Answered step by step

Verified Expert Solution

Question

1 Approved Answer

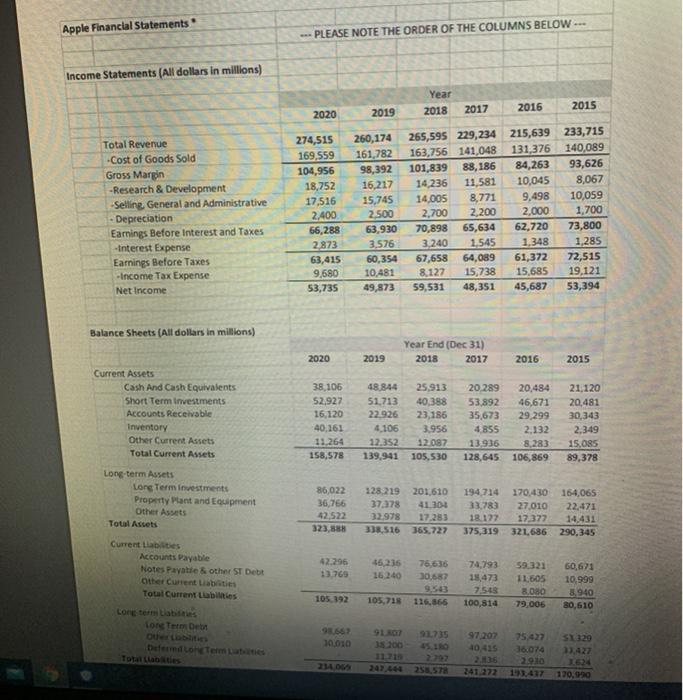

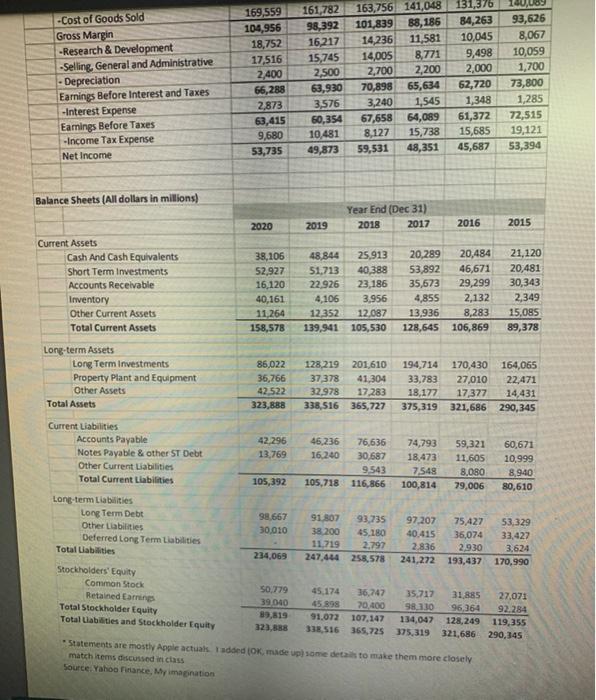

Refer to the Apple financial statements on the last page of this exam. Imagine that Apple is planning for 2021 and they hope to achieve

Refer to the Apple financial statements on the last page of this exam. Imagine that Apple is planning for 2021 and they hope to achieve Net Income of 75,000. (This is up from 53735 in 2020.) Assuming the following, how much revenue (sales) will they need to generate? Their tax rate will be 29% Interest expense will be 4,000. Depreciation will be 3,000 Selling, General and Administrative will be 14,500 and Research and Development 15,000 Variable costs will be 64% of revenue.

Apple Financial Statements Income Statements (All dollars in millions) Total Revenue -Cost of Goods Sold Gross Margin -Research & Development -Selling, General and Administrative Depreciation Earnings Before Interest and Taxes -Interest Expense Earnings Before Taxes -Income Tax Expense Net Income Balance Sheets (All dollars in millions) Current Assets Cash And Cash Equivalents Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Long-term Assets Long Term Investments Property Plant and Equipment Other Assets Total Assets Current Liabilities Accounts Payable Notes Payable & other ST Debt Other Current Liabilities Total Current Liabilities Long term Liabidities Long Term Debt Other Liabilities Deferred Long Term Latiities Total Llabilities --PLEASE NOTE THE ORDER OF THE COLUMNS BELOW ---. 2020 2020 38,106 52,927 16,120 40,161 11,264 158,578 274,515 260,174 169,559 161,782 104,956 98,392 101,839 18,752 16,217 14,236 17,516 15,745 14,005 8,771 2,400 2,500 2,700 2,200 63,930 70,898 65,634 62,720 66,288 2,873 3,576 3,240 1,545 1,348 63,415 60,354 67,658 64,089 61,372 9,680 10,481 8,127 15,738 15,685 53,735 49,873 59,531 48,351 45,687 2019 42.296 13,769 98.667 1,010 2019 234,069 Year 2017 2016 265,595 229,234 215,639 233,715 163,756 141,048 131,376 140,089 84,263 93,626 10,045 8,067 2018 86,022 128,219 201,610 36,766 37,378 41.304 42,522 323,888 32,978 17,283 338,516 365,727 Year End (Dec 31) 2018 2017 91.807 38.200 88,186 11,581 46,236 76,636 16,240 30,687 9,543 105,392 105,718 116,866 100,814 48,844 25,913 20,289 20,484 51,713 40,388 53,892 46,671 22,926 23,186 35,673 29,299 4,106 3,956 4,855 12.352 12.087 13,936 2,132 8,283 139,941 105,530 128,645 106,869 9,498 2,000 2016 2015 10,059 1,700 73,800 1,285 72,515 19,121 53,394 2015 21,120 20,481 30,343 2,349 15,085 89,378 194,714 170,430 164,065 33,783 27,010 22,471 18.177 17,377 14,431 375,319 321,686 290,345 74,793 59.321 60,671 18,473 11,605 7,548 8,080 79,006 10,999 8,940 80,610 93.735 97,207 75427 SX. 329 45,180 40,415 36.074 33,427 2.797 2.836 2.930 3.624 247,444 258,578 241.272 193,437 170,990

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the revenue Apple needs to achieve a net income of 75000 million in 2021 we can work th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started