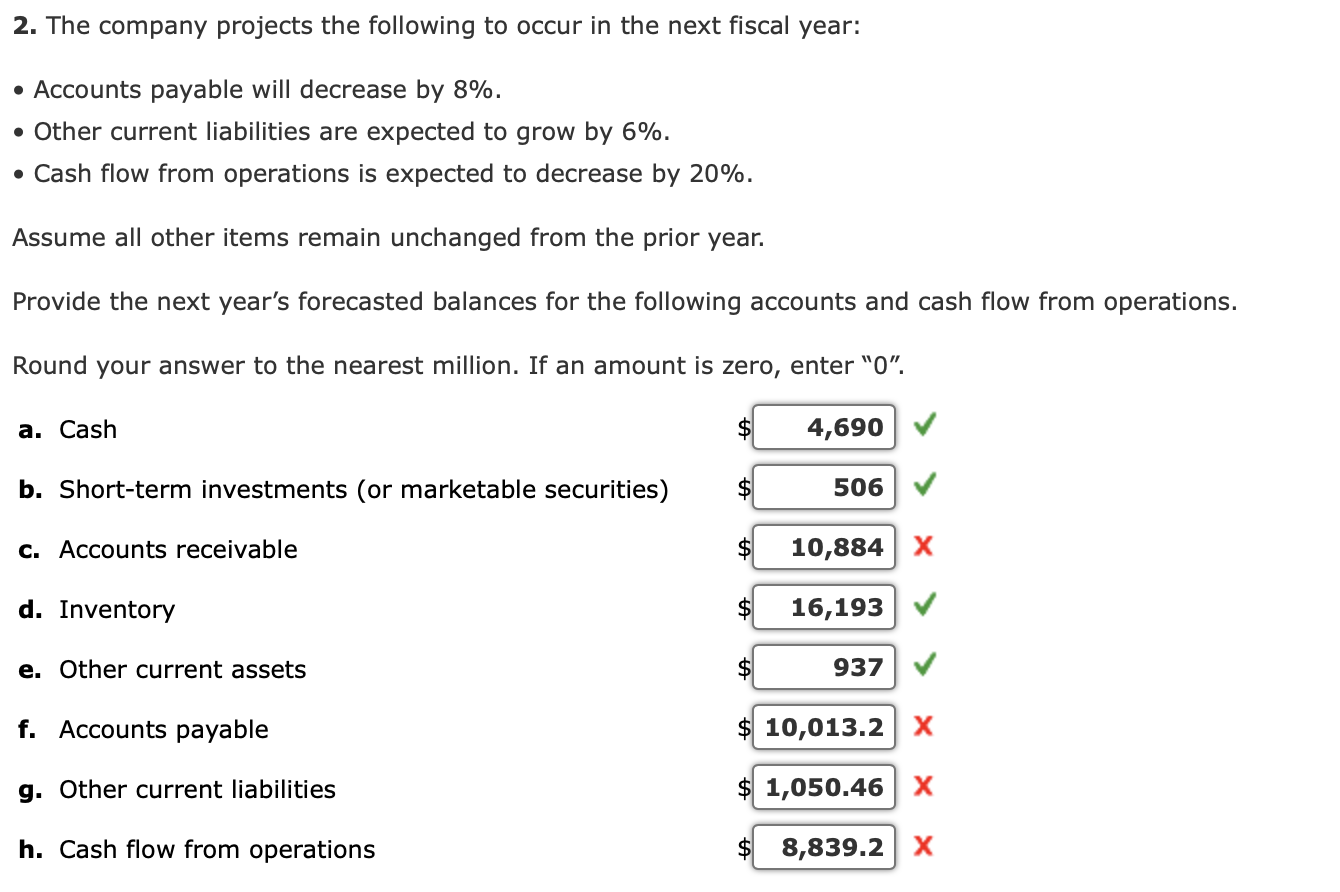

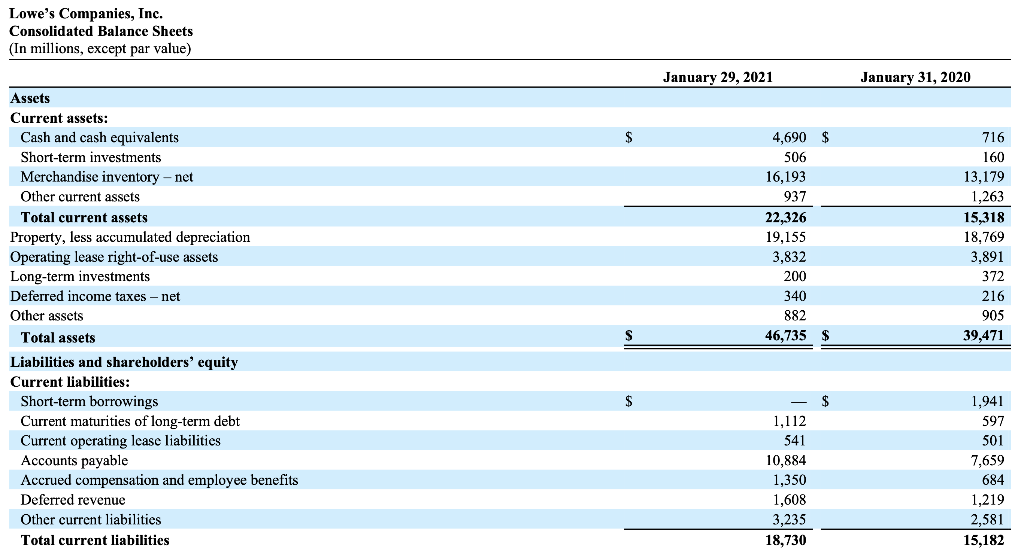

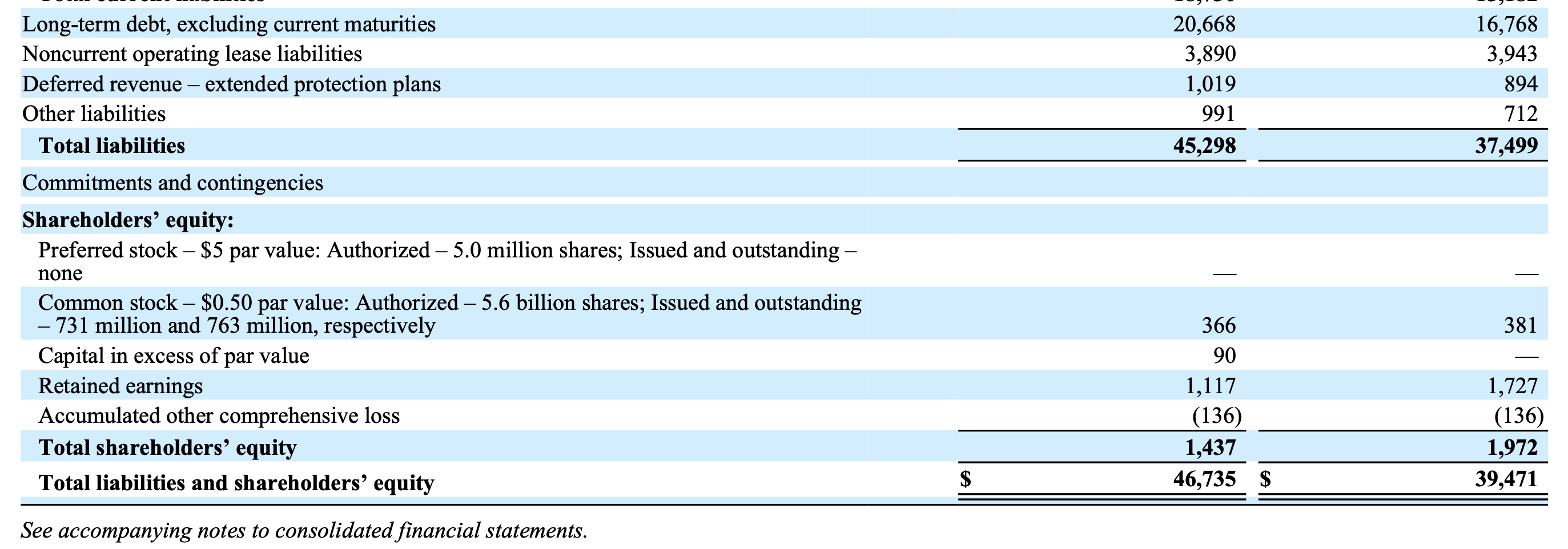

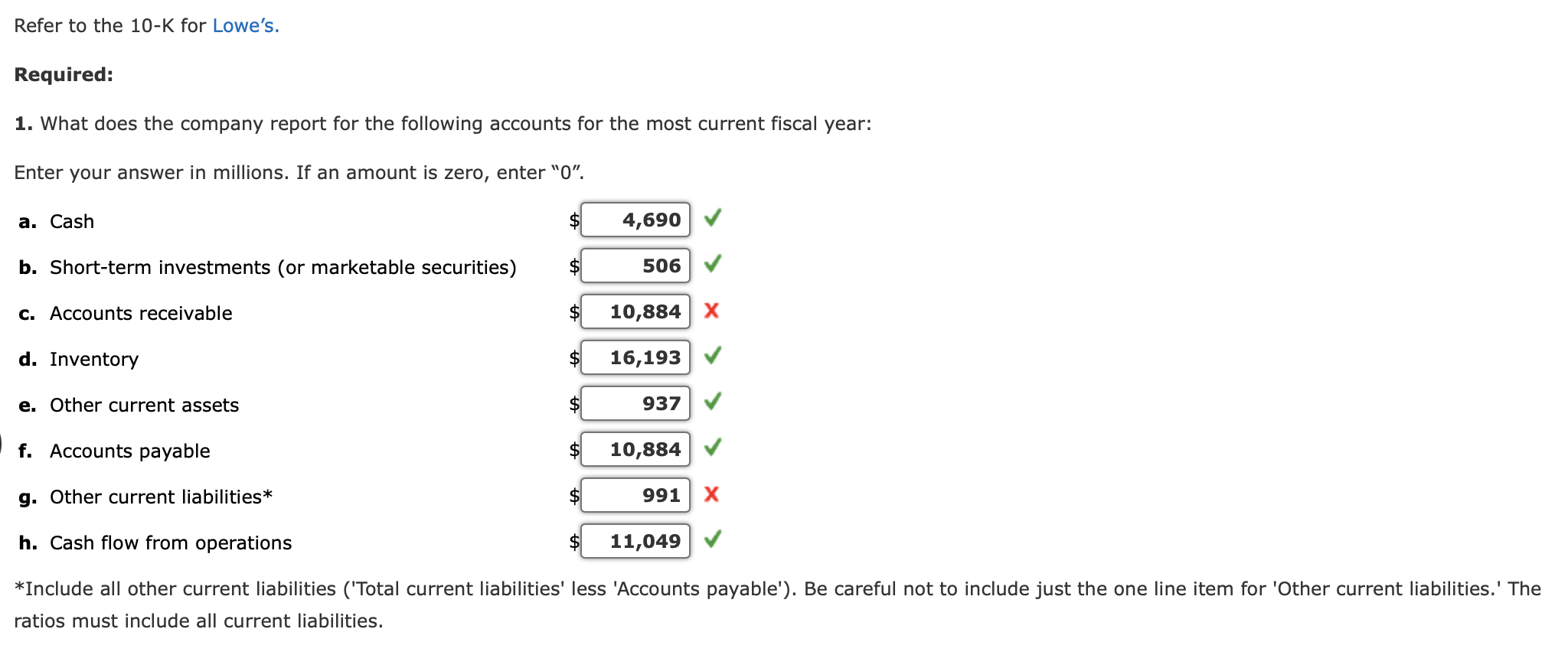

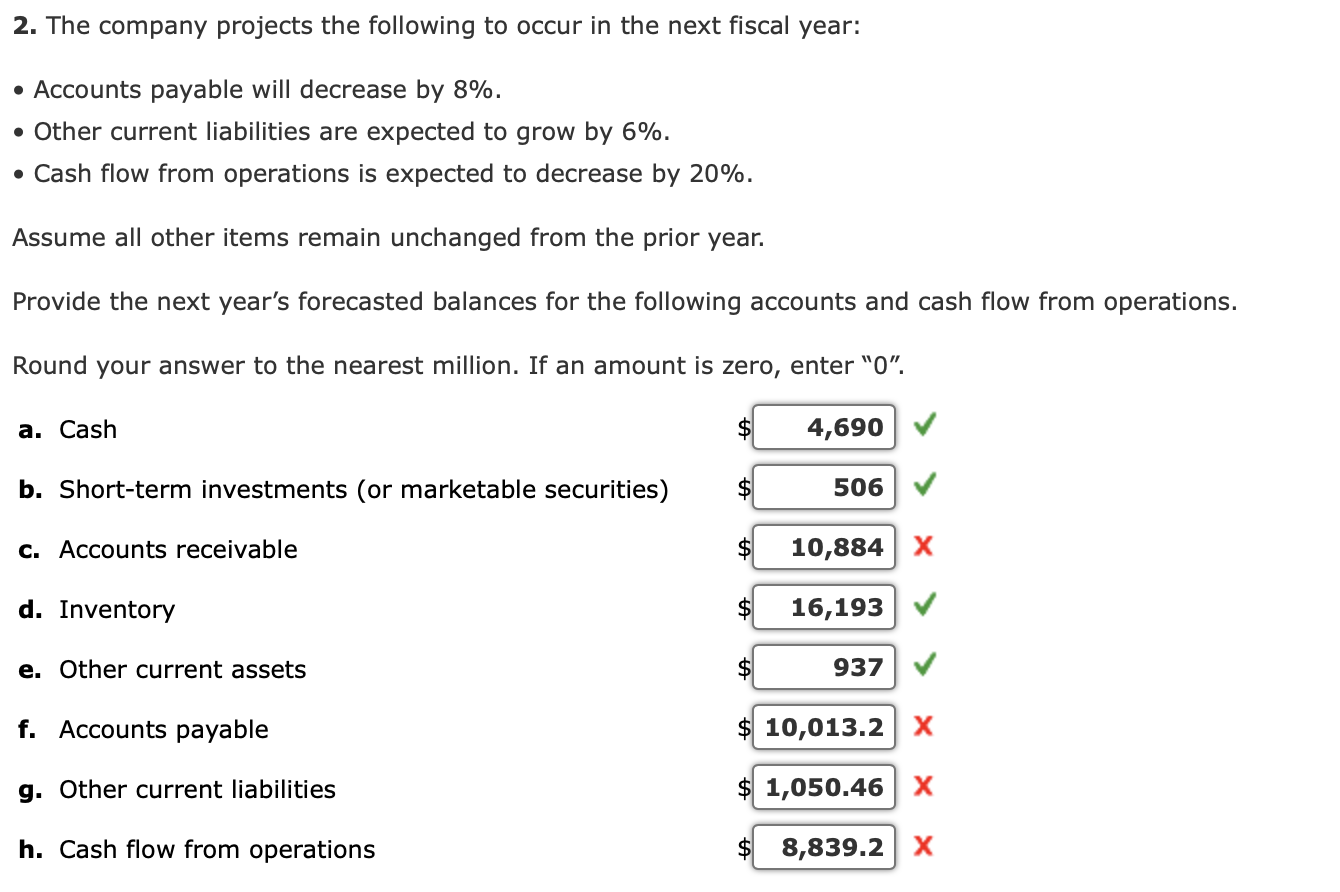

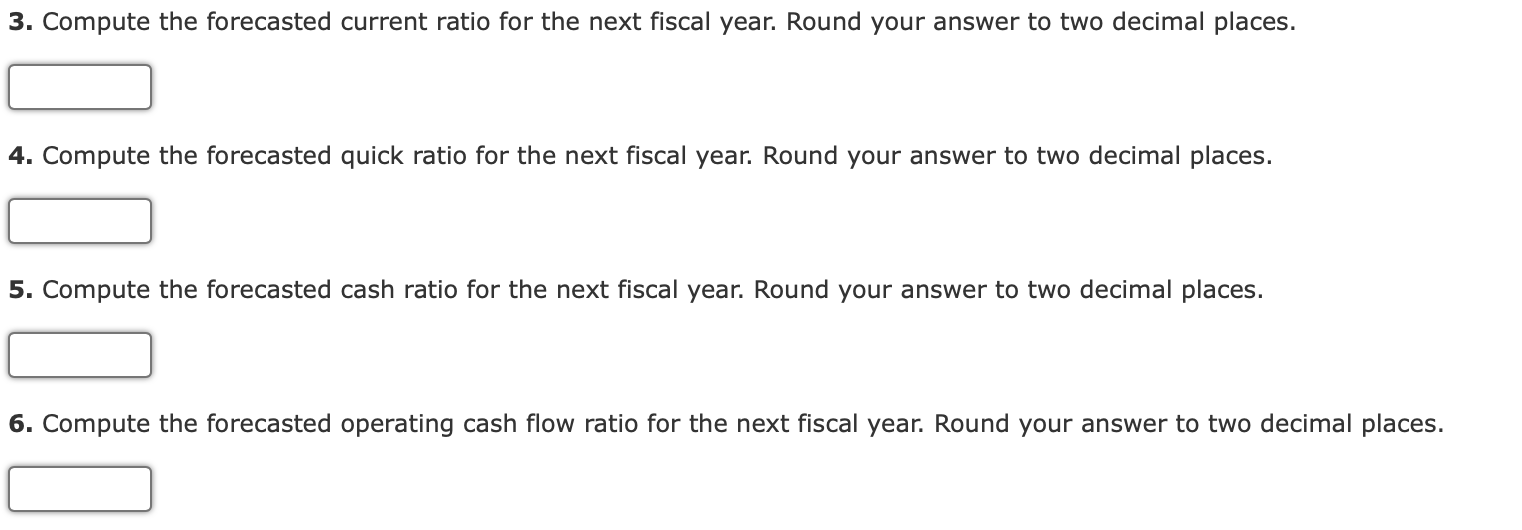

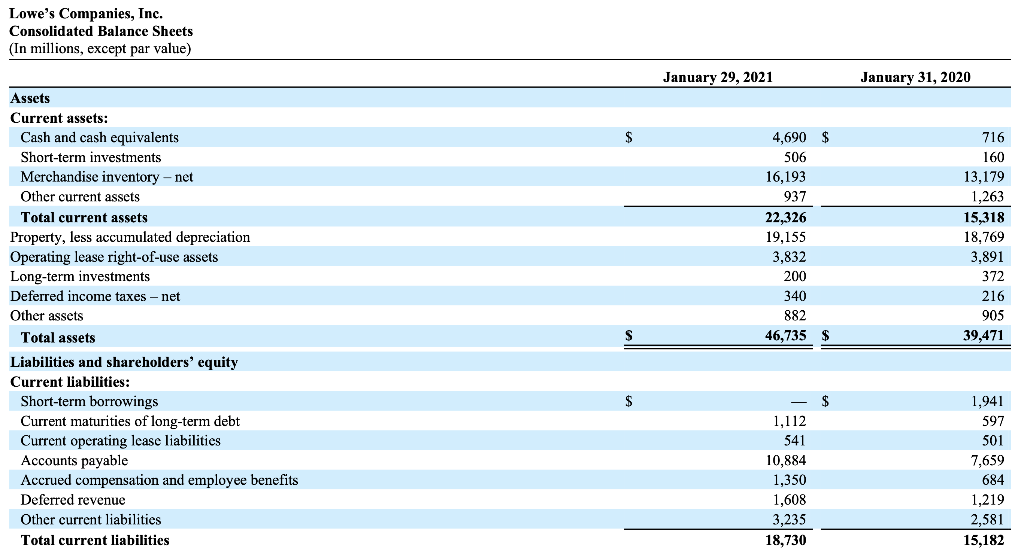

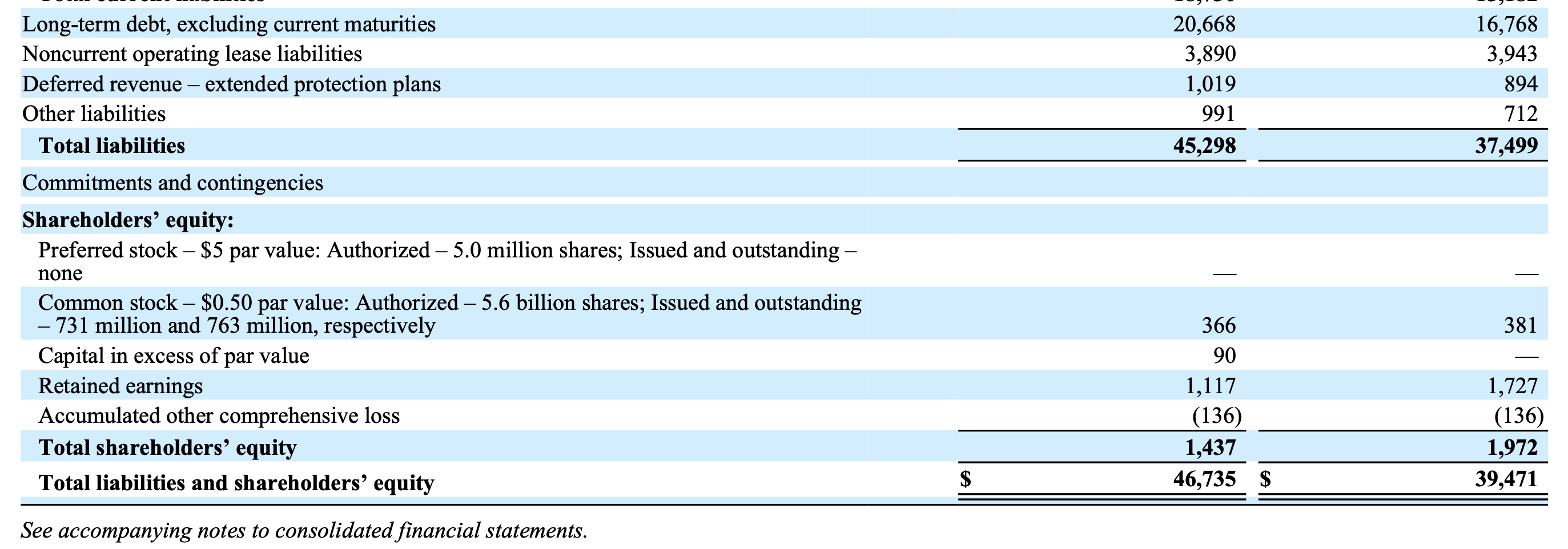

Refer to the 10-K for Lowe's. Required: 1. What does the company report for the following accounts for the most current fiscal year: Enter your answer in millions. If an amount is zero, enter "O". a. Cash 4,690 b. Short-term investments (or marketable securities) 506 c. Accounts receivable 10,884 X d. Inventory 16,193 e. Other current assets $ 937 f. Accounts payable 10,884 g. Other current liabilities* 991 X h. Cash flow from operations 11,049 *Include all other current liabilities ('Total current liabilities' less 'Accounts payable'). Be careful not to include just the one line item for 'Other current liabilities.' The ratios must include all current liabilities. 2. The company projects the following to occur in the next fiscal year: Accounts payable will decrease by 8%. Other current liabilities are expected to grow by 6%. Cash flow from operations is expected to decrease by 20%. Assume all other items remain unchanged from the prior year. Provide the next year's forecasted balances for the following accounts and cash flow from operations. Round your answer to the nearest million. If an amount is zero, enter "0". a. Cash $ 4,690 b. Short-term investments (or marketable securities) $ 506 c. Accounts receivable 10,884 X d. Inventory 16,193 e. Other current assets 937 f. Accounts payable $ 10,013.2 X g. Other current liabilities $ 1,050.46 X h. Cash flow from operations $ 8,839.2 X 3. Compute the forecasted current ratio for the next fiscal year. Round your answer to two decimal places. 4. Compute the forecasted quick ratio for the next fiscal year. Round your answer to two decimal places. 5. Compute the forecasted cash ratio for the next fiscal year. Round your answer to two decimal places. 6. Compute the forecasted operating cash flow ratio for the next fiscal year. Round your answer to two decimal places. Lowe's Companies, Inc. Consolidated Balance Sheets (In millions, except par value) January 29, 2021 January 31, 2020 Assets Current assets: Cash and cash equivalents Short-term investments Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes - net Other assets Total assets Liabilities and shareholders' equity Current liabilities: Short-term borrowings Current maturities of long-term debt Current operating lease liabilities Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities 4,690 $ 506 16,193 937 22,326 19,155 3,832 200 340 882 46,735 $ 716 160 13,179 1,263 15,318 18,769 3,891 372 216 905 39,471 $ 1,112 541 10,884 1,350 1,608 3,235 18,730 1,941 597 501 7,659 684 1,219 2,581 15,182 Long-term debt, excluding current maturities Noncurrent operating lease liabilities Deferred revenue - extended protection plans Other liabilities Total liabilities 20,668 3,890 1,019 991 45,298 16,768 3,943 894 712 37,499 Commitments and contingencies Shareholders' equity: Preferred stock - $5 par value: Authorized - 5.0 million shares; Issued and outstanding - none - 381 Common stock $0.50 par value: Authorized 5.6 billion shares; Issued and outstanding 731 million and 763 million, respectively Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity 366 90 1,117 (136) 1,437 46,735 $ 1,727 (136) 1,972 39,471 $ See accompanying notes to consolidated financial statements